- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- all the reports to download...which ones are the m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

all the reports to download...which ones are the most important for 1099k tax time ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2022 09:14 AM

Am fairly new to man. pymts, well...as of last year. Won't be getting a 1099K from ebay until for the year 2022 so am trying to figure all this mess out now .

I see so many doggone reports that can be downloaded and am getting overloaded trying to figure it all out.

I see folks here saying some reports are not available after 3 months, which ones are not and are they that important ?

In the past for tax purposes, to arrive at my net income from sales here... I've just gone to paypal, added up all my income from payments made to me through there then deducted the fees from them , the fees from ebay ( from ebay invoices ) and the postage I had to pay to ship items in order to arrive at my net income.

Would it not be simple ... (since paypal will not come into play for 2022), to just print out all my payouts from here for the year 2022 ? That way I can see what the actual sales were, the fees I was charged and the shipping paid by buyers. ( I do keep postal receipts also )

I always have reported my net income from here on my taxes but did NOT break it down into postage and fees taken away from the gross...just subtracted those costs from my gross to arrive at my net.

I don't sell much here but it will be over the $ 600.00 threshold for 2022.

Just trying to simplify things if possible, lol.

all the reports to download...which ones are the most important for 1099k tax time ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2022 10:07 AM

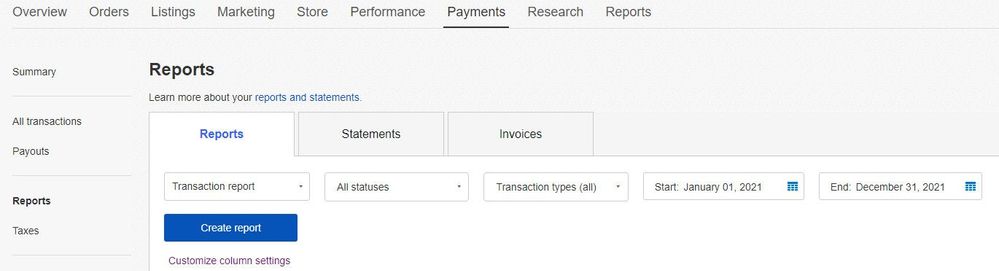

I pull one report and it contains everything I need for tax purposes. You have to sort and rack and stack the data but EVERYTHING, and then some, is there to do your taxes. From the seller hub and the payments tab simply use the reports tab to run the transaction report setting the start and end dates to 1/1/2021 and 12/31/2021 respectively. You will receive a message when the report is ready to download. It can be opened, manipulated and saved as an EXCEL file.

I separate the data into individual tabs copying the original data tab and then work with each of the tabs to obtain the information I need/want. Of course individual preferences may vary as to what format you prefer.

all the reports to download...which ones are the most important for 1099k tax time ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2022 10:17 AM

I can't offer any advice on which reports to use, but as a small seller this might work for you. I maintain a spreadsheet with a column for each of these and at the end of the year it's just a matter of summing each column:

Date Paid - The date the buyer paid

Item Description

Gross Sale Amount - Total the buyer paid, including sales tax (I do this because eBay bases fees on this)

Sales Tax - This is subtracted from Gross Sale Amount to give:

Amount Received - My Gross receipts for the sale, sum of these should equal amount on 1099-K

Item Cost - What I paid for item

eBay fee - What eBay took

Shipping - What I paid to ship the item

Profit = Amount received - Item Cost - eBay fee - Shipping - Refund

Refund - Amount refunded

I also have a column for Supplies costs.

Having all these totals available at the end of the year makes if simple to complete Schedule C.

The Volunteer eBay Community Mentor formerly known as juanmogamer

all the reports to download...which ones are the most important for 1099k tax time ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 09:32 AM

ok, thanks to you both, guess I'll muddle through it.

Really...this is getting to be too much stress and trouble here.

Think I may retire from ebay after this year , considering I don't sell enough for all the worry and I AM officially retired now ....age wise.

I sell maybe 25 items a year but they bring in enough to put me over that $ 600.00.

all the reports to download...which ones are the most important for 1099k tax time ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 11:50 AM

@tatertot2u57 wrote:ok, thanks to you both, guess I'll muddle through it.

Really...this is getting to be too much stress and trouble here.

Think I may retire from ebay after this year , considering I don't sell enough for all the worry and I AM officially retired now ....age wise.

I sell maybe 25 items a year but they bring in enough to put me over that $ 600.00.

I know it's a bit much the first time you do it, but with the spreadsheet I maintain it takes me like 2 minutes to do the Schedule C. I file online though Free Tax USA and they carry over information from year to year, so it's only necessary to enter eBay's information one time.

The Volunteer eBay Community Mentor formerly known as juanmogamer