- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Tax Being Charged At International Shipping Hubs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 09:30 AM

I noticed a tax is being charged to sellers on packages that are passing through Ebay International Hubs in Glendale Heights, IL and Commerce, CA.

These are not final destinations for these packages, therefore it seems it should not be legal to apply local taxes to these shipments.

Can you imagine local taxes being charged every time a package passed through a FEDEX/UPS/USPS shipping hub for domestic shipments?

What do you think? How are local tax authorities able to do this? Is this even legal?

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 09:49 AM - edited 06-28-2023 09:50 AM

If you are talking about the EIS hubs I have yet to ship anything through those hubs or the program but would tend to agree there should not be any sales tax applied. The hubs are nothing more than a freight forwarder but it may be something particular to the state ecommerce laws either that or eBay has a glitch.

This may be something to reach out to the eBay employees that respond on this forum.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 09:57 AM - edited 06-28-2023 10:00 AM

I certainly am not qualified to supply an answer to your question. I do know that many of the freight forwarding companies are in non sales-tax jurisdictions for that reason though.........

and I will say that....

"...Can you imagine local taxes being charged every time a package passed through a FEDEX/UPS/USPS shipping hub for domestic shipments?..."

is not a good analogy....since the "hub" is not the addressee...

EVERY Single Piece of MAIL goes through a "hub" somewhere.......

and....

"...How are local tax authorities able to do this..."

You would need to check and see if that jurisdiction has a tax law that applies...remember, there are over 11,000 different sales tax jurisdictions active in the US...

theoretically, the locals could enact a tax JUST FOR THAT facility if they want....

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:05 AM

I certainly am not qualified to supply an answer to your question. I do know that many of the freight forwarding companies are in non sales-tax jurisdictions for that reason though.........

and I will say that....

"...Can you imagine local taxes being charged every time a package passed through a FEDEX/UPS/USPS shipping hub for domestic shipments?..."

is not a good analogy....since the "hub" is not the addressee...

EVERY Single Piece of MAIL goes through a "hub" somewhere.......

and....

"...How are local tax authorities able to do this..."

You would need to check and see if that jurisdiction has a tax law that applies...remember, there are over 11,000 different sales tax jurisdictions active in the US...

theoretically, the locals could enact a tax JUST FOR THAT facility if they want....

Most freight forwarders are established in states that do not have sales tax anyway so it is not an issue. Florida while it has sales tax has, in some cases, assigned a specific zip code to the FF that makes it sales tax exempt. As you suggested Illinois and CA could do the same thing but eBay or the EIS contractor is going to have to push the issue with the state.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:13 AM

Im sure "legally" it is what is supposed to happen.

Sales tax is charged to the buyer for the delivery address.

Sellers pay a fee on the tax.

EIS - the buyer pays the tax for the delivery address,

Seller pays fee on tax.

eBay pays tax to the state.

No different than any other sale in the US.

EXCEPT the seller doesnt pay the foreign transaction fee and the seller doesnt pay fees on the rest of the shipping to the buyer or the customs fees.

klhmdg • Volunteer Community Mentor

klhmdg • Volunteer Community MentorTax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:17 AM

@american-photography wrote:I noticed a tax is being charged to sellers on packages that are passing through Ebay International Hubs in Glendale Heights, IL and Commerce, CA.

I'd like to see some actual evidence that this is happening. Especially the part where "sellers" are being charged a "tax".

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:19 AM

No different than any other sale in the US.

Not necessarily true. See my post about the Florida freight forwarders, there are probably others but I am familiar with Florida since I have shipped a couple items through FF'ers in that state.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:24 AM

@dbfolks166mt wrote:I certainly am not qualified to supply an answer to your question. I do know that many of the freight forwarding companies are in non sales-tax jurisdictions for that reason though.........

and I will say that....

"...Can you imagine local taxes being charged every time a package passed through a FEDEX/UPS/USPS shipping hub for domestic shipments?..."

is not a good analogy....since the "hub" is not the addressee...

EVERY Single Piece of MAIL goes through a "hub" somewhere.......

and....

"...How are local tax authorities able to do this..."

You would need to check and see if that jurisdiction has a tax law that applies...remember, there are over 11,000 different sales tax jurisdictions active in the US...

theoretically, the locals could enact a tax JUST FOR THAT facility if they want....

