- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- 1099 form

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-20-2020 07:55 PM

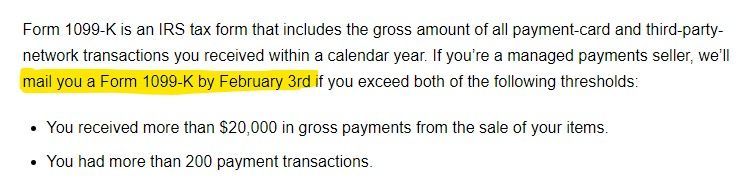

I am wondering if I will get a 1099 from ebay this year. Is the document based on total or net sales? If total I may just squeak in under the wire if I make enough sales by the end of the month. But I will be well below the $20K threshold if based on net sales.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 05:20 PM

@mam98031 wrote:Let's be clear here. I do KNOW what the IRS requires on the 1099K, that wasn't the concern. What I said I did not know about was IF Ebay is correcting the way they issue 1099Ks or it's policy. I'm not sure how much clearer I can be or why what I said required clarity.

@mam98031 that statement is still assuming that there is something that needs to be corrected in eBay's policies or the way they issue the 1099K. That is the part that needs clarity.

Per your definition "Gross Receipts are 100% of the money you received from your customers without exception or exclusion"

If sellers do not receive the Marketplace Facilitator tax, it should not be included in the 1099K. In that case eBay's policies (as stated on that help page) and the way they are presumably going to issue the 1099K based on those policies would be accurate and not need any corrections - again per your definition.

If you have explicit knowledge or information from eBay that contradicts that help page, please share it. If not, then I would suggest that the advice to take a breath and step back is a good plan until payments_team@ebay confirms whether or not Marketplace Facilitator taxes are included on the 1099K.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 05:31 PM

@valueaddedresource wrote:

@mam98031 wrote:Let's be clear here. I do KNOW what the IRS requires on the 1099K, that wasn't the concern. What I said I did not know about was IF Ebay is correcting the way they issue 1099Ks or it's policy. I'm not sure how much clearer I can be or why what I said required clarity.

@mam98031 that statement is still assuming that there is something that needs to be corrected in eBay's policies or the way they issue the 1099K. That is the part that needs clarity.

Per your definition "Gross Receipts are 100% of the money you received from your customers without exception or exclusion"

If sellers do not receive the Marketplace Facilitator tax, it should not be included in the 1099K. In that case eBay's policies (as stated on that help page) and the way they are presumably going to issue the 1099K based on those policies would be accurate and not need any corrections - again per your definition.

If you have explicit knowledge or information from eBay that contradicts that help page, please share it. If not, then I would suggest that the advice to take a breath and step back is a good plan until payments_team@ebay confirms whether or not Marketplace Facilitator taxes are included on the 1099K.

Money received into the MP account for any seller has to be accounted for on the 1099K. Whether it is removed for some reason by Ebay, a refund or some other means makes not difference. The fact that it came into the MP account is the driver on this. And that is because on a 1099K it reports Gross RECEIPTS. It doesn't discriminate about what the money is received for, just simply that a buyer paid it to you.

All deductions to include those for taxes are detailed out on a Schedule C as part of the Federal Tax Return, so you can arrive at your Net sales [after all expenses].

With all that said, I really don't see this as a huge thing as long as a seller can see the taxes Ebay charged to the buyer on a report for the period. Which we can now with the updated transaction report in MP. It would be an easy thing to explain to IRS if the need arose if Ebay doesn't change how they explain the 1099K on their policy page.

Your difference is how you define "received". In came into MP, therefore it was received into MP. One can't remove something from MP if it was never received, therefore it has to be received.

IMHO there are much bigger issues to be concerned about. This one is minor.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 05:59 PM

@valueaddedresource wrote:

@mam98031 wrote:Let's be clear here. I do KNOW what the IRS requires on the 1099K, that wasn't the concern. What I said I did not know about was IF Ebay is correcting the way they issue 1099Ks or it's policy. I'm not sure how much clearer I can be or why what I said required clarity.

@mam98031 that statement is still assuming that there is something that needs to be corrected in eBay's policies or the way they issue the 1099K. That is the part that needs clarity.

Per your definition "Gross Receipts are 100% of the money you received from your customers without exception or exclusion"

If sellers do not receive the Marketplace Facilitator tax, it should not be included in the 1099K. In that case eBay's policies (as stated on that help page) and the way they are presumably going to issue the 1099K based on those policies would be accurate and not need any corrections - again per your definition.

