- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: New 1099 reporting requirements for an estate ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 06:55 AM

Sometime back someone posted on here how/wear on your income tax return you will show the sales from eBay as being "marked to market" as opposed to having to report a profit. Anyone remember where this can be found? In other words, if you're selling items you have inherited, you would not pay any income tax on those sales in terms of profit.

Solved! Go to Best Answer

Accepted Solutions

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:04 AM - edited 09-02-2023 07:09 AM

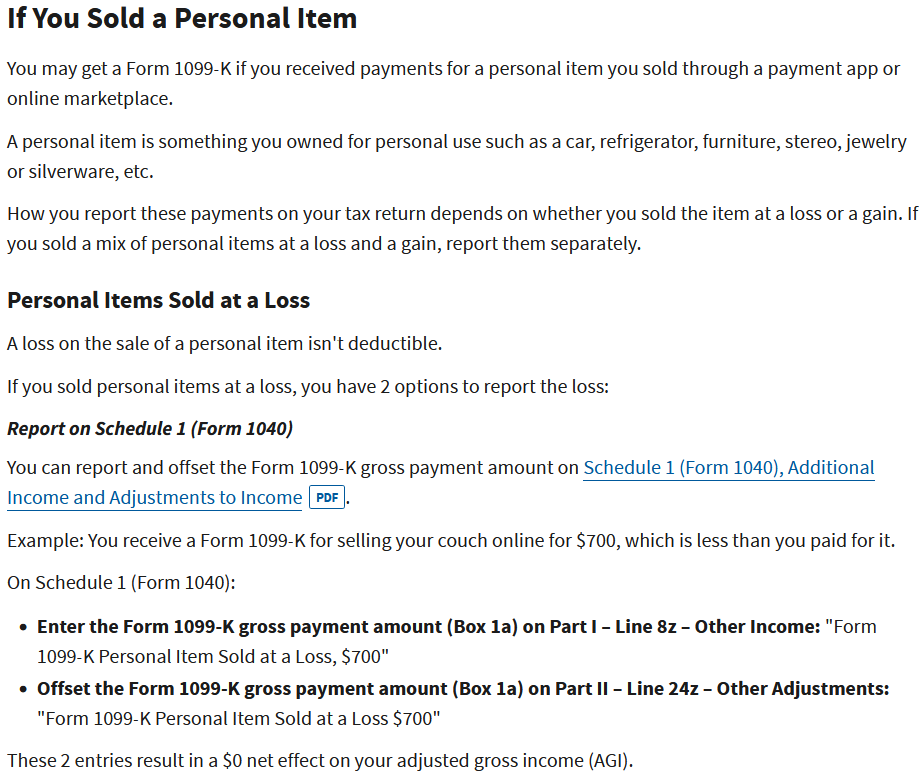

You need to know the cost basis for the items involved, to be able to determine if they were sold at a profit or a loss. The cost basis is basically how much you paid to acquire the items, but for inherited items, there's a different way to figure it. For inherited items, your cost basis is the market value of the items at the time you inherited them, so you will need to do some research if they were not valued as part of settling the estate. This is explained in IRS Publication 551, here:

https://www.irs.gov/publications/p551

Here is the IRS page that explains how you report these sales on your income tax return:

https://www.irs.gov/businesses/understanding-your-form-1099-k#do

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 06:59 AM

Since each state is different, it would probably be better to talk to a tax specialist in your area.

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:04 AM - edited 09-02-2023 07:09 AM

You need to know the cost basis for the items involved, to be able to determine if they were sold at a profit or a loss. The cost basis is basically how much you paid to acquire the items, but for inherited items, there's a different way to figure it. For inherited items, your cost basis is the market value of the items at the time you inherited them, so you will need to do some research if they were not valued as part of settling the estate. This is explained in IRS Publication 551, here:

https://www.irs.gov/publications/p551

Here is the IRS page that explains how you report these sales on your income tax return:

https://www.irs.gov/businesses/understanding-your-form-1099-k#do

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:06 AM

I live in Texas. We have no state income tax but even if we did, that would not affect my question: this is concerning the 1099 that is now required to be issued by eBay and reported to the IRS.

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:11 AM - edited 09-02-2023 07:11 AM

@anvilring wrote:I live in Texas. We have no state income tax but even if we did, that would not affect my question: this is concerning the 1099 that is now required to be issued by eBay and reported to the IRS.

That ^^^ is the very 1099 that @lacemaker3 has explained. It's for your Federal tax return. 🙌

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:23 AM

Ty lacemaker !!

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 07:28 AM

Here is a perfect step by step explanation:

https://www.ecommercebytes.com/2022/09/13/how-do-you-report-sales-of-inherited-stuff-sold-online/

Re: New 1099 reporting requirements for an estate sale.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-02-2023 01:47 PM

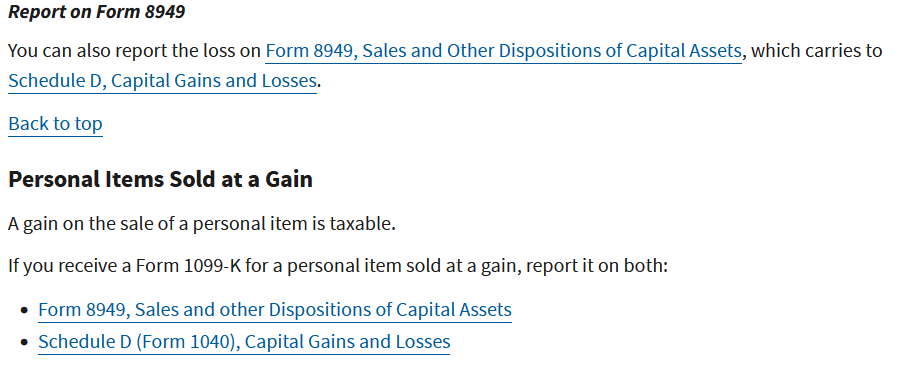

FYI, items inherited certainly can be taxed by the IRS. It depends on a range of things. Example: Inherited Real Estate. Sat on it for years. Then sold. Any amount over the market value (your cost basis) at the time you received the deed would be taxable. There is a host of items and conditions on inherited property.

Also besides income tax there maybe deductions for losses.

Best to consult a Tax Attorney or Licensed CPA. States also have laws on inherited items.