- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: Quickbooks and Recording eBay collected and pa...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 10:28 AM - edited 11-13-2019 10:29 AM

Question now is how to record in QuickBooks. Tax transactions that don't really happen

Easy to record actual tax collection that has to be paid to our home states but how to handle if eBay collects and pays for you.

Do we record the extra $$ on sales price as revenue then expense the tax movement or just ignore and do not bother recording in the first place ?? seeing as eBay collected and paid anyway

Solved! Go to Best Answer

Accepted Solutions

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:54 PM

@support-manufacturing wrote:Appreciate quick reply, I am okay with ignoring as well, just concerned that if something should happen a couple years in and we had to prove to IRS that we did all we could as sellers to collect or have eBay collect for us.

We would have to reply on eBay records I guess.

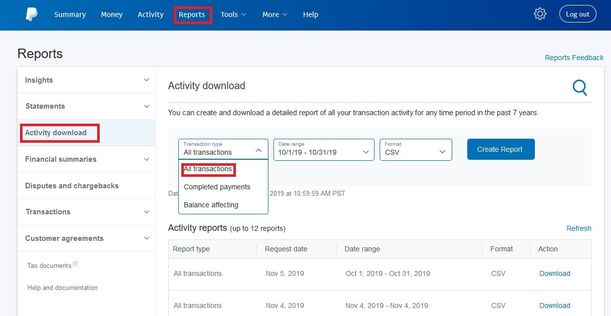

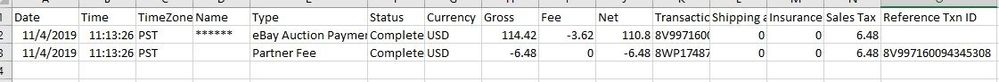

You can also get the records from PayPal, which may be helpful because eBay reports usually only go back 90 days. If you download an activity report from PayPal, it will show the taxes on the order and then a separate line item for "Partner Fee" which is the tax going back to eBay.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 10:54 AM

@support-manufacturing wrote:Question now is how to record in QuickBooks. Tax transactions that don't really happen

Easy to record actual tax collection that has to be paid to our home states but how to handle if eBay collects and pays for you.

Do we record the extra $$ on sales price as revenue then expense the tax movement or just ignore and do not bother recording in the first place ?? seeing as eBay collected and paid anyway

It is my understanding that those tax amounts will now be included in the gross sales number on the 1099K form that PayPal will be sending to the IRS, so you definitely do need to keep track of how much money comes in and then goes back out to eBay for the sales tax.

Depending on your situation, you may be able to just pull reports from PayPal, total up what they are calling the "Partner Fee" (that is the tax amount sent to eBay), and that will give you the number to use as a deduction on your taxes.

If you need or want to track it in Quickbooks, the first thing to look at is how do the sales get entered in to your Quickbooks? If you have an app or program that automatically imports sales directly from PayPal, it may already be including the tax amount in those sales when they are imported. If so, you just need to make sure it is separating the tax amounts out properly and then that you show that same amount going back out to eBay.

I'm not a Quickbooks expert, so someone else may have better advice for you, but maybe you could create an "other income" account to assign the tax amount to and then an "other expense" account to record those amounts going back to eBay? I believe that would allow you to be able to track and pull reports for just those amounts.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 12:07 PM

I'm ignoring it. I don't have to account for tax I don't collect.

As far as the 1099K, since I only get a 1099K from Paypal for Ebay/Ruby Lane and my 3 small Etsy shops aren't big enough these days to generate a 1099K, my books always show my gross receipts as greater than the 1099K I do get. The only time you would have to reconcile this is if you are audited by the IRS which is rare. Don't do more work than you have to.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:31 PM

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:45 PM

Appreciate quick reply, I am okay with ignoring as well, just concerned that if something should happen a couple years in and we had to prove to IRS that we did all we could as sellers to collect or have eBay collect for us.

We would have to reply on eBay records I guess.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2019 01:54 PM

@support-manufacturing wrote:Appreciate quick reply, I am okay with ignoring as well, just concerned that if something should happen a couple years in and we had to prove to IRS that we did all we could as sellers to collect or have eBay collect for us.