If you have explicit knowledge or information from eBay that contradicts that help page, please share it. If not, then I would suggest that the advice to take a breath and step back is a good plan until payments_team@ebay confirms whether or not Marketplace Facilitator taxes are included on the 1099K.

@valueaddedresource I've been following enough of this AND will be downloading 4Q20 Managed Payments CSV files soon to begin the tax reporting process ... completing my Corp books for a different business this weekend so the personal stuff is next. I checked my Sept CSV from MP for last year and NO Sales Tax Column for what eBay collected. Column R is "Seller collected sales tax" but its completely empty. So unless some thing has changed I do NOT expect 4Q20 CSVs to have a new column for Sales tax with it handled like PayPal did (include it in the gross then back it out separately).

I will be able to take the total of the 5 CSVs from last year and compare it to the Gross total on the 1099K that I anticipate getting from eBank and will know if they did indeed include some / all Sales tax in our gross totals from 2020.

Regards,

Regards,Mr. Lincoln - Community Mentor

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:01 PM - edited 01-21-2021 06:02 PM

@mam98031 wrote:The fact that it came into the MP account is the driver on this.

@mam98031 to my knowledge, it has not been established as fact that Marketplace Facilitator tax "comes into" the seller's account.

The screenshot I provided from Adyen shows it is at least possible for them to take a payment from the buyer and allocate certain amounts to the seller and certain amounts to the platform separately.

If that is the case, it would not be accurate to say it "came into the MP account" as if there is only one place for all of the money to go. It would be more accurate to say that some money was allocated to the seller account and some money was allocated to the platform account.

Again, if that is the case, the 1099K would and should accurately only be based on that money which was allocated to the seller account. If MF tax is *not* part of the allocation to the seller account, then it shouldn't be part of the 1099K either.

Just because eBay shows MF tax in the reports or on the transaction page does not in any way prove how, where or when funds are allocated on the actual money processing side. Neither does the fact that eBay has chosen to include those amounts in the total for the purposes of fee calculations. Those are all separate issues.

The screenshot from the eBay help page about the 1099K that explicitly states the tax money from those states is not paid to the seller would seem to indicate that something similar to what is shown in that screenshot from Adyen is at least possibly how the money actually flows.

I'm not saying I know for a fact that is how any of this works, because I don't have that degree of visibility inside either eBay or Adyen.

I am saying that until I hear otherwise from those who do have that visibility, I'm going to go with the resources and information currently publicly available from those who do have that visibility, and all of that is pointing to Marketplace Facilitator tax correctly not being included in the 1099K.

If that's not how it works, eBay needs to update that help page pronto!

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:14 PM

@fern*wood wrote:

@nobody*s_perfect wrote:I'm in MA, where the $600 threshold was implemented a couple of years ago with great stealth. I just Googled to find out whether other states had done the same.

Good catch. I bet that info will catch a bunch of tax deniers off guard. I wish I could remember the ID of the poster that used to frequent the board advising everyone to ignore reporting ebay income to the IRS and calling ones that did foolish and alarmists.

If you're a small seller, I don't know why you wouldn't want to report your income... my reporting started when I was making $7K in a year of selling at the market in my city. The first year I reported I had so much negative income from the deductions I got, I ended up with a 3K refund. (I don't know if this is the same in the US.. but in Canada as a jewellery manufacture with inventory, 1/3 of my house expenses was a write off, including property taxes and mortgage interest). Then there's all the regular stuff you can deduct like advertising costs, table rent, materials, etc.

C.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:15 PM

@valueaddedresource wrote:@bowoninc the 1099K help page shows eBay will be mailing them by Feb 3rd, so I imagine they *should* be available to download under the Payments tab around that time as well.

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

You know, I exceed both thresholds and no one has ever mailed me a 1099-K. I got an email about on once, followed by an apology because they sent it to Canadians too by mistake.

I'm wondering if they don't need to issue me a 1099-K because I'm in Canada if that means they won't be asking me why I don't have an SSN.

C.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:18 PM

@mam98031 wrote:

@dlg01 wrote:As a intermittent seller of personal items (not doing it as a job or business) my personal opinion is that eBay should not treat me like I work for them and send me a 1099.

Every single transaction conducted on this site is a business transaction. There are NO personal transaction on this site. Whether or not you consider yourself a little business or not.

