- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- 1099 form

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-20-2020 07:55 PM

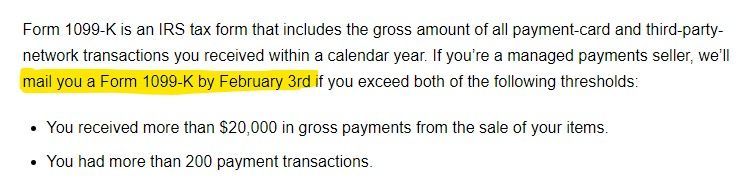

I am wondering if I will get a 1099 from ebay this year. Is the document based on total or net sales? If total I may just squeak in under the wire if I make enough sales by the end of the month. But I will be well below the $20K threshold if based on net sales.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-16-2021 07:10 AM

As a intermittent seller of personal items (not doing it as a job or business) my personal opinion is that eBay should not treat me like I work for them and send me a 1099.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-16-2021 07:21 AM

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 11:07 AM

Is 2020 Form 1099-K from ebay available yet? Where is it?

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 12:06 PM

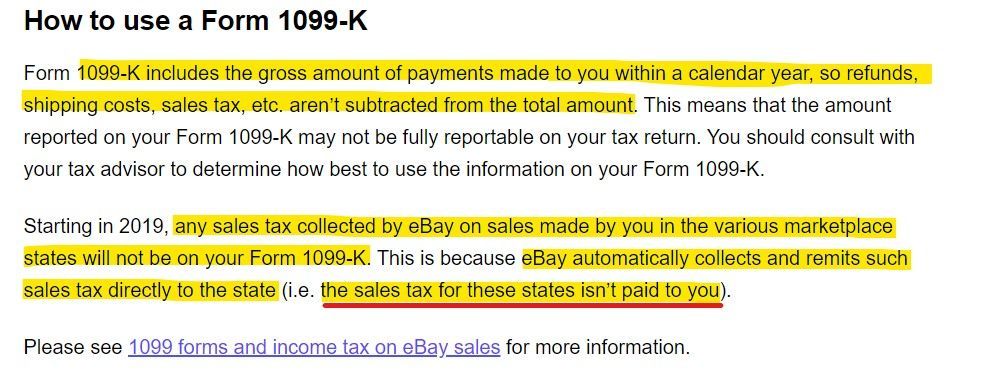

@keziak wrote:Those 2 paragraphs seem to contradict each other. Does the total include the sales tax or not?

@keziak - to me it sounds like eBay will include seller collected tax in the 1099K (because it was paid to you, the seller), but will not include Marketplace Facilitator tax (because it was paid to eBay to remit to the state, not to the seller).

Maybe payments_team@ebay can clarify this for us.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 12:12 PM

@bowoninc the 1099K help page shows eBay will be mailing them by Feb 3rd, so I imagine they *should* be available to download under the Payments tab around that time as well.

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 12:53 PM

@keziak wrote:I am wondering if I will get a 1099 from ebay this year. Is the document based on total or net sales? If total I may just squeak in under the wire if I make enough sales by the end of the month. But I will be well below the $20K threshold if based on net sales.

ONLY if you had the minimum [or above] requirement that ran through MP.

The amounts prior to entry into MP would be reported by PP.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 12:56 PM

If they treated you like you worked for them, you'd get a W-2, not a 1099.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 12:59 PM

@keziak wrote:Those 2 paragraphs seem to contradict each other. Does the total include the sales tax or not?

This is often confused by sellers.

1099K's have ALWAYS [even in PP] reported Gross RECEIPTS. Gross Receipts is NOT the same thing as Gross Sales.

Gross Receipts are 100% of the money you received from your customers without exception or exclusion. On the Schedule C that goes with your Federal Tax report you will see all the stuff you can deduct from that amount to arrive at your Net income / sales.

You will deduct product costs, shipping costs, shipping supplies, sales tax, and so on.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 01:02 PM

@dlg01 wrote:As a intermittent seller of personal items (not doing it as a job or business) my personal opinion is that eBay should not treat me like I work for them and send me a 1099.

