Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:00 PM

Hi everyone! Thanks for joining us for the Weekly Chat with eBay Staff. We don't have a specific topic this week, so feel free to share any general buying or selling questions you may have.

The chat thread will remain open until 2 PM PT at which point we'll close it from additional responses. After that time, we'll continue to work on responding to any queries that might still be unanswered.

To post your question, click Reply in the lower right corner of this post, type your question, and hit submit between 1-2 PM Pacific Time. The format of our chat mirrors the format of our Community Discussion Boards, where each post will appear in the thread chronologically. The Community Team will review each question as it comes in, and will quote the original question in our reply. This quote and the reply will appear later in the thread, so just keep scrolling down to see our answers.

Missed the chat? Send your questions to the podcast by calling 888-723-4630 or email us at podcast@ebay.com and maybe your questions will make it on the air! Or listen to past episodes while you wait for next Wednesday!

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:25 PM

@coffeebean832 wrote:

The active listings page search on Seller Hub (not general search) is malfunctioning. Pretend I sell t-shirts.

If I type “shirt” in the search box it yields 0 listings.

If I type “tie dye” in the search box it yields 0 listings.

If I type “large” in the search box it will pull up a lot of listings, 30 of which are tie dye shirts.

All listings have both “shirt” and “tie dye” in the listing title. My search filters are set appropriately.

I don’t actually sell tie dye shirts, but I needed a generic example to explain my issue. I have screenshots showing my actual items and search results that I can send via e-mail.

Hi @coffeebean832 - thanks for letting us know what you're running into. If you'll send the examples we'll make sure they're reported!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:25 PM - edited 02-03-2021 01:48 PM

@carlqsportscards wrote:

When I click on ship your next item, it goes to the most recently paid. I want it to go to the earliest paid. Is this possible? I tried changing the order of the list, but it still goes to the most recently paid.

_____

Edit: A reply to your post can be found here

@carlqsportscards - I am not quite sure on this. Let me get with the correct team for more info and I will follow up with you here.

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:27 PM

@tink012 wrote:

Hi, Thanks for holding chat again!

I have a question about group 2 of managed payments. It appears I will no longer get an invoice for my store subscription or late shipping fees(ie FedEx). Instead those will be taken from sales receipts. Then if not enough cash is left, the remainder will come from my checking, not a credit card or PayPal even if I were to prefer. I phoned cs twice and this was confirmed. My settings reflect this – I cannot add a credit card as a preferred payment method for fees.

Can you confirm

- No more invoices or “heads up” when excess fees are taken from checking?

- We must pay store subscription fees and FedEx shipping in cash instead of credit card? Permanently?

If these two things are correct, there are several problems.

- if we can’t pay our subscription fees with a cash back or points card, that is another cost to us to use MP.

- If part of a fee that belongs to a prior sale (like a late shipping charge) or is non-specific (like a store fee) comes partially from current sales receipts and the rest from checking, that is extra accounting adjustments we have to make. This is exactly what happened to me last week with December FedEx fees, a small amount came out of a current sale and the rest from my checking.

- I struggle with the idea that our customers can pay in credit card but your customers(us) have to pay cash.

- I understand group 1 will be notified before this happens to them, but I joined MP on Jan 1, and what I understood from the website was that I could continue to pay my invoice via credit card. There was no information letting me know that I was in a group for whom the MP settings were different. Will you be updating the website to indicate that everything, even store subscriptions, must be paid in cash?

@tink012 I can confirm that sellers on this type of billing will no longer receive a monthly invoice. For sellers who do not receive a billing invoice your fees will be deducted from your Available funds awaiting to be sent to your bank account. This means you cannot use PayPal to pay for them. I believe the Expenses tab in Seller Hub should provide information on fees and give more information.

A checking/bank account will need to be used to pay for fees. Credit cards are not an option. If you want your fees to come out of your checking or bank account, you need to proactively change your payment method by going to your Account Settings, or in the Payments tab for those who are opted into Seller Hub.

