- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: eBay Seller Hub - IRS Tax Identification Numbe...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 04:54 AM

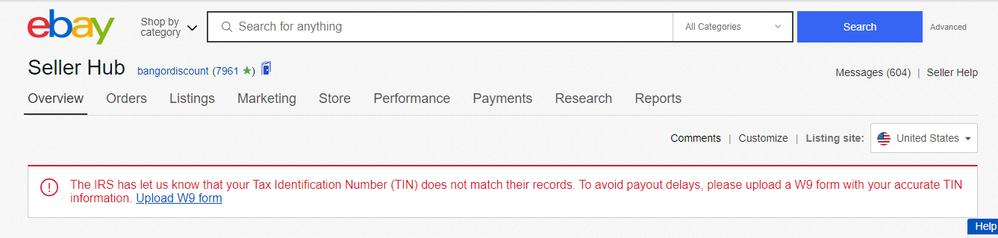

I checked my seller hub this morning and saw the below error (see attached): I haven't made any changes to my status as a seller with the IRS and I thought I always filed just using my SSN when it came time to do my taxes. Now it looks like eBay is requesting a W-9.

Is this affecting anyone else? I believe this has to be an error on eBay's side, maybe to do with managed payments, but I don't want to ignore and end up in eBay jail and have my listings become affected.

Solved! Go to Best Answer

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 02:27 PM

It seems odd that the IRS hasn't sent anything in mail to ANYONE dealing with this issue besides ebay.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 02:48 PM

Just a thought, but the IRS isn't sending e-mail (notification) out - ebay is. Perhaps it has something to do with collecting.

The foolishness of one's actions or words is determined by the number of witnesses.

Perhaps if Brains were described as an APP, many people would use them more often.

Respect, like money, is only of 'worth' when it is earned - with all due respect, it can not be ordained, legislated or coerced. Anonymous

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 04:25 PM

@gracieallen01 wrote:Just a thought, but the IRS isn't sending e-mail (notification) out - ebay is. Perhaps it has something to do with collecting.

I pay an enormous amount every quarter so idk what they'd be trying to collect from me. Every time I do my taxes Turbotax tells me I'm the least likely to be audited. I have enough stress as it is.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:32 PM

@ohgollythrift wrote:It seems odd that the IRS hasn't sent anything in mail to ANYONE dealing with this issue besides ebay.

I personally don't find that Odd since Ebay is the responsible party to issue the 1099Ks. They would also be the one's responsible for withholding taxes if it became necessary.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:33 PM

@gracieallen01 wrote:Just a thought, but the IRS isn't sending e-mail (notification) out - ebay is. Perhaps it has something to do with collecting.

To my knowledge, the IRS does not send email notifications. It is an unsecured method of communicating.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:35 PM

It's interesting that I have two eBay accounts, file them under the same SSN (mine) and only got this message on one account....

I set both accounts up for MP the same way at the same time using the same information.

As someone else mentioned, shouldn't we be getting mail notices from the IRS if our information was not correct? I trust eBay just as... well not at all.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2021 11:55 AM

This is literally ridiculous. Got something in mail today from ebay claiming the same thing. That the IRS said my SSN doesn't match up with their records and ebays records. But after checking 20 times it's all matched up on ebay, 1099k, my tax forms, everywhere! They're saying if it doesn't match up after sending in the W9 they're going to start withholding 24% of my earnings. I PAY TAXES! MY INFO IS CORRECT! I don't get how I am given no information to figure out whatever the discrepancy is. Thanks for the help ebay as always! I uploaded the W9 last night. They claim I'll hear back from them in 2 days but knowing ebay it'll probably be 4 weeks.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2021 12:13 PM

Can you continue to post updates?

I'm hesitant to upload a w9 as I'm not sure exactly what information eBay is looking for and I don't want to give them something that conflicts with what they have on record since I've had this account since 1999 and had several different "primary" addresses in that time span and I don't want to go through the hassle of having an account restriction or payment holds just because I send them something different then what they are looking for.

But it amazes me that I file as a sole proprietor using my personal SSN and have never had tax issues and furthermore they're not requesting any information from my secondary selling account which uses the exact information from this account.

I never had problems with PayPal in regards to the 1099-K, I didn't have problems getting into managed payments and I just don't understand what is causing the account to get flagged now and they're vagueness is unsettling.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2021 12:17 PM

@bangordiscount wrote:Can you continue to post updates?

I'm hesitant to upload a w9 as I'm not sure exactly what information eBay is looking for and I don't want to give them something that conflicts with what they have on record since I've had this account since 1999 and had several different "primary" addresses in that time span and I don't want to go through the hassle of having an account restriction or payment holds just because I send them something different then what they are looking for.

But it amazes me that I file as a sole proprietor using my personal SSN and have never had tax issues and furthermore they're not requesting any information from my secondary selling account which uses the exact information from this account.

I never had problems with PayPal in regards to the 1099-K, I didn't have problems getting into managed payments and I just don't understand what is causing the account to get flagged now and they're vagueness is unsettling.

You would need to be using your Current Primary address you have on Ebay. Now if your IRS records do not reflect your current address, I would say go to IRS and get your address corrected BEFORE your file the W9 as this is likely what has caused your problem in the first place.

