- Community

- News & Updates

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- 30th Anniversary Celebration

- eBay Live

- eBay Categories

- Community Info

- Events

- eBay Community

- Buying & Selling

- Selling

- 1099 and end of year sales question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:03 PM

For 2023 I don't think I will be receiving a 1099-k (over 300 sales but under $20,000). I need to know when is the cutoff for sales being included in the 2023 tax year and what sales will be included in the 2024 tax year? Is the determination based on the date the sale/payment was made? Or the date Ebay initiated the payout? Or the date the payout funds were actually sent? Thank you in advance.

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:07 PM

The date that eBay received the payment.

"As Form 1099-K is an IRS information return, it includes the gross amount of all reportable payments within a calendar year, based on when funds settle to eBay, not necessarily when funds are received by sellers."

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:19 PM

All of my sales are Immediate Payment Required, so does that mean that all sales made on 12/31/2023 will be included in the 2023 tax year (even though the payout wasn't initiated until 1/1/2024)?

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:22 PM

What state are you in? In addition to the information nobody*s_perfect provided the numbers you referenced are at the Federal level. There are 8 states that already have their own established 1099-K issuance thresholds. The federal delay does NOT impact or override state requirements so you may well get a 1099.

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:26 PM

North Dakota

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 02:28 PM

I received a 1099-k for 2021 and 2022 but won't for 2023. Everything is so much easier when I get a 1099-k (know what sales to include/exclude for the given year).

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 03:56 PM - edited 01-05-2024 04:00 PM

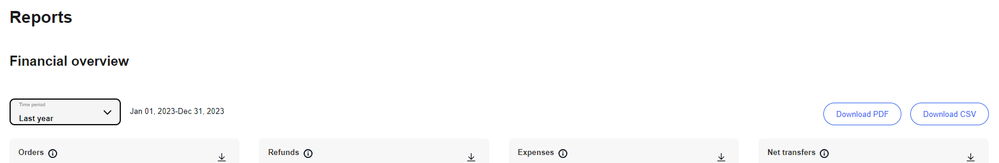

There is a Report available that will give you the totals for the year. If you kept tract of all you sales you should be able to figure out the last transaction eBay counted for 2023.

This may get you there.

https://www.ebay.com/sh/fin/reportslanding

If not, then there is a series of steps to get to it, but it is there.

There are other reports that will provide much more information on each individual sale.

My totals are off by 40¢ so I am going to have to go back thru every transaction and find the error.

1099 and end of year sales question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2024 04:47 PM

Just use the figures ebay reported in your Dec 2023 statement summary.pdf

It can be found here: