- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: Ebay taxes shipping costs etc

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023

08:02 AM

- last edited on

07-19-2023

01:23 PM

by

![]() kh-taylarie

kh-taylarie

Okay so ebay used to be fun ! I'm not only getting a 1099 to pay taxes on my sales of less than 5k" but ebay also deducting social security and Medicare from my sales 🤪 cause I'm considered self employed! Top it off with shipping costs gone up 25% this past week and I'm basically making nothing!

I feel like I'm back at work and not retired 😕 so I'm done! I've had enough!

I don't really need the money it's just something to fill my time in retirement selling collectibles I've purchased throughout my life but I'll just take it all to my local auction house and be done with it... I just feel bad for the folks who actually work hard finding things to sell and actually need the money

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 10:33 AM

Ebay taxes shipping costs etc

Yeah. I'm in Tennessee where s&h is taxed now on online purchases. That 10% discount I used to get was fun, no doubt.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 10:40 AM

@sylvercoins wrote:Okay so ebay used to be fun ! But now with the Biden administration all over it, we are basically making money for everyone else! Biden promised NOT to raise taxes on anyone making LESS than 400k. Well lookie here" I'm not only getting a 1099 to pay taxes on my sales of less than 5k" but ebay also deducting social security and Medicare from my sales 🤪 cause I'm considered self employed! Top it off with shipping costs gone up 25% this past week and I'm basically making nothing!

Now that a number of people have posted corrections to the numerous misconceptions you have - please reply to let us know that you have a clearer picture now or if you have any further questions.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 01:09 PM - edited 07-19-2023 01:10 PM

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 01:29 PM

@sylvercoins wrote:... ebay also deducting social security and Medicare from my sales 🤪 cause I'm considered self employed!...

Nonsense. eBay cannot pay your FICA tax, even it wanted to. Employers pay this federal payroll tax and you are not an eBay employee, while the self-employed pay FICA themselves.

If you are paying FICA, it is because whoever handles your financial affairs for you has determined it is owed and is paying it into your FICA accounts. It will increase your SS benefit when you begin to draw it, and you will still take more in Medicare benefits than you will ever contribute through FICA. Anyhow, you don't need the money, so why complain?

-

-

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 01:48 PM

@laststopgeneralstore wrote:

-eBay does NOT deduct social security or medicare from your sales. No Idea were you're getting that from...

No, but you do have to pay self-employment tax on 1099 income which supposedly goes to Social Security and Medicare (I'm skeptical that it actually does). Ebay doesn't deduct it, but I'm sure that's what she (he?) was getting at.

The whole system is kind of a crock because if I make $599 or less I can just include it as "other income" on my 1040 and pay my marginal rate on it (or just not report it, but I'm assuming that everybody wants to do the ethical thing), but if I make $600 or more I have to fill out a Schedule C and pay my marginal rate + 15.3%.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 01:59 PM

Anyone giving you more than $600. will have to give you a 1099K...including your local auction house...plus the fee for using them is something like 20+% commission. And I see you haven't done that yet because you still have items for sale here.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 02:17 PM

@duster1979 wrote:

@laststopgeneralstore wrote:

-eBay does NOT deduct social security or medicare from your sales. No Idea were you're getting that from...

No, but you do have to pay self-employment tax on 1099 income which supposedly goes to Social Security and Medicare (I'm skeptical that it actually does). Ebay doesn't deduct it, but I'm sure that's what she (he?) was getting at.

The whole system is kind of a crock because if I make $599 or less I can just include it as "other income" on my 1040 and pay my marginal rate on it (or just not report it, but I'm assuming that everybody wants to do the ethical thing), but if I make $600 or more I have to fill out a Schedule C and pay my marginal rate + 15.3%.

Sorry but you have misunderstood your tax liability here.

