- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: new 600 dollar SALES threshold for IRS Reporti...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-16-2023 06:55 PM - edited 07-16-2023 06:58 PM

This is what's going on with the draconian, insane IRS requirement for ebay to send far too many sellers a 1099-k form, which is also sent to the IRS.

If we sold more than $600 worth of anything during each year, it will be reported to the IRS and their system will treat it as reportable income. Even if you are selling at a loss, or reselling a used item of yours, and you won't legally be required to pay any tax on it. If you did not make a profit off of it., or your income is too low, then you won't owe anything. Yet this horriffic new Biden admin rule, tells the IRS that you do owe or that it should show on your tax form. You will then have to prove that you didn't make a profit.

This could be impossible for people who don't have a receipt, or are selling items that are 5, 10, 20, or 50 years old. No record may exist for what you paid for it, only what you sold it for.

This will be triggering the IRS system for God knows what, to send out a fake notice of discrepancy if your tax returns ( or by not filing), show something different from what they THINK they know about your income.

This is outrageous and detrimental, it is not a truthful way of informing the IRS at all.

Previously, before Biden's new regulation, the reporting threshold was $20,000 worth of online sales, and 200 transactions, before ebay had to send out a 1099-k to you and report it to the IRS.

So this recent change is just not workable at all, it is now being put in action since January 2023, and sellers can expect to receive a 1099-k if they have sold 600 bucks or more of household used items. Also, this will be reported to the IRS.

OUTRAGEOUS!

*********Now that there's a change of who controls congress, we all need to step up and call our Representatives and demand it return to what it was before. Or give us exemptions.

Give good reasons in your letter or call - such as, We are selling used items of our own , we aren't a business. we are just trying to get SOME of our money back by selling stuff we couldn't return to the store, etc.( be truthful of course) *********

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-01-2023 06:20 AM

If trump can do it, why can't everyone else?

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-01-2023 09:09 AM - edited 11-01-2023 09:10 AM

My big concern is that I don't know how to prove I sold items at a loss. With the way things work on eBay, if I'm honest after fees and packaging and USPS I'm definitely making losses on pretty much everything I sell. Including eBay fees. I am not a business so I don't keep receipts of anything other than my phone bill. Which is really the only thing I can write off. And I can't afford an accountant to help me. I'm a disability applicant and my eBay income is literally all I made for the entire year.

I'm not in denial that this measure is going to stand (none of our reps will do anything) but we're also not being given the tools as folks just selling our spare items online. Feel really lost and frustrated.

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-01-2023 11:26 AM

@koreycabra wrote:My big concern is that I don't know how to prove I sold items at a loss. With the way things work on eBay, if I'm honest after fees and packaging and USPS I'm definitely making losses on pretty much everything I sell. Including eBay fees. I am not a business so I don't keep receipts of anything other than my phone bill. Which is really the only thing I can write off. And I can't afford an accountant to help me. I'm a disability applicant and my eBay income is literally all I made for the entire year.

I'm not in denial that this measure is going to stand (none of our reps will do anything) but we're also not being given the tools as folks just selling our spare items online. Feel really lost and frustrated.

Ebay has a variety of reports you can run in the Seller Hub. Proving Ebay fees and any shipping you do through Ebay is really easy. Are you saying you are losing money even with just these two expenses?

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-03-2023 01:49 AM - edited 11-03-2023 01:53 AM

----------

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-23-2023 07:53 AM

It appears that the 1099K reporting threshold decrease has now been suspended for another year: https://www.irs.gov/newsroom/irs-announces-delay-in-form-1099-k-reporting-threshold-for-third-party-...

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-23-2023 02:17 PM

5K still no different then $600 or $1, but suppose some will be happy if they didn't reach the 5K - idk, I'll get one anyways far beyond 5K gross.

And it only gets worse since that conclusion...

...There is something about the rigid posture of a proper, authentic blind

As if extended arms reached to pass his blindness onto others.

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-04-2023 03:26 PM

EXCELLENT NEWS FOLKS ! THEY ARE AGAIN DELAYING IT FOR THIS YEAR !

AND the plan is to PHASE IT IN SLOWLY FOR NEXT YEAR ( 2024) AS WELL, @ $5000. They may still up it again, who knows !

read about it all here on the IRS site!!!

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-04-2023 06:22 PM

It is good news for some, not sure why, but if it makes them feel better, that is a good thing.

The important thing to realize is that it does NOT mean you do not have to report your income from items sold here or on other sites. The IRS rules for reporting income did NOT change.

With or without a 1099k FORM [merely a form] you need to report your income to the IRS.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 12:40 PM - edited 12-13-2023 12:43 PM

plenty of casual sellers don't have to do any such thing. under very common circumstances, many don't have to as it 's not enough under Capital Gains or even under regular personal income tax, to have to report anything. So NO, not everyone does. yes, we are talking low income people. That's a lot of folks who sell their personal belongings on ebay, which isn't taxable at all unless it exceeds a certain amount. Capitol gains is WAAY over 600. . Let's not lump everyone into t he same tax situation, it differs widely from person to person.

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 12:50 PM - edited 12-13-2023 12:51 PM

@newleaflady wrote:plenty of casual sellers don't have to do any such thing. under very common circumstances, many don't have to as it 's not enough under Capital Gains or even under regular personal income tax, to have to report anything. So NO, not everyone does. yes, we are talking low income people. That's a lot of folks who sell their personal belongings on ebay, which isn't taxable at all unless it exceeds a certain amount. Capitol gains is WAAY over 600. . Let's not lump everyone into t he same tax situation, it differs widely from person to person.

