- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- eBay Open 2024 Kickoff Party

- Up and Running 2024

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: 1099k issued a year late!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 11:08 AM

I have received my 2023 1099k on the 26th. At the same time ebay issued a 2022 1099k too! This is causing me to amend my taxes. By law they have to have all information provided to the seller by jan 31st. I don't understand why they are a year late on the 2022 1099k. Has this happened to anyone else???

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 01:13 PM

@gail5176 wrote:Mine says issued for 2022 on 1-26-24

big goof on eBay’s part

@gail5176 & @gamermaster2007 - if your 1099-Ks for 2022 were not issued until today per the 'date generated' column, I suggest following the advice posted above from dbfolks and report the problem to the IRS.

Just verify you didn't miss anything like a physical form mailed last year or a notice from eBay in your email. Cross the Ts and dot the Is before contacting the IRS because if eBay did issue the forms on time, the IRS will have records.

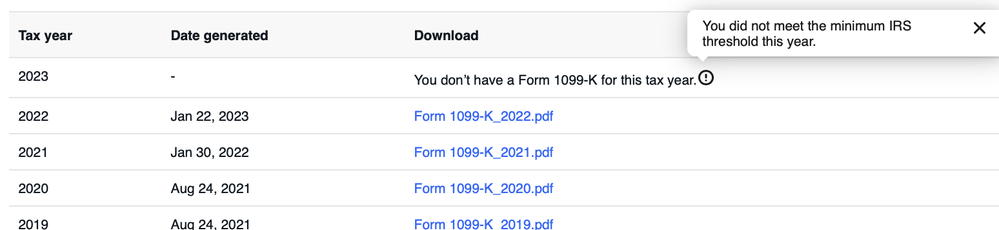

On my page I do have some 'off' dates generated, but it's not because I got the forms late. It's because I was an early adopter of managed payments, and once eBay onboarded the bulk of the site in summer 2021 they had to re-upload 3 years of past 1099-Ks so they show the re-upload date instead of the original issue date. My point is to double-check in case yours is a re-upload situation.

I agree with above posters that a late 1099 shouldn't have much, if any, impact on your reported income last year so hopefully this is nothing more than a very minor inconvenience to cross-check the numbers.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 01:17 PM

Mine says issued for 2022 on 1-26-24

big goof on eBay’s part

Call the IRS at the number I provided.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 01:27 PM

As I said...unless the number is substantially different than the OP claimed...

filing an amended return, while maybe being a slight inconvenience, is an inconsequential event.....

done it many times over the years when I realized I missed something or forgot a deduction.....

and, yes, as @dbfolks166mt pointed out, the agency should be made aware of the late issuance....but no one does that because they are "afraid" of anything that engages them with the IRS

I worked with the IRS on multiple occasions over the years when doing both my taxes and preparing taxes for others and the IRS hates it when companies fail to meet their reporting deadlines. It not only causes headaches for the individuals filing their taxes but creates havoc with IRS's own accounting systems especially when it's a year late. Imagine your employer not issuing your W-2 until the following year. Similar situation and it is the reason there are heavy fines levied against non-compliant companies for failing to meet deadlines.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 02:08 PM

I just received both 2022 and 2023 as well.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 02:55 PM

@gamermaster2007 @cinnamon1114 @gail5176 - if you are all in MO, I just remembered that eBay had a similar snafu for sellers in MO in 2022.

Not sure if this is related, but here's some info on that situation in case it's helpful.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 03:13 PM

Hey @gamermaster2007 we wanted to share some info we got from our tax team on this subject. Here is what they said:

"We are aware and are currently working on getting the erroneous forms removed

We did not report this income to the IRS in previous years and will not be including this year

Sellers can disregard the 2021 or 2022 forms generated on 1/26/24"

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 03:13 PM

Good eye @valueaddedresource . All 3 sellers' listings show they are in Missouri. In fact, the OP participated in that discussion you linked.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 03:16 PM

kyle@ebay wrote:Hey @gamermaster2007 we wanted to share some info we got from our tax team on this subject. Here is what they said:

"We are aware and are currently working on getting the erroneous forms removed

We did not report this income to the IRS in previous years and will not be including this year

Sellers can disregard the 2021 or 2022 forms generated on 1/26/24"

Thanks for providing a quick response kyle@ebay !

And in case any sellers are not aware, you can always check to see what was reported to the IRS by logging in to your IRS account online. eBay doesn't have to report 2023 until the end of Feb so that gives sellers a month to review their 1099-Ks and ensure there are no errors before eBay sends the info to the IRS.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 03:38 PM

kyle@ebay wrote:Hey @gamermaster2007 we wanted to share some info we got from our tax team on this subject. Here is what they said:

"We are aware and are currently working on getting the erroneous forms removed

We did not report this income to the IRS in previous years and will not be including this year

Sellers can disregard the 2021 or 2022 forms generated on 1/26/24"

Thanks for providing a quick response kyle@ebay !

