- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: New Tax Laws -- Info for Confused Small Seller...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-09-2022 10:33 AM

THIS IS A POSITIVE THREAD. PLEASE DON'T TURN IT INTO A WHINE-FEST!

I am NOT an attorney or accountant. Just a small seller, like you. Been on here for 20 years, now. Since the days of checks, cash and money orders only. Casual seller, mostly things from my house that we don't want. It's been about making a little bit of money so that I could buy the things I like from other sellers cleaning out their own houses (smile). One collection feeding another, if you like. Can't think of a thing I've ever sold that made a profit, that's for sure. Like the old Harold Arlen song says, "It's been fun. Now I'm done. But I'll never sing a loser's song. So long."

This is not the thread to discuss whether the IRS rules are fair or not. (Heaven knows, there are enough of those on this seller forum and elsewhere, if you're so inclined.) I just want to share what I've recently learned.

What I got from the IRS is that I am classified as a "hobby seller". Like my daughters who decided to open Etsy stores for their knitting and felted items. The IRS does not view any of us as a business, because we're not doing it "for income purposes". (Not true, but let's move on. Positive, remember.) Turns out that since 2018, "hobby sellers" cannot deduct any expenses on a Schedule C. They can only pay income taxes on the gross (whole) amount of money processed by the entity who handles that for them (Paypal Invoice, eBay, Etsy, Venmo, Zelle, et al). That includes the item's price plus the shipping charged to the buyer (sales tax should not be included, if the money handler is doing their business right). Let me repeat this: As a "hobby seller", the entire price that a buyer pays for an item (ITEM PRICE + SHIPPING) is counted as income to me for tax purposes. There is no deduction for fees or shipping charges paid out by me because of the sale.

The IRS said that, in order to qualify as an "unincorporated business seller" and not a "hobby seller", I would have to show that I made a profit on my sales for three of the last five years. (And if they allow me to be a "business seller", they see me as "self-employed", and I would then owe them an additional 15.3% per year on the whole amount for FICA (Social Security & Medicare taxes). Or I can become a business by incorporating (big $$ for a casual seller, when combined with accountant's fees). TurboTax has made a nice page explaining this. Just search for "When the IRS Classifies Your Business as a Hobby" and look for the turbotax.intuit URL.

I'm taking the time to post this, not to feed the whining and recriminations found out there, but to clarify something that never seems to be mentioned in the threads I find. I see a lot of casual sellers like me asking this "gross amount" question, and the advice is always to get a Schedule C and start deducting the bookkeeping you've meticulously documented. That is not correct for most of the people I see who are asking! And absolutely no one explains about the 15.3% FICA tax that's mandatory for "self-employed hobby sellers" (remember, that's how the IRS will classify them, if they are allowed to file a Schedule C). Before anyone gets surprised at the end of the year (especially those of you on Social Security and SSDI), you really want to consider ending your listings and making an informed decision. If it's still a go for you after that, then you can just hit the relist button. But we're already well into the New Year, and there is no forgiveness period with the IRS.

Let me give you an example, and then you can do your own math for your listings. We're assuming (for the sake of the people I'm talking to here) that you take your mail to the PO to buy postage and use recycled packing from items that you've bought. If you decide to print your own labels, you save a bit and spend a bit, so it may or may not be worth it in the end. If you have to buy packing, you spend a lot. You're just selling stuff from around your house, so your investment is zero. (Remember, the IRS no longer allows deductions for "hobby sellers".)

I sell a number of items for $9 (I have two other selling IDs). They're small and lightweight so classify for USPS First Class postage. To provide eBay with a tracking number, I have to use FC Package Service. With the USPS rates that became effective today (09 Jan 2022), it costs $5 to ship 4oz. to the furthest point from me. That brings us to $14 for the buyer. Then we add their sales tax (averaging in the US, it's safest to use 8%), for another $1.12 that the buyer's paying. eBay Managed Payments deducts $2.20 for final value fees before sending the money to my bank. Shipping costs $5. So, let's do the math here on a few of my items:

$9 + 5 + 1.12 = $15.12 (buyer pays)

$-5 + -2.20 = $-7.20 (expenses)

I will net $7.92 on this $15.12 sale. I will pay income tax on $15.12.

++++++++++++++++

$225 + 24.89 + 19.99 = $269.88 (buyer pays)

$-34.17 (fees) + -24.89 (ship) + -160.00 (cost of item) + -5.00 (large box) = $-224.06

I will net $45.82 on this sale. I will pay income tax on $269.88. (Remember, even though I have the receipt for this one, a "hobby seller" is not allowed to deduct it anymore.)

++++++++++++++++

Now, assuming that I spent nothing on the item, didn't pay for packing or printing, didn't use extra gas to get to the PO, and the buyer doesn't return the item or ask me to combine shipping after they've paid, you can see that I will pay tax on about twice what I actually "made" on the small item. The large item . . . well, I bought that one before I knew about the "hobby seller" rule. If you did my math with me, you'll see that I get to take a loss of 83% of what I'll have to claim as income and am not allowed to deduct it. I receive 17% of that total sale but pay income tax on 100%.

Let's move on from "that's not fair" and "what a fool you are" and all those other nasty comments I see floating around on eBay (and the rest of the internet). I'm trying to help small sellers like myself to understand what's happening here, because the IRS is not going to accept "I had no idea" when you file those 2023 income tax returns.

I feel like a lot of people are going to be hurt, since they're getting wrong answers from big "business sellers" here on eBay. DO THE MATH on your own listings, and really figure out how this will play out for you. You can always call the IRS at 800-829-1040, and get it straight from the horse's mouth.

