- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Community Info

- Retired Monthly Chat with eBay Staff

- Re: Community Chat, February 3 @ 1:00 pm PT - Gene...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:00 PM

Hi everyone! Thanks for joining us for the Weekly Chat with eBay Staff. We don't have a specific topic this week, so feel free to share any general buying or selling questions you may have.

The chat thread will remain open until 2 PM PT at which point we'll close it from additional responses. After that time, we'll continue to work on responding to any queries that might still be unanswered.

To post your question, click Reply in the lower right corner of this post, type your question, and hit submit between 1-2 PM Pacific Time. The format of our chat mirrors the format of our Community Discussion Boards, where each post will appear in the thread chronologically. The Community Team will review each question as it comes in, and will quote the original question in our reply. This quote and the reply will appear later in the thread, so just keep scrolling down to see our answers.

Missed the chat? Send your questions to the podcast by calling 888-723-4630 or email us at podcast@ebay.com and maybe your questions will make it on the air! Or listen to past episodes while you wait for next Wednesday!

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:55 PM

@mr_lincoln wrote:

@mam98031 wrote:

@mr_lincoln wrote:Good afternoon eBay Support Team

Subject: eBay contributing to Tax Fraud

First pic below is from the IRS Schedule C form, Line 2 is where Sellers record refunds. The government expects Retailers to record ALL sales regardless if they result in a return or not, THAT would be Line 1.

Our State requires the SAME Gross total Sales dollars for State Tax ID holders AND we have to report as often as quarterly. So through the year I rely on the CSV file to total my Gross Sales for State reporting purposes.

eBay's recent changes to the CSV Transaction reports are contributing to Tax Fraud by creating NEW transaction types like "Claim" and "Hold" classifications and taking those values OUT of the Order's Gross total ... these two classifications are in addition to the three we had last year "Order", "Refund", "Shipping label". I had to change the "Hold" values to both Orders and Refunds to 1) satisfy the state's and ultimately the IRS requirement for Gross sales and 2) accurately reflect the sales that occurred.

However, in doing this the 1099k issued by eBay is NOT correct since it ONLY includes the Order amounts on the CSV and NOT the Hold amounts.

You CAN'T do what you are doing with Sales transactions because you are contributing to tax fraud. Below is a screen shot from the CSV before I fixed it ... NOTE that you also have the dates ALL WRONG for Holds ... YOU show dates as close as same or one day when the FACTS are weeks in some cases where an item is shipped and then returned and THEN refunded. This is really fraudulant information and you better get if fixed ASAP.

Speaking for myself only. How I remedied this for myself is took Column B and sorted it. I inserted three columns. One for Claims / holds, Shipping and Refunds. I moved the numbers appropriate for the columns to the new columns from the original column. Then resorted by date and did my total lines.

For those of us use to working with worksheet programs it doesn't take very long to do this. It would be nice if these items were split up by Ebay into their own columns, but absent that this is what I do.

@mam98031 eBay should have put the Hold and Claims amounts in additional columns if THEY need the info for some reason BUT leave the Sold amounts as Order transactions and refunded Hold amounts as Refunds via the original 3 transaction types they had last year ... if those Hold sales are ADDED to the Order totals then the 1099K does NOT match despite the fact that those Sales occurred ...

I've been working with spreadsheets longer then some of these programmers have been alive ... they have NO experience with Selling on online venues NOR any Tax experience ... THAT's pretty obvious.

My personal opinion is yes. They know we have to fill this information into the Schedule C of our tax reports. This info needs to be more seller friendly. It isn't that difficult for Ebay to actually change this stuff to benefit every single seller out there.

With that said, PP doesn't separate them either. You have to do the same thing to PP's reports.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999"I can explain it to you, but I can't understand it for you." Quote from Edward I Koch

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:56 PM

@valueaddedresource wrote:

tyler@ebay - just my weekly reminder, checking in on that issue with taxes being overcharged on batteries. 😊

I think it's more important than ever to get some sort of resolution on this. eBay just reported Q4 2020 earnings today and all of those overcharged fees were presumably counted in GMV. 😬

Agreed @valueaddedresource - I got it escalated last week (thanks for your help there) and am hoping we'll see something come of it!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:57 PM

tyler@ebay wrote:

@valueaddedresource wrote:tyler@ebay - just my weekly reminder, checking in on that issue with taxes being overcharged on batteries. 😊

I think it's more important than ever to get some sort of resolution on this. eBay just reported Q4 2020 earnings today and all of those overcharged fees were presumably counted in GMV. 😬

Agreed @valueaddedresource - I got it escalated last week (thanks for your help there) and am hoping we'll see something come of it!

