- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- Sales Tax Collection Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 07:58 AM

We know that eBay has said starting January 1, they will be collecting and remitting sales tax for WA and MN. We have not yet had a sale to either of these states this year, but have noticed a difference between our listings and other sellers listings.

Our listings still show in the sales tax tab "Seller charges sales tax in multiple states" with "multiple states" being a link that takes you to the tax rate table as we had previously set it up, which shows WA at 8.76% and nothing for MN. (Listing ID 253474630872 for example)

However, if we look at another seller's listing for the same item (253975812991), they show " FL*(7.0%), MN*, WA*."

@Anonymousor one of the other blues, can you let us know if this is a glitch or if there is something we need to do to update our listings so eBay will be properly collecting and remitting tax for WA and MN?

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 08:44 AM

Here are some screen shots and directions. See if this link works https://bulksell.ebay.com/ws/eBayISAPI.dll?FileExchangeCenter or you can find File Exchange in Seller Hub under Selling Tools.

Under Downloads, click Create A Download Request

Select Paid and Shipped, the date range, and enter your email address.

You'll get an email with a link to download the file when it is ready. It's a CSV file, so what you do with it at that point will depend on what info you need and how comfortable you are working with spreadsheets. In Excel you could sort/filter to see transactions just for specific states if that would make it easier.

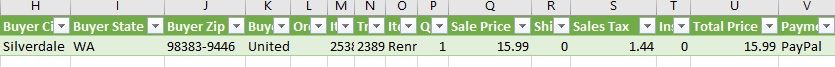

There's nothing in the file that specifically says eBay collected the tax. However, for states where we still collect directly, the Total Price adds up to Sale Price + Sales Tax. For WA it shows Sale Price and Sales Tax in their respective columns, but Total Price doesn't include the tax ( like in this example Sale Price $15.99, Sales Tax $1.44, Total Price $15.99).

Hope that helps!

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 08:57 AM

To make it more visual you could add a calculated column that retotaled the sales amount Q + R + S + T and subtract the total (column U). Give the column a title like "Ebay ST" and then you can easily see where eBay collected the sales tax vs you.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 09:02 AM

Sellers need to be proactive and not wait for some eventual eBay report. Download your Sales history monthly. Download your invoice monthly. If you use Paypal, download your detailed activity reports from Paypal monthly.

I feel sorry for the sellers that enrolled in Managed payments in 2018. They have no way to download any reports that will show their sales volume in states that they may have needed to start collecting on Jan. 1. Once again eBay is several weeks behind the actual need in supplying a solution.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 11:12 AM

@dtexley3 wrote:To make it more visual you could add a calculated column that retotaled the sales amount Q + R + S + T and subtract the total (column U). Give the column a title like "Ebay ST" and then you can easily see where eBay collected the sales tax vs you.

Good call! That's exactly what I do before I send the report to our accounting department. I kept the example to how the report looks as it comes from eBay just to hopefully avoid confusion. ![]() I can post a screenshot of the report with that column as well if anyone would find that helpful. I know the whole FileExchange/spreadsheet thing can be a little intimidating for those who haven't done it before. I am by no means an expert, but happy to try to help where I can.

I can post a screenshot of the report with that column as well if anyone would find that helpful. I know the whole FileExchange/spreadsheet thing can be a little intimidating for those who haven't done it before. I am by no means an expert, but happy to try to help where I can.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 11:54 AM

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 11:57 AM

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2019 01:48 PM

@serenitystrawsnstuff wrote:

I'm getting too old, this is way over my head. I have no clue how to 'add another column' to the report that ebay created. Someone keeps saying the fix in the process of being made. Will it be made in the next week or so, the submission is due the 1st week in Feb.

I'm getting way too old to deal with all the Ebay confusion. I have been searching info for several days now, related to Ebay reporting State tax we collected from our buyers. I looked thru all the notices Ebay sent out and I completely misread the notice about when they started reporting the tax for us. They sent out the notice in October, but it didn't start till 1/1/2019!!! So we still have to report any State tax we collected from buyers in 2018. Thank God I finally found this. So I'm good to go, and from now on, we don't have to worry about it, because it will be reported by Ebay. I printed that announcement in case the State tries to fine me for not reporting it next year. 🙂

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 09:00 AM

@Anonymous - Has there been any progress made on figuring out the issue with the tax tables? eBay started collecting tax for Iowa as of 2/1 and that is also not showing in the tax table list on our listings. It has been a month since I first reported this issue.