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:28 PM - last edited on 02-03-2021 02:11 PM by tyler@ebay

Hi there! I just happened upon a thread mentioning that there was a weekly chat and lo and behold, it was today, right now!

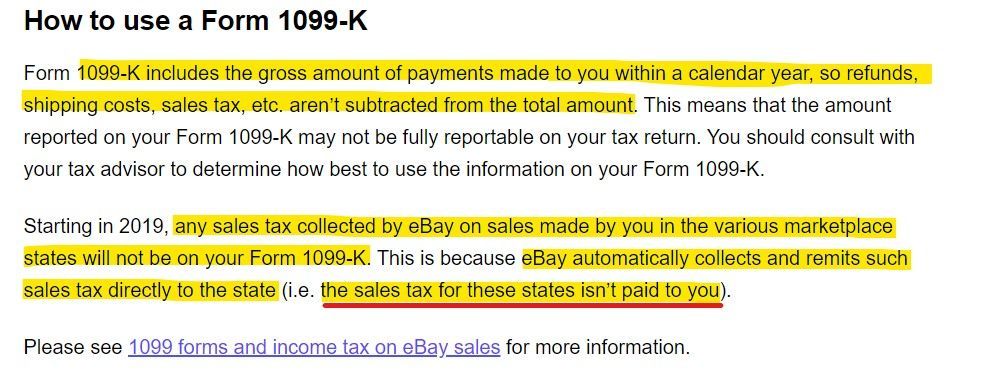

I can't think of anything to add right now but am interested in hearing more definite answer on the 1099-K and sales tax.

-----

edit: A reply to your comment can be found here

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:29 PM - edited 02-03-2021 01:30 PM

I get Standard Envelope is a new service, but it needs some work.

- Purchasing the labels and printing them fails maybe 25% of the time. I've had to ship a few with a stamp because it never resolved itself. I'm also aware of the issue warning the other day. It had since disappeared but I still couldn't generate a handful of labels.

- The shipping payment method cannot be changed, and I cannot confirm where I am being charged for these. Not reflecting on account balance, not pulling from any of my accounts.

- The cost of shipping for this service is not displaying on the transaction summary. I need to enter .51 for the postage, but then it ruins the formatting in Excel. It shouldn't be this difficult for eBay to reflect the cost of postage. There is a spot for it! Why does it show $0?

- USPS, including supervisors completely unaware of this service. I can confirm it works and scans in the postage machine for those wondering, but very typical of eBay to rush a new product without the communication side confirmed.

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:29 PM

@mr_lincoln wrote:Good afternoon eBay Support Team

Subject: eBay contributing to Tax Fraud

First pic below is from the IRS Schedule C form, Line 2 is where Sellers record refunds. The government expects Retailers to record ALL sales regardless if they result in a return or not, THAT would be Line 1.

Our State requires the SAME Gross total Sales dollars for State Tax ID holders AND we have to report as often as quarterly. So through the year I rely on the CSV file to total my Gross Sales for State reporting purposes.

eBay's recent changes to the CSV Transaction reports are contributing to Tax Fraud by creating NEW transaction types like "Claim" and "Hold" classifications and taking those values OUT of the Order's Gross total ... these two classifications are in addition to the three we had last year "Order", "Refund", "Shipping label". I had to change the "Hold" values to both Orders and Refunds to 1) satisfy the state's and ultimately the IRS requirement for Gross sales and 2) accurately reflect the sales that occurred.

However, in doing this the 1099k issued by eBay is NOT correct since it ONLY includes the Order amounts on the CSV and NOT the Hold amounts.

You CAN'T do what you are doing with Sales transactions because you are contributing to tax fraud. Below is a screen shot from the CSV before I fixed it ... NOTE that you also have the dates ALL WRONG for Holds ... YOU show dates as close as same or one day when the FACTS are weeks in some cases where an item is shipped and then returned and THEN refunded. This is really fraudulant information and you better get if fixed ASAP.

