- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- eBay Open 2024 Kickoff Party

- 30th Anniversary Celebration

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: New rules regarding charity donations

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 11:48 AM

I have been selling since 2001 which I believe makes me a long time seller. Since then I have seen my profits going down either from raises in percentages of fees on sales, taxes on sales over $600 (is it even worth selling?) and now ebay is going to automatically take out money for Charities! This is outrageous. If I want to give to a charity, I will do it myself. I don't need ebay running my life. Just when I think that selling on ebay can't get more outrageous, they come up with a new gimmick! Does anyone else feel the same way?

- Labels:

-

Fees

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 11:50 AM

1st; the $600 deal has been an IRS requirement (you are to report ALL additional income- then write off as needed if you can)

2nd; where did you read/hear that? (about charity?)

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 01:42 PM

Deep breath. I think this is just a misunderstanding. As @stainlessenginecovers said, the $600 is the minimum threshold by the IRS a Federal entity that requires Ebay and all other money processer by LAW to issue a 1099K if any seller hits that much money processed through them by the end of 2023.

Ebay has no ability to Tax you on anything. If you are charged a tax for something, it would be because your state has required Ebay BY LAW to do so.

For those that CHOOSE to donate to Charities, it is better having Ebay deduct it than going through the Giving Fund [the old program] which keeps a percentage of what you donate. No one on Ebay has to donate to a Charity, but it is an option that all sellers have if they want to use it. Not sure why that should be an issue.

Ebay has always deducted the amount a Seller has committed to donate to the Charity of their Choice and turn it over to the Giving Fund. What changed or what do you think has changed that has you so upset?

https://community.ebay.com/t5/Selling/New-rules-regarding-charity-donations/m-p/34049598#M2293912

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 01:49 PM

Donations to charities are not mandatory, you either misunderstood or have been misinformed. Best of luck to you....

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 01:49 PM

You have always ONLY had to pay taxes on PROFITS, not revenue. Having a piece of paper makes no difference in your reporting requirements.

I'm beginning to think this complaint is just a dodge to justify tax avoidance in the past.

“The illegal we do immediately, the unconstitutional takes a little longer.” - Henry Kissinger

Check your voting registration! YOUR VOTE IS PRIVATE

#freedomtoread

#readbannedbooks

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 01:57 PM

It seems you have misunderstandings about both these points.

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-17-2023 03:27 PM

Value Added has a explanation on the charity thing here:

https://www.valueaddedresource.net/ebay-for-charity-changes-trouble-seller-refunds/

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-05-2024 09:23 AM

HOW DO I NOT CONTRIBUTE TO CHARITY WHEN LISTING AN ITEM ON EBAY ? I JUST LISTED AN ITEM AND IT SEEMED AS THOUGH I WAS REQUIRED TO DO SO . DO I CONTRIBUTE AFTER THE SALE IS FINAL ? THANKS PS THEY HAVE YA COMMIN & GOIN GRRRRRRR

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-05-2024 09:38 AM - edited 04-05-2024 09:39 AM

