- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- eBay Seller Hub - IRS Tax Identification Number (T...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 04:54 AM

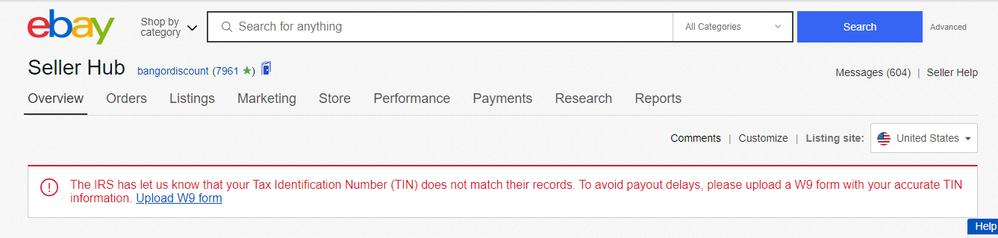

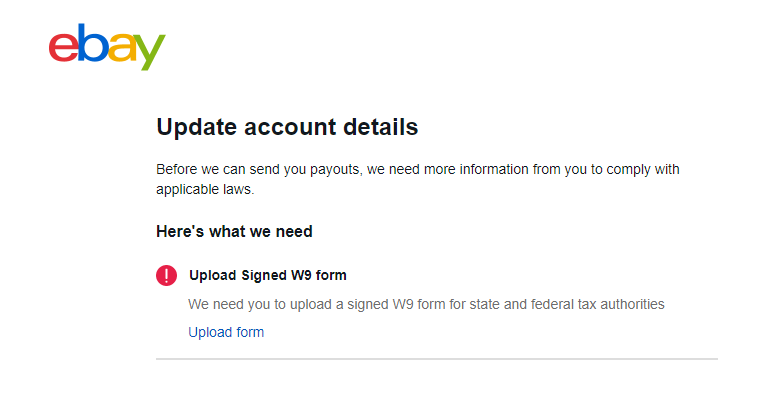

I checked my seller hub this morning and saw the below error (see attached): I haven't made any changes to my status as a seller with the IRS and I thought I always filed just using my SSN when it came time to do my taxes. Now it looks like eBay is requesting a W-9.

Is this affecting anyone else? I believe this has to be an error on eBay's side, maybe to do with managed payments, but I don't want to ignore and end up in eBay jail and have my listings become affected.

Solved! Go to Best Answer

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 07:45 AM

@rfmtm wrote:If you have a business account and you want your taxes reported under your business ID there is a place to enter either your EIN or TIN, near the middle of the business information page. You still have to supply your SSN further down the page for personal or corporate officer ID as required by the IRS.

