- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- Re: 1099-K Reported Numbers Do Not Match

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2022 05:46 PM

Has anybody else recently got their 1099K from eBay and noticed that the reported numbers are doubled?

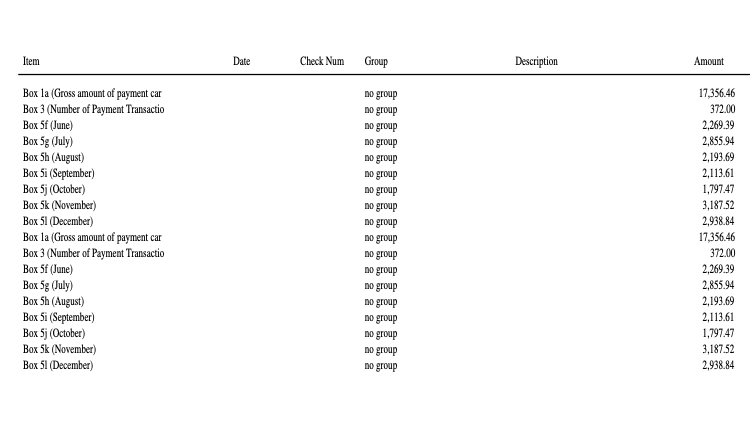

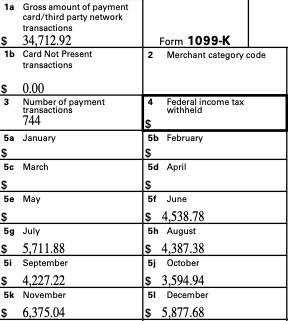

With the records I keep i had a good idea of what my gross sales would be this year. The #s that were sent on my 1099K however did not match my records or even the records on eBay own sales reports. My best guess is if you look at the first picture you'll notice how each "Box" is listed and then repeated. The Box 1a on the list 17,356.46 is the correct number. But if you look at the second picture Box 1a reports double that amount 34712.92. Who should I contact to get this corrected? Thanks

Solved! Go to Best Answer

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-31-2022 09:37 PM

The millions of incorrect 1099s that may be issued next year...what a disaster...

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 04:39 AM

Thanks everyone! Lots of helpful information here. A little comforting that I'm not the only one seeing these errors with their 1099. Also very disturbing that such a large company is still getting these things wrong and making so many mistakes. Just shows you how vital, keeping accurate records for yourself is.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 07:43 AM

That has nothing to do with this. Deductions are completely different than an issued 1099. A quick glance at the 1099 posted and a 10 year old can tell you it is wrong.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 08:00 AM

@singular-source wrote:I can't imagine the weight of the new $600 limit on eBay and the IRS...Not to mention the every other company that must adhere to this limit. IRS is going to be eaten alive.

The IRS appears to have had a system in place to deal with 1099-Ks since 2011.

According to reports on this board, if the amount of 1099-K income is not accounted for on the taxpayer's return (business income, non-business income, capital gains, etc.), the IRS computer algorithm adds it as income and recalculates the tax and send a bill for the tax due.

The taxpayers either files an amended return to explain the income or add business deductions, or he pays the bill.

So I guess I'm failing to see how this will be much of a burden on the IRS.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 08:21 AM

The IRS appears to have had a system in place to deal with 1099-Ks since 2011.

According to reports on this board, if the amount of 1099-K income is not accounted for on the taxpayer's return (business income, non-business income, capital gains, etc.), the IRS computer algorithm adds it as income and recalculates the tax and send a bill for the tax due.

The taxpayers either files an amended return to explain the income or add business deductions, or he pays the bill.

So I guess I'm failing to see how this will be much of a burden on the IRS.

It's going to be the volume increase and the IRS has advised that they are not sure how the influx of millions of additional 1099's is going to impact their IT systems. While there was funding in the bill to augment the IRS the government is still operating on a continuing resolution which means organizations are spending at their 2021 funding levels and there are no new starts or additional funds.

Even if the funds were immediately available you don't simply make adjustments overnight or hire new people to support things. It takes time to setup buildings, enhance computer systems, hire people......... The IRS is already in arrears in processing 2020 federal returns and there are millions of unprocessed filings to be processed and people waiting on their refunds.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 08:23 AM

@dbfolks166mt wrote:I have not received mine from eBay yet but my assumption is that it is in the mail.