Most freight forwarders are established in states that do not have sales tax anyway so it is not an issue. Florida while it has sales tax has, in some cases, assigned a specific zip code to the FF that makes it sales tax exempt. As you suggested Illinois and CA could do the same thing but eBay or the EIS contractor is going to have to push the issue with the state.

@dbfolks166mt actually Florida has changed how this works - orders shipping to freight forwarders in the state are now assessed sales tax and the buyer has to provide documentation to the marketplace to get the tax refunded.

I think there may have been issues with some less than honest forwarders allowing domestic shipments to their facilities to bypass taxes, so now buyers have to prove the items really are being forwarded internationally and should not have tax applied.

eBay's Tax policy page was updated to say:

Tax refunds for items shipped outside of the US via freight forwarding

To request a tax refund for items shipped to a location outside of the United States through a freight forwarder, please contact us and provide supporting documentation.

Supporting documentation includes copies of the bill of lading or air waybills. If submitting a request for tax refunds on multiple items, please indicate the item associated with each document.

https://www.ebay.com/help/buying/paying-items/paying-tax-ebay-purchases?id=4771#section11

That being said, by virtue of what the EIS program is, any shipment going through that program is de facto being forwarded and since eBay is the one administering the program, they should already have access to all the documentation required to show that - so in theory, buyers should not have to jump through hoops to request a tax refund.

devon@ebay kyle@ebay elizabeth@ebay can you check with the EIS team on this please?

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:29 AM

@slippinjimmy wrote:

@american-photography wrote:I noticed a tax is being charged to sellers on packages that are passing through Ebay International Hubs in Glendale Heights, IL and Commerce, CA.

I'd like to see some actual evidence that this is happening. Especially the part where "sellers" are being charged a "tax".

@slippinjimmy you are correct that sellers are not charged sales tax, buyers are - however, this issue will still impact sellers as well since if tax is included where it should not be, sellers will be paying FVF and ad fees if applicable on that sales tax amount.

eBay is administering the program and already has all the documentation they need to know these packages are being forwarded so there is really no reason to make buyers pay sales tax up front and jump through hoops to get a refund, nor is there a reason for sellers to be paying fees on tax that shouldn't be charged.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:40 AM

@dbfolks166mt actually Florida has changed how this works - orders shipping to freight forwarders in the state are now assessed sales tax and the buyer has to provide documentation to the marketplace to get the tax refunded.

I think there may have been issues with some less than honest forwarders allowing domestic shipments to their facilities to bypass taxes, so now buyers have to prove the items really are being forwarded internationally and should not have tax applied.

eBay's Tax policy page was updated to say:

Tax refunds for items shipped outside of the US via freight forwarding

To request a tax refund for items shipped to a location outside of the United States through a freight forwarder, please contact us and provide supporting documentation.

Supporting documentation includes copies of the bill of lading or air waybills. If submitting a request for tax refunds on multiple items, please indicate the item associated with each document.

Thank you for that information I was not aware of the change but just read the new laws. Ironically there appear to be a couple of ways to handle this one of which is for the FF to provide the exemption certification to eBay and eBay to incorporate that into their process but it appears eBay chose to dump this on the buyer to request sales tax refunds for each item. Why does that not surprise me.

Suspect buyers will simply dump their accounts with the Florida FF and open one with one of the 5 states that have no sales tax Oregon, Delaware and New Hampshire being the most notable.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 10:58 AM - edited 06-28-2023 11:01 AM

Suspect buyers will simply dump their accounts with the Florida FF and open one with one of the 5 states that have no sales tax Oregon, Delaware and New Hampshire being the most notable.

My guess is it won't be that easy. In my experience, FF in different areas tend to have a majority of orders going to certain areas of the world - Oregon tends to be heavily weighted toward Asia/Pacific region countries, Delaware tends toward European countries and Florida tends toward Caribbean/Latin American countries.

I don't think there's a hard and fast rule, unless individual forwarders specifically limit their services, but it just makes sense from a shipping perspective that those areas would be more cost effective to forward to those regions.

