- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- 1099 question for those who have received one

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:00 AM

I sell most of my items from our own 'things'. I'm also starting to sell some of my mom's things because she is also downsizing. I'll have a few items for a schedule D. Since I won't get a 1099 for 2023, but expect one for 2024 provided there's not another delay and I do not file as a business, I have a question for those who have received a 1099.

When I pay for my ebay store and supplies on ebay (using my coupon), I pay with my ebay funds. Will my 1099 from ebay show what was

sold (gross sales) OR

sold items - shipping & ebay fees OR

sold items- shipping & ebay fees & taxes collected by ebay OR

sold items - shipping & ebay fees & taxes collected by ebay & store costs OR

sold items - shipping & ebay fees & taxes collected by ebay & store costs & shipping supplies

purchased from ebay OR

sold items - shipping & ebay fees & taxes collected by ebay & store costs & shipping supplies

purchased from ebay & personal ebay purchases purchased with ebay funds OR

only amounts transferred out of ebay funds into my personal account OR

some other net amount?

Thanks in advance!

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:09 AM

My 1099 showed only gross income as sales.

It is up to me to deduct shipping, supplies, value of items, refunds and any other expenditures as related to my ebay sales as expenses.

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:10 AM

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:18 AM

EBAY shows "gross sales" (purchase price + shipping income). Sales tax does NOT go to you so it is not reported as income. Because you are selling your mother's items (you will incur her tax liability).

EBAY has "easy to read" 1-page report that shows YTD totals for (gross sales/orders, refunds, EBAY fees, shipping expense). You must file as a "business" is you want to deduct business expenses.

To print report go to Payments, Reports, REPORTS (NEW) and select LAST YEAR.

GROSS SALES

- Refunded merchandise

- EBAY fees

- Shipping expense (cost to print labels)

- Cost of goods sold (your cost to purchase items)

- Shipping Supplies and office supplies

- Mileage and Miscellaneous expenses

NET TAXABLE INCOME

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:23 AM

EB AY does NOT keep track of items you purchased (toner cartridge/shipping supplies) for your business. That is your responsibility (be sure to keep all receipts to backup all your tax deductions).

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 08:53 AM

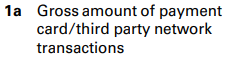

What the 1099-K will show is the gross amount of funds processed by the third party financial processor as shown below. You do NOT have to receive a 1099 to file a schedule C and it may behoove you to do so. That figure represents what heckofagame referenced in the link provided.

As others mentioned there are reports you can pull to get the details of your eBay selling expenses, which you will need for the Schedule C if you do one. Other expenses outside of eBay are your responsibility to keep track of. Shipping supplies, Cost of Goods Sold (COG), printer ink, mileage, shipping labels if you don't use eBay...........

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:26 AM

Deadline for eBay to release 1099-K forms is Jan 31st each year. They will be posted on your payments section here:

https://www.ebay.com/sh/fin/taxforms

Rundown on eBay 1099-Ks:

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

You can go to this page and generate a CSV report and you'll see what's counted on your 1099-K at the transaction level. https://www.ebay.com/sh/fin/taxdetails

"Your 1099-K Details report shows all the orders that factored into your gross amount of payments. The report also provides other details, such as transaction fees, which may be relevant when preparing your taxes."

There's a guide published here where you can further drill down and get reports for expenses and refunds: https://www.ebay.com/mes/taxguide?sh=true

You can also download a transaction report here:

https://www.ebay.com/sh/fin/reportslanding

Confused about the switch to eBay discounted shipping? Read this discussion to make an informed decision about opt in / opt out.

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:31 AM - edited 03-28-2024 09:32 AM

Rather than filing as a business you may wish to consider filing ebay as income from source "self employment" or "self-employed."

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:32 AM

I thought a schedule C is for businesses?

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:34 AM

Got it! So it's a 1099 stating the total processed amount. It does not state income or profit.

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:39 AM

@anasazirose wrote:Got it! So it's a 1099 stating the total processed amount. It does not state income or profit.

It's gross $ processed on your behalf. Sales tax is not included.

You have to account for your own subtractions like cancellations and refunds because they will be included in the gross amount as money processed into your account.

You have to account for your eBay fees, store fees, shipping supplies, and any other expenses.

All of the report links I provided above should help to a large degree.

Confused about the switch to eBay discounted shipping? Read this discussion to make an informed decision about opt in / opt out.

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 09:44 AM - edited 03-28-2024 09:48 AM

As I understand it, it is not. However, what it does is give you (individual) the benefit of business-type deductions to lower any tax liability you may have. (noting you are filing Sch D long term capital gains and assuming those are not losses) You may want to try and reduce that liability by using Sch C

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 11:39 AM

I'm not quite sure why so many people are so reluctant to be considered a Business. It doesn't mean that those that are not calling themselves a business do not have to report ALL their income sources to the IRS yearly. We are all responsible to do that.

Most states allow you to set yourself up as a Sole Proprietorship at no cost or around $50. I've been set up that way with the state I'm in for all my internet selling career. My state offers credits for small businesses, so I have never paid any state business taxes.

https://community.ebay.com/t5/Announcements/eBay-and-TaxAct-partner-to-help-you-navigate-new-Form-10...

https://www.irs.gov/faqs/small-business-self-employed-other-business/income-expenses/income-expenses

https://www.irs.gov/businesses/gig-economy-tax-center

https://pages.ebay.com/seller-center/service-and-payments/2022-changes-to-ebay-and-your-1099-k.html

https://www.irs.gov/pub/taxpros/fs-2022-41.pdf

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 19991099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 03:19 PM

I thought a schedule C is for businesses?

It is. Whether you use the schedule C or not depends on whether you meet the conditions the IRS considers to be a business. A business is loosely defined by the IRS as any activity carried on for the production of income from selling goods or performing services.

You do NOT have to make a profit and in fact a lot of businesses/companies don't but there are restrictions and conditions regarding operating in the red that impose limitations on doing so.

1099 question for those who have received one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-28-2024 03:23 PM

@anasazirose wrote:Got it! So it's a 1099 stating the total processed amount. It does not state income or profit.

It's gross $ processed on your behalf. Sales tax is not included.

You have to account for your own subtractions like cancellations and refunds because they will be included in the gross amount as money processed into your account.

You have to account for your eBay fees, store fees, shipping supplies, and any other expenses.

All of the report links I provided above should help to a large degree.

One other link that may assist the OP is the following if they elect to file a schedule C. As always nobody on this forum can provide an exact solution without knowing specific financial information relating to the filer and those details are more than they would want to disclose on this forum. They should talk to a local tax professional.