We need to get this resolved ASAP so the listings are accurately showing the taxes before a customer commits to purchase.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 10:27 AM

I checked on an item and under the shipping and payments tab is the following:

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 10:35 AM

I think I figured why we will be paying on S&H. The same reason that eBay charges a fee on S&H. To avoid someone from pricing their 9.00 widget at 1.00 and shipping as 9.00

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 10:36 AM

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 11:28 AM

@myjunqueyourtreasure wrote:

Nothing to do with it. Some states tax S&H, some don't.

Correct, it is based on each state's specific tax laws.

General reply just to clarify because a lot has been added on to this thread since I originally posted it: As far as I can tell, eBay is correctly calculating and collecting tax for the states with Marketplace Facilitator laws where required (WA, MN, IA at this time).

The only issuing I am having is that the tax table in our listings has not been updated to reflect the fact that eBay is collecting for those states. If someone in IA clicks on the "Shipping and Payments" tab in one of our listings to see which states are subject to tax before purchasing, it does not show their state in the list. However, once they go to checkout, they will see the tax added.

I am concerned about how this discrepancy may be affecting the buyer experience (possible lost sales and risk of negative feedback) and frustrated that the issue was reported to eBay a month ago but still hasn't been fixed.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-04-2019 01:40 PM

@stickboy1974 wrote:I checked on an item and under the shipping and payments tab is the following:

Sales tax may apply when shipping to: Iowa*, Minnesota*, Washington*.* Tax applies to subtotal + S&H for these states onlyIt is crazy that tax will be applied to the shipping since I don't have to pay tax when I buy stamps or the handling part since I am not getting paid for packing the item - just for the item itself.

Good luck convincing state legislatures of that. It's up to each state to decide if they want to tax shipping or not.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-05-2019 02:40 PM

@autopiacarcare wrote:

@Anonymous - Has there been any progress made on figuring out the issue with the tax tables? eBay started collecting tax for Iowa as of 2/1 and that is also not showing in the tax table list on our listings. It has been a month since I first reported this issue.

We need to get this resolved ASAP so the listings are accurately showing the taxes before a customer commits to purchase.

Hi @autopiacarcare, I want to start out by reassuring you that the tax for these states is applying properly at checkout, and I have just confirmed this by testing out checkout with one of your listings. That being said, there does appear to be a display issue with what is visible in your listing compared to the Tax Table you have set up. I've reported this to our tech team and will see what might be going on.

I do want to touch on the report you filed related to this issue last month - at the time we first discussed this, the updated Tax Table that had the disclaimer that eBay would be collecting tax for Washington and Minnesota was not yet rolled out. Shortly after first discussing this, we updated the site with the new Tax Table and I have confirmed that for most other sellers, this is displaying correctly.

It does appear that your listings, however, are not updating in the same way - can you tell me a little more about how you are listing your items? Are you using a third party listing tool? Do you primarily use Good 'Til Cancelled listings, or a set duration? Do you typically create listings by using the Sell Similar feature or are they from scratch? As much detail as you can provide would be appreciated so we can work to determine why your listings are not updating like many others.

Sales Tax Collection Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-05-2019 02:57 PM

Thanks @Anonymous - Yes the actual collection of tax is working correctly. My issue at this time is just the display of the tax table in the listings. I am concerned about the negative affect it may have on the buyer experience when their state is not shown in the tax table in the "shipping and payments" tab on the listing, but they are charged tax by eBay when they checkout.

We don't use third party listing tools. We create the listings directly in eBay using the advanced listing form. Our listings are all Good Til Canceled. We use "Sell Similar" occasionally, mostly to relist products that may have been previously ended. The tax rate table displays the same both for listings that were created from scratch and for listings that were created from "sell similar."

All of the listings have checked the option that says "Charge sales tax according to the sales tax table." I have tried editing our tax rate table and then doing a bulk update/edit to "refresh" the listings, but that does not apply the new tax information for WA, MN and IA.