Every single transaction conducted on this site is a business transaction. There are NO personal transaction on this site. Whether or not you consider yourself a little business or not.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 01:27 PM

@mam98031 - I think the confusion seems to be, at least on the 1099k help page, eBay is saying that Marketplace Facilitator tax is not paid to the seller in Managed Payments and therefore won't be included in the 1099k.

I'm not saying this is legally correct as far as the IRS (I'm not a tax expert) or even that it accurately reflects how eBay is going to actually handle 1099ks in practice (we've all seen examples where what a help or policy page says and what eBay does are not the same thing.)

I think it is going to come down to the technicality of whether or not Marketplace Facilitator taxes are paid to the seller and then deducted back out to eBay or go directly from buyer to eBay to the state. That help page seems to be indicating it is the latter, but hopefully the payments team can give us some more clarity.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 02:21 PM

@valueaddedresource wrote:@mam98031 - I think the confusion seems to be, at least on the 1099k help page, eBay is saying that Marketplace Facilitator tax is not paid to the seller in Managed Payments and therefore won't be included in the 1099k.

I'm not saying this is legally correct as far as the IRS (I'm not a tax expert) or even that it accurately reflects how eBay is going to actually handle 1099ks in practice (we've all seen examples where what a help or policy page says and what eBay does are not the same thing.)

I think it is going to come down to the technicality of whether or not Marketplace Facilitator taxes are paid to the seller and then deducted back out to eBay or go directly from buyer to eBay to the state. That help page seems to be indicating it is the latter, but hopefully the payments team can give us some more clarity.

I know. I've been very vocal to Ebay on this and the fact it is incorrect. We are part way there. The detailed report in MP now includes the sales tax Ebay collects. It is my hope they will get the 1099K correct too as if the money enters MP on a seller's account it is suppose to be part of the Gross Receipts stated on the 1099K.

IDK, but maybe this is why the 1099K for 2020 seems to be taking a little time to generate. It is coming, but maybe they are doing it correctly this time. Again IDK that to be the case, but we can cross our fingers and hope for the best.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 02:57 PM

@mam98031 wrote:It is my hope they will get the 1099K correct too as if the money enters MP on a seller's account it is suppose to be part of the Gross Receipts stated on the 1099K.

@mam98031 - key word there being IF. If it doesn't enter MP "on the seller's account" then it would stand to reason it isn't supposed to be part of the Gross Receipts, right?

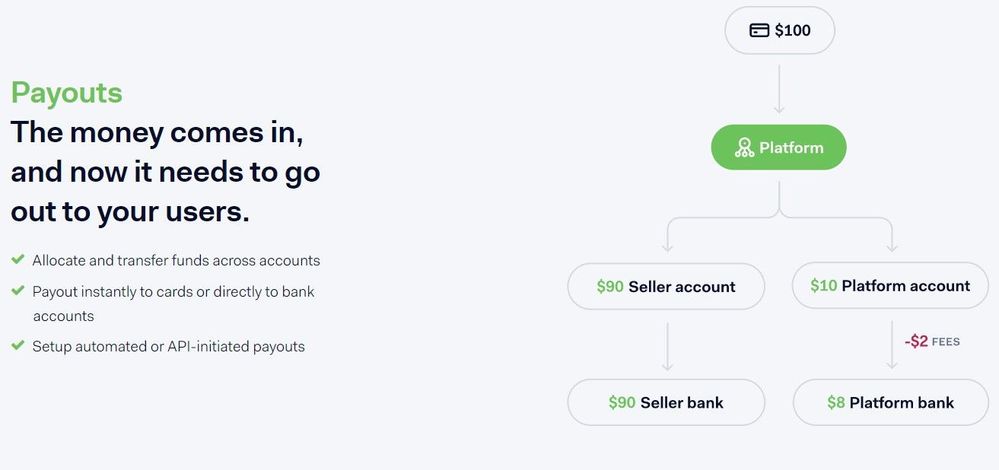

When PayPal processes payments, the entire amount pretty much has to flow through them and then the Marketplace tax amount is forwarded on to eBay. With eBay managing payments, it may not necessarily be the case that it has to be done the same way it was under PayPal.

