- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- sales tax washington state- is it coming out of wh...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 12:25 PM

I see ebay has started chrging sales tax in washington state as they alerted us months ago. my question is is it coming out of what we charge for an item or are they adding it to the price we charge?

on the note they posted after our 1st washington sale it read to look at the sales record. i see no additional charge for sales tax here or on the paypal transaction.

i hope that they are not taking it out of our money we charge, that would mean our profit would be even less than now.

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 12:31 PM

I was under the impression ebay is collecting and paying the sales tax on there end. No collecting is done by the seller, no worries for the seller

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 12:36 PM - edited 01-03-2019 12:37 PM

Hi @fashionandform,

No, the buyers are responsible for sales tax not sellers. eBay is charging the buyers for the sales tax based on their ship-to location. The seller receives the purchase price plus shipping (if any) and eBay receives the sales tax. According to one buyer, they are split into different transactions by PayPal (similar to GSP payments).

This is what it looks like on the checkout page. In this example, the sales tax for Algona, WA is 10%.

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 12:50 PM

I called eBay today and they are automatically adding the sales tax to the price we charge for items shipped to Washington State. If this is true then it should not affect our profit. You are correct that you won't see it in Paypal because the sales tax accounting should be internal to eBay. You will see a statement under "View Order Details" that reads, "We collect sales tax in accordance with applicable state law. We will remit the tax directly to the tax authority."

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 12:51 PM

thank you, yes now i see that if i add the numbers on my manage all orders page for that item ( item plus the shipping) there is a difference of $4.00 which must be the tax they charged the customer. my paypal shows that i was paid what i charged for shipping and the item without any sales tax added.

there should be some place on ebay that would show the tax that ebay has paid , anyone no where that is? i called ebay and they didnt know.

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2019 06:09 PM

Go read the e-bay announcement on sales tax from last year - from 9/13/18:

Upcoming changes in how Internet Sales Tax may apply to your eBay business

Other than the total outlay for your item for the buyer is higher with sales tax, there is no impact on the seller. For states that e-bay listed (WA & MN effective 1/1/19 and PA & OK effective 7/1/19) would automatically collect the

sales tax and submit to state tax authorities --- probably filing one big tax return for all the sales done on e-bay

for that particular state. So more likely there won't be a separate amount maintained by a seller's specific transaction. The buyer would be able to see it since they pay for it and their order details would show that.

There is no reason for the seller to worry about it since the seller is not collecting and does not need to file a return or pay to tax authorities. If e-bay fails to submit the sales tax it collected (which I very much doubt they would do that --- the state can shut e-bay from selling in that state if they do that) the issue would be with the state and e-bay --- not the seller. This is how I understand it.

Here is the MN sales tax announcement - 10/29/18:

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2019 04:19 PM

Can someone clarify if they're only collecting Use Tax on sales from outside these said states or are they also collecting sales tax when a seller in one of those states sells IN state?

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2019 04:25 PM

From the other discussions if eBay is collecting in state sellers to instate buyers they override the seller collection and prevent them from collecting.

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2019 06:32 PM

The relevant revenue depts aren't going to settle for "anything I sold on ebay, ebay already paid the tax" and even if you didn't sell in state anywhere else BUT ebay, you still have be able to take credits for tax paid for resale goods etc, so you still have to file.

Add to to this that most of the resellers I know pay ST quarterly, and ebay will tell us this info maybe yearly (if then) and it's a right mess.

Looks like I need to build yet another spreadsheet to keep track of stuff

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 04:23 AM

Another member, @autopiacarcare, has reported in another thread that the sales tax collected by eBay was recorded and he can see it after a sale to Washington.

@autopiacarcare wrote:After doing some more digging, we have more information. Hopefully this may help others who are looking for answers as well.

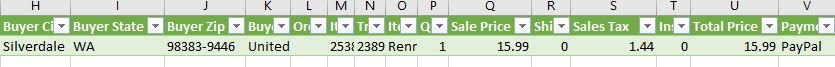

First, the good news. We had a sale to WA today. On the sales record page, it shows $0.00 under tax with an * that leads to a note at the bottom that says "eBay collected sales tax from your buyer.” If we pull a "Paid and Shipped" report from File Exchange, under the Sales Tax column for that transaction it says $1.44 which would be 9% and the correct amount for the buyer's address according to https://www.taxjar.com/sales-tax-calculator/ . So, as far as the actual tax collection, as far as we can tell everything is working correctly.

