- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Community Info

- Retired Monthly Chat with eBay Staff

- Re: Sales Tax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Community Chat, March 6 @ 1:00 pm PT - General Topics

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 07:41 AM - edited 03-06-2019 07:43 AM

Hi everyone! We hope to see you here on March 6 at 1 PM PT for our weekly Chat with the Community Team. Bring your general buying and selling questions for discussion ![]()

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:55 PM

@mendelsons wrote:

The state tax that eBay will be collecting for States that require tax to be collected in will only be visible if you download the orders report ? Is this for real ? Why is it being buried in a downloaded report, why not on the sales record since there is plenty of room to add any tid bit of information on that page. I guess I don't understand why its not visible unless you download your report assuming the report is ready to be downloaded.

Not seeing how this makes it easy for anyone.

Hi @mendelsons - thanks for your patience while we work on getting you information, and for this feedback on what you'd prefer to see.

If you would rather not download the report, an alternative is to compare the 'Total' column to the amount given in the 'Sales Record' section of an order. The total will display the total the buyer paid, and the tax amount would be included in that. However, there is not currently a column in Seller Hub that will display the total amount of tax that was collected in an order. Thanks!

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:55 PM

@golfingaddict wrote:

I was going to order some things today but noticed that ebay is charging me tax. In my state the items are non taxable (groceries)

Why and how is ebay getting away with charging tax on non-taxable items?

WAC 458-20-244 (Washington code)

Does anyone care that they ebay is fraudulently collecting sales tax?

I understand sales tax , I understand why you have to collect and pay to my state and I appreciate it, sincerely, but you are collecting it when it is not necessary.

Can't this be fixed?

Hi @golfingaddict, we would need an item number to review but in general, categories that are excluded from tax in Washington have this exclusion automatically applied. We are only be able to address this at the category level and our system currently looks to the primary category, not any secondary category present when determining if tax should apply. Ultimately, we have taken steps to minimize the issue you describe but are not able to support all exclusions. If a buyer has tax collected for an item unnecessarily, the buyer can work with the tax authority to receive a credit of these funds.

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:55 PM

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:56 PM

There are sellers in my dental category that have duplicate listings, I report, but they remain. This has been going on for years!

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:56 PM

I must be missing something about the GTC

So I list an item today 3/6/2019 at 5:00 pm with GTC

This item will run for 30 days and renew automatically on 4/6/2019 at 5:00 pm

is this correct?

when I list it it will show up as newly listed and when it renews it will also show up as newly listed? Is this correct?

when it ends it will show up as ending soonest right?

ღஐƸ̵̡Ӝ̵̨̄Ʒஐღ Patty ღஐƸ̵̡Ӝ̵̨̄Ʒஐღ

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:57 PM - edited 03-06-2019 01:59 PM

@Anonymous wrote:

@mg152 wrote:

Thanks again for everyone’s help in the community again this week. Personally I have no problems with GTC. I use it most of the time anyway. I guess I don’t understand long time members threatening to quit the site over this.

As long as my eBay stock is rising and my account is in good standing I have no issues. 😀😎Hi @mg152, thank you for sharing your perspective! I have spoken with countless sellers who have had the same experience as yourself. We are confident that in the coming months as sellers have an opportunity to experience the GTC format first hand the benefits will speak for themselves

Many sellers are much larger, many pay for a larger store & want to use fixed price for 7 days to use the number of allotments the way they decide

Hoping ebay will allow sellers to downgrade as asked

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:57 PM

brian@ebay wrote:

@this4chris2012 wrote:In the sales record of something I just sold it says: "eBay note: This total includes tax that eBay is required to collect from your buyer. You can view the amount paid to you in the sales record." Two questions:

1) It wasn't directly available in the sales record. I had to search around and finally noticed in two different places that one screen showed one total and another screen showed a different total. I assume the difference of $1.30 is the sales tax eBay collected? Why did I have to search? Why isn't the tax collected a line item in the sales record?

2) eBay paid the tax to me. I thought eBay was going to collect state sales tax and pay it directly to the states? (Unless it's a sale to my own state.)

Hi @this4chris2012, the total amount the buyer paid (including sales tax) is shown on the Orders page in Seller Hub. This is also where the eBay note you mentioned is located. The first sentence (This total includes tax that eBay is required to collect from your buyer) of the note is referring to the total found on the Orders page. The second sentence of note (You can view the amount paid to you in the sales record) gives directions for a seller to see the total they received from the transaction, which will not include sales tax. This means sales tax info will not be displayed on the Sales Record. You are correct that the difference in price from the Sale Record and what is shown on the Orders page is the tax collected by eBay.

A Sold record in File Exchange will include eBay collected tax within the file. You can access File Exchange here. Go to Download Files and download a Sold record.

Please double check the amount you received in PayPal. You should not have received the sales tax as eBay collects and remits it. If the PayPal transaction shows that you received the tax then please let us know.

Did you answer my question as to whether or not eBay is going to pay states directly? Or is it up to me to file a sales tax report to give Iowa its $1.30?