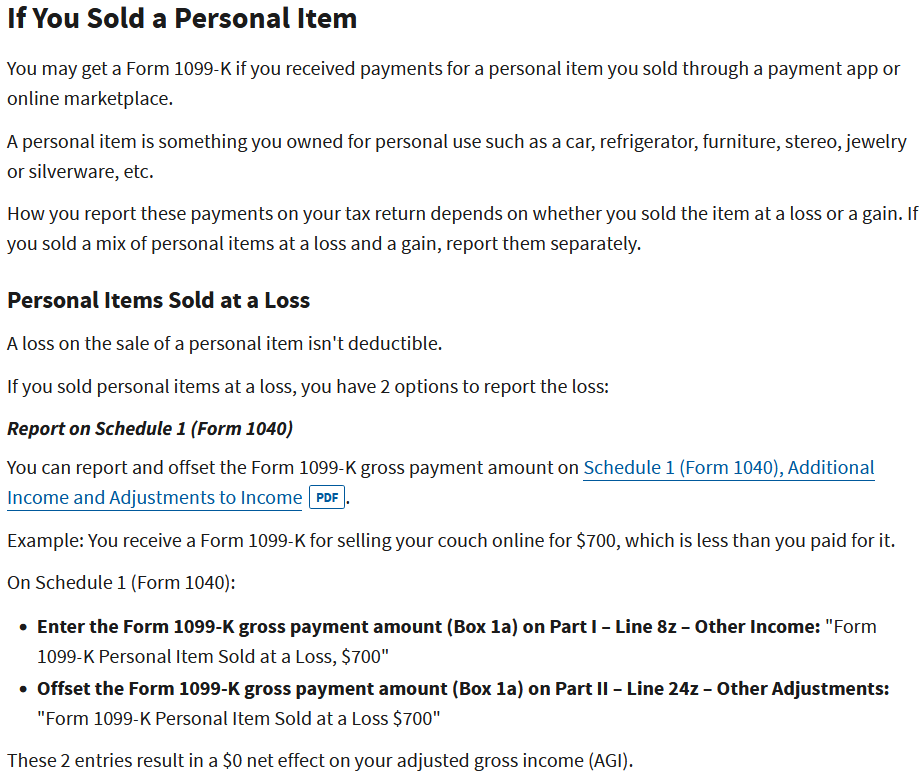

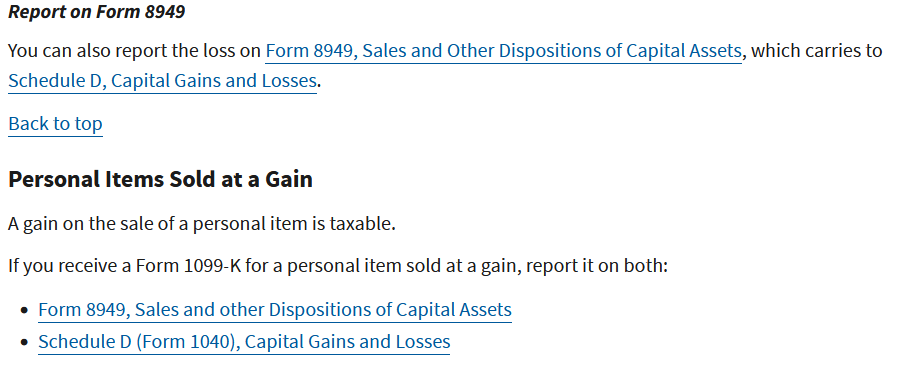

Receiving a 1099-K does NOT mean that have to (or can) file a Schedule C, and pay self-employment tax. You can only file a Schedule C if you are running a business, to report your business income on your personal tax return. The advantage of doing this, is that you can deduct a lot of expenses to reduce the amount of the income that you owe taxes on.

If you're not running a business, then there are two different ways to deal with a 1099-K. They are easier than running a business and filing schedule C, but you don't get to take as many deductions. That doesn't matter if you're selling at a loss, which includes most sellers who are selling personal items (as opposed to selling as a business).

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 03:15 PM

Can you show us proof that eBay is deducting Social Security and Medicare from your sales?

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 06:00 PM

Your thread title says eBay taxing shipping costs... I have a question about that. How are they allowed to charge buyers tax on the cost to ship, when there is no sales tax collected on the actual shipping of the item (meaning, sellers aren't paying sales tax on the price of their label when they print it and if you just go to the post office to mail your items, there is no sales tax on the cost of whatever freight service you use or on stamps).