...

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 07:09 AM

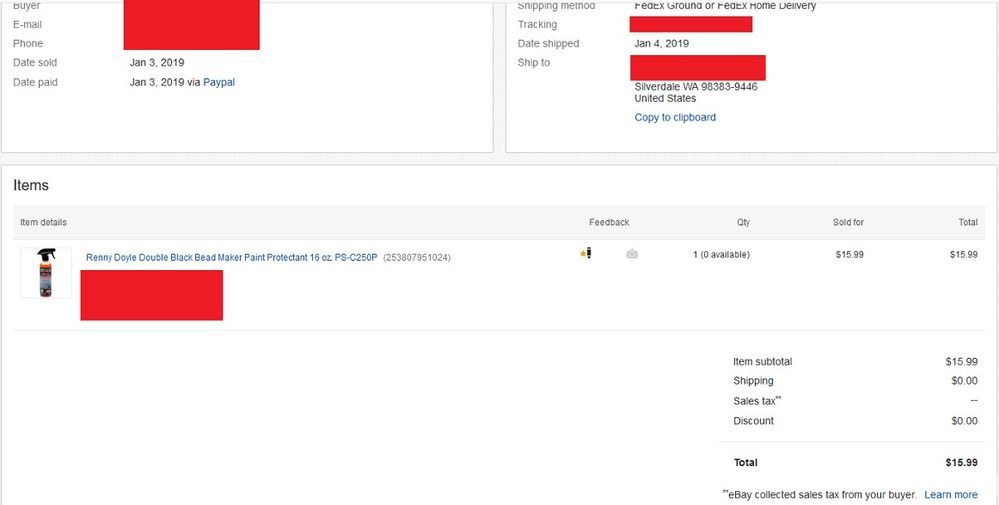

Here are a couple screen shots of our first order to WA with eBay collecting tax. The first screen shot is what the sales record page in Seller Hub shows - $15.99 item price, free shipping, -- for tax with a note saying eBay collected the tax. The PayPal transaction shows the same thing, $15.99 total payment, no tax.

The second screen shot is from a "Paid and Shipped" Report which was pulled by going to File Exchange - Download Files - Paid and Shipped and selecting the appropriate date range. This report shows this transaction with a sale price of $15.99, sales tax of $1.44 (calculates out to 9%, which is correct for buyer's address) and a total price of $15.99.

Hopefully eBay will come out with some better reporting features as they move forward with the tax changes, but this seems to work for now at least.

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 01:17 PM - last edited on 02-25-2019 03:08 PM by kh-valeria

No! initiat a separate charge, like a second invoice.. like the greedydon't screw you enough! I'm closing my ebay account, like a LOT of people, and with a prefect seller record way over a thousand - ebay does NOTHING but rip off the seller, always on them to lower their price, and with their constant changes, never if favor of the people who made them..

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 02:00 PM - edited 01-05-2019 02:01 PM

Interesting that the SH screen doesn't actually show the amount of ST collected and paid by ebay.

Why is a secret you can only find by going to FE?

How does that help my record keeping for when I file ST?

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 08:12 PM

So I charge $2 in the USA for shipping and $8 to Canada for shipping coins. Last week sold to a man a few coins and the sales tax came up to $21.20 +$2 shipping so $23.20 just because he was in Washington State. Had he lived over the border in Canada he would have only paid $8 period. VCOIN dealers sell coins and does not do this, but eBay does so the platform has to hurt my business when others don't charge like VCOINS. Just is not sustainable with Canada and even the UK at $12 shipping from me is a better deal than being an American citizen to buy coins from another American. Maybe Canada will tax next and that will "solve" the problem. (Yes I know Washington excludes coins from sales tax but there are now countless people sending messages to eBay about being charged for selling coins and the Washington buyers being taxed and eBay has been responding that they won't be fixing this anytime soon. ) To quote Jimmy Hayes, dorector fo ICTA (Industry Council for Tangible Assets), "One dealer has confirmed the taxation of a numismatic sale to Washington state and an eBay reply that they had no intention of monitoring such exemptions or making refunds."

sales tax washington state- is it coming out of what we charge?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2019 09:36 PM

It's always sad to hear of a good seller leaving. It is true that a lot of the new policies hugely favor buyers. Unfortunately, Ebay needs buyers much more than they need sellers. When a seller leaves here, another one (or two) takes his place (especially with the emphasis on China).