- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- eBay Open 2024 Kickoff Party

- Up and Running 2024

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Payments

- Re: 1099-K Detailed Report

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 09:57 AM

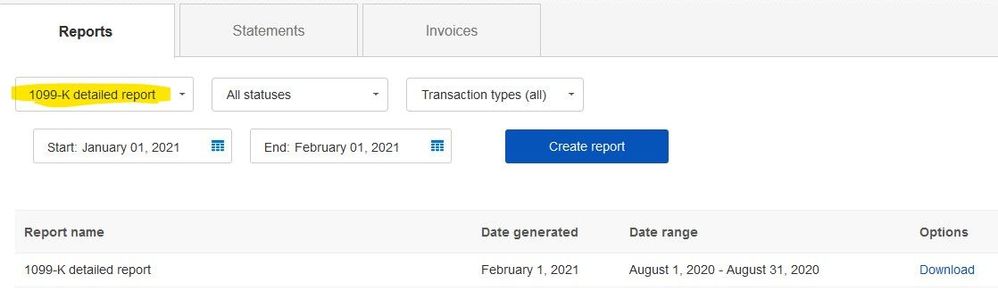

The Payments team just announced 1099-Ks and a new 1099-K Detailed Report are available.

https://community.ebay.com/t5/Payments/Form-1099-K-Detailed-Report/m-p/31575590#M106915

Hopefully that report will be easier to follow to match up exactly what is included and how eBay arrived at the numbers on the 1099-K.

Interested to hear people's thoughts and experiences with the 1099-K Detailed Report vs the Transaction Report!

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 11:20 AM

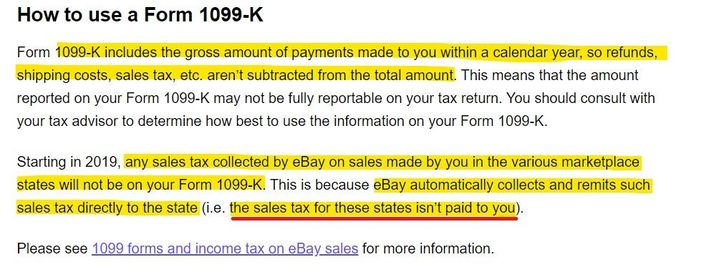

So are the sales taxes collected from sales included on the 1099-K? There was never a definitive answer to this - although in the help pages, a paragraph titled Ebay and Form 1099-K says sales taxes are not included in the reported gross income. There has been a lot of debate about this and no clear answer.

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 12:05 PM

@sylvan_belle the payments team did finally confirm

Seller collected sales tax will be included on the 1099-K form. eBay collected sales tax will not be included on the 1099-K form.

https://community.ebay.com/t5/Selling/1099-form/m-p/31553585/highlight/true#M1692282

There have been and probably still are differing opinions about whether or not eBay is correct in how they are doing it 🙂 But as far as the numbers that eBay is sending to the IRS on the 1099-K form, they have confirmed the information from the 1099-K help page is how they are processing these forms.

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 12:26 PM

One thing I noticed right away when I saw that my monthly totals did not match up to what the 1099 says each month, is that according to the 1099 "detail" report eBay is using a settlement date vs an order date. This effectively causes one month to overlap into the next. Example: my Nov 30th sales are showing in my December 1099 total because they did not "settle" on eBay until Dec 1. (i.e. when orders go from "processing" in our Payments summary to "completed").

