- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Shipping

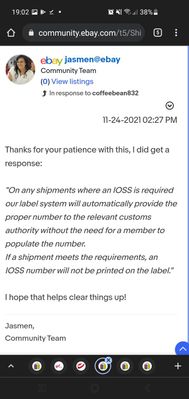

- Re: IOSS and double VAT taxation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

08-09-2021 03:30 AM

I purchased some stuff from the US, with shipping method `USPS First Class Mail International Parcel`, and got charged VAT by eBay at checkout.

On eBay the order have a tracking number starting with `ESUS`, and when arriving in Sweden it had gotten a new tracking number in the form of `LW*********DE` and the postal service is requesting VAT to be paid again.

When asking the postal service about it the reply was:

```

I detta fall har inte avsändaren föraviserat IOSS på korrekt sätt med rätt underlag och i dessa fall kan vi inte hantera försändelsen utan betalning utan försändelsen hamnar i momsflödet. Betalning behöver inkomma för att denna försändelse ska kunna skickas vidare till dig.

Du behöver därefter vända dig till din avsändare för återbetalning av avgiften.

```

Translation:

```

In this case the sender have not sent the IOSS pre-notification in a correct way with correct documentation and in these cases the parcel cannot be handled without payment, and it ends up in the regular VAT flow. Parcel cannot be forwarded to you before payment have been received.

Afterwards you have to contact the sender for refund of the fee.

```

How best to handle this?

Will I be able to get the VAT refunded from eBay (and if so how?), or do I have to wait for the payment timeout to be reached, so the parcel gets returned, and get the order refunded?

- « Previous

-

- 1

- 2

- Next »

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-17-2021 01:37 AM

I have twice paid VAT at eBay checkout and in both cases the sellers did not provide the required IOSS information on the packages.

One was from China, but it passed unnoticed through the customs - I think because it looked like a letter - it certainly didn't have IOSS data printed on it.

Another was a US package that was withheld in customs (Denmark) for payment of VAT and Clearance Fee.

I contacted the seller, which had no clue about IOSS.

Then I contacted eBay, who said if was the obligation of the seller to provide the IOSS number on the parcel. However since it is eBay that collects the VAT, eBay will refund it if the seller fails their obligation and you can provide documentation for the double expenses.

eBay will NOT refund the clearance fee, so the current situation is that not only will you pay VAT twice, you will still have the customs delay and pay the dreaded clearance fee AND you will have the paperwork to get the eBay refund. Very unfortunate as the IOSS system is designed to eliminate all these troubles, and if wold probably work if the sellers played along.

In line with eBay pointing finger at the seller, you should also give a negative rating on the seller for not understanding the platform through which they have chosen to sell their goods.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-27-2021 10:31 AM

I have the same problem in Belgium.

I bought from a Swiss seller and they were unaware of the IOSS number having to be added. Customs included a photo of the package and it shows that the seller labelled the item as a gift.

I am now charged VAT a second time (and the amount customs charges is higher than the VAT I paid to ebay) and have to pay an extra administrative cost of €15.

Now the thing is, I am not sure if this is actually the seller's mistake. I am of the opinion that ebay should inform it's seller's about the IOSS number with every sold item for at least a year after the new regulations.

I'm also not convinced that if the seller adds the IOSS number when shipping, that the package will arrive without issue. I read in another thread that ebay is the one that should electronically forward the IOSS number and not the seller.

I also read from a lot of people here that customs simply does not want to accept ebay's IOSS number...

I don't know what to think of this issue, but I do know I'm unhappy with ebay's lack of communication.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-27-2021 06:00 PM

From what I understood, since we have the same problem in multiple countries, it could show that this is eBay that does something wrong. Besides having IOSS number, each purchase needs to be registered in IOSS system and then the customs should be able to look it up and verify that there is such a package and that VAT was actually paid. It is not just sticking the IOSS number on the package but a several steps process, since then anyone could use this number and pretend that they are eBay. If someone knows how the IOSS system actually works and what steps that need to happen behind the scene for this to work, please share.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-04-2021 11:15 AM

Update for my bPost (Belgium) package;

I asked for a recalculation of the import cost, adding my ebay invoice/VAT receipt as proof that contains both the VAT calculation, explicitly mentions ebay's IOSS number and shows that VAT was already paid. It took them 2 weeks to review it, but in their reply they dropped the added €15 administrative cost and only charged me the VAT. Technically I can recover the VAT from eBay so I would have been happy with this offer from bPost.

Only problem with it, is that they somehow made a mistake in calculating the VAT and are still charging me a higher amount than what I'm supposed to pay. I'm deliberating just paying, since they already dropped the administrative cost and in reviewing it again, they might change their mind about that. But I decided to request yet another review because they should simply calculate everything correctly and not charge me the administrative cost to begin with.

It might help to just endlessly request a recalculation to wear then down until they eventually just let it pass 😆

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-21-2021 03:22 AM

The only meaningful technical solution to this would be that for each purchase/shipment that is subject to VAT in E collection by ebay in EU, ebay generates unique code or qr-code which is shared only between ebay, buyer and seller. In this case, if this code is simply printed anywhere on the parcel and then scanned by the customs on import, they can see that it indeed belongs to that shipment and once scanned, it becomes invalid in the system to be reused and abused for another shipment.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2022 03:54 PM

Same problem in Norway. Posten Norge request a ton of documentation, and might not forward the item to you at all, not even claiming the fee + tax, but returning the item to the US. eBay is not helpful, as they seem to try and enforce sellers in the US to use their Global Shipping program. If the US seller ships with USPS, then there are massive problems.

Solution might be to contact the seller, ask if you can buy outside eBay and use PayPal. You still have to pay the fee and tax in destination country, but the fee that eBay claim is avoided. Or check with amazon. I buy more stuff from amazon now due to problems with eBay. No problems with amazon. Amazon often uses DHL from the US as well.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 03:46 AM

Same thing happened to me when purchasing an item from UK and the Slovenian Custom Post Office requested to again pay the VAT as the IOSS number was not entered in the system....

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-05-2022 12:24 AM

I tried that, customer support said they will repay the tax and then they ghosted me.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-26-2022 05:02 PM

Is a scam, becareful.

Re: IOSS and double VAT taxation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-26-2022 06:59 PM

- « Previous

-

- 1

- 2

- Next »

- « Previous

-

- 1

- 2

- Next »