- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: WARNING SELLERS! Ebay is adding tax to your s...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-08-2019 10:34 AM

I don't mind paying tax in the state I've made a purchase from but to pay a sales tax to my state when I make a purchase from your state is simply WRONG! Washington State has a GREED that keeps growing. Ebay is now required to collect my states sales tax on all items I purchase no matter what state their from. Here's where it is costing the Ebay sellers. You have an item that I want to purchase. Guess what. You have just lost a sale because I know Washington State TAX will be added to my purchase at checkout. Unfair to you-unfair to me. If I were a seller I would be pretty angry about this practice as Washington State is the only one who benefits from this. End result is that my purchases on Ebay are now cut back to a very bare munimum. I just want the sellers to be aware of their lost revenue and Ebay to understand the impact this practice is causing.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-08-2019 11:55 PM

@milehigh3131 wrote:My state (CO) has literally 100s of different sales tax rates. Different for every town, city, county.

You can search (in quotes) "Colorado Sales Tax Rates by City" to see.

I haven't seen much online as to how that will be 'dealt with'.

Not going to stress out much over it, as I play to phase out my online selling hobby.

Many states have tax rates that vary owing to local option taxes being added to the state's base sales tax rate. I can only assume that eBay, as the merchant of record, would have things worked out as to how they will need to conform to each state's statutes.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 06:55 PM

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 07:00 PM

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 07:05 PM

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 07:08 PM

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-14-2019 07:35 PM

I order something from NY for about $45.xx, I got a bill for $49.xx

I live in California, where Ebay is. Actually, I met some programmers who started at that place. ![]()

If you haven't paid for your item, you're a winning bidder, not a buyer!

-----------------------------------------------------------------------------------------------

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 01:22 AM

I've heard NY is one of the highest taxers as well so surprised they haven't done it yet.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 03:53 AM

@cashvaluerecovery2011 wrote:

Its funny that you warn us about this............when the real problem will be when ebay realizes they can force ebay sellers to pay the buyers sales tax and then charge a final value fee on it like they do shipping.

This bears repeating. While Ebay has stated that they will not be charging a fee to COLLECT the taxes, has anyone heard whether they will be collecting fees for PROCESSING the taxes? Etsy does through their payment service, which also uses Adyen.

Are there any sellers here that are in Ebay's managed payments and have sold to one of the states where taxes are now collected? If so, have you paid processing fees on the tax collected? Likewise, are there any sellers here that have had taxes collected in one of those states and the payment was through PP--have you paid PP any processing fees?

This is yet another factor sellers will need to figure into their prices and may become difficult due to the various tax rates across the country.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 05:55 AM - edited 01-15-2019 05:57 AM

Considering that ebay charges FVF on shipping - right, everybody does, of course ![]() - IF there is a way for ebay to legally monetize it, I'm fairly sure, there is a good probability, that they will.

- IF there is a way for ebay to legally monetize it, I'm fairly sure, there is a good probability, that they will.

The foolishness of one's actions or words is determined by the number of witnesses.

Perhaps if Brains were described as an APP, many people would use them more often.

Respect, like money, is only of 'worth' when it is earned - with all due respect, it can not be ordained, legislated or coerced. Anonymous

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 06:04 AM

This is only on items that your state taxes in the first place.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 06:05 AM

Since Etsy is collecting Marketplace Facilitator taxes that THEY are responsible for it does not make sense that they are charging fees to sellers for this service. I read the Etsy page on internet sales taxes and didn't see anything about fees.

https://www.etsy.com/seller-handbook/article/how-marketplace-tax-laws-impact-state/321914904041

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 07:46 AM

Since fees are charged on the total amount the seller receives, and the seller does not receive the tax payment, then I would imagine that the seller is not charged fees on the tax.

We seem to be getting closer and closer to a situation where nobody is responsible for what they did but we are all responsible for what somebody else did. - Thomas Sowell

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 07:49 AM

@where*you*crowin wrote:Are there any sellers here that are in Ebay's managed payments and have sold to one of the states where taxes are now collected? If so, have you paid processing fees on the tax collected? Likewise, are there any sellers here that have had taxes collected in one of those states and the payment was through PP--have you paid PP any processing fees?