We would have to reply on eBay records I guess.

You can also get the records from PayPal, which may be helpful because eBay reports usually only go back 90 days. If you download an activity report from PayPal, it will show the taxes on the order and then a separate line item for "Partner Fee" which is the tax going back to eBay.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-03-2019 08:56 AM

Just being a devil's advocate here, but who do you send the 1099 to when your "partner" has received more than $600 in a year?

Having recently seen someone go through an audit, our friends at the IRS want to see EVERY receipt for everything paid. Partner Fee sounds like a business partner that should be reporting income.

Do we create a journal entry for every sale where eBay collects and remits the tax? One monthly journal entry for the collected tax? How do you reconcile your PayPal account at the end of the month with all of the Partner Fees?

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-03-2019 09:52 AM

@lgbusinesscenter wrote:Just being a devil's advocate here, but who do you send the 1099 to when your "partner" has received more than $600 in a year?

Having recently seen someone go through an audit, our friends at the IRS want to see EVERY receipt for everything paid. Partner Fee sounds like a business partner that should be reporting income.

Do we create a journal entry for every sale where eBay collects and remits the tax? One monthly journal entry for the collected tax? How do you reconcile your PayPal account at the end of the month with all of the Partner Fees?

I wish it was an easy answer, but different business situations may have different needs, requirements, concerns and risk assessment and/or aversion. That's why I was very careful to be generic in my advice.

Members here can advise where/how within eBay and PayPal you can access the relevant data and some possible ways to get that data into Quickbooks to keep track of it. Beyond that, you're probably going to have to consult an accountant or tax professional to get specific answers to your questions.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2019 01:08 PM

@lgbusinesscenter wrote:Just being a devil's advocate here, but who do you send the 1099 to when your "partner" has received more than $600 in a year?

Having recently seen someone go through an audit, our friends at the IRS want to see EVERY receipt for everything paid. Partner Fee sounds like a business partner that should be reporting income.

Do we create a journal entry for every sale where eBay collects and remits the tax? One monthly journal entry for the collected tax? How do you reconcile your PayPal account at the end of the month with all of the Partner Fees?

@lgbusinesscenter - I just happened to notice this note when I logged in to PayPal today to download our Activity Report for last month to get the sales tax numbers. It sounds like PayPal is aware of the concern over the term "Partner Fee" and is working to improve their reporting.

"Currently sales tax collected by us on your eBay sales appear as Partner Fee. We will be updating our reports to describe tax transactions appropriately. Thank you for your understanding."

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-09-2019 01:46 PM

@lgbusinesscenter wrote:

Do we create a journal entry for every sale where eBay collects and remits the tax? One monthly journal entry for the collected tax? How do you reconcile your PayPal account at the end of the month with all of the Partner Fees?

Just to give everyone a heads up, while reconciling the PayPal report for November, we found 4 transactions that show the marketplace facilitator tax included in the payment to us, but do not show a record of the tax being deducted back out and sent to eBay. The tax for all other transactions to those states was handled correctly, we just had these 4 random ones that are off. My guess is it was a temporary error in communication between eBay and PayPal, but I'm still working through it with Customer Service on both sides.

It ended up only being a few dollars and is a small error rate considering our volume, so I don't want to cause panic or concern, but I did want to post this as a follow up to let everyone know to check that report very carefully to make sure you have a corresponding Partner Fee line item for each transaction that has marketplace facilitator tax included.

As far as how to reconcile the Partner Fees - ultimately every business will have to figure out what works best for them. Basically what we did was used Excel to sort, filter, and narrow down the report a bit and then just manually checked the ones that we couldn't match up at the end.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2020 11:09 AM

It would be nice if QuickBooks allowed for Non-Posting Items.

The we could enter and item such as "Sale Tax Collected by eBay" with the amount so our Invoice reflects what the customer paid to eBay/PayPal.

