- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- Re: Accounting 101 - An Example of how the Date af...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Accounting 101 - An Example of how the Date affects your numbers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 12:56 PM - edited 01-31-2024 12:58 PM

I see many posts about why the sales/payouts do not match up....1 of the many possibilities are the posting dates of the funds....

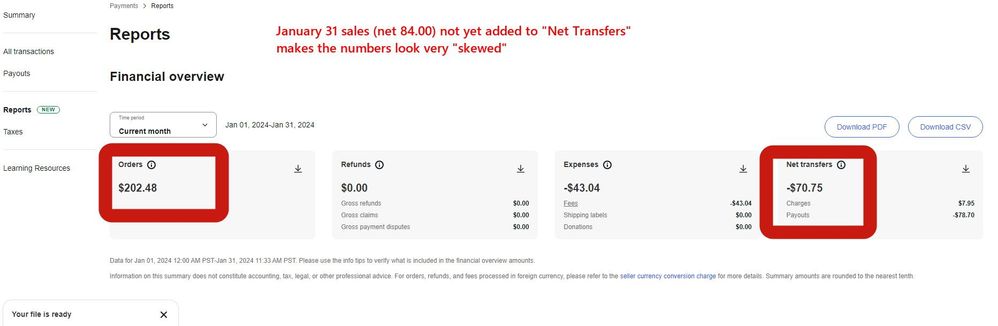

This screenshot is a good example of 1 month (January 2023) showing the "Gross Sales"...the various "Expenses" and the resulting "Payout" for the period displayed (Jan 1 - Jan 31)........

Orders totaled 202.48 (Real-Time for the period)

Fees/expenses (-43.04 Real-Time Amounts for the period)

But the payout is only 78.70...that doesn't seem possible...right?

It is completely accurate....because the payout for a sale that occured today will not post until tomorrow (Feb 1)...totally skewing the PERIOD (Jan 1 - Jan 31) stats ......

The same circumstances can be applied to ANY period or even annually.....

(in fact, if you are using cash basis for accounting, which most of us do, you catch a break since the amount in processing (income) does not have to be reported until the next year if this series of events falls on the 31st of december),,,,,,

hope this helps some folks have a clearer picture of how this works.....

Re: Accounting 101 - An Example of how the Date affects your numbers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2024 01:15 PM

One reason I have always used accrual accounting on my schedule C when filing taxes is to avoid this situation. Cash accounting is complex enough when it comes to the revenues it is even more of a problem if you purchase a lot of items or supplies using a CC. Say you purchase something on 12 December 2023 but the charge does not show up on your CC statement until January 2024 and your deadline to pay the invoice is 26 January. You pay the CC bill in full, gets more complicated if you don't, and the money does not actually get taken from your account until February 2024. This is for just one charge. I happen to pay for all of my shipping labels with a CC and I sure don't want to have to carry over expenses from 2023 to 2024.

However, I suspect a LOT of filers are using cash accounting on their schedule C but in reality using a hybrid of cash accounting for their revenues and accrual for their expenses. This is fine but would probably not hold up under an audit. Both cash and accrual accounting have their pro's and con's but in some cases you don't have a choice. If you report inventory on your taxes, you have over $25M in sales or you are a publically traded company, you must use accrual accounting.