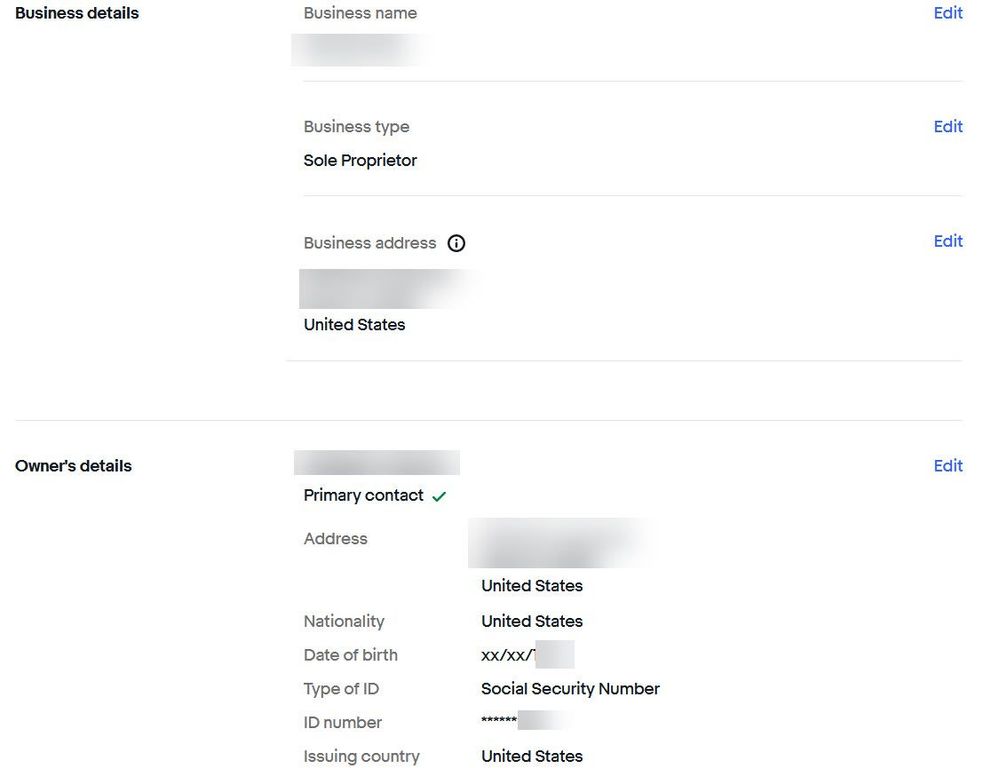

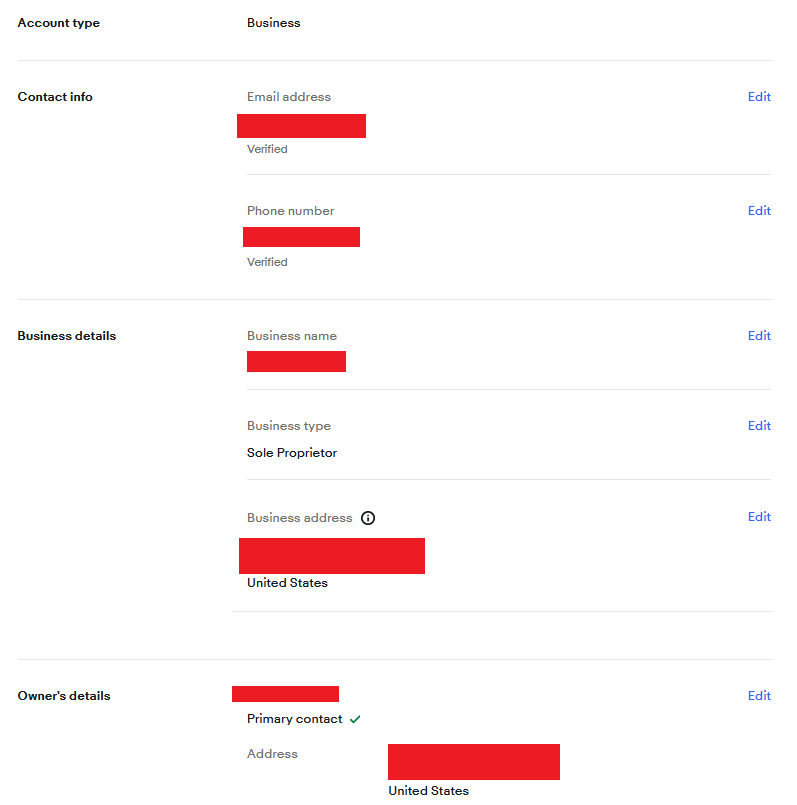

All I have in the business details section is Name, Type, and Address. Then it's Owner's Details which has my SSN.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 08:26 AM

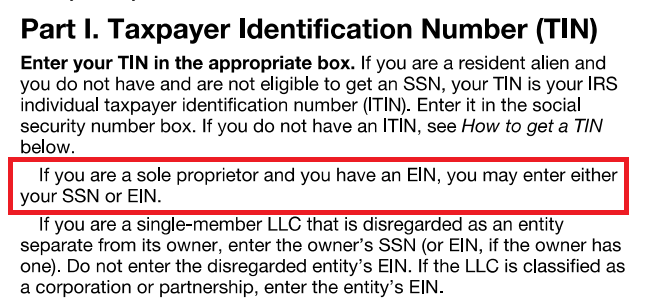

This is why I hate ebay. Looking at the W9 it literally says a sole proprietor can use either SSN or EIN. Well my SSN is on ebay and there's no spot to put my EIN anywhere. So what's the issue? I checked my tax documents for the past 2 years and both have my SSN and EIN and they match up with the 1099-K from ebay. So now I'm worried I'm going to fill out the W9 and they're going to screw up and close my account because of their incompetency.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 08:56 AM

I believe I have a business account on eBay. I had been getting 1099-K's from PayPal for YEARS. I file my taxes using my personal SSN. I am aware of how to file my taxes related to eBay income as for a handful of years that was my only income.