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 12:40 PM

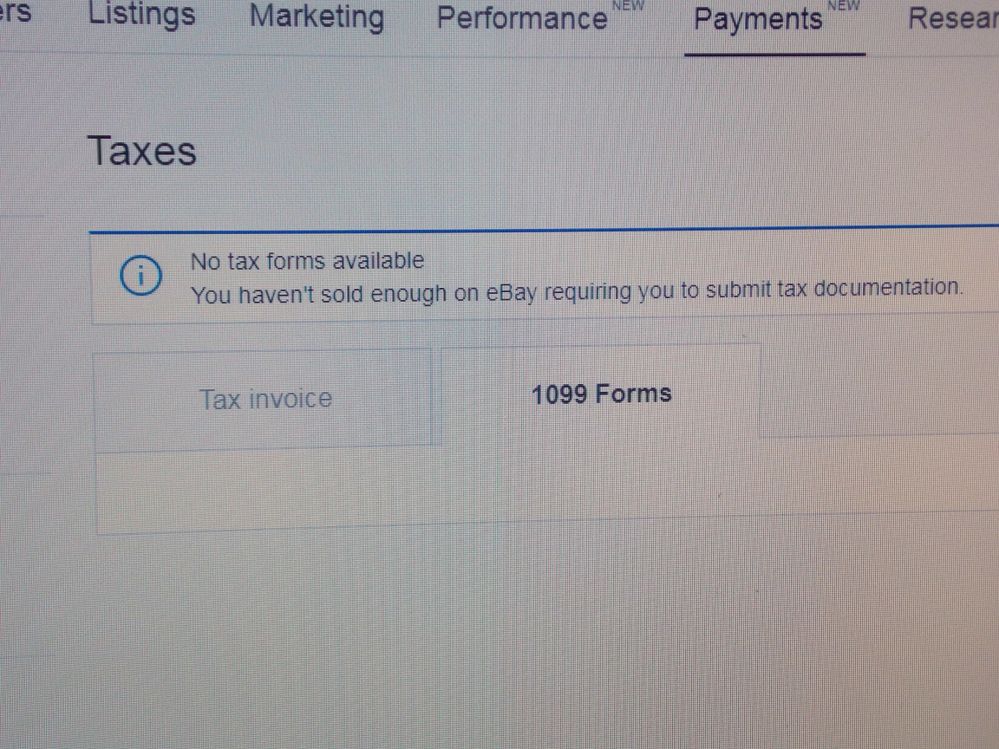

This kind of wording will get some sellers in trouble with the IRS!

evry1nositswindy • seller since 2013

evry1nositswindy • seller since 2013Volunteer Community Mentor

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 12:56 PM

Thank you. This seems perfectly logical to me.

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 01:02 PM - edited 02-01-2021 01:03 PM

Thanks @myhomeschooldelights ! That's a great observation.

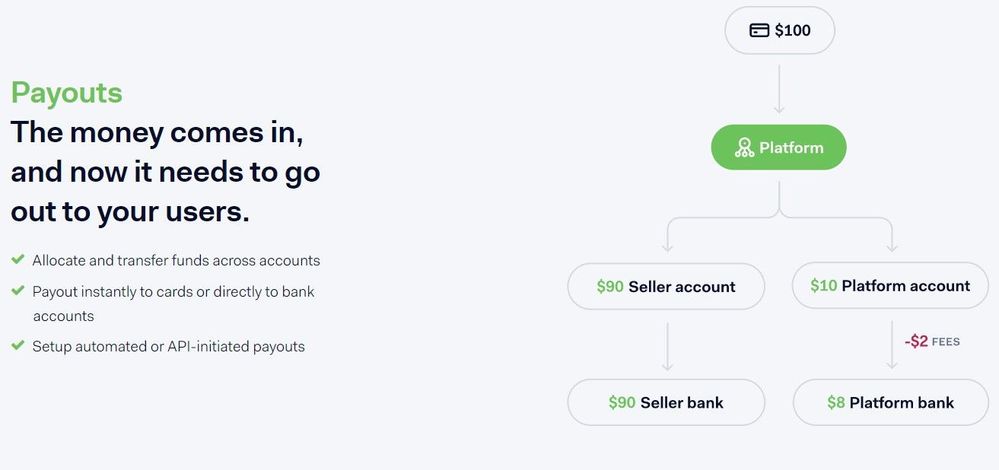

That makes me think there could be something to the idea of how the money flows with Managed Payments/Adyen being maybe a little different than with PayPal.

This is a screenshot from Adyen's site that is just a generic image for demo purposes, but it got me thinking on this thread that if the payment flow looks at least somewhat like this, it could possibly explain why the eBay collected tax is not included in our 1099-Ks.

Now that you've pointed out the difference between "order date" and "settlement date" for the 1099-K report, it makes me think again that the payment flow may look something like this where the payment goes from buyer to Platform (eBay or Adyen?) then appropriate amounts are allocated out to "seller account" and "platform account" from there.