In Canada there is an exception for selling personal items and not being required to report sales (like yard sale type of thing). However there are a number of people who are claiming to be selling their own stuff and making thousands... I've known people who made more on eBay then their salary at their regular job. You can't claim that it's not a business at that point...

C.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:34 PM

@sin-n-dex wrote:

@fern*wood wrote:

@nobody*s_perfect wrote:I'm in MA, where the $600 threshold was implemented a couple of years ago with great stealth. I just Googled to find out whether other states had done the same.

Good catch. I bet that info will catch a bunch of tax deniers off guard. I wish I could remember the ID of the poster that used to frequent the board advising everyone to ignore reporting ebay income to the IRS and calling ones that did foolish and alarmists.

If you're a small seller, I don't know why you wouldn't want to report your income... my reporting started when I was making $7K in a year of selling at the market in my city. The first year I reported I had so much negative income from the deductions I got, I ended up with a 3K refund. (I don't know if this is the same in the US.. but in Canada as a jewellery manufacture with inventory, 1/3 of my house expenses was a write off, including property taxes and mortgage interest). Then there's all the regular stuff you can deduct like advertising costs, table rent, materials, etc.

C.

Generally in the US, or at least in our state, a Corporation has to show a profit in its first 5 years. I'm sure there are some other requirements after that for showing a profit on some kind of a regular basis. I am not sure how they handle a Sole Proprietor's business (meaning everything is run through the person's personal income tax reporting opposed to a separate set of taxes docs for reporting purposes) but I suspect that at some point a profit is required ...

Our state also has like a $ 500 threshold for selling personal items through yard -porch-garage sales ... above that you are "supposed" to report it.

There was a member who recently asked if ANY sales were reported to the IRS or just that issued on the 1099K if one met that threshold? Care to guess why they might want to know that? I am sure there are a lot of eBay and other internet Sellers who don't report their sales on their income tax ... if there is no infrastructure to report it to the government then it is seen as an opportunity to dodge paying taxes.

Regards,

Regards,Mr. Lincoln - Community Mentor

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 06:50 PM

@mr_lincoln wrote:

@sin-n-dex wrote:

@fern*wood wrote:

@nobody*s_perfect wrote:I'm in MA, where the $600 threshold was implemented a couple of years ago with great stealth. I just Googled to find out whether other states had done the same.

Good catch. I bet that info will catch a bunch of tax deniers off guard. I wish I could remember the ID of the poster that used to frequent the board advising everyone to ignore reporting ebay income to the IRS and calling ones that did foolish and alarmists.

If you're a small seller, I don't know why you wouldn't want to report your income... my reporting started when I was making $7K in a year of selling at the market in my city. The first year I reported I had so much negative income from the deductions I got, I ended up with a 3K refund. (I don't know if this is the same in the US.. but in Canada as a jewellery manufacture with inventory, 1/3 of my house expenses was a write off, including property taxes and mortgage interest). Then there's all the regular stuff you can deduct like advertising costs, table rent, materials, etc.

C.

Generally in the US, or at least in our state, a Corporation has to show a profit in its first 5 years. I'm sure there are some other requirements after that for showing a profit on some kind of a regular basis. I am not sure how they handle a Sole Proprietor's business (meaning everything is run through the person's personal income tax reporting opposed to a separate set of taxes docs for reporting purposes) but I suspect that at some point a profit is required ...

Our state also has like a $ 500 threshold for selling personal items through yard -porch-garage sales ... above that you are "supposed" to report it.

There was a member who recently asked if ANY sales were reported to the IRS or just that issued on the 1099K if one met that threshold? Care to guess why they might want to know that? I am sure there are a lot of eBay and other internet Sellers who don't report their sales on their income tax ... if there is no infrastructure to report it to the government then it is seen as an opportunity to dodge paying taxes.

I'm not a corporation (and I do get what you're saying about showing a profit so it's not just a money sink/tax refund grab). I'm a sole proprietor which means they take all my income. At present I have four registered businesses and one full time job. One of the businesses does exceedingly well, the others are showing a loss. (The jewellery/sewing one doesn't make money because I'm not doing that right now, but we're talking a $400 annual loss, nothing major. My bookkeeping business has a loss only because of deductions, and my stamps business is just getting started so I haven't been at it more than one year). The coins is the only one that makes money, but the losses of the others greatly reduce taxes owed since as a sole proprietor, it is all attributed you your name on one refund, with a T2125 (think Schedule C) filled out for each business.

