- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: New Method of Sales Tax Collection, effect on ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 09:15 AM

I received messages from ebay (yesterday) and paypal (today) outlining the new method of collecting the required state/county/city sales taxes starting in November.

Up until now, I as a seller have not seen the sales tax portion of any of my sales, although I know it is being charged to buyers in states where required as a separate charge.

These two messages indicate that the sales tax will now be included in one transaction charge to the buyer and I assume will now be shown as part of the total transaction on the seller's account, even though it is being sent to the appropriate state.

Should I assume that the sales tax will also become subject to the 10% final value fee on ebay and the 2.9% transaction fee on paypal?

The message from ebay is very specific on several points of the new method, but fails to discuss the impact on selling fees. I would have thought that ebay would clarify that, so sellers can consider that in their pricing of items with 'thin' margins.

Solved! Go to Best Answer

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 09:00 AM

Technically the money bounces through the seller’s PayPal account. Plus I looked up he marketplace facilitator laws and most say the mf is collecting sales tax on behalf of the seller. That seems to be how they are justifying it.

however sellers were not paying the percentage before November and it seems unfair that now they have to pay for a change to benefit buyers.

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 11:29 AM

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 11:36 AM

This is exactly how it is working.

Please enlighten me: How will refunds work? Where are we supposed to get the tax money to refund that we never received to return to the customer?

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 11:41 AM

I too am most interested to see how a return works........I see it as very difficult to return money never received.

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 11:42 AM - edited 11-19-2019 11:45 AM

@troopermikesThat is not legal!!!

Sure it is. Since banks/money institutions have been processing electronic payments (ie. credit card purchase at Macy's in 1975 for example), the institution charges the store a percentage on the 'total' collected. Therefore, including tax. Nationwide. For 50+ years. Paypal is the institution, ebay is the store, and the seller is the person creating the opportunity for the sale.

Even persons selling at Swap Meets using their 'I phone' with a credit card processor on it, are paying the processing fees on the total sale.

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-19-2019 12:52 PM

All credit card / processing fees are called cost of doing business, but as a B&M store -- heres how it goes-- I sell widget in Oct , sales tax is recorded and paid in Jan ( I'm on a quarterly cycle). If they return it in Nov then it goes on my sales tax report as a credit so all is good, If I took a CC then the processing fee is part of my overhead . If I pay my taxes on time I get a 2% credit from the state of Mo for collecting and sending in taxes. That would offset some or all of my overhead . So any processing company is entitled to their %, all good till now. But the sticky part comes in with ebay filing and paying sales tax for you. ---- You sell and ship widget paypal and ebay take their cut ( we still not sure what ebay does with the state credit they are keeping but the headache of doing taxes for multi states makes me say keep it). Buyer returns widget and you refund through paypal (100% of sale). We know that we will not get our fees back so the question becomes what is going on with the sales tax.

The simple answer is that when the refund is done thru ebay returns Ebay should credit your account for the sales tax. Thats not going to happen unless there is a big outcry from sellers .

Also that is going to be a headache for them so with my rose colored glassed I would guess that Ebay would stop encouraging returns:![]()

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2019 10:05 AM

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2019 10:18 AM

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2019 10:22 AM

It is "unfair", is not "illegal".

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2019 12:16 PM

Sorry if cross posting is frowned upon here, but I'm hoping to get some input from other sellers on an issue we are having with the new way eBay and PayPal are handling the tax for marketplace facilitator states.

After reconciling our November PayPal report, we found 4 transactions where the marketplace facilitator tax was included in the payment sent to us, but there is no record of it being deducted back out and sent to eBay. All other transactions for the month to those states were handled correctly, it is just these 4 random ones that are off.

I'm working with eBay and PayPal support to try to figure it out, but in the mean time, I'm wondering if any other sellers have had this issue?

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2019 03:39 PM

I just did a refund on a sale that was cancelled 5 minutes after purchase and Paypal refunded the sales tax portion

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-16-2020 01:03 PM

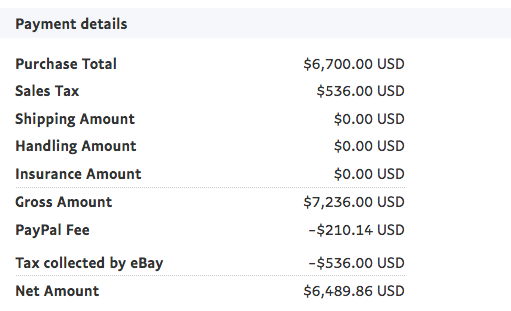

Check the invoice from paypal below and you will see that they are charging 2.9% + $.30 on Gross mount that includes the tax money that seller will never see. This is ridiculous. Why in the world I should pay fees on the money that will go to government.

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-16-2020 01:13 PM

I don’t know why people keep replying to me that PayPal is collecting fees on the sales tax. I know that and repeatedly said that since early November Paypal and eBay changed the processing method to stop two charges for each purchase.

I also said I think it is UNFAIR that PayPal sellers are paying fees on sales tax and Managed Payments sellers are not.

However since most Marketplace Facilitator Laws refer to the MF collecting on behalf of the seller, it is NOT ILLEGAL.

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-19-2020 01:36 PM

Just wondering if anyone in this thread can alleviate my confusion.

Say I sell an item for $10.

Ebay collects $11, $10 for the item $1 for tax.

Pays me $9, Keeps $1, Sends $1 to a state on my behalf.

It seems to me that technically I earned $11 and paid $1 in taxes.

I should be able to deduct that when I file federal right?

Can someone explain how that works?

Re: New Method of Sales Tax Collection, effect on Seller Fees and Paypal Fees?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-11-2020 01:37 PM

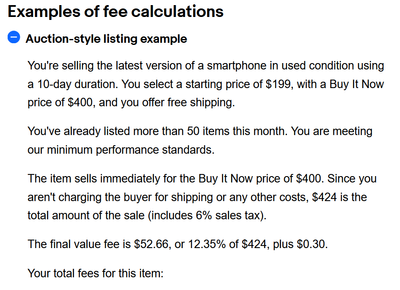

With ebay's new managed payments that everybody has to sign on by July 15th (tax day), ebay IS charging final value fees on the taxed amount collected.

https://www.ebay.com/help/selling/fees-credits-invoices/selling-fees?id=4822#section10