I can guarantee the additional international shipping from Oregon to most Caribbean/Latin American countries compared to Florida is going to be more than the state tax in many cases and it's very likely the same may be true in a lot of instances comparing Delaware to Florida too.

So buyers in those countries that previously used Florida will likely continue to do so and either just eat the tax or jump through the hoops to get it refunded.

What's not clear to me is if eBay does refund the tax, do they also automatically refund the fees on the tax to the seller - my guess is no but eBay has not confirmed or denied that.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 11:39 AM

Correction - I went back to check the EIS FAQ and it appears that seller fees are not assessed on the sales tax.

https://www.ebay.com/sellercenter/shipping/ebay-international-shipping/faqs#shipping-and-packaging

How will my final value fee be calculated?

Your final value fee is based on the final price of the item, plus shipping cost you charged the buyer to deliver the item to the US shipping hub, and any other amounts you may charge the buyer. If you offer free domestic shipping, the final value fee won’t be applied to this component.

Sales tax, international shipping cost, and import charges are not included into the final value fee calculation. Refer to our standard eBay selling fees for more information.

So that would just leave the question of why doesn't eBay automatically refund or better yet, not charge, the tax to the buyer when they know it is being forwarded?

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 12:13 PM - edited 06-28-2023 12:15 PM

@american-photography wrote:I noticed a tax is being charged to sellers on packages that are passing through Ebay International Hubs in Glendale Heights, IL and Commerce, CA.

...

You're correct, the international shipping hubs are not the final destinations for international packages. But, eBay is charging the correct amount of tax for international purchases, when eBay is required to collect the tax.

eBay does not charge sales tax based in the location of the shipping hubs. The sales tax is charged based on the final destination, the buyer's shipping address.

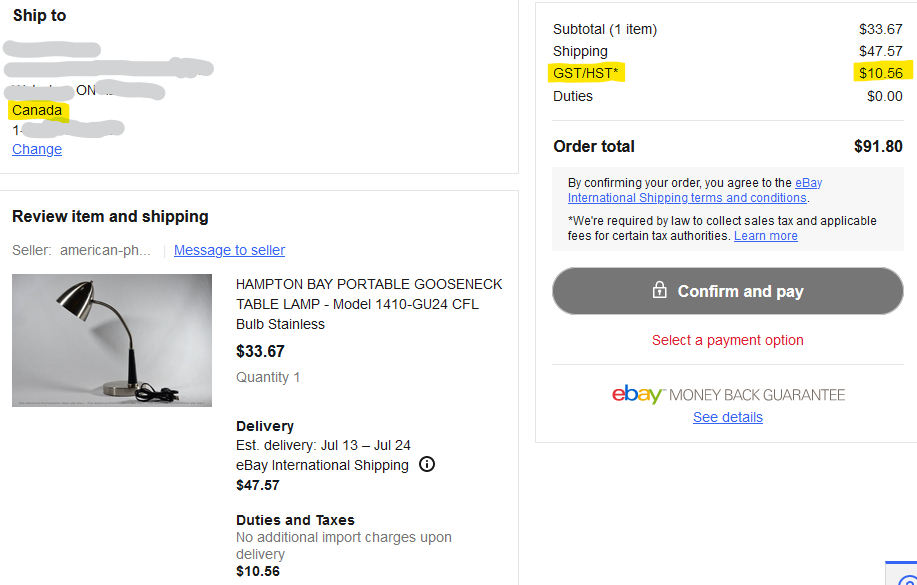

For example, here is the checkout page for one of your items, with a shipping address in Canada. It doesn't charge Illinois sales tax, it charges the correct amount for GST/HST, which is the sales tax in Ontario, Canada.

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 12:20 PM

What is the tax being charged? CA sales tax?

Tax Being Charged At International Shipping Hubs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-28-2023 12:29 PM

Thanks for posting real facts. This was my assumption that any tax being charged was the same as eBay currently collects when a direct sale is made to buyers in the UK, EU, AU etc.

While eBay does not normally collect GST/HST on sales to Canadian buyers the EIS is probably using a DDP service to Canada where they need to do this.

When EIS first started they were using only DDU shipping but they made it clear that DDP would be something that would be coming in the future.

Although I would never use EIS myself I have tried to keep up with the constant changes in the service but it's become such a moving target that I've pretty much given up.