What I stated is true and factual. We are all suppose to report all our income regardless if you receive a 1099K or not. The 1099K is merely a FORM and nothing more.

I don't know how many of my posts you have read on this subject, but I often have said that for many people, the act of reporting their income from selling here to their taxes will likely have little to no impact on the taxes owed. However that does not mean they don't have to claim it [the income].

Depending on the situation of the taxpayer, they may use the Capital Gains form, Schedule C or some other form to report their income.

I don't lump everyone together with the exception that we are all suppose to report our income to the IRS.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 01:01 PM - edited 12-13-2023 01:03 PM

you don't have to report a thing until you make X amount o f money, that is, taxable money. imagine someone making 5,000 a year on SS and having to report it. NO you do not. not til you make enough to clear the personal exemption and all other exemptions. And some types of income are not taxable as well. making one size fits all statements is not accurate. https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 01:16 PM

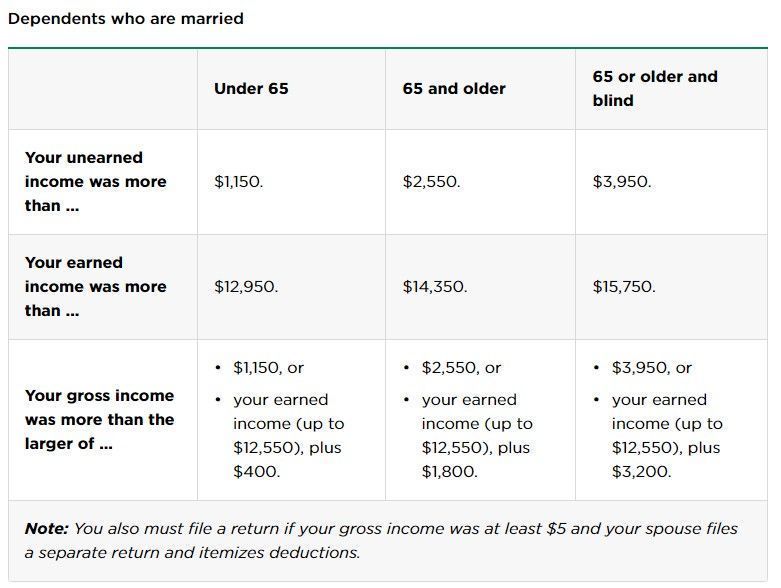

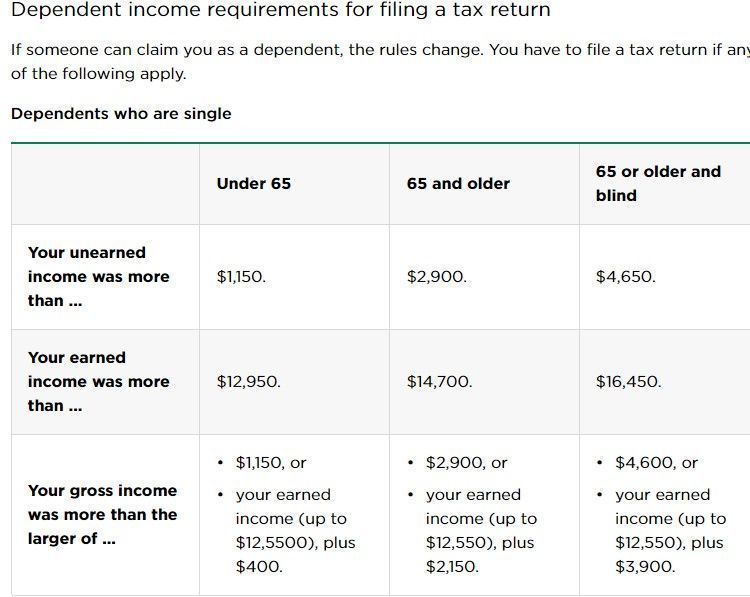

This info may be helpful to some.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 01:25 PM - edited 12-13-2023 01:30 PM

you are contradicting the IRS itself. you're no expert. but outrageously presumptive. people really just need to go to the actual IRS site, then get the forms, fill them out, and figure it out for themselves. It's different for everyone. NOT one- size- fits- all. "DO I NEED TO FILE A TAX RETURN" the answer is , a lot of people don't. But you DO need to read up ! there's a lot to find out. And it won't happen on the ebay boards. https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-13-2023 11:05 PM

https://community.ebay.com/t5/Announcements/eBay-and-TaxAct-partner-to-help-you-navigate-new-Form-10...

https://www.irs.gov/faqs/small-business-self-employed-other-business/income-expenses/income-expenses

https://www.irs.gov/businesses/gig-economy-tax-center

https://pages.ebay.com/seller-center/service-and-payments/2022-changes-to-ebay-and-your-1099-k.html

https://www.irs.gov/pub/taxpros/fs-2022-41.pdf

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: new 600 dollar SALES threshold for IRS Reporting , and ebay 1099-k required

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-14-2023 10:48 AM

@newleaflady wrote:you don't have to report a thing until you make X amount o f money, that is, taxable money. imagine someone making 5,000 a year on SS and having to report it. NO you do not. not til you make enough to clear the personal exemption and all other exemptions. And some types of income are not taxable as well. making one size fits all statements is not accurate. https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return

@newleaflady yeah, but never said anything towards any of that, making posts just to try and make some point irrelevant to someone's elses post(s). Obvious and well known by everyone who files taxes that are exemptions of income and age and dependents etc... all of which don't need to be discussed on here. All of which have nothing to do with getting 1099K and reporting the money one made selling, which is what my post mentioned.

And it only gets worse since that conclusion...

...There is something about the rigid posture of a proper, authentic blind

As if extended arms reached to pass his blindness onto others.