Wrong, it will be found in the Seller Hub under Payments -> Taxes. You will not be notified when it is generated, certainly no letter will be sent, and it is probably just sitting there waiting for your perusal at this very moment.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 08:30 AM

@m60driver wrote:

@dbfolks166mt wrote:I have not received mine from eBay yet but my assumption is that it is in the mail.

Wrong, it will be found in the Seller Hub under Payments -> Taxes. You will not be notified when it is generated, certainly no letter will be sent, and it is probably just sitting there waiting for your perusal at this very moment.

Earlier in the month the option to receive your 1099 was electronically or mailed. However, eBay's recommended method was electronically. I won't get a 1099 because I took the year off but had mine set to mail and electronic. A few days ago I checked to see if it was still set to that and somehow eBay has changed it to electronic only. So maybe those people who are expecting to receive one in the mail because they chose that option have been changed without their knowledge.

Interesting on eBay's part ... I guess it would save them a ton of money and time not to have to mail them out but on the other hand I wouldn't want to waste my printer ink and paper to print it out.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 08:31 AM

Wrong, it will be found in the Seller Hub under Payments -> Taxes. You will not be notified when it is generated, certainly no letter will be sent, and it is probably just sitting there waiting for your perusal at this very moment.

Actually that is not correct. EBay is required by the IRS to send/mail the 1099's to the sellers. I received mine last year with no problem, along with all the others from the third party financial providers, but it was sometime in February before it arrived.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 09:14 AM

This also happened to me... 2021 was my first year selling a significant amount on eBay and I guess income being reported as double is my reward 😂

But I'm hopeful that they will get this sorted out before actually transmitting the info to the IRS. I did also reach out to support and the response was pretty comical:

"I really appreciate your efforts in reaching out to us with your concern about the 1099K form. I will try my best to help you with your issue.

I have checked the details and the issue seems to be out of our reach. I would request you to get it checked with your tax advisor. Since we are not trained on this we will not be able to properly guide you what happened."

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 10:18 AM

@m60driver wrote:

@dbfolks166mt wrote:I have not received mine from eBay yet but my assumption is that it is in the mail.

Wrong, it will be found in the Seller Hub under Payments -> Taxes. You will not be notified when it is generated, certainly no letter will be sent, and it is probably just sitting there waiting for your perusal at this very moment.

You won't get an instant notice when it becomes available- but eBay does send out an e-mail within the week to alert you that it's available. This is a screenshot of the e-mail I received last year.

Unless a seller confirmed they wanted an electronic copy exclusively- then eBay will also snail mail a physical copy.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 10:20 AM

I reviewed at least 3 threads about these duplicate totals and so far it doesn't look like anybody tagged eBay to find out what's going on.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 10:54 AM

Lol. Ebay can't even generate accurate Transaction Data CSV reports... Should we expect the data they send to the IRS to be any better... NOPE.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 11:05 AM - edited 02-01-2022 11:07 AM

Seems that I am given a choice as to a method to get the 1099-K

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 11:44 AM - edited 02-01-2022 11:46 AM

My numbers don’t match because EBAY SHIFTED MONTHS ENDS. THEY THROW IN LAST 2 DAYS OF THE MONTH ONTO ANOTHER MONTH. YOU CAN SEE IT WHEN YOU DOWNLOAD DETAILED REPORT. THEY MADE SOME SORT OF FICTICIOUS SETTLEMENT DATE— AND THEY GO BY IT NOT BY WHEN BUYER PAID. They threw some december 2020 transaction on it and they end months on the 28th. They call reports january 1 through 31 but it is december 31 2020 till january 28 2021 and so on.

Re: 1099-K Reported Numbers Do Not Match

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 12:41 PM

Hey @coffeebean832 we reached out for the best course of action, and the Payments team came back with this:

“If a member feels there's a discrepancy with their IRS Form 1099-K, they should review their payout report to identify which transactions are in question. If there is still a discrepancy after reviewing their payout report, please contact us and provide us with the disputed transactions and the reason why they feel they are not correctly reflected.”

Once sellers have the disputed transactions they'll want to reach out to the Payments team directly.

Thanks!

Community Team