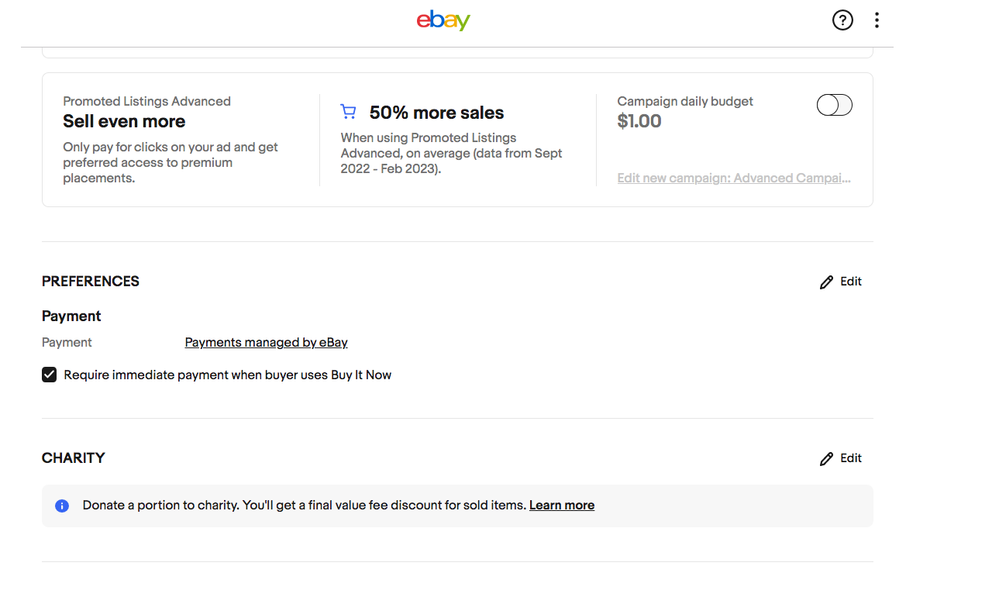

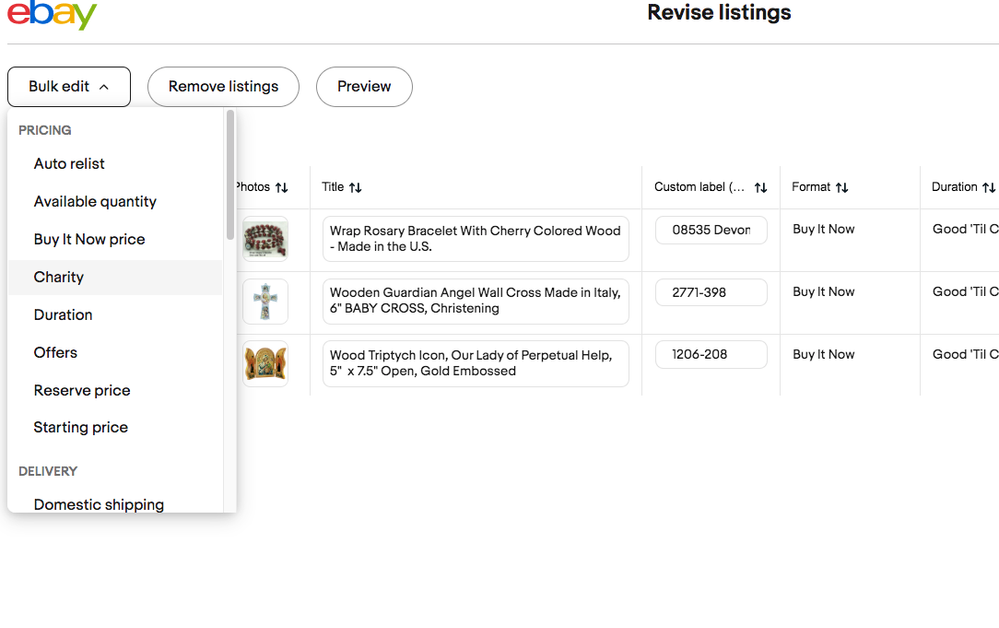

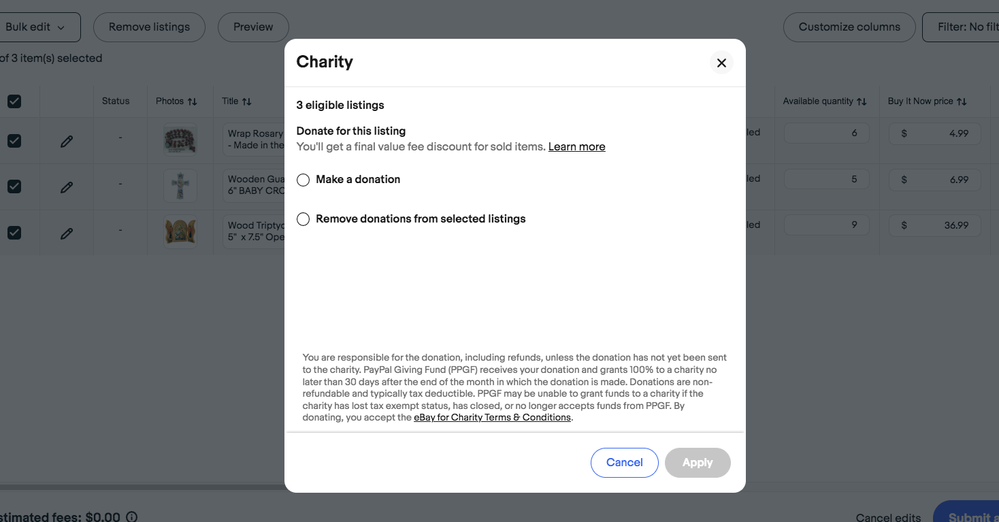

You go into your listing and at the very bottom is the Charity button. Use the edit function to turn off anything that might be on there by leaving everything blank. You can also change donations in bulk edit. Just choose your listings, and use the bulk edit to remove or add your charity info. It's very easy. Hopefully the screenshots help.

Re: New rules regarding charity donations

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-05-2024 11:19 AM