No the tax eBay paid me is not recorded as part of the payment. PP has a line item for sales tax. Etsy has been paying state tax as long as I've been on Etsy. I am not familiar with File Exchange. Are you saying FE is the only way to get a report on sales tax? Can't that be done more simply?

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:58 PM

@dentalsales4u wrote:

I don't believe this is true Trinton.

There are sellers in my dental category that have duplicate listings, I report, but they remain. This has been going on for years!

That could be due to a good sell thru rate.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:58 PM

@my-cottage-books-and-antiques wrote:

Tyler, My understanding is that the "Ending Soonest" sort treats GTCs as 30 days....so a GTC at the end of its 30 day cycle is high up on the ending soonest page, with the time left displayed.

But, as far as new listings go, I think it is treated differently, isn't it? The "newly listed" sort shows items in the order of listing, but not renewing. In other words, only listings NEW to the site are shown. Since a GTC renewal is NOT new to the site, it isn't shown as if it were newly listed. GTC listings only get to the top of the "newly listed" sort the very first time they are listed. Whereas, a 30 day listing that has ended and been manually relisted, is treated as new to the site (since it has a new listing number).

Am I wrong or right about that?

Hi @my-cottage-books-and-antiques - that's my understanding as well.

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:58 PM

@Anonymous wrote:

@vrykalak wrote:Several times in the last couple of weeks, I've relisted something that I thought I had already relisted, but couldn't find in a search. So I relist it, no problem...then I see it actually IS already there, and now I have two of them. Why are they still on the "Unsold (not relisted)" page? And why doesn't eBay catch duplicate listings anymore?

(a couple that I caught, and did not relist: 382801187551 & 382748836325, 382776640949 & 382754910721)Hi @vrykalak. while eBay does review for duplicate listing violations and notifies a seller when these are found so they can resolve this, the responsibility for preventing this type of issue from arising is ultimately the seller's.

As for these listings showing up on the Not yet relisted page, the first item number you shared is not present on this list. The second item number is present, because you ended that listing and have not yet relisted it. It will not automatically be removed from this list because you accidentally listed it twice and ended one of the listings. You would need to take steps to delete it from this list before it was inadvertently relisted again. The same is true for the third and fourth item numbers you shared - the third is not on the Not yet relisted list because it is currently listed. The fourth item number is present on that list because you ended the listing and did not delete it from your not yet relisted list. These are the steps you would need to take when you mistakenly created duplicate listings and have ended one of the duplicates.

I think you missed my point.

The first number in each pair is an Active listing.

The second number in each pair is on the Unsold (not relisted) page.

The point is

- the same item should NEVER appear on both lists at the same time.

- those are two that I caught, so I didn't Relist either of them

- in those two cases, I did a search on Active listings, and found them

- in four previous cases, I did a search on Active listings and DID NOT FIND THEM

...but they were indeed there, so I ended up with two copies of the same listing.

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 01:59 PM - edited 03-06-2019 02:00 PM

