- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: Taxes on discount postage.. who do i call to r...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 08:56 AM

Hi, one of our clients lives in Indiana and purchased discount postage and was charged tax, postage is not a taxable item. who do i call to get them to take it off......Thanks..

- « Previous

- Next »

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 01:02 PM

Tell your buyer to bring up their issue with Ebay and the government not you. THEY are the ones who charged the buyer tax and it is out of your hands. Ask them if they would like to cancel but remind them no matter which seller they buy postage from on Ebay they have to pay up.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 01:08 PM - edited 01-11-2023 01:12 PM

@hgitner wrote:when we sell collectable stamps, or sheets we are charged tax and thats fine.... but in the "postage" category to be used they do not charge

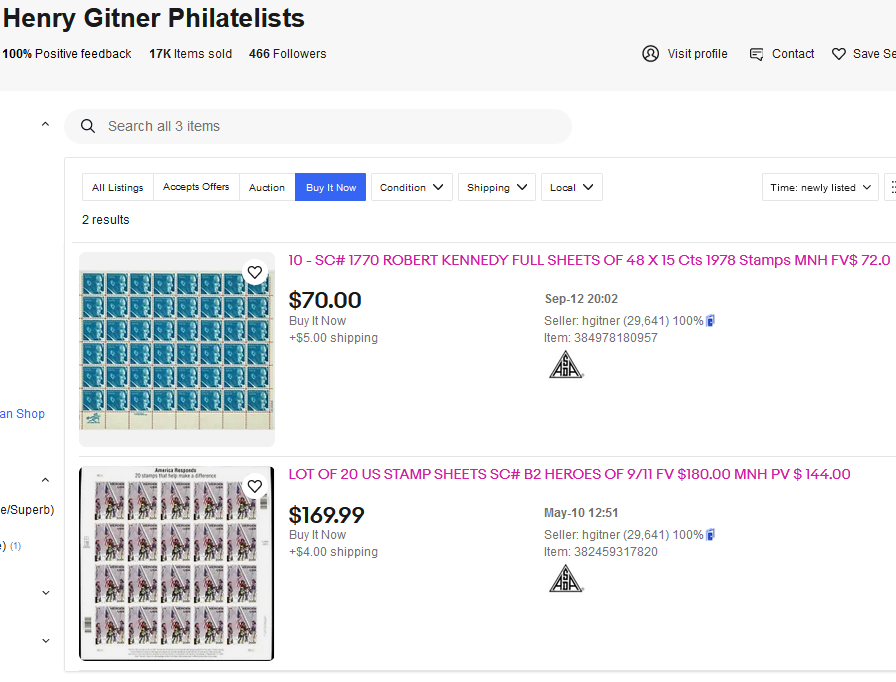

You have only 2 fixed-price listings in that category at the moment, which I can check the sales tax status on.

The first listing, the blue Robert Kennedy stamps, is for 10 sheets of stamps, each with 48 x 15 cent stamps, so the face value of the stamps is $72.00, and you are selling them for $70.00. They are being sold for just under the face value, and they are not considered taxable (when I put them into the shopping cart to check, there was no sales tax added).

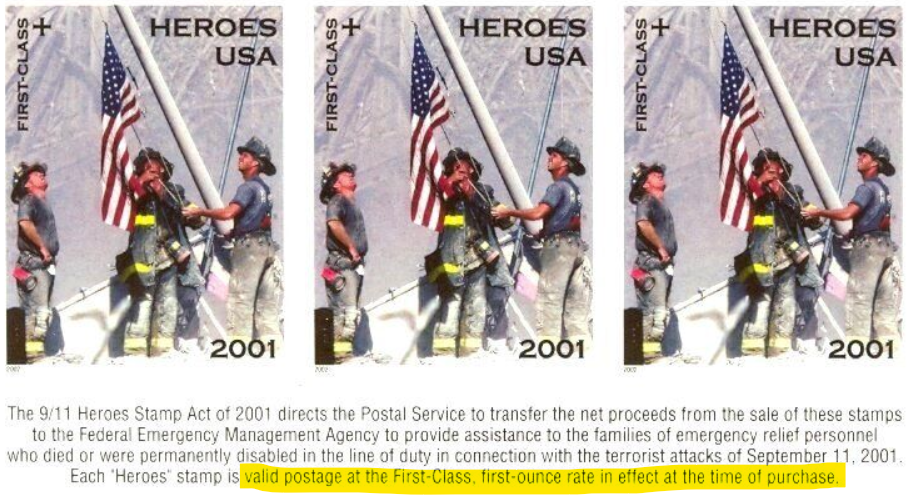

The second listing, the Heroes stamps, state on the bottom of the sheet that they are valid for first class 1 oz postage at the time they were sold. They went on sale June 7, 2002 with a postage value of $0.34, so one sheet of 20 stamps is worth $6.80. They were fund-raising stamps, and were actually sold for $0.45 each, but the postage value was $0.34 each. It's not clear how many sheets are included; assuming that it is 20 sheets, the face value would be $136.00. The amount that was considered a donation would not be included in the face value. You are selling them for a bit more than their actual value, and they are considered taxable (when I put them into the shopping cart, there was sales tax added).