I think it would be a mistake to assume that the total amount including marketplace facilitator taxes is being deposited in a seller's MP "account" and then deducted back out in exactly the same way that it used to be with PP.

This screenshot from Adyen's page on their Platform Solution shows they clearly have the capability to allocate and transfer to "seller account" and "platform account" separately.

Based on the wording of that 1099 help page which explicitly says "the sales tax for these states isn't paid to you", I'd say it's likely that's exactly what they are doing.

If eBay has said somewhere else that marketplace facilitator taxes "enter MP on a seller's account", we definitely need to bring that to the attention of payments_team@ebay as well because that would be a huge contradiction to what is stated in that help page.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 03:48 PM

@valueaddedresource wrote:

@mam98031 wrote:It is my hope they will get the 1099K correct too as if the money enters MP on a seller's account it is suppose to be part of the Gross Receipts stated on the 1099K.@mam98031 - key word there being IF. If it doesn't enter MP "on the seller's account" then it would stand to reason it isn't supposed to be part of the Gross Receipts, right?

When PayPal processes payments, the entire amount pretty much has to flow through them and then the Marketplace tax amount is forwarded on to eBay. With eBay managing payments, it may not necessarily be the case that it has to be done the same way it was under PayPal.

I think it would be a mistake to assume that the total amount including marketplace facilitator taxes is being deposited in a seller's MP "account" and then deducted back out in exactly the same way that it used to be with PP.

This screenshot from Adyen's page on their Platform Solution shows they clearly have the capability to allocate and transfer to "seller account" and "platform account" separately.

Based on the wording of that 1099 help page which explicitly says "the sales tax for these states isn't paid to you", I'd say it's likely that's exactly what they are doing.

If eBay has said somewhere else that marketplace facilitator taxes "enter MP on a seller's account", we definitely need to bring that to the attention of payments_team@ebay as well because that would be a huge contradiction to what is stated in that help page.

Which is why I said I DON'T KNOW [IDK]!

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 04:39 PM

@mam98031 - I was only clarifying because I have seen several posts from you where you state that in fact you DO know, not the least of which was earlier in that same post "I've been very vocal to Ebay on this and the fact it is incorrect. "