Also... I only recently noticed because I sold an item for a family member and I had to look at the payment for the item to see how much money I had to give them for the sale of their item after the fees and such.... the item sold for $63, the total came to $66 and change with the tax.. I was charged final value fees on the grant total of $66 which included the sales tax. The final value fees eBay collects from the sale of the item is, obviously, how much money they made of the sale of the sellers item... why are they making money by way of collecting final value fees off of the amount of money the buyer paid for sales tax?? Is that legal???? I didn't think anybody but the state was supposed to benefit financially from the collection of sales tax. But eBay is making money off of it. 😕 Am I wrong? (I might be, I don't know, it just doesn't seem like that's on the up and up.

Another sales tax beef I have on here.... I live in the good old state of New Jersey. We do not pay sales tax on clothing items. Period. Doesn't matter if you're buying it as an article of clothing or as a collectible item.... a t-shirt is a t-shirt and we don't pay sales tax on a t-shirt. Ever. But on here, I buy band t-shirts from time to time, and if they are in the "entertainment memorabilia: music" category" instead of in the clothing category, I am charged tax, FORCED to pay a few extra dollars out of my wallet that eBay has no right to charge me and I'm sick of it. (Please don't tell me that I DO have the option not to buy.... I am fully aware of that option 🙂 and that's not a helpful point to make... not trying to be rude but I'm not looking for a "then just don't buy it" solution 🙂 With all the algorithms, filters, whatever the heck is used these days to flag everything under the sun, it's probably not a difficult thing to flag it by keyword or some kind of image filter to somehow figure out what is being sold in any particular listing, regardless of what category it's in, so people don't get taxed on non-taxable items where they live, and end up having to fork over extra money unfairly. I'm sorry, but since it's as simple a thing as, had that same exact item just been listed in a different category, I would not have been charged sales tax at checkout, eBay owes me all of the extra money back that I've had to pay out for sales tax on items that are non-taxable in my state. It adds up and I shouldn't have to be out that money.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 06:25 PM - edited 07-19-2023 06:26 PM

@magic*moonbeams wrote:Your thread title says eBay taxing shipping costs... I have a question about that. How are they allowed to charge buyers tax on the cost to ship, when there is no sales tax collected on the actual shipping of the item (meaning, sellers aren't paying sales tax on the price of their label when they print it and if you just go to the post office to mail your items, there is no sales tax on the cost of whatever freight service you use or on stamps).

...

A seller buying shipping labels from eBay or at the post office is not the same thing as a buyer paying for shipping.

When the seller buys the shipping label, they are paying for postage, and the post office doesn't charge sales tax on postage.

When the buyer pays for shipping, they are not paying "postage" they are paying for the service of shipping their item. It's a completely different thing. Some states (about half of them more or less) charge sales tax on services which can include shipping, and some states don't. It's generally considered to be a way to level the playing field, so that in-state and local sellers are not at a disadvantage compared to out-of-state sellers.

When eBay collects sales tax (or VAT, or GST/PST/HST) they do it according to the laws where the buyer lives. eBay would not be doing it at all if they weren't forced to collect it by the state laws or laws in other countries.

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 06:40 PM

Of course you must be including Joe and hunter Biden as the biggest tax evaders on the planet? Over 16 million in foreign money and no taxes paid .

Get a life!

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 06:59 PM

Man, this thread came from the drain and then went right back down it.

Full circle.

When you dine with leopards, it is wise to check the menu lest you find yourself as the main course.

#freedomtoread

#readbannedbooks

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 08:56 PM

All your comments and questions have been posted here many, many times and discussed into the ground and still they resurrect from time to time. Like here in your post.

"Your thread title says eBay taxing shipping costs... I have a question about that. How are they allowed to charge buyers tax on the cost to ship, when there is no sales tax collected on the actual shipping of the item (meaning, sellers aren't paying sales tax on the price of their label when they print it and if you just go to the post office to mail your items, there is no sales tax on the cost of whatever freight service you use or on stamps)."

In your third paragraph you say you live in New Jersey. The answer to that question I put in bold italic red typeface is -- eBay is not merely allowed to charge you, a buyer in New Jersey, the sales tax on the cost of postage. eBay is required to charge sales tax on the cost of postage/shipping to buyers who have their purchases shipped to New Jersey. It's part of New Jersey's tax laws.