If that were the case, it sounds like eBay considers the "settlement date" to be the when the payment to the seller actually occurred, for tax purposes any way.

That's all just hypothetical "thinking out loud" on my part - so take it with a huge grain of salt. None of this is a comment on whether I believe eBay is right or wrong, just me trying to think through the possibilities as far as the "how" or "why" eBay is doing it the way they are. 😊

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 01:32 PM

@evry1nositswindy wrote:This kind of wording will get some sellers in trouble with the IRS!

That says you haven't had enough in sales to require a Tax Document NOT that you aren't responsible for claiming your sales on your income tax reports. The two statements are vastly different.

Seller whether they get a 1099 or not have been required to claim their sales on the Federal Tax returns for years. It doesn't start and stop at the threshold for 1099Ks.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 01:53 PM

I know what it means. I was saying someone else might see that on their account and think they don't have to claim their eBay $ as income because of it. eBay needs to hire someone full time to work on grammar and linguistics.

evry1nositswindy • seller since 2013

evry1nositswindy • seller since 2013Volunteer Community Mentor

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 02:02 PM

@evry1nositswindy wrote:I know what it means. I was saying someone else might see that on their account and think they don't have to claim their eBay $ as income because of it. eBay needs to hire someone full time to work on grammar and linguistics.

Oh there are so many sellers that firmly believe they don't have to claim there income here without ever seeing that page.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 06:07 PM

I believe you're absolutely correct in that it appears eBay considers our income to be realized the day the order is "completed" and not while "processing". The hassle comes from not realizing they were going to do that from the beginning when we started in MP. I've gone by order dates on my own accounting, not knowing that some of those orders would actually be counted as income for the following month per eBay 1099 month totals. Now that I know, I can account for it in my own 2021 bookkeeping, but cleaning up the records from 2020 to match the 1099 is turning my brain to mush right now. And then there is the PPal 1099 for the first 7 months of the year to go through. 😅 Tomorrow is another day.

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 06:14 PM

@myhomeschooldelights wrote:I believe you're absolutely correct in that it appears eBay considers our income to be realized the day the order is "completed" and not while "processing". The hassle comes from not realizing they were going to do that from the beginning when we started in MP. I've gone by order dates on my own accounting, not knowing that some of those orders would actually be counted as income for the following month per eBay 1099 month totals. Now that I know, I can account for it in my own 2021 bookkeeping, but cleaning up the records from 2020 to match the 1099 is turning my brain to mush right now. And then there is the PPal 1099 for the first 7 months of the year to go through. 😅 Tomorrow is another day.

I do cash accounting, so I go by date paid. And Ebay has consistently told us that our orders are paid for when the buyer submits payment to our MP account. But now there is this curve ball. Either payment is made when a buyer submits it or it isn't. It can't be both ways.

PP's will be easy. They go by the date the payment arrives in your account. So for this year due to what Ebay has done you will need two accounting systems. One for the way MP accounts for sales and one for the way PP accounts for them.

What a mess.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 06:44 PM

It is a mess, for the whole 2020 I ran a sales report, transaction report and 1099, ALL 3 numbers were off $250 to $355 from each other, which is not good but closer then I would have guessed. I know I'll have to use 1099 but god forbid I ever get audited because the eBay's fee's and shipping labels off the 1st 2 and the financial report are not even close

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 06:53 PM

@myhomeschooldelights wrote:The hassle comes from not realizing they were going to do that from the beginning when we started in MP.

@myhomeschooldelights that could be said about soooo many things with MP, couldn't it? 🤣

I agree, it's a pretty big curveball to throw in the last inning. ☹️ Good luck and make sure to take a break before the brain gets too mushy. lol

Re: 1099-K Detailed Report

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2021 08:00 PM

I feel like a zombie after looking at this all day. Thanks for all your great insights and informative posts. Very much appreciated!

![Video [Russian Language]: Answers to common Payoneer registration issues](/t5/image/serverpage/image-id/750612i41F587DBC26EF24C/image-size/large?v=v2&px=999)