- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- Has anyone else not received their 1099-K?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 09:42 AM

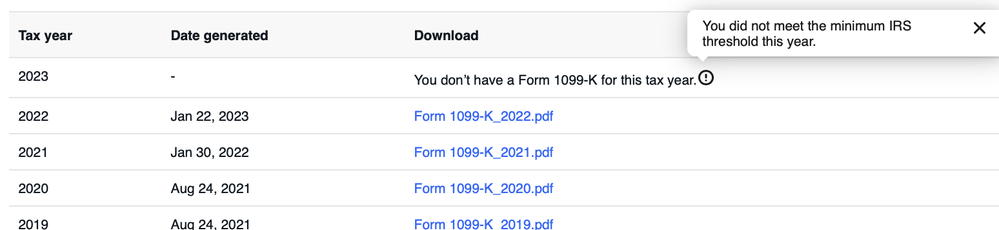

When I check for mine it states "You don’t have a Form 1099-K for this tax year." That's impossible. Are they just delayed? I am showing the same under both my eBay ID's. Thanks!

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 09:49 AM

If you didn't sell over $20,000 you won't get one.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 09:50 AM

They have until the 31st of January. I *know* I'll get a 1099k this year, and that's what it says for my account too.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 09:54 AM

They are not delayed; the deadline is Jan 31. They are not available yet. The wording on that page is very misleading. A week or two I tagged Devon from the eBay team and asked him to escalate the FB.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 09:56 AM - edited 01-27-2024 09:57 AM

Not exactly true. Some states have already lowered the threshold. I am in Missouri and ours is $600.00.

Got one the last 2 years and never hit $20,000 in sales either year

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 10:08 AM

I have not received my either, Is it not the law to receive one no matter the earnings?

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 10:10 AM - edited 01-27-2024 10:12 AM

@meme6253 wrote: ... Is it not the law to receive one no matter the earnings?

No. The law requires eBay to issue a 1099-K only if the member reaches the thresholds set by the feds or by their state, whichever is lower. Your listings indicate that you're in Illinois, where the threshold is $1000.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 10:29 AM

It seems they go above and beyond to use verbiage that is confusing.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 10:34 AM

@fern*wood wrote:It seems they go above and beyond to use verbiage that is confusing.

My guess is there are 2 reasons but they want to just do one 'blanket' remark...and that one is probably more popular and since most anyone doing over $20k, know that they are getting one.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 10:44 AM

We should see the 1099-K sometime next week. Normally, its uploaded around 31/January.

Hang tight. 🙏😎✌️😁

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-27-2024 11:12 AM

@stainlessenginecovers wrote:

@fern*wood wrote:It seems they go above and beyond to use verbiage that is confusing.

My guess is there are 2 reasons but they want to just do one 'blanket' remark...and that one is probably more popular and since most anyone doing over $20k, know that they are getting one.

It's lazy programming resulting in a misleading and confusing message - especially since the 1099-K threshold keeps yo-yoing. The info pop-up is flat out wrong.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 07:56 AM

Why put a message like "you don't have a form 1099K for 2023" and then all of a sudden on the 31st post the 1099K. I've been calculating my gain/loss over the last few days based on earnings (payout), and now I see they're reporting gross figures. This means I have to abandon all the work I've done and recalculate everything based on gross. Of course eBay hasn't provided ANY guidance regarding how they calculate the figures they're reporting to the IRS. So I have to go into a very detailed transaction report and try to "reverse engineer" how they did it. I thought eBay was a billion dollar multi-national corporation? They're acting like a start-up with incompetents putting confusing and incorrect information out on their site. I thought the purpose of a 1099 is to report INCOME. That's what ALL of my other 1099's report. In the Help section, eBay shows a "tax tip" comment box that says what you report to the IRS may be different than the gross amounts eBay reports...WHAT!?!? What weird world are they living in? So confused and frustrated with something that should be straightforward.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 08:12 AM

ebay's 1099K, like those from any payment processor will ALWAYS list the total gross amount of ALL payments received through them (excluding state sales tax). The payout figures you've been using (apparently) already have any fees, shipping labels, promotional fees etc taken out.

When filing your taxes you use the gross amount from the 1099 and then deduct all your expenses from that to come up with your taxable income.

"If it sold FAST, it was priced too low" - also Reese Palley

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 08:27 AM

They have until the 31st of January.

Has anyone else not received their 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 08:40 AM

@donnasfinds wrote:Of course eBay hasn't provided ANY guidance regarding how they calculate the figures they're reporting to the IRS.

They do @donnasfinds if you poke around. Or I can go ahead and provide some direct links for you. 🙂

Deadline for eBay to release 1099-K forms is Jan 31st each year. They will be posted on your payments section here:

https://www.ebay.com/sh/fin/taxforms

Rundown on eBay 1099-Ks:

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

You can go to this page and generate a CSV report and you'll see what's counted on your 1099-K at the transaction level. https://www.ebay.com/sh/fin/taxdetails

"Your 1099-K Details report shows all the orders that factored into your gross amount of payments. The report also provides other details, such as transaction fees, which may be relevant when preparing your taxes."

There's a guide published here where you can further drill down and get reports for expenses and refunds: https://www.ebay.com/mes/taxguide?sh=true