- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- sales tax charged even though the seller resides o...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 02:13 PM

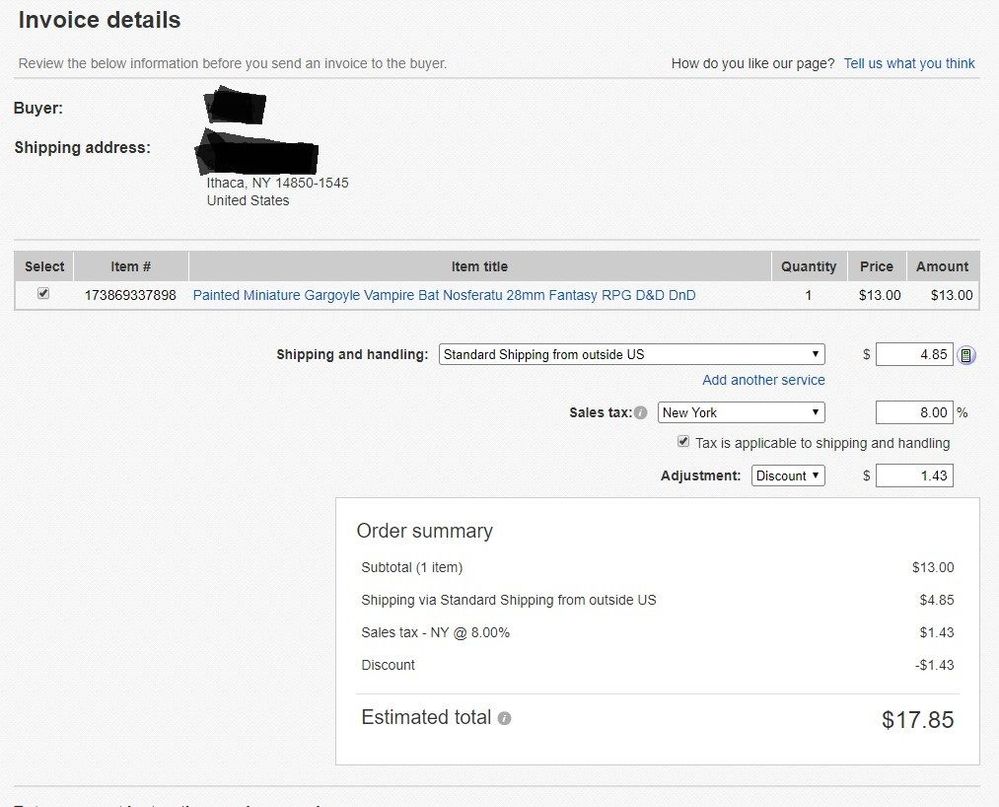

I am in Greece (europe) and so are my wares.

the customer is in NY. He wasn't paying. i went to send an invoice, and found out Sales Tax is charged on him!

i discounted it just in case, but i am confused. Shouldnt i be based in the US for the US to collect Sales Tax?

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 02:24 PM

It is correct that sales tax is collected.

Over the last year in the United States, multiple states have passed laws requiring "Marketplace Facilitators" to collect sales tax if their marketplace's total sales to the state is over some specified amount.

eBay started collecting sales tax on New York resident purchases beginning on June 1.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 02:32 PM

Everyone has options. Just be sure the best option is right for you.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 02:33 PM

Sales and use tax is based on where the buyer is, not the seller.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 02:40 PM

@loveyourimagination49 wrote:

You didn’t get charged tax.

Sorry ran out of edit time, please ignore post.

Everyone has options. Just be sure the best option is right for you.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 03:07 PM - edited 06-19-2019 03:09 PM

@orangehound wrote:It is correct that sales tax is collected.

Over the last year in the United States, multiple states have passed laws requiring "Marketplace Facilitators" to collect sales tax if their marketplace's total sales to the state is over some specified amount.

eBay started collecting sales tax on New York resident purchases beginning on June 1.

