- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Does eBay collect and remit the required local an...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 07:44 PM

Before I set up my business, I'm researching the tax requirements. I'm confused about state and local sales taxes. I have economic nexus in Colorado so for any sales I make to Colorado addresses, the buyer must pay Colorado sales tax and if local taxes apply (for home rule cities, etc.), those must be collected and remitted also. Is this correct? Does eBay collect and remit the CO state AND local taxes for me? Example: Carbondale, CO, is a home rule city. They have their own local sales tax. If I were to sell and ship an item to a Carbondale address would eBay collect and remit both the state and local tax for me? If eBay collects and remits, do I have any responsibilities in that process? Thank you!

Solved! Go to Best Answer

Accepted Solutions

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 12:01 AM

Below is a link to the Ebay policy. You may need to read it a few times, but bookmark it as it is very handy to have.

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

You also need to check with your state to make sure you keep appropriate records so you can comply with the reporting requirements to your state.

For me, in my state. They require us to report all our taxable sales, even if Ebay collects the sales tax and remits it directly to the state. We need to report our total taxable sales, then we can take a deduction for the sales in which Ebay collected and remitted taxes to the state for a net result [likely to be zero].

But make sure you know what your state needs you to do when you do your report, so that you keep all the right records.

Also make sure you have your zip code set up in your account to be your 9 digit zip. Encourage everyone to do that. It is the only way the Ebay program can tell where you are exactly within the state. And as you say a state typically has many different rates across the state. The 9 digit zip code will enable them to zero in to where you are and charge the appropriate tax rate.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 07:57 PM

Ebay is the one responsible for collecting and dealing with the sales tax...

Thank God, honestly..lol..

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 08:03 PM

@canesi It is a good question and you should either post it on the Weekly Chat or loop one of the eBay Support team in to your thread. I don't think eBay will tak Sales tax down to the county level but I could be wrong. Their focus is to charge the state's sales tax rate on ALL sales both IN state and those shipped OUT of state. They collect it, the report it and they remit it.

Up until these laws went in to effect our state required all those who possess a state Tax ID to report and remit ONLY "IN" state sales. Effective July 1 that changed and now eBay collects it all. Tax ID holders still have to file BUT they do not NOT report any online sold amounts for sales tax purposes.

This is really a win win for both the states and the venues ... our state gives Sellers a discount if they pay their tax early so now eBay will benefit from that. States now get tax on transactions that non-tax ID sellers ship and who in the past never bothered reporting anything ... including online sales as income on their tax returns. So, while those sellers may not report income they are helping the state get tax on what they do ... I suspect the day will come when the states require the venues to provide them with the names of Sellers and their total sales ... in our state that would mean another 3.07% in income tax ... think about it ...

Regards,

Regards,Mr. Lincoln - Community Mentor

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 08:05 PM

Thanks, Emerald1830! Yes, I'm grateful that eBay collects state sales taxes!

Do you know if eBay collects and remits the local "home rule" taxes? I kind of figured they would collect the state taxes but there are hundreds of special local tax districts in Colorado and so if I sell to a Colorado customer, those have to be paid too. Do you know if eBay collects and remits those?

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 08:13 PM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-06-2019 08:14 PM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 12:01 AM

Below is a link to the Ebay policy. You may need to read it a few times, but bookmark it as it is very handy to have.

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121

You also need to check with your state to make sure you keep appropriate records so you can comply with the reporting requirements to your state.

For me, in my state. They require us to report all our taxable sales, even if Ebay collects the sales tax and remits it directly to the state. We need to report our total taxable sales, then we can take a deduction for the sales in which Ebay collected and remitted taxes to the state for a net result [likely to be zero].

But make sure you know what your state needs you to do when you do your report, so that you keep all the right records.

Also make sure you have your zip code set up in your account to be your 9 digit zip. Encourage everyone to do that. It is the only way the Ebay program can tell where you are exactly within the state. And as you say a state typically has many different rates across the state. The 9 digit zip code will enable them to zero in to where you are and charge the appropriate tax rate.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 01:35 AM

eBay uses avalara.com to get down the the exact sales tax for a ZIP+4 address.

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 05:49 AM

@canesi To "loop" another member in to your thread you use the "@" symbol and their name. Like I did here with your name.

You need to go to your states government web site www.colorodo.gov and create an account there for reporting purposes.