That's great news tyler@ebay ! Thank you for continuing to knock on those doors. 😊

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 01:58 PM

Can you tell me where to find 'Group 1' vs. 'Group 2', and the deadlines for the new billing implementation?

Sorry... asked way back at #22, and wanted to make sure to ask again before Chat closes. Hit me up. Thanks!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:00 PM

@sunshines-surprises wrote:Hello! My seller name is sunshines-surprises. Because I haven't read my emails from ebay in a long time, I didn't know that Paypal is no longer related to eBay. I sold an item a few weeks ago, and the buyer paid me. I went to paypal as I always do, to retrieve my money, put it in my savings account, and then print up a usps label to ship. Welll, no matter how I tried I couldn't get the money out of ebay since the payment was not in my paypal account. I was beside myself and so I wrote to the buyer and said I couldn't get their money out, so they cancelled the sale and took their payment back. Okay, so I thought that was it and I put my entire auction list on "vacation" until I could figure out what happened to eBay. Apparently it doesn't stay on vacation forever, because today I sold a pair of socks. Same problem as the last sale. Couldn't retrieve my money and for whatever reason, the cost of a USPS First Class Shipping label was over $5.00 for a 3-oz package, which is $2.00 more than I always pay. So, I cancelled the label with USPS and here I sit, unable to get my money and unable to print up the shipping label for the correct amount. I've been trying to get through to eBay for hours, but we know that's impossible. I don't know what to do and I would SO SO appreciate it if you could help me. I will be watching for a response, or if you possibly could, a phone call! Thank you so much!

Oh that is a dangerous thing to do with how quick things change on the site.

Ebay and PP split in 2015. But I think you are more talking about Managed Payments and the fact that this is required for sellers that receive the email that it is time to enter the program.

You need to register for Manage Payments. They will require your bank routing number, checking account number and your SSN or EIN. Below is a list of common mistakes that can complicate your registration process, so make sure everything is accurate.

Common reasons for needing further verification on your MP account. Sometimes it does take an MP team member to help fix this issue but sometimes it can be troubleshooted by the seller themselves. Check the following.

For any field you update, clear the field and retype the entire entry. Don’t just adjust the field for any changes. Clear it and start fresh.

- Make sure you birth date is correct on your Ebay set up.

- Your primary address can NOT be a PO box, it needs to be a physical address.

- Your name on your Ebay account must PERFECTLY match your bank account you want to attach without the least little exception. If you have a middle initial on one and not the other, that will be enough to cause you issues. They must be perfectly matched.

- Verify your routing number and account number before entering it. Review it carefully on screen before committing it. If you have the need to correct your routing number or your bank account number, clear the field FIRST. Then re-enter the numbers. Sounds unimportant, but it is something that can make the difference.

- The bank account you attach MUST be a checking account.

- Verify that your SSN, EIN or TIN is correctly entered, no dashes, just numbers.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999"I can explain it to you, but I can't understand it for you." Quote from Edward I Koch

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:00 PM

@mr_lincoln wrote:

Good afternoon eBay Support Team

Subject: eBay contributing to Tax Fraud

First pic below is from the IRS Schedule C form, Line 2 is where Sellers record refunds. The government expects Retailers to record ALL sales regardless if they result in a return or not, THAT would be Line 1.

Our State requires the SAME Gross total Sales dollars for State Tax ID holders AND we have to report as often as quarterly. So through the year I rely on the CSV file to total my Gross Sales for State reporting purposes.

eBay's recent changes to the CSV Transaction reports are contributing to Tax Fraud by creating NEW transaction types like "Claim" and "Hold" classifications and taking those values OUT of the Order's Gross total ... these two classifications are in addition to the three we had last year "Order", "Refund", "Shipping label". I had to change the "Hold" values to both Orders and Refunds to 1) satisfy the state's and ultimately the IRS requirement for Gross sales and 2) accurately reflect the sales that occurred.

However, in doing this the 1099k issued by eBay is NOT correct since it ONLY includes the Order amounts on the CSV and NOT the Hold amounts.

You CAN'T do what you are doing with Sales transactions because you are contributing to tax fraud. Below is a screen shot from the CSV before I fixed it ... NOTE that you also have the dates ALL WRONG for Holds ... YOU show dates as close as same or one day when the FACTS are weeks in some cases where an item is shipped and then returned and THEN refunded. This is really fraudulant information and you better get if fixed ASAP.

@mr_lincoln I'm happy to pass along your feedback. In the meantime, @mam98031 gave a good suggestion in post 20. Thanks!

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:02 PM

Thanks for joining the chat - it is now closed but we will continue working through to ensure that questions receive a reply.

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:10 PM

@cassandradavi38 wrote:

Hi there! I just happened upon a thread mentioning that there was a weekly chat and lo and behold, it was today, right now!

I can't think of anything to add right now but am interested in hearing more definite answer on the 1099-K and sales tax.

Well welcome to the chat @cassandradavi38 we're happy to see you here! We should be here every Wednesday to address your questions (though some weeks we have an on-topic chat with guests from various eBay departments to address specific questions).

Hoping to see you more on the boards!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:11 PM

@mtgraves7984 wrote:

brian@ebay wrote:

@tink012 wrote:

Hi, Thanks for holding chat again!

I have a question about group 2 of managed payments. It appears I will no longer get an invoice for my store subscription or late shipping fees(ie FedEx). Instead those will be taken from sales receipts. Then if not enough cash is left, the remainder will come from my checking, not a credit card or PayPal even if I were to prefer. I phoned cs twice and this was confirmed. My settings reflect this – I cannot add a credit card as a preferred payment method for fees.

Can you confirm

- No more invoices or “heads up” when excess fees are taken from checking?

- We must pay store subscription fees and FedEx shipping in cash instead of credit card? Permanently?

If these two things are correct, there are several problems.

- if we can’t pay our subscription fees with a cash back or points card, that is another cost to us to use MP.

- If part of a fee that belongs to a prior sale (like a late shipping charge) or is non-specific (like a store fee) comes partially from current sales receipts and the rest from checking, that is extra accounting adjustments we have to make. This is exactly what happened to me last week with December FedEx fees, a small amount came out of a current sale and the rest from my checking.

- I struggle with the idea that our customers can pay in credit card but your customers(us) have to pay cash.

- I understand group 1 will be notified before this happens to them, but I joined MP on Jan 1, and what I understood from the website was that I could continue to pay my invoice via credit card. There was no information letting me know that I was in a group for whom the MP settings were different. Will you be updating the website to indicate that everything, even store subscriptions, must be paid in cash?

@tink012 I can confirm that sellers on this type of billing will no longer receive a monthly invoice. For sellers who do not receive a billing invoice your fees will be deducted from your Available funds awaiting to be sent to your bank account. This means you cannot use PayPal to pay for them. I believe the Expenses tab in Seller Hub should provide information on fees and give more information.

A checking/bank account will need to be used to pay for fees. Credit cards are not an option. If you want your fees to come out of your checking or bank account, you need to proactively change your payment method by going to your Account Settings, or in the Payments tab for those who are opted into Seller Hub.

Can you tell me where to find 'Group 1' vs. 'Group 2', and the deadlines for the new billing implementation?

@mtgraves7984 the easiest way to tell if you are in group 2 is if you no longer receive an invoice. This began on or around October 26th. My understanding is that this will be the experience for all sellers eventually, but I don't have a timeframe.

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:13 PM

@wooden_flower wrote:

In the reports available in the payment tab, you are supposed to be able to run reports for specific transaction types. But none of the types can be selected. Can you let the appropriate folks know that this doesn't work?

thanks!

Hi @wooden_flower - I'll get that reported and let you know what I hear back!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:19 PM

@wooden_flower wrote:

On the 'request your eBay data' selections - I do not see seller invoices.

Am I just missing it? Or does it still take a call to CS to get older invoices? I know the new invoice tab in payments goes back farther that the invoice list in your selling account, but sometimes you need back to the beginning of the previous calendar year.

thanks!

Hi @wooden_flower - older invoices is something that CS can help generate for you if they're not immediately available. It can sometimes take a few days for it to generate but they should follow up with you to include those invoices as attachments. Thanks!

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:19 PM

@coffeebean832 wrote:

From today's e-mail that eBay sent-

"Starting February 22nd, 2021, as part of our item specifics updates, certain variation details will no longer be valid. When you update listings with variations, you may need to revise your variation details."

Listings that are missing required IS appear in the search filter provided. Variation listings that may be flagged for IS no longer being valid are not appearing in the search filter unless they're missing IS. eBay is not flagging those listings in any way. I can only find out when a listing is affected if I attempt to individually update that listing by chance- when updating price, inventory, etc.

How can I find out which variation listings have attributes that are no longer valid as of February 22 since the required IS filter does not flag them?

@coffeebean832 - Great question! I don't have a lot of details on this at the moment, to determine if what you're seeing is correct or not, so I've reached out to get more information. I will follow up with you here when I know more.

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:21 PM

@mr_lincoln wrote:

Subject: New Reply to Feedback process

You have GOT to change this new Feedback system back to the old way without delay ... you have DELETED all my pre-typed replies when I Reply to Feedback AND this new system does NOT record the replies I now have to type in ... prior to this change, all you needed to do was type the first letter and ALL replies starting with that letter would appear and you could POINT AND CLICK to select one.

I created a thread on this and another member posted a link to a thread from a Buyer who is NOT happy with how they have to Leave Feedback ... TOO much work.

Why is it that virtually every new feature eBay creates does nothing but create more work ???

Whoever is doing this type of programming is NOT a user and therefore shouldn't be anywhere near an eBay program. Who would make this change and not carry the pre-typed replies forward? THAT is such poor programming its not even funny.

@mr_lincoln thanks for sharing this with us! I wasn't aware that had changed. I'll send your feedback over to the right team. Thanks!

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:23 PM

@valueaddedresource wrote:

brian@ebay wrote:

@valueaddedresource wrote:

brittanie@ebay payments_team@ebay

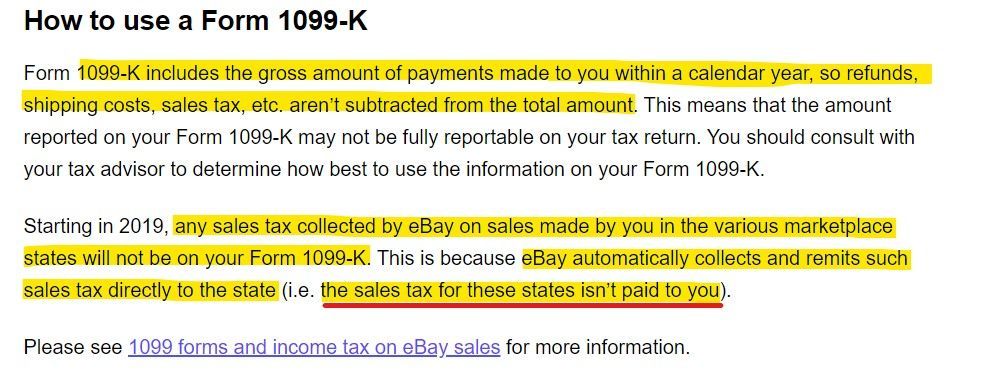

Just when we *finally* got a clear and definitive answer from the payments team that seller collected sales tax *is* included in the 1099-K, but eBay collected tax is *not*, eBay seems to be doing its best to throw more confusion back into this subject.

rebecca@ebay & Griff talking about 1099-K’s on the eBay for business podcast made no clear distinction between seller collected or eBay collected tax, which just muddies the water and isn’t very helpful.

Then I noticed today that the 1099-K help page has been changed! The previous version was a much more clear, direct, and explicit explanation of what is and is not included in the 1099-K and most importantly, why it is or is not included.

The new version is much less clear.

“Form 1099-K does not include sales tax, which is automatically collected and remitted by eBay.”

Forgive me for calling in the grammar police here, but the placement of the comma in that sentence makes it read as if all sales tax is automatically collected by eBay and therefore all sales tax will not be included in the 1099-K form.

While this could certainly change in the coming year, it is important to note there are still a few states which have sales tax but do not have Marketplace Facilitator laws on the books, so sellers may still have an obligation to collect and remit tax for those states directly.

Sellers need to have clear, direct, and accurate information about Managed Payments, and especially about how it may affect their income tax filing.

Why on earth would eBay change a “help” page to be far less helpful when the previous language was much more precise and easier to understand?

Or is this change an indication that something bigger has changed in the policy or how eBay will be handling 1099-Ks going forward? And if so, why is that not spelled out?!@valueaddedresource seller collect sales tax will be included on the 1099-K form while eBay collected sales tax will not be included. I'm happy to pass along your feedback about the updates to the wording on that help page!

brian@ebay thanks for the re-clarification, and for passing on the feedback. 😊

@valueaddedresource happy to help where I can 😁

Community Team

Re: Community Chat, February 3 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2021 02:35 PM

@go-bad-chicken wrote:

The eBay Payments team and tyler@ebay posted an announcement/update, last week on the payments board regarding the on-boarding of coin and paper money sellers into Managed Payments.

My question is what is the NEW Managed Payments FVF rate/fee structure for coin and paper money sellers once they are activated into MP?

eBay has yet to inform sellers what the new FVF will be in the coin and paper money category but yet insist on advising sellers to "If you've received a notification to register, we recommend you do so by the deadline indicated in the email you received.".

IMO I think that eBay would find that sellers would be less resistant to pre registering or enrolling into MP if they were not being asked to do so blindly and without all of the pertinent information to make an informed decision for themselves. Let me put it this away. Would you sign up for a credit card, and give them all of your financial information without knowing what the actual interest rate is before hand.

Hi @go-bad-chicken - Current details on fees for the coins categories are available here (for store sellers) and here (for non-store sellers). These pages will be updated as additional subcategories are added. Thanks!