But this seller is in Greece. Do states collect sales tax on purchases ordered from a different country than the USA? If that is so, then ebay would have to charge sales tax (if your state has sales tax) on any purchases a buyer makes from china. Or Canada... I don't know if states can collect sales tax on out of country purchases.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 03:12 PM

.

But this seller is in Greece. Do states collect sales tax on purchases ordered from a different country than the USA? If that is so, then ebay would have to charge sales tax (if your state has sales tax) on any purchases a buyer makes from china. Or Canada... I don't know if states can collect sales tax on out of country purchases.

States collect tax on anything delivered to that state. It matters not where the item came from. Items bought from a seller on the moon are taxable.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-19-2019 04:13 PM

@findingfinds888 wrote:

@orangehound wrote:It is correct that sales tax is collected.

Over the last year in the United States, multiple states have passed laws requiring "Marketplace Facilitators" to collect sales tax if their marketplace's total sales to the state is over some specified amount.

eBay started collecting sales tax on New York resident purchases beginning on June 1.

But this seller is in Greece. Do states collect sales tax on purchases ordered from a different country than the USA? If that is so, then ebay would have to charge sales tax (if your state has sales tax) on any purchases a buyer makes from china. Or Canada... I don't know if states can collect sales tax on out of country purchases.

eBay is already collecting sales tax on ANY sale from ANY seller from ANY country if the buyer is located in one of the States with a marketplace facilitator laws. eBay is also collecting sales tax on sales to buyers in Australia and New Zealand and coming in a year or two eBay will be collecting VAT on shipments destined for the EU.

Bottom line, the days of tax avoidance on cross-border (State or Country) buying/selling are coming to an end. You can add this to the list of "I remember when" things just like payments by mail, negs for buyers, gas used to cost 25 cents a gallon or my personal favorite....."I'm going to quit smoking when they hit 50 cents a pack!".

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 07:05 PM - edited 10-02-2019 07:07 PM

if i go to china to buy something, I am NOT charged tax in the state I live in to purchase said item. I call bull sheet.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 11:27 PM

Actually, if you look at your state income tax form you will see a line for USE TAX - where you were supposed to declare items bought out of state/county and pay the appropriate taxes on them when you filed your return. So, yes, since its inception, your state has taxed items bought in China or anywhere else. You just haven't been paying it and now the advent of the internet has allowed states to close that loophole and collect the taxes they mandate.

The above is not my opinion, which is irrelevant to the conversation. THAT rant is posted elsewhere.......................................

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2019 12:07 AM

Sales/use tax has for decades been the responsibility of NY residents to pay. It doesn't matter where the seller is located, if it is delivered within the state of New York the tax applies and the buyer should have been paying it although many neglected to do so. However, New York's legislature has enacted a marketplace facilitator law making facilitators, such as eBay, responsible for collecting it from the buyer. It doesn't matter where the seller is located, it is the buyer's location that matters.

You are not responsible for collecting the tax and remitting it, eBay handles that. However the buyer is responsible for paying it and if he refuses to pay for his purchase because of the sales tax being charged, I suggest filing a UID and closing it after 96 hours and giving him an unpaid item strike on his account. You can then safely re-list. Don't forget to put him on your BBL.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2019 12:09 AM

@findingfinds888 wrote:

@orangehound wrote:It is correct that sales tax is collected.

Over the last year in the United States, multiple states have passed laws requiring "Marketplace Facilitators" to collect sales tax if their marketplace's total sales to the state is over some specified amount.

eBay started collecting sales tax on New York resident purchases beginning on June 1.

But this seller is in Greece. Do states collect sales tax on purchases ordered from a different country than the USA? If that is so, then ebay would have to charge sales tax (if your state has sales tax) on any purchases a buyer makes from china. Or Canada... I don't know if states can collect sales tax on out of country purchases.

Yes, they can and do.

sales tax charged even though the seller resides outside the US

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2019 12:13 AM

@kat1123 wrote:if i go to china to buy something, I am NOT charged tax in the state I live in to purchase said item. I call bull sheet.

You would be charged whatever type of tax China levies on sales there. However, if you purchased it there and had it delivered to you in your home state, unless that state is one without a sales/use tax, you would still owe it to your state.