Here is what we are seeing so far on sales to WA where eBay has collected the tax. We are not seeing any additional fees being charged to us by eBay or PayPal at this time in regard to eBay collecting and remitting the tax. It is basically a separate transaction between the buyer, eBay and eventually the state - the seller is pretty much taken out of the loop.

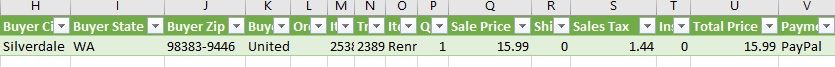

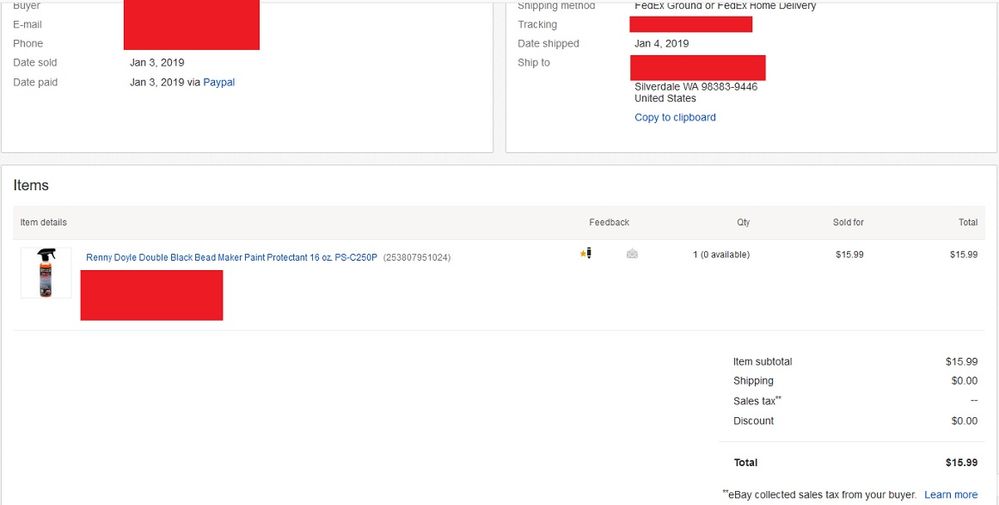

The first screen shot is what the sales record page in Seller Hub shows - $15.99 item price, free shipping, -- for tax with a note saying eBay collected it. The PayPal transaction shows the same thing, $15.99 total payment, no tax and the normal PayPal transaction fees based on the $15.99 total.

The second screen shot is from a "Paid and Shipped" Report which was pulled by going to File Exchange - Download Files - Paid and Shipped and selecting the appropriate date range. This report shows this transaction with a sale price of $15.99, sales tax of $1.44 (calculates out to 9%, which is correct for buyer's address) and a total price of $15.99. FVF on our invoice is correct for that category based on $15.99, so it does not include the tax.

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 08:08 AM

@southern*sweet*tea wrote:Since fees are charged on the total amount the seller receives, and the seller does not receive the tax payment, then I would imagine that the seller is not charged fees on the tax.

eBay has always specifically excluded sales tax paid by the buyer from the amount that sellers pay final value fees on.

https://www.ebay.com/help/selling/selling-fees/selling-fees?id=4364#section2...

Final value feesWe charge a final value fee when your item or relisted item sells, or if we determine that you intended to complete a sale outside of eBay.

Final value fees are calculated as a percentage of the total amount the buyer pays, including shipping and handling. Sales tax isn't included.

...

Re: WARNING SELLERS! Ebay is adding tax to your sales. You ARE losing sales because of it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2019 08:24 AM

Yes but the poster who brought it up was talking about Etsy and using them as an example.

I don't believe they charge fees on sales taxes either.