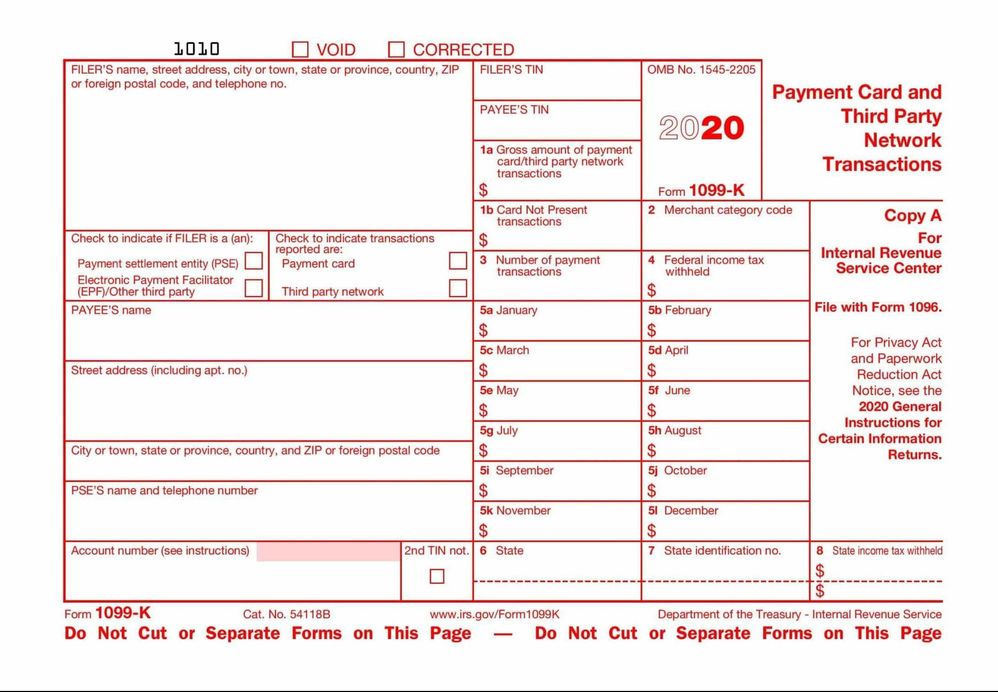

Almost every post I have seen you make where you use that screenshot of the 1099 form, you state as if it is a fact that Marketplace Facilitator taxes are paid into the seller's MP account, they should be included in the 1099 and eBay is just wrong or incorrect if they don't.

Yesterday in the weekly chat when @mr_lincoln brought up the topic of MP fees being charged on sales tax, you quite confidently and assertively stated that it is part of the money transaction processed through MP just as it was in PayPal.

"That isn't completely accurate. It is part of the $$ that go into MP and it is part of what ALL sellers have to account for if they get a 1099K. Ebay immediately removes the money to process it onto the appropriate state, but it is part of the money transaction processed through MP. Just as it was in PP and PP charged a fee on the sales tax for processing it. That is normal money processing procedures."

There are other examples and you can't just shrug it away with a not even spelled out IDK.

I appreciate the help you give in a lot of threads here, but unless you work for eBay and are a "payments trained teammate" or you have something directly from eBay where they explicitly state something different than what is on that 1099k help page, please do not throw "facts" around that are just your beliefs about how normal money processing procedures work. It's not helpful and just leads to more confusion.

1099 form

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-21-2021 04:50 PM

@valueaddedresource wrote:@mam98031 - I was only clarifying because I have seen several posts from you where you state that in fact you DO know, not the least of which was earlier in that same post "I've been very vocal to Ebay on this and the fact it is incorrect. "

Almost every post I have seen you make where you use that screenshot of the 1099 form, you state as if it is a fact that Marketplace Facilitator taxes are paid into the seller's MP account, they should be included in the 1099 and eBay is just wrong or incorrect if they don't.

Yesterday in the weekly chat when @mr_lincoln brought up the topic of MP fees being charged on sales tax, you quite confidently and assertively stated that it is part of the money transaction processed through MP just as it was in PayPal.

"That isn't completely accurate. It is part of the $$ that go into MP and it is part of what ALL sellers have to account for if they get a 1099K. Ebay immediately removes the money to process it onto the appropriate state, but it is part of the money transaction processed through MP. Just as it was in PP and PP charged a fee on the sales tax for processing it. That is normal money processing procedures."

There are other examples and you can't just shrug it away with a not even spelled out IDK.

I appreciate the help you give in a lot of threads here, but unless you work for eBay and are a "payments trained teammate" or you have something directly from eBay where they explicitly state something different than what is on that 1099k help page, please do not throw "facts" around that are just your beliefs about how normal money processing procedures work. It's not helpful and just leads to more confusion.

Let's be clear here. I do KNOW what the IRS requires on the 1099K, that wasn't the concern. What I said I did not know about was IF Ebay is correcting the way they issue 1099Ks or it's policy. I'm not sure how much clearer I can be or why what I said required clarity.

I have no need to "shrug" away anything. Maybe you are in a different position and you know what Ebay is going to do with the form and it's policy page. IDK as I don't have that inside track and make no claim that I do.

Your closing paragraph simply makes no sense I've repeatedly said IDK what Ebay is going to do [if anything] with the policy page or the form they issue. Take a breath and step back please. And don't represent my posts to say or mean something I never said.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999