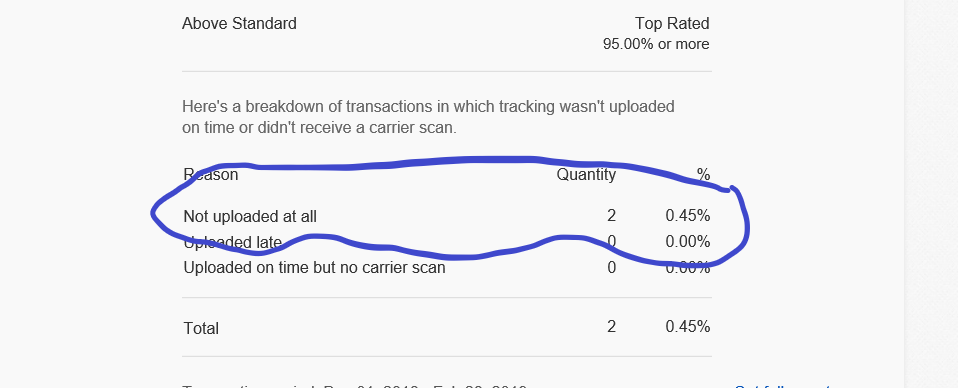

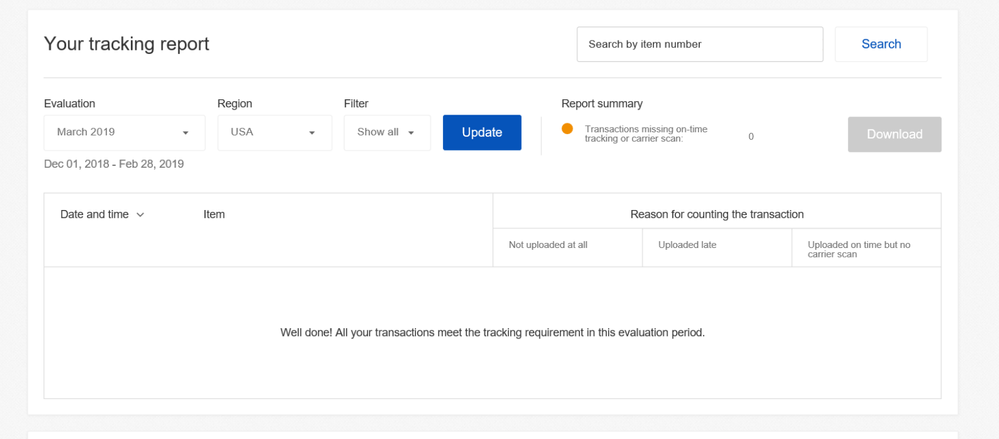

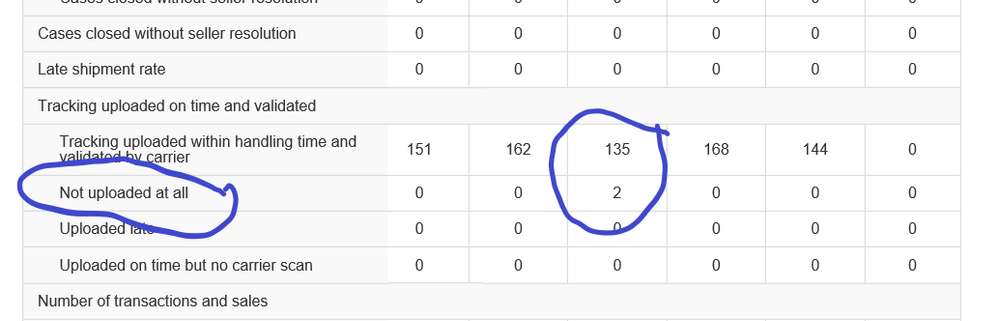

I really find it hard to believe that you hide the "no tracking uploaded" since December and then show it in March.

I did nothing wrong. Everything was shipped on time, everything had tracking and everything was delivered on time. My numbers were clear in December, January, February.

In March these appear and you tell me that it is stressful and frustrating?

PS I know how my dashboard works, I look at it every day.

I give up.

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 02:02 PM

This week's chat is now closed. We'll continue to answer questions and will follow up as needed.

Thanks for joining us and see you next week!

@Anonymous wrote:

Hi everyone! We hope to see you here on March 6 at 1 PM PT for our weekly Chat with the Community Team. Bring your general buying and selling questions for discussion

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 02:03 PM

@globalautodistributors wrote:

Hello Community Team members!

I've got a suggestion for your IT team to consider. I wonder if it's possible to develop a feature where sellers can REPRINT shipping labels in bulk?

It doesn't happen often, but once in a blue moon, I encounter a system error where a bulk batch of labels that were successfully paid for, did not print. When that happens, it's impossible to reprint in a single bulk batch. Instead, I have to click each label individually to reprint. If I had less than 10 labels, it's no big deal. But if I have more than 20 labels to reprint individually, it gets to be time-consuming. I'm sure there are other high volume sellers out there who may even print up to 50 labels in one shot. But if the dreaded technical system error happens right when the bulk label printing window is supposed to appear, then the labels cannot be printed in bulk.

If I'm mistaken and there currently *is* a way to reprint in bulk, please let me know how to do it. Otherwise, I think the fix would be for a "checkbox" placed next to each of the shipping label transactions, so sellers can select multiple labels that need to be reprinted in bulk.

Thank you!

Hi @globalautodistributors, great suggestion! I know how frustrating reprinting 50 labels is and will get this to the appropriate team for consideration ![]()

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 02:06 PM

@vrykalak wrote:

@my-cottage-books-and-antiques wrote:

When you relisted did you use relist or sell similar? I'm not sure, but I think if you use Sell Similar the listing remains in unsold not relisted, since technically it wasn't relisted.....could that be the issue?I used Relist. And I didn't "Relist" until I had checked with a search to make sure it wasn't already active. The Search turned up nothing, so I relisted the item...and then found out later that it was already there.

The two examples I gave are items that are shown on BOTH the Active Listings page and the Unsold/Relist page right now.

That should never happen. As far as I know, it didn't ever happen until a couple of months ago.

Hi @vrykalak, I think that the cause of this confusion may have been that listings do not always appear in search immediately after going live. It can take up to 24 hours for a listing to appear in search results. I recommend you check your active listings page to confirm what you have listed and wait at least 24 hours before attempting to relist. This kind of event will be much less common once the Good 'Til Cancelled listing format becomes standard ![]()

Re: Sales Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-06-2019 02:06 PM

@echo_and_zip wrote:

On the SELLER Board, a seller details that he sold an antique book.

His "buyer" opened a "SNAD" return.

The book seller got back had all the illustrations CUT OUT.

So, even w/ "free" returns, seller loses: postage 2x and 1/2 item price.

And basically gets back worthless, un-sellable paper.

WHY can't eBay 'bond' good sellers, who have a long, clean history,

so THOSE sellers get to report to eBay, BEFORE a refund is issued ?

Seller would complete a form, attach proof, and eBay can review.

This would certainly stop the bad apples.

It would SAVE eBay money in the long run.

Hi @echo_and_zip - I'm sorry to hear about that return. If the item was listed with free returns a seller has the option to issue a less than full refund and can work with CS on the best course of action to take from there.

Happy to pass your feedback to the right folks on your ideas for the future of returns!