Hope this helps, and wishing you the best of success on whatever you decide to do!

- « Previous

- Next »

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2022 05:48 AM

@kds99 wrote:I don't know where it is in writing but I understood that if a profit is not reported in the said 3 out of every 5 years, one CANNOT take a deduction for expenses. Correct?

This is untrue it depends on if you are a hobby or business.

If you're a hobby then you can't take anything and can't deduct expenses. (Trump 2018.)

Just like the 1099 K $600 trigger was (Biden 2021.)

I would do some more research prior to jumping to that conclusion to be honest.

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 06:33 PM

I think I am going back to garage sales in the summer. I am assuming these things are a result of Biden's tracking $600. So it makes selling on ebay is way too complicated for me. The government wants every last dime they can get, they don't care if your house thermostat has to be set at 58 degrees when it's below zero outside. I can barely pay for my living expenses so a little extra money has been helpful. I am going to removing my couple of listings here on ebay, because it's just not worth the hassle. Sadly greed is everywhere in our government, corporation and capitalism has gone awry. To the person who posted sorry if this comes across as negative, that's not my intention at all, it's the reality of my life in the US. This is a good thread with some good information. I am glad you posted it.

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-01-2022 06:37 PM

Loved this post, good information. I am only going to do garage sales in the summer now and not going to sell online. I had 2 item I just removed from ebay, not going to list any more.

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-02-2022 09:00 AM

I was not clear in my intent. If a proclaimed business does not report profit in at least 3 out of 5 consecutive years, one is forced to file as though they are a hobby seller until they can once again qualify under the 3 of 5 rule to be considered a business filer again.

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-02-2022 09:02 AM

Excellent synopsis - thanks!

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-02-2022 09:14 AM

Here's an example of Hobby turned into a Business:

I bought Collector Coins (pennies) from 2000 to 2010, as a hobby. But, since I was aware that things go up in value, they were also an 'investment'. Since none of the coins have went up in value (any SUBSTANTIAL value), and now I've decided to collect 'quarters instead of penny's). So, the $5000 worth of pennies I've collected are now my cost basis to start a 'business' selling pennies online. I have now converted my 'hobby' into a business and since listing and selling on the internet (eBay for example) and I now begin to keep 'books' while selling these pennies, I will now WRITE OFF ALL EXPENSES SELLING THESE.

I also plan to now buy "lots" of pennies and sell them individually for a profit (even if $1 each sale over fees and shipping costs).

So, now- aren't I now a business? When I file my 1040A and use Schedule C and pay the 15.3% Self Employment tax on the 'profits' (after cost of item, shipping, fees are deducted)- so again, therefore I now turned my 'hobby' into a business?

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-02-2022 10:20 AM

@kds99 wrote:I don't know where it is in writing but I understood that if a profit is not reported in the said 3 out of every 5 years, one CANNOT take a deduction for expenses. Correct?

@kds99, not really, no. At least not according to the latest information from the IRS (that I was able to find).

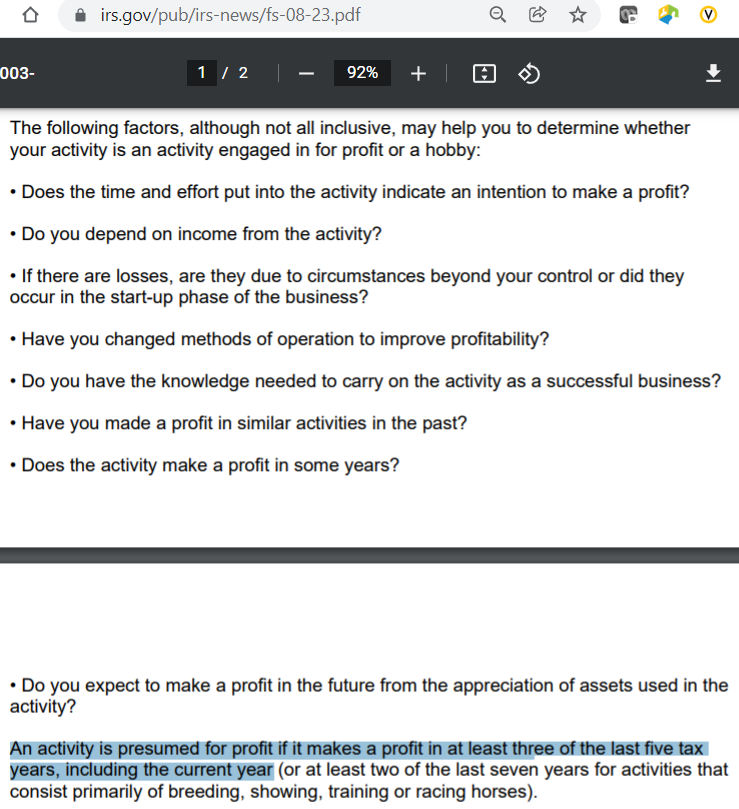

I found that rule, the "hobby loss rule" in a couple of IRS pdf newsletters, from the 2000's. This was the latest one I could find, from June 2008. But, it was actually stated the other way round; so it was defining what would be considered to be "for profit". It doesn't necessarily follow that an activity that didn't meet the rule, would always be considered to be "not for profit". There were other factors that also needed to be considered:

https://www.irs.gov/pub/irs-news/fs-08-23.pdf

So, just because your activity didn't make a profit in at least 3 of the last 5 tax years, that didn't necessarily mean that it wasn't a for-profit business activity. You had to consider the other factors as well, and that's what the auditor would have done, if you got audited.