Speaking for myself only. How I remedied this for myself is took Column B and sorted it. I inserted three columns. One for Claims / holds, Shipping and Refunds. I moved the numbers appropriate for the columns to the new columns from the original column. Then resorted by date and did my total lines.

For those of us use to working with worksheet programs it doesn't take very long to do this. It would be nice if these items were split up by Ebay into their own columns, but absent that this is what I do.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:31 PM - last edited on 02-03-2021 02:20 PM by brittanie@ebay

From today's e-mail that eBay sent-

"Starting February 22nd, 2021, as part of our item specifics updates, certain variation details will no longer be valid. When you update listings with variations, you may need to revise your variation details."

Listings that are missing required IS appear in the search filter provided. Variation listings that may be flagged for IS no longer being valid are not appearing in the search filter unless they're missing IS. eBay is not flagging those listings in any way. I can only find out when a listing is affected if I attempt to individually update that listing by chance- when updating price, inventory, etc.

How can I find out which variation listings have attributes that are no longer valid as of February 22 since the required IS filter does not flag them?

_____

Edit: A reply to your post can be found here

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:32 PM - last edited on 02-03-2021 02:12 PM by brian@ebay

brian@ebay wrote:

@tink012 wrote:

Hi, Thanks for holding chat again!

I have a question about group 2 of managed payments. It appears I will no longer get an invoice for my store subscription or late shipping fees(ie FedEx). Instead those will be taken from sales receipts. Then if not enough cash is left, the remainder will come from my checking, not a credit card or PayPal even if I were to prefer. I phoned cs twice and this was confirmed. My settings reflect this – I cannot add a credit card as a preferred payment method for fees.

Can you confirm

- No more invoices or “heads up” when excess fees are taken from checking?

- We must pay store subscription fees and FedEx shipping in cash instead of credit card? Permanently?

If these two things are correct, there are several problems.

- if we can’t pay our subscription fees with a cash back or points card, that is another cost to us to use MP.

- If part of a fee that belongs to a prior sale (like a late shipping charge) or is non-specific (like a store fee) comes partially from current sales receipts and the rest from checking, that is extra accounting adjustments we have to make. This is exactly what happened to me last week with December FedEx fees, a small amount came out of a current sale and the rest from my checking.

- I struggle with the idea that our customers can pay in credit card but your customers(us) have to pay cash.

- I understand group 1 will be notified before this happens to them, but I joined MP on Jan 1, and what I understood from the website was that I could continue to pay my invoice via credit card. There was no information letting me know that I was in a group for whom the MP settings were different. Will you be updating the website to indicate that everything, even store subscriptions, must be paid in cash?

@tink012 I can confirm that sellers on this type of billing will no longer receive a monthly invoice. For sellers who do not receive a billing invoice your fees will be deducted from your Available funds awaiting to be sent to your bank account. This means you cannot use PayPal to pay for them. I believe the Expenses tab in Seller Hub should provide information on fees and give more information.

A checking/bank account will need to be used to pay for fees. Credit cards are not an option. If you want your fees to come out of your checking or bank account, you need to proactively change your payment method by going to your Account Settings, or in the Payments tab for those who are opted into Seller Hub.

Can you tell me where to find 'Group 1' vs. 'Group 2', and the deadlines for the new billing implementation?

_____

Edit: Reply to this post can be read here

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:32 PM - last edited on 02-03-2021 02:22 PM by brian@ebay

Subject: New Reply to Feedback process

You have GOT to change this new Feedback system back to the old way without delay ... you have DELETED all my pre-typed replies when I Reply to Feedback AND this new system does NOT record the replies I now have to type in ... prior to this change, all you needed to do was type the first letter and ALL replies starting with that letter would appear and you could POINT AND CLICK to select one.

I created a thread on this and another member posted a link to a thread from a Buyer who is NOT happy with how they have to Leave Feedback ... TOO much work.

Why is it that virtually every new feature eBay creates does nothing but create more work ???

Whoever is doing this type of programming is NOT a user and therefore shouldn't be anywhere near an eBay program. Who would make this change and not carry the pre-typed replies forward? THAT is such poor programming its not even funny.