I've been doing business taxes for 15 years and probably have never shown a profit across the board with all businesses because some are always losing money while others make money. But since I have a full time job and pay a large amount of my salary in income tax, that probably helps my situation.

In Canada, there are two basic rules for refunds. You can only deduct your house expenses from profits you make. So the jewellery business that suffered a $400 loss is ineligible for any house expense related deductions (but they can be carried forward and used later if I turn a profit, which is another way of using deductions as I rotate what I work on in my time away from my job).

The other thing is, you can't get a refund unless you pay taxes. So if you are an unemployed person (your spouse works) and you sell on eBay but have a loss for some reason (I understand you can use the cash method in the US to deduct inventory, not allowed in Canada), you cannot get a refund on those losses because you paid no tax. For instance if I paid 5K at my job this year in tax, the most my refund will be is 5K. All those credits you get are "non refundable" and get deducted from tax you owe on your income. If your income is zero, the credits are to be transferred to your spouse so they can benefit from supporting you.

I'm not super knowledgeable on US Tax Law (aside from what I've read on here), but I work as a bookkeeper by trade, so I've familiarized myself with Canadian Tax law. There is an advantage to doing your own returns. My accountant would charge me 3K to do my return if I couldn't do it myself.

C.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 10:40 PM

The report was updated just recently. There has been a flag on the page for a couple weeks now saying we had a new report format coming. For me it arrived.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 10:46 PM

@valueaddedresource wrote:

@mam98031 wrote:The fact that it came into the MP account is the driver on this.

@mam98031 to my knowledge, it has not been established as fact that Marketplace Facilitator tax "comes into" the seller's account.

The screenshot I provided from Adyen shows it is at least possible for them to take a payment from the buyer and allocate certain amounts to the seller and certain amounts to the platform separately.

If that is the case, it would not be accurate to say it "came into the MP account" as if there is only one place for all of the money to go. It would be more accurate to say that some money was allocated to the seller account and some money was allocated to the platform account.

Again, if that is the case, the 1099K would and should accurately only be based on that money which was allocated to the seller account. If MF tax is *not* part of the allocation to the seller account, then it shouldn't be part of the 1099K either.

Just because eBay shows MF tax in the reports or on the transaction page does not in any way prove how, where or when funds are allocated on the actual money processing side. Neither does the fact that eBay has chosen to include those amounts in the total for the purposes of fee calculations. Those are all separate issues.

The screenshot from the eBay help page about the 1099K that explicitly states the tax money from those states is not paid to the seller would seem to indicate that something similar to what is shown in that screenshot from Adyen is at least possibly how the money actually flows.

I'm not saying I know for a fact that is how any of this works, because I don't have that degree of visibility inside either eBay or Adyen.

I am saying that until I hear otherwise from those who do have that visibility, I'm going to go with the resources and information currently publicly available from those who do have that visibility, and all of that is pointing to Marketplace Facilitator tax correctly not being included in the 1099K.

If that's not how it works, eBay needs to update that help page pronto!

Well I can tell you it is on the Detailed Transaction downloadable report for MP. Not sure why it would appear there if it did not enter MP. That certainly would make no sense at all. But hey, maybe you have another explanation for it being there.

I don't deal with what Adyen has to say or do. I just deal with MP / Ebay. Adyen is Mp's vendor, not mine. I have no direct contact with Adyen, I wasn't aware that any seller did. I think you are just reaching for some justification or you are being obtuse.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-22-2021 03:11 AM - edited 01-22-2021 03:13 AM

@mam98031 wrote:

@valueaddedresource wrote:

@mam98031 wrote:The fact that it came into the MP account is the driver on this.

@mam98031 to my knowledge, it has not been established as fact that Marketplace Facilitator tax "comes into" the seller's account.

The screenshot I provided from Adyen shows it is at least possible for them to take a payment from the buyer and allocate certain amounts to the seller and certain amounts to the platform separately.

If that is the case, it would not be accurate to say it "came into the MP account" as if there is only one place for all of the money to go. It would be more accurate to say that some money was allocated to the seller account and some money was allocated to the platform account.

Again, if that is the case, the 1099K would and should accurately only be based on that money which was allocated to the seller account. If MF tax is *not* part of the allocation to the seller account, then it shouldn't be part of the 1099K either.