Ignoring the sales tax amount on our docs creates this invoice total discrepancy.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2020 11:15 AM

Since it is considered 'money in' in your account, you are liable to that gross amount. Assuming you are getting one 1099 from PP, you want to 'write off' these tax amounts. They are tricky to get on pp reports, as they have them shown as 'money sent' with other items such as postage etc, so I keep track on a per order basis as a separate line item of 'write offs'.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2020 08:10 AM

So im just getting started in Quickbooks, and appreciate the feedback to this point

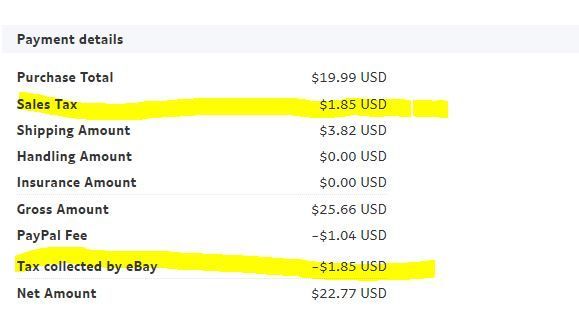

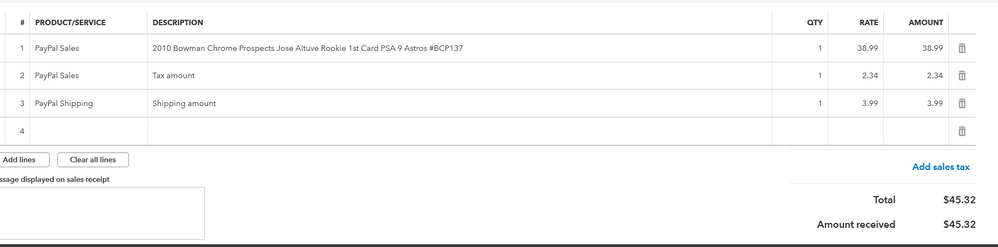

But the one think Im hearing is that the Tax is being included in our Gross, but below in the First screen shot is a recent transaction from an Ebay purchase in payapal. Ony $41.37 is being deposited in my account, not the $2.34 in Taxes.

Now Jump to the Second Screen shot, that is from Quick Books, which is SYNCd with Paypay, and it is counting the taxes in our Gross, But the Taxes are being collected and dispersed by EBAY. So Im reading that mos are just ignoring , but could we offset it with a (-) and categorize it as Taxes Paid by Ebay, if so, whats the correct accounting way to do that,

Thanks

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2020 04:18 PM

To all the above answers...not helpful!

The question was how to record in quickbooks, not where it is in Paypal or ?

This question does not appear to be solved at all.

Re: Quickbooks and Recording eBay collected and paid Internet Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-02-2020 04:08 PM

I also posted this reply on the Quickbooks online community pages. Cross posting here for reference.

This is what I do if you want to have your transactions exactly match what is entered at PayPal, especially if you have the Quickbook Online App connected to download transactions from PayPal. Currently, the App will download payment transactions as sales receipts including the PayPal fee. However, Tax collected by eBay will be a separate downloaded transaction displayed as an expense.

You can't set your sales receipt items as taxable because that would require you to setup a tax item for every state agency and since eBay is paying these taxes on your behalf, you don't want them included in your sales tax liability in QBO.

Create 2 things in QBO:

1. Create a new "Other Current Liability" account in your chart of accounts. I called mine "eBay Sales Tax Payable".

2. Create a new non-inventory product, I called mine "eBay Sales Tax Collected". Make the income account the "eBay Sales Tax Payable" liability account you created in step 1.

Now when a transaction is downloaded into your online banking tab to be matched, you edit that transaction and make sure the item purchased is NOT taxable. Then add a new line item using the product "eBay Sales Tax Collected" from step 2 above, with the amount from PayPay for "Tax Collected by eBay". When you save this transaction it may give you an error popup that the downloaded balance does not match, just click yes to continue, it will be enter correctly.

Then on the separate expense transaction downloaded from PayPal, just assign that to the liability account "eBay Sales Tax Payable", which will zero out the tax you collected in the sales receipt.

Basically now you are running a zero amount liability account with deposits from PayPal and immediate corresponding payment back to eBay for the tax collected.

This allows you to actually match downloaded transactions without having ignore them.

I'm not a CPA so this is not considered tax advice. Please consult with your accountant if you have questions on adding these transactions to Quickbooks.

Happy to answer any questions on how this works.

Thanks,

Joe