_____

Edit: Reply to this post can be read here

Regards,

Regards,Mr. Lincoln - Community Mentor

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:34 PM - last edited on 02-03-2021 02:14 PM by tyler@ebay

In the reports available in the payment tab, you are supposed to be able to run reports for specific transaction types. But none of the types can be selected. Can you let the appropriate folks know that this doesn't work?

thanks!

-----

edit: A reply to your comment can be found here

wooden_flower Volunteer Community Mentor.

wooden_flower Volunteer Community Mentor.eBay member since 2001.

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:36 PM

@valueaddedresource wrote:

brittanie@ebay payments_team@ebay

Just when we *finally* got a clear and definitive answer from the payments team that seller collected sales tax *is* included in the 1099-K, but eBay collected tax is *not*, eBay seems to be doing its best to throw more confusion back into this subject.

rebecca@ebay & Griff talking about 1099-K’s on the eBay for business podcast made no clear distinction between seller collected or eBay collected tax, which just muddies the water and isn’t very helpful.

Then I noticed today that the 1099-K help page has been changed! The previous version was a much more clear, direct, and explicit explanation of what is and is not included in the 1099-K and most importantly, why it is or is not included.

The new version is much less clear.

“Form 1099-K does not include sales tax, which is automatically collected and remitted by eBay.”

Forgive me for calling in the grammar police here, but the placement of the comma in that sentence makes it read as if all sales tax is automatically collected by eBay and therefore all sales tax will not be included in the 1099-K form.

While this could certainly change in the coming year, it is important to note there are still a few states which have sales tax but do not have Marketplace Facilitator laws on the books, so sellers may still have an obligation to collect and remit tax for those states directly.

Sellers need to have clear, direct, and accurate information about Managed Payments, and especially about how it may affect their income tax filing.

Why on earth would eBay change a “help” page to be far less helpful when the previous language was much more precise and easier to understand?

Or is this change an indication that something bigger has changed in the policy or how eBay will be handling 1099-Ks going forward? And if so, why is that not spelled out?!

@valueaddedresource seller collect sales tax will be included on the 1099-K form while eBay collected sales tax will not be included. I'm happy to pass along your feedback about the updates to the wording on that help page!

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:37 PM

brian@ebay wrote:

@valueaddedresource wrote:brittanie@ebay payments_team@ebay

Just when we *finally* got a clear and definitive answer from the payments team that seller collected sales tax *is* included in the 1099-K, but eBay collected tax is *not*, eBay seems to be doing its best to throw more confusion back into this subject.

rebecca@ebay & Griff talking about 1099-K’s on the eBay for business podcast made no clear distinction between seller collected or eBay collected tax, which just muddies the water and isn’t very helpful.

Then I noticed today that the 1099-K help page has been changed! The previous version was a much more clear, direct, and explicit explanation of what is and is not included in the 1099-K and most importantly, why it is or is not included.

The new version is much less clear.

“Form 1099-K does not include sales tax, which is automatically collected and remitted by eBay.”

Forgive me for calling in the grammar police here, but the placement of the comma in that sentence makes it read as if all sales tax is automatically collected by eBay and therefore all sales tax will not be included in the 1099-K form.

While this could certainly change in the coming year, it is important to note there are still a few states which have sales tax but do not have Marketplace Facilitator laws on the books, so sellers may still have an obligation to collect and remit tax for those states directly.

Sellers need to have clear, direct, and accurate information about Managed Payments, and especially about how it may affect their income tax filing.

Why on earth would eBay change a “help” page to be far less helpful when the previous language was much more precise and easier to understand?

Or is this change an indication that something bigger has changed in the policy or how eBay will be handling 1099-Ks going forward? And if so, why is that not spelled out?!@valueaddedresource seller collect sales tax will be included on the 1099-K form while eBay collected sales tax will not be included. I'm happy to pass along your feedback about the updates to the wording on that help page!

brian@ebay thanks for the re-clarification, and for passing on the feedback. 😊

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:38 PM

After reading this weeks thread, it is clear now more than ever eBay needs to step up and act accountable for the many site issues. I get you are the messengers, but I'd be embarrassed to have to try and answer this mess. Who is actually in charge? Step it up, this is real business and real money.