I don't have a SSN/EIN/TIN that was created just for my business.

I updated my mailing address over a year ago with eBay that's the only thing that's changed. I filed for 2020 using this new address and I techincally still own the properties where I had filed from (mailing address) in years past.

My biggest concern, as others have mentioned, is that I don't want to open up a can of works with eBay and stop getting payouts OR having my account closed or restricted because I provide the "wrong information" (i.e. not what they're looking for).

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 08:59 AM

@ohgollythrift In the Business Details it is right below Business Type and before DBA and Address.

Business details:

Business name

Business type

Employer ID Number

Doing Business As (DBA) - optional

Business address

If you don't see it, try a different browser like Firefox. Some versions of some browsers have a problem with this page and don't show the edit options.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:17 AM

@rfmtm wrote:@ohgollythrift In the Business Details it is right below Business Type and before DBA and Address.

Business details:

Business nameBusiness type

Employer ID Number

Doing Business As (DBA) - optional

Business address

If you don't see it, try a different browser like Firefox. Some versions of some browsers have a problem with this page and don't show the edit options.

Tried Chrome as I already use Firefox. The EIN and DBA sections don't exist. This is what's a headache. How can I provide the correct details when they don't allow me to? This would be a lot easier to deal with if I could call someone at ebay (not a foreigner) who could explain what's going on.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:25 AM

This is my biggest worry... I got a payout today, will I get one tomorrow? Are they going to end until this is resolved? Is the next step restricting my account? I got not communication regarding any of this until the notification that was on my seller hub this morning.

Nothing has changed with my personal life except in 2019 I moved from ME to NY while my girlfriend finishes grad school. I filed as having lived in NY for 2020 and updated all my information on eBay so that my product returns weren't sent to ME while I was living in NY. I would honestly not be providing eBay any new information by submitting the W-9 but something internal or external (IRS) is requesting I do this and I just don't know why and don't want to send any conflicting information that puts my account at risk.

Maybe the anxiety is for nothing and a quick document upload resolves itself and maybe it causes weeks of more headaches

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:31 AM

@ohgollythrift Are you sure you ebay account is set as a Business? Do you see all the other business entries and just not the EIN one?

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:40 AM

@rfmtm wrote:@ohgollythrift In the Business Details it is right below Business Type and before DBA and Address.

Business details:

Business nameBusiness type

Employer ID Number

Doing Business As (DBA) - optional

Business address

If you don't see it, try a different browser like Firefox. Some versions of some browsers have a problem with this page and don't show the edit options.

I'm with @ohgollythrift on this one. No option for an EIN or DBA and under owner details it only allows an SSN.

Not sure why there would be different versions of that page shown to different people but maybe that is part of the issue?

Also I know previously when entering info for MP some sellers had issues because eBay didn't provide an area for a middle name or initial and they were told if that was needed to match bank account info to put it in along with the first name field.

I see that the owner's details area does now have an option for middle name - again not sure if that is relevant but given how picky the IRS can be about info matching exactly I'm wondering if eBay submitting the first name with a possible middle name or initial in that field as well could be throwing up a red flag?

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:40 AM

@rfmtm wrote:@ohgollythrift Are you sure you ebay account is set as a Business? Do you see all the other business entries and just not the EIN one?

Pics attached.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:42 AM

@bangordiscount wrote:Maybe the anxiety is for nothing and a quick document upload resolves itself and maybe it causes weeks of more headaches

This is where I'm at with things. Planning on sending in the W9 tonight. Worried as heck over all this nonsense.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:51 AM

Still my biggest concern is somehow not filling out the W9 correctly to match up with whatever ebay has. The directions literally state SSN or EIN is acceptable. Well ebay has my SSN and is saying it doesn't match up. Ridiculous.

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 09:59 AM

@valueaddedresource wrote:

@rfmtm wrote:@ohgollythrift In the Business Details it is right below Business Type and before DBA and Address.

Business details:

Business nameBusiness type

Employer ID Number

Doing Business As (DBA) - optional

Business address

If you don't see it, try a different browser like Firefox. Some versions of some browsers have a problem with this page and don't show the edit options.

I'm with @ohgollythrift on this one. No option for an EIN or DBA and under owner details it only allows an SSN.

Not sure why there would be different versions of that page shown to different people but maybe that is part of the issue?

Also I know previously when entering info for MP some sellers had issues because eBay didn't provide an area for a middle name or initial and they were told if that was needed to match bank account info to put it in along with the first name field.

I see that the owner's details area does now have an option for middle name - again not sure if that is relevant but given how picky the IRS can be about info matching exactly I'm wondering if eBay submitting the first name with a possible middle name or initial in that field as well could be throwing up a red flag?

velvet@ebay - I know you had said in the other thread about this that there wasn't much other information you could provide, however there seems to be some confusion about what options/fields are supposed to be available for sellers on this page and some sellers are seeing different things than others.

Is there any way you could check with the team and at least clear up confusion about what this page is supposed to look like and/or submit a report letting them know not all sellers are seeing the same thing, please?

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:17 AM - edited 12-08-2021 10:17 AM

Well your screen shot is different than mine and I just checked it again. So on your form not only isn't there anyplace for the EIN there also is no place for your DBA name. This certainly would be a problem for me, or anyone that operates using a DBA and wanting taxes reported under their business EIN and not their personal SSN.

We need some guidance here from ebay. velvet@ebay

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:39 AM

My point being there should be no reason for eBay to require a W-9 they already have the TIN information, along with everything else they need to report the 1099 to the IRS. I have received the 1099's from eBay, PayPal, Venmo, etc both last year and will again this year and have never been required to upload a W-9. So yea the request is strange unless the OP has some other issues.

- Form W-9 provides personal identifiable information to a person or business used for reporting income paid to self-employed people like independent contractors, freelancers, vendors or other customers

- The person or business you do business with uses the W-9 to collect some of your personal information like your name, address and taxpayer identification number (Social Security numbers for individuals and employer identification numbers, or EINs, for businesses)

- You will usually submit a W-9 when you engage in most taxable transactions that need reporting to the IRS

The person or business paying you is responsible for requesting the W-9 Form from you. However, the requester has no obligation to file the W-9 with the IRS. That person keeps the form on file and uses this information to prepare other returns, such as 1099 forms and 1098 Forms, as well as to determine whether federal tax withholding is necessary on the payments you receive.

Backup withholding is money taken out of your pay and paid to the IRS from income payments which otherwise wouldn’t be subject to withholding. Payers may be required to withhold taxes to ensure that the IRS will receive income taxes that are owed to them.

Taxpayers may be subject to backup withholding when failing to supply a correct taxpayer identification number (TIN) or if the IRS believes that they owe them money and they aren’t able to collect it any other way. Further, individuals or businesses can become subject to backup withholding for failing to report interest, dividend or patronage dividend income.

Specifically, you may be subject to backup withholding and the payer must withhold at a flat 24% rate when:

- You fail to supply your TIN or provide an incorrect TIN

- The IRS notifies the payer to withhold taxes because you have a history of underreporting your income on your tax return (the IRS typically will only do this after it has mailed you four notices over at least a 120-day period)

- You fail to certify that you’re not subject to backup withholding

eBay Seller Hub - IRS Tax Identification Number (TIN) error - Anyone else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2021 10:43 AM

It's not just me (the OP) in this thread that is seeing the disclaimer on the Seller Hub landing page.

I've been getting 1099-K's since PayPal first started issuing them. I did move in 2019 but changed that information with eBay then and filed taxes last year from the new state.

But yes you're right, they (eBay) have had this information of mine for many years---not sure what is going on with the request now.