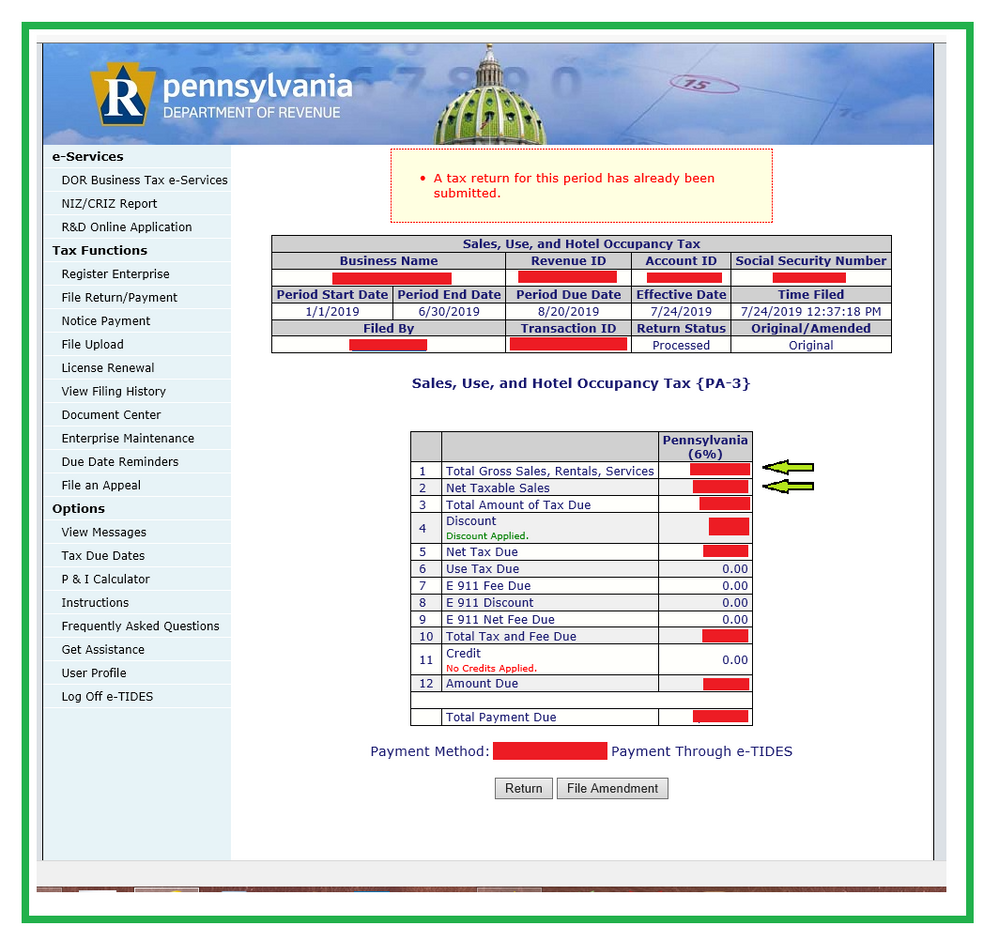

Below is a pic of our state's reporting page for Tax ID holders ... its not complicated but prior to online venues collecting taxes we had to include line 2 total of our "IN" state shipments and that amount we paid tax on. I spoke to the state and now when we report we do NOT put any value in for our "IN" state online sales because the venues do that. We do however have to put NON Internet sales amounts on that line and pay the sales tax on it.

Regards,

Regards,Mr. Lincoln - Community Mentor

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 07:04 AM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 07:51 AM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 08:35 AM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 10:12 AM

@canesi wrote:

This is very helpful, mam98031 !! Thank you for the link and the explanation. I'm so relieved that eBay has taken the lead on this! I will work on getting compliant with CO state tax laws/forms/licenses and what eBay needs from me before I even start sourcing and selling.

I'm glad I could help. It sounds like you have a very good plan. Do come on back if you run across any other questions. Always happy to help.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 11:22 AM

Does eBay collect and remit the required local and state sales taxes for Colorado?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-07-2019 12:44 PM

@canesi wrote:

I wonder if there are local taxes that apply. Here in CO, we have hundreds of tiny tax districts that collect taxes on top of state taxes.

That is where having your account addresses containing your full zip code will help. If a buyer only has their 5 digit zip code in their address set up, then they will be charged the flat rate for sales tax that your state has determined for Ebay to charge. But if they want to be more accurate to their location, they need to get that 4 digit tail number added to their delivery address. That will enable the software to pinpoint where they are in the state and the exact rate that is to be charged to them.

For me the rate our state has give Ebay permission to charge with only the 5 digit zip code is 10%. I updated my zip code right away because for where I live, it is 8.7%. So it can save buyers money if they have their complete 9 digit zip code in their delivery to address.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999