I continue to grow my own website, yet I just want eBay to work? I don't mind sharing the profit in fees, but I do expect a reliable service for it.

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:39 PM

@sshorn64 wrote:

In December I shipped a package via UPS. I entered the dimensions of 36 x 24 x 4 with a weight of 14 pounds and purchased the label through ebay. When my invoice arrived it had a charge of $991.99 for shipping for this package. I have been trying to resolve this issue for more than a month. Ebay's dispute department says they submitted this issue to UPS and the amount is correct. UPS says the package was 81 x 40 x 3 and 90 pounds. UPS cannot help me because the label was purchased through ebay, and I am a third party. Ebay expects me to accept this resolution. I do not have a thousand dollars to pay for someone else's mistake. I have been bounced from department to department, and I cannot speak to someone from the dispute department. What can I do to resolve this problem?

Hi @sshorn64 - the best course of action to address a UPS label dispute is to contact Customer Support. They are able to raise an inquiry directly with the carrier. If the inquiry is denied, there may not be any further recourse you have. Please consider contacting CS again so they can look further into it. Thanks!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:39 PM - last edited on 02-03-2021 02:37 PM by brian@ebay

brian@ebay wrote:

@tink012 wrote:

Hi, Thanks for holding chat again!

I have a question about group 2 of managed payments. It appears I will no longer get an invoice for my store subscription or late shipping fees(ie FedEx). Instead those will be taken from sales receipts. Then if not enough cash is left, the remainder will come from my checking, not a credit card or PayPal even if I were to prefer. I phoned cs twice and this was confirmed. My settings reflect this – I cannot add a credit card as a preferred payment method for fees.

Can you confirm

- No more invoices or “heads up” when excess fees are taken from checking?

- We must pay store subscription fees and FedEx shipping in cash instead of credit card? Permanently?

If these two things are correct, there are several problems.

- if we can’t pay our subscription fees with a cash back or points card, that is another cost to us to use MP.

- If part of a fee that belongs to a prior sale (like a late shipping charge) or is non-specific (like a store fee) comes partially from current sales receipts and the rest from checking, that is extra accounting adjustments we have to make. This is exactly what happened to me last week with December FedEx fees, a small amount came out of a current sale and the rest from my checking.

- I struggle with the idea that our customers can pay in credit card but your customers(us) have to pay cash.

- I understand group 1 will be notified before this happens to them, but I joined MP on Jan 1, and what I understood from the website was that I could continue to pay my invoice via credit card. There was no information letting me know that I was in a group for whom the MP settings were different. Will you be updating the website to indicate that everything, even store subscriptions, must be paid in cash?

@tink012 I can confirm that sellers on this type of billing will no longer receive a monthly invoice. For sellers who do not receive a billing invoice your fees will be deducted from your Available funds awaiting to be sent to your bank account. This means you cannot use PayPal to pay for them. I believe the Expenses tab in Seller Hub should provide information on fees and give more information.

A checking/bank account will need to be used to pay for fees. Credit cards are not an option. If you want your fees to come out of your checking or bank account, you need to proactively change your payment method by going to your Account Settings, or in the Payments tab for those who are opted into Seller Hub.

Except the Expense tab doesn't allow for downloading or printing. You can only view it on screen.

Question? When do these fees get deducted from those in Phase 2 of MP, those that entered between approximately November of 2020 and now? Do the deduct immediately upon the fee being charged the seller or after it is 30 days old? I suspect that it is when the fee is issued but I just want to verify. So it is when the fee is incurred.

Your mention of "checking/bank account". It is my understanding that the only form of account that can be attached to MP is a Checking Account. Has this changed? I know things do frequently in MP so just asking.

_____

Edit: Reply to this post can be read here

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999