"Also... I only recently noticed because I sold an item for a family member and I had to look at the payment for the item to see how much money I had to give them for the sale of their item after the fees and such.... the item sold for $63, the total came to $66 and change with the tax.. I was charged final value fees on the grant total of $66 which included the sales tax. The final value fees eBay collects from the sale of the item is, obviously, how much money they made of the sale of the sellers item... why are they making money by way of collecting final value fees off of the amount of money the buyer paid for sales tax?? Is that legal???? I didn't think anybody but the state was supposed to benefit financially from the collection of sales tax. But eBay is making money off of it. Am I wrong? (I might be, I don't know, it just doesn't seem like that's on the up and up."

eBay charges Final Value Fees (FVFs) to the sellers in a percentage of the total amount paid by the buyers. Since most sales to eBay buyers in the United States do require buyers to pay sales taxes, that total amount will usually include some sales tax. Then eBay will keep anywhere from 6.35% of the sales tax on the sale of a guitar on eBay to 15% of the sales tax on a set of Joan Rivers interchangeable earrings that are sold on eBay.

I bolded that one sentence in red because at least you've got one thing correct: Your state and my state and my nephews' and all my cousins' states all benefit from the sales taxes we all pay, whether we're buying a toaster at Walmart or a guitar on eBay. (Only five of the 50 United States do not impose state-wide sales taxes on purchases made within or mailed to their state. New Jersey is not one of those five.)

"Another sales tax beef I have on here.... I live in the good old state of New Jersey. We do not pay sales tax on clothing items. Period. Doesn't matter if you're buying it as an article of clothing or as a collectible item.... a t-shirt is a t-shirt and we don't pay sales tax on a t-shirt. Ever. But on here, I buy band t-shirts from time to time, and if they are in the "entertainment memorabilia: music" category" instead of in the clothing category, I am charged tax, FORCED to pay a few extra dollars out of my wallet that eBay has no right to charge me and I'm sick of it. . . . . . . With all the algorithms, filters, whatever the heck is used these days to flag everything under the sun, it's probably not a difficult thing to flag it by keyword or some kind of image filter to somehow figure out what is being sold in any particular listing, regardless of what category it's in, so people don't get taxed on non-taxable items where they live, and end up having to fork over extra money unfairly. I'm sorry, but since it's as simple a thing as, had that same exact item just been listed in a different category, I would not have been charged sales tax at checkout, eBay owes me all of the extra money back that I've had to pay out for sales tax on items that are non-taxable in my state. It adds up and I shouldn't have to be out that money."

But you said: " I didn't think anybody but the state was supposed to benefit financially from the collection of sales tax."

So a semi-obvious question back to you is -- "Do you hate New Jersey? Don't you think New Jersey can put your sales taxes to good use?" (Maybe I don't want to know your answer, though . . . . .)

One could infer that the taxing authorities in New Jersey may have decided not to impose sales taxes on clothing when it's purchased in physical retail stores, but then they just slightly increased the sales tax percentage on other things (toasters, guitars, earrings), maybe a little more than NJ really neeeeeeeds? You know, to make up for the lack of sales tax income that NJ isn't getting every time somebody buys a T-shirt at Target?

Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-19-2023 09:03 PM

You seem to be having a very tough time. I'm very sorry. But if you will keep an open mind, we may be able to help you because things are not as bad as you think they are. You have some misunderstanding that we can help you get a better handle on if you give us a chance.

Remember you do get to subtract all your costs for that 5k you sold. So make sure you keep track of all your costs. FYI, not Ebay's fault for this, they have fought the existence of the 1099K very hard. This is an IRS FORM not one Ebay created. But with our without a 1099K form, we are all responsible for reporting ALL our income to the IRS yearly. So even in years where you did not get a 1099k you were responsible for reporting your Ebay sales.

As to Ebay deducting Medicare and Social Security from your money. That is something that rarely happens. Did you refuse to give them your Social Security number?? If so that can cause this to happen. But if they have it, then Ebay would have no need to withhold those taxes from your money.

Ebay doesn't control Shipping costs. They are always trying to negotiate with carriers to keep costs down as much as they can, but it doesn't always work, especially with USPS as they don't allow for negotiations on Ground Advantage or Media Mail. When carriers raise pricing on shipping, then sellers in turn have to raise their pricing for shipping to the buyers. They do get use to it. They don't like it much at first, but it will taper out.

It helps to understand that most of what you complain about is controlled by LAWS that Ebay has not choice but to adhere to. I wish you the very best.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Ebay taxes shipping costs etc

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-20-2023 08:32 AM

I still see listings.