And in case any sellers are not aware, you can always check to see what was reported to the IRS by logging in to your IRS account online. eBay doesn't have to report 2023 until the end of Feb so that gives sellers a month to review their 1099-Ks and ensure there are no errors before eBay sends the info to the IRS.

Since we don't know the amounts for the individual sellers it's difficult to say if the 1099's are erroneous. Missouri has had a $1,200 1099-K threshold issuance limit since 2021 so each poster will have to make the assessment of whether the 1099 for the prior years can be ignored.

This may in fact be similar to prior year issues eBay has had with the 1099's. I remember one year a bunch of CA sellers who had under the $20K limit received a 1099 in error. This is some of the complexities of the Fed not getting their act together and the individual states creating their own reporting requirements. Who knows what will happen in 2024 with the Fed and the states. Ironically this is probably a train wreck eBay never saw coming with managed payments. Had PayPal still been the financial processor the 1099 issue would be in their ball park.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 03:53 PM

Received one this year as well for NJ for this account that had less than $300 in sales last year. I’m completely perplexed.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 04:18 PM

@buzzapparel wrote:Received one this year as well for NJ for this account that had less than $300 in sales last year. I’m completely perplexed.

NJ minimum is $1,000 @buzzapparel . Did you run the transaction report to see what eBay is including on your form? Are you factoring in gross sales including things like cancelled transactions and other refunds?

Rundown on eBay 1099-Ks:

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

You can go to this page and generate a CSV report and you'll see what's counted on your 1099-K at the transaction level. https://www.ebay.com/sh/fin/taxdetails

"Your 1099-K Details report shows all the orders that factored into your gross amount of payments. The report also provides other details, such as transaction fees, which may be relevant when preparing your taxes."

There's a guide published here where you can further drill down and get reports for expenses and refunds: https://www.ebay.com/mes/taxguide?sh=true

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 05:03 PM

@dbfolks166mt wrote:kyle@ebay wrote:Hey @gamermaster2007 we wanted to share some info we got from our tax team on this subject. Here is what they said:

"We are aware and are currently working on getting the erroneous forms removed

We did not report this income to the IRS in previous years and will not be including this year

Sellers can disregard the 2021 or 2022 forms generated on 1/26/24"Thanks for providing a quick response kyle@ebay !

And in case any sellers are not aware, you can always check to see what was reported to the IRS by logging in to your IRS account online. eBay doesn't have to report 2023 until the end of Feb so that gives sellers a month to review their 1099-Ks and ensure there are no errors before eBay sends the info to the IRS.

Since we don't know the amounts for the individual sellers it's difficult to say if the 1099's are erroneous. Missouri has had a $1,200 1099-K threshold issuance limit since 2021 so each poster will have to make the assessment of whether the 1099 for the prior years can be ignored.

This may in fact be similar to prior year issues eBay has had with the 1099's. I remember one year a bunch of CA sellers who had under the $20K limit received a 1099 in error. This is some of the complexities of the Fed not getting their act together and the individual states creating their own reporting requirements. Who knows what will happen in 2024 with the Fed and the states. Ironically this is probably a train wreck eBay never saw coming with managed payments. Had PayPal still been the financial processor the 1099 issue would be in their ball park.

@dbfolks166mt yep, the CA error was the same year as the other MO error I posted about above.

That was a weird year all around since there was confusion about what the threshold(s) would be with a few different states laws changing plus federal changing and then not changing at the last minute when they punted that one down the road.

It was also a weird year because while eBay had been slowly moving some sellers over to Managed Payments before, that was the year the majority of the rest of them were moved over and we started seeing a bunch of reports of identity theft fraud being revealed, with bad actors using people's stolen identities to create accounts and sell things here.

I had hoped this year would go more smoothly with eBay having a couple years under the belt now...hopefully this will be just a minor bump in the road and everything else will be smooth sailing.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 06:33 PM

This just happened to me, also. When I went to get my 2023 1099, there was a brand new 2022 1099 both with an issue date of Jan 27, 2024. **bleep**, indeed.

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2024 07:29 AM

Good to know

Re: 1099k issued a year late!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2024 09:32 AM

@gail5176 wrote:By not sending one when they were supposed to, taxpayer filed without it, now will have to be dealt with, and is late.

@gail5176 should not matter as you would have filed using your books (ebay payment report, paypal prior) as you sold 3800 items since being on ebay; so hopefully for you, you have ALWAYS been reporting your sales since you've been here.

Since selling that much, you are obviously a seller- buying 'old stuff' to resell, so you would be able to write off shipping labels, packing materials purchased, ebay fees, cost of goods...and possibly mileage, a portion of home use etc.

As I stated, looks like Missouri requires at $1200- and that's where you are.