Just because eBay shows MF tax in the reports or on the transaction page does not in any way prove how, where or when funds are allocated on the actual money processing side. Neither does the fact that eBay has chosen to include those amounts in the total for the purposes of fee calculations. Those are all separate issues.

The screenshot from the eBay help page about the 1099K that explicitly states the tax money from those states is not paid to the seller would seem to indicate that something similar to what is shown in that screenshot from Adyen is at least possibly how the money actually flows.

I'm not saying I know for a fact that is how any of this works, because I don't have that degree of visibility inside either eBay or Adyen.

I am saying that until I hear otherwise from those who do have that visibility, I'm going to go with the resources and information currently publicly available from those who do have that visibility, and all of that is pointing to Marketplace Facilitator tax correctly not being included in the 1099K.

If that's not how it works, eBay needs to update that help page pronto!

Well I can tell you it is on the Detailed Transaction downloadable report for MP. Not sure why it would appear there if it did not enter MP. That certainly would make no sense at all. But hey, maybe you have another explanation for it being there.

I don't deal with what Adyen has to say or do. I just deal with MP / Ebay. Adyen is Mp's vendor, not mine. I have no direct contact with Adyen, I wasn't aware that any seller did. I think you are just reaching for some justification or you are being obtuse.

@mam98031 - as I said, just because it is on the transaction report doesn't prove how the money actually flows or what should or shouldn't be on the 1099K.

eBay collected tax didn't used to be on the report. As you pointed out that is a very recent change. Maybe eBay heard you and other sellers requesting it and put it on there? IDK. It is helpful information to have regardless and I think it's good they updated the report with that info.

That still doesn't mean it proves anything as far as how the money flows and whether or not eBay collected tax should be on the 1099K. Those reports are for informational purposes and may be helpful in reconciling bookkeeping or understanding your business so you can properly file your taxes, but that doesn't mean every piece of information on that report is necessarily included in the 1099K.

I don't have any direct contact with Adyen. I simply went to their publicly available website and poked around.

As you are fond of pointing out, it's important to educate ourselves and understand how things that affect our businesses work so we can make the best decisions. Understanding how eBay and Adyen work together to implement Managed Payments would seem to me to be part of that due diligence, to whatever degree we can understand it without inside knowledge.

The only thing I'm reaching for is understanding and clarification. The eBay help page explicitly says "Starting in 2019, any sales tax collected by eBay on sales made by you in the various marketplace states will not be on your Form 1099-K. This is because eBay automatically collects and remits such sales tax directly to the state (i.e. the sales tax for these states isn’t paid to you)."

If any of those statements are not true, we need to know that and we need to hear it from eBay directly, not just someone's opinion about how things are supposed to be.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-22-2021 04:28 AM

@mam98031 wrote:

The report was updated just recently. There has been a flag on the page for a couple weeks now saying we had a new report format coming. For me it arrived.

Thank you for that ... I'm sure it will come here too at some point ...

Regards,

Regards,Mr. Lincoln - Community Mentor

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-22-2021 10:49 AM

@valueaddedresource wrote:

@keziak wrote:

Those 2 paragraphs seem to contradict each other. Does the total include the sales tax or not?

@keziak - to me it sounds like eBay will include seller collected tax in the 1099K (because it was paid to you, the seller), but will not include Marketplace Facilitator tax (because it was paid to eBay to remit to the state, not to the seller).

Maybe payments_team@ebay can clarify this for us.

@valueaddedresource we don't have an answer to this specific question so we've requested more information. When we know more then we will share it here.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-22-2021 10:59 AM

payments_team@ebay wrote:

@valueaddedresource wrote:

@keziak wrote:Those 2 paragraphs seem to contradict each other. Does the total include the sales tax or not?

@keziak - to me it sounds like eBay will include seller collected tax in the 1099K (because it was paid to you, the seller), but will not include Marketplace Facilitator tax (because it was paid to eBay to remit to the state, not to the seller).

Maybe payments_team@ebay can clarify this for us.

@valueaddedresource we don't have an answer to this specific question so we've requested more information. When we know more then we will share it here.

payments_team@ebay Seriously? 1099K either DO or they DO NOT include the sales tax eBay collected and charged Sellers their fees on ... PayPal had no issues implementing Sales tax in their process (1099K Gross total AND specific column in their CSV database) when it started to happen ... someone from eBay should call them and ask how to do it ...

Managed Payments has been around for what, over 2 years???

Regards,

Regards,Mr. Lincoln - Community Mentor