Rules have changed on the CIP [Customer Identification Program] that money processors are now required to comply with in concert with the needs required by the Anti Money Laundering law. The Federal government is really clamping down on the compliance with these laws.

https://www.fdic.gov/regulations/laws/rules/8000-1600.html#fdic8000fra1020.220

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2021 01:23 PM

@bangordiscount wrote:Can you continue to post updates

Yeah I plan to. I'm just confused how this seems to be affecting a very limited amount of users. Unless most people aren't talking about it. I know a good handful of resellers in my area who don't even pay taxes. Haven't seen them post anything on their socials about any ebay issues. Meanwhile here we all are.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2021 01:32 PM

@ohgollythrift wrote:

@bangordiscount wrote:Can you continue to post updates

Yeah I plan to. I'm just confused how this seems to be affecting a very limited amount of users. Unless most people aren't talking about it. I know a good handful of resellers in my area who don't even pay taxes. Haven't seen them post anything on their socials about any ebay issues. Meanwhile here we all are.

Well that doesn't mean much as some people do whatever they can to avoid paying taxes that they should be paying. For this very reason the 1099Ks were created in 2012. Solely because of so many internet sellers getting away with not claiming their income on their tax returns.

Things change a bit in 2022 that will affect a whole lot more sellers. The threshold for the 1099K drops from $20K to $600 per year. So a whole bunch of sellers that have never reported their income will be reporting next year. Now some will need to report but find it won't increase their taxes if they are ONLY selling certain items from around the home. Nothing is purchased for resale and nothing is being sold on behalf of others. Just stuff from their own closets.

So IRS is really tightening their belts this year likely to be prepared better for next year. So their are doing some clean up they have likely needed to do for awhile.

You are right, until this thread and another one that I've read. I too have not heard of this crack down with the W9s. Ebay certainly hasn't announced anything. I also sell on a couple other sites and they haven't announced anything either. That certainly doesn't mean it isn't going on with these other sites, it only means they haven't announced it.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-10-2021 11:09 AM

Recently eBay, as required by the IRS, sent a letter and notice to a very small number of sellers requesting they complete a physical Form W-9. This was because there were discrepancies with the Tax ID and name provided to us, which was then reported on their Forms 1099-K for the 2020 tax period.

If you received a notice by mail, we ask that you complete the Form W-9 and return it by December 17th. In addition to the notice, you should have received a banner communication upon logging into your eBay account which contains a link that will allow you to digitally upload your Form W-9. In order to process your updates in a timely manner, we encourage you to use the upload feature to avoid delays.

If you did not receive a letter and notice you are not required to complete a W-9.

Thank you for selling on eBay.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-10-2021 01:29 PM

It appears that, in my wife’s situation, this issue resulted from the eBay Managed Payments system not allowing a SSN to be used with a single-member LLC. At least, this is what the eBay representative that we spoke with over the phone indicated to us recently.

Hopefully, by sending in the W-9, your system will be set up to transmit her information to the IRS, per the W-9…

I have three questions….

1). When will we know that eBay has confirmed the updated TIN information with the IRS? How will eBay notify us of this?

2). Will eBay be sending corrected 2020 1099-K’s to the IRS for these small number of sellers?

3) Will eBay communicate to the IRS that this error on the 2020 1099-K was on eBay’s end and not on her end? (We have records of our correspondence with eBay from last year where she told the Managed Payments team that our single member LLC was a disregarded entity for federal tax purposes, that she did not have an EIN, and that she properly uses her SSN)

I am concerned that IRS might think she did something improper or that they now think she earned twice the income that she did in 2020 on eBay MP if two 1099-K’s with identical amounts end up being sent.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-10-2021 04:43 PM - edited 12-10-2021 04:43 PM

Wondering the same as the user above how will I know if everything is correct after submitting the W9? I submitted mine almost 48 hours ago. I'm still super concerned about these discrepancies as everything is correct everywhere I look and there's users who've posted about who have stated they have multiple accounts all with the same info but one account was required to submit a W9. Doesn't really make much sense.

Re: eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-14-2021 07:08 AM

It appears that, in my wife’s situation, this issue resulted from the eBay Managed Payments system not allowing a SSN to be used with a single-member LLC. At least, this is what the eBay representative that we spoke with over the phone indicated to us recently.

Hopefully, by sending in the W-9, your system will be set up to transmit her information to the IRS, per the W-9…. However, several days have passed now and the taxpayer settings don’t match the info she sent on the W-9 form yet….

I have three questions….

1). When will we know that eBay has confirmed the updated TIN information with the IRS? How will eBay notify us of this? Will our taxpayer setting in eBay match the W-9 info we sent?

2). Will eBay be sending corrected 2020 1099-K’s to the IRS for these small number of sellers?

3) Will eBay communicate to the IRS that this error on the 2020 1099-K was on eBay’s end and not on her end? (We have records of our correspondence with eBay from last year where she told the Managed Payments team that our single member LLC was a disregarded entity for federal tax purposes, that she did not have an EIN, and that she properly uses her SSN)

I am concerned that IRS might think she did something improper or that they now think she earned twice the income that she did in 2020 on eBay MP if two 1099-K’s with identical amounts end up being sent