http://old.post-gazette.com/nation/20020606postal2.asp

It appears that eBay considered the actual value of the stamps being sold in the Stamps > United States > Postage category, and considers stamps that are being sold for more than their face value to be purchased for the purpose of collection, and to be taxable.

It is likely that, if eBay can't calculate the actual face value of the stamps or if it is ambiguous, they would consider the stamps to be sold for collection purposes.

As has been said before, if your buyer feels that they should not have been charged sales tax, they can contact eBay and ask for it to be refunded. That's between them and eBay.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 01:12 PM

@lacemaker3 After your explanation it looks like the buyer and (possibly the seller), are both trying to scam the system. Those seem to be collectable stamps and will most likely neve be used for actual postage.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 01:39 PM - edited 01-11-2023 01:41 PM

After a little more investigation, this appears to be how eBay handles the sales-taxable status of listings like that:

- For listings in the Stamps > United States > Postage category:

- IF the listing has a Face Value specified in the item specifics,

- AND IF the purchase price is less than the Face Value that was given in the item specifics,

- THEN the purchase is not subject to sales tax.

Which is a neat algorithm, and quite a nice little bit of programming. Kudos to the programmer.

It's possible this may be different for purchasers in different states, depending on their sales tax legislation.

I didn't investigate any other categories of stamps.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 02:05 PM

So, conversely, if:

- IF the listing had a Face Value specified in the item specifics as $400,

- AND IF the purchase price is more than the Face Value that was given in the item specifics ($610),

- THEN the purchase is subject to sales tax.

Are those fair statements?

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 02:07 PM - edited 01-11-2023 02:09 PM

@pburn wrote:So, conversely, if:

- IF the listing had a Face Value specified in the item specifics as $400,

- AND IF the purchase price is more than the Face Value that was given in the item specifics ($610),

- THEN the purchase is subject to sales tax.

Are those fair statements?

I didn't go that far, because I was not able to test those assumptions.

I was pretty careful about how I worded my statements 🤣 .

But, to address the point that [I think] you are trying to make:

- Yes, that is probably why the buyer of the listing that OP was asking about was charged sales tax.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 02:08 PM

@hgitner wrote:no my error.... it was a face value of $1000, we sold for $610 free shipping......I made a mistake with the item specifies...... the stamps that we sell as discount are usable stamps... not stamps you would collect...

If @lacemaker3's information is correct, the mistake make in your entry of $400 in the item specifics may have been what triggered eBay to charge the sales tax.

If you agree with the information presented, you may want to consider refunding the buyer whatever was paid in sales tax.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 08:41 PM

Our supermarket, Publix, sells books of postage stamps, there is no tax. BTW, in Florida, there also is no tax on the sale of USA coins. Proof sets, USA silver coins etc. no tax.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2023 08:54 PM

I believe they wouldn't need to pay when purchasing postage when actually shipping something. Technically they are buying stamps, which are usable when paying postage which then wouldn't be taxed. Stamps are (were) prepaid anyway.

You customer is trying to avoid taxes. I'd not help them.

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-12-2023 08:17 AM

coolections** we are not scamming anybody! neither one of those is used for postage,

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-12-2023 08:19 AM

ahhh maybe... i copied an existing listing and forgot to change the item specific.......WOW!!

could it really be that simple...

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2023 11:40 AM - edited 01-17-2023 11:41 AM

Re: Taxes on discount postage.. who do i call to remove

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2023 03:49 PM - edited 01-17-2023 03:51 PM

it sounds like an interesting workaround for buyers to avoid sales tax by claiming to be collecting unused stamps rather than using them!

I sell mint postage and once or twice have been informed that the buyer was using some of the stamps for their collection and the rest as postage.

One guy was furious that the package he got was not the package in the picture, so now when I am selling (for example) packets of 100x32c and have seven available, all seven are pictured, and the one sent is removed from the gallery when shipped.

we did not charge shipping on that order!

You did not charge shipping as a separate line item on that order.

You included your cost for shipping in your asking price.

This is called "free shipping" but is just a marketing ploy.

- « Previous

- Next »

- « Previous

- Next »