- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: Tell Congress how you feel about $600 sale amo...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2023 12:27 PM

In case you are not subscribed to ebay`s Main street emails and want to send your Congressman/Senators your voice, here is the message:

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-04-2023 05:41 AM

They get paid by Treasury of the United States, and IRS is part of it. If you don`t like those Yahoos, why are you so happy to pay them but don`t want to "bother" them?

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-04-2023 05:43 AM

Article I, Section 6, Clause 1:

The Senators and Representatives shall receive a Compensation for their Services, to be ascertained by Law, and paid out of the Treasury of the United States.

https://constitution.congress.gov/browse/essay/artI-S6-C1-1/ALDE_00001044/

IRS is the part of the Treasury.

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-04-2023 06:23 AM

I will tell congress to lower the threshold to $0.01. The law was implemented because people have been failing to report income because for some reason, they thought that since they did not get a 1099-K, they were not required to report income, which is false. There have also been people abusing the system for years by selling just under $20k on multiple accounts across several platforms, resulting in tens of thousands of dollars in unpaid taxes. For anyone concerned about selling items at a loss, the IRS website provides instructions on their website on how to offset the amount of the sale since the cost of goods sold exceeds the sale price. Not rocket science. It's time to crack down on the tax crooks.

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 07:18 AM

lets make the reporting rule 1 dollar, thats my vote then give half of that for tax, people on here make me laugth

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 07:22 AM

i like it i think you should, let them know we all are not paying enougth in taxes, we all need to pay more .more more

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 07:27 AM

you might as well give up on this buddy, your not going to get any action from this bunch. i cant wait a few years from now to see where this goes, but i have an idea . we need more more more

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 07:41 AM

@worldwidetreausures wrote:In case you are not subscribed to ebay`s Main street emails and want to send your Congressman/Senators your voice, here is the message:

I had a chuckle when I read this: "Just fill out the form below to make your voice heard."

Back in my IT days when these Internet petitions first got going, we referred to them as "click-and-drools." They were (and still are) the laziest, least-effective way of expressing your concern about anything. Your one-click sign-on would be matched by a one-click delete at the recipient's end. Your voice really isn't "heard" at all this way; all it results in is a one-byte increment in the number of people whose boilerplate text gets sent to the spam filters of every representative on the mailing list.

Regardless of how you feel on the matter, the way to make yourself actually heard is to Write. A. Letter. Put your thoughts in your own words down on paper and mail it in. Sure, it's old-fashioned, old school. But the recipient will actually open it and see what is says. That makes an impression. The junior-level staffer who opens your letter and reads it will remember it when telling his boss what The Mood of The People is. He might also add at the end of his conversation with Senator So-and-So, "Oh, yeah, we got a bunch of those eBay canned messages. I forget how many. I deleted them."

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 08:02 AM

let me tell you what i think, a few years from now buy the time you sellers pay all these fees and tax there wont be much left in it for you, because sooner then later they will start taking a lot of your wtite offs away too, but you guys go ahead and keep giving more more more, just like a while back they didnt mess with people getting tips,then guess what they wanted a piece of that, its never going to enougth

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2023 08:47 AM

i dont sell on ebay just buy, but here is what i think. they are going to keep comming after you sellers every year to pay more of your profits for tax and fees, now you think about that, sure you got all these write offs now but that will slowly be grinded down too

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 10:44 AM

Sadly, things had changed with those staffers. I used to have an amazing Congressman whose staff was equally amazing and helped me with what I needed to get help with. With current public servants we, the people, put in government, we, the people, don`t get heard no matter a form of a contact. Experienced it within a couple of years with different issues such as hurricane, election, business, etc. Up to this date, a Congressman is still haven`t replied to me even in auto reply once, yet he is active and vocal to waste money on wars overseas. Two Senators (well, their staffers) sometimes reply with a different issue, not the one I had concerns, just copy/paste something, they can`t even comprehend that part. Very, very sad.

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 11:23 AM

when has it ever mattered what people tell congress? Think by now all realize congress and it's members don't give flying toot about what the people say or feel. Aside from that, the $600 1099K requirement doesn't change anything other then getting a 1099K, changes nothing about filing your taxes on money one made (or lost), as far as I'm concerned the amount can be $1 wouldn't make any bit of difference unless one isn't reporting their income.

And it only gets worse since that conclusion...

...There is something about the rigid posture of a proper, authentic blind

As if extended arms reached to pass his blindness onto others.

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 01:19 PM

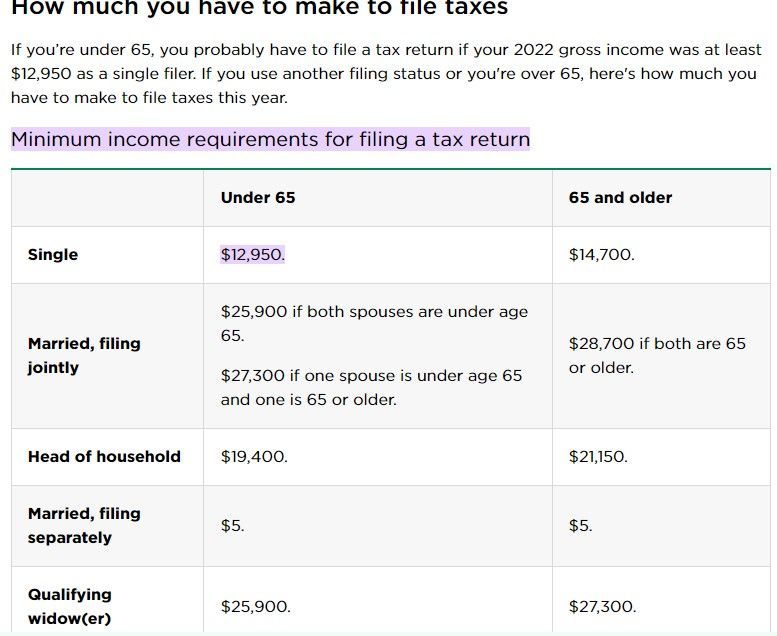

To me, this seems a lot of upset over something that isn't as scary as some make it out to be. The 1099K is merely a FORM. It is nothing more than a FORM. Just like any other form you may get for tax season like a 1099misc, 1099int, W2, etc. Just a FORM.

It does NOT set the minimum amount of income you are suppose to report to the IRS. IRS requires ALL of us to report ALL our income with a form or without, period. So lets say you were paid $599 on Ebay over the year and you do NOT get a 1099K, you are STILL suppose to claim that income on your Federal Tax Report if you are require to report your income.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 01:23 PM

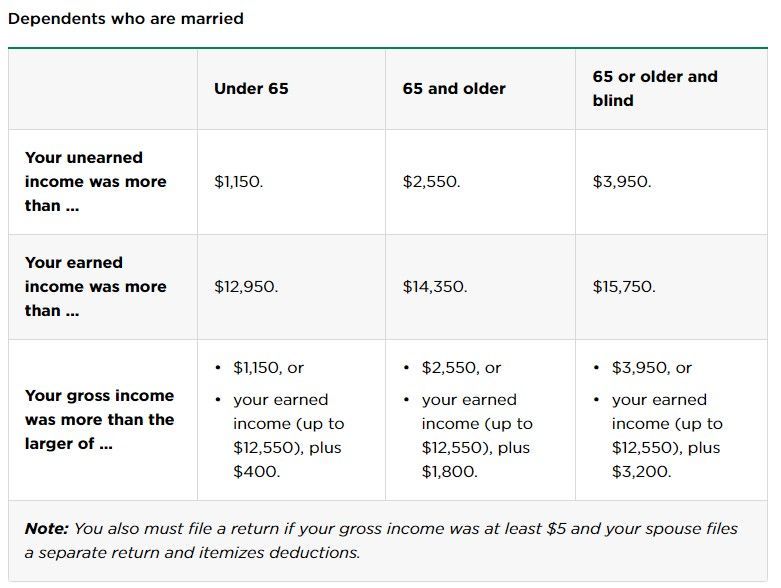

It should also be noted that some states are require 1099Ks to be filed at certain levels and more states are adding this requirement all the time. So even if the Congress backs off of the threshold for a 1099K, we all still have to abide by the state requirement.

https://stripe.com/docs/connect/1099-K

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 02:29 PM

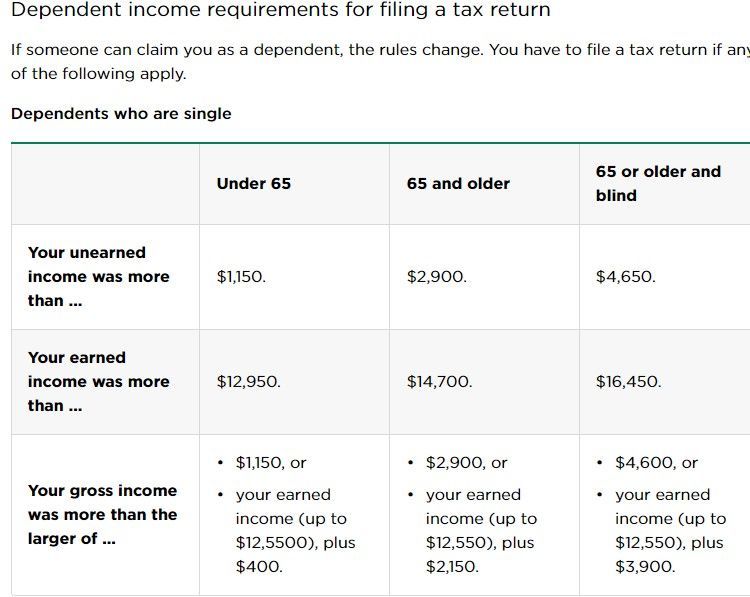

The thing you seems to be confused with is that the amount on 1099-K is not an income as you state, but a gross amount, which includes cost of goods sold, shipping, ebay/etc fees, etc etc. To sort things out, and possible get $1 profit or none at all, one has to file Schedule C. Or to pay whatever % income tax-$100 or something like that in most cases.

Re: Tell Congress how you feel about $600 sale amount for IRS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-08-2023 02:39 PM - edited 10-08-2023 02:42 PM

What makes you think they are confused? That’s how 1099ks work. It is also how sales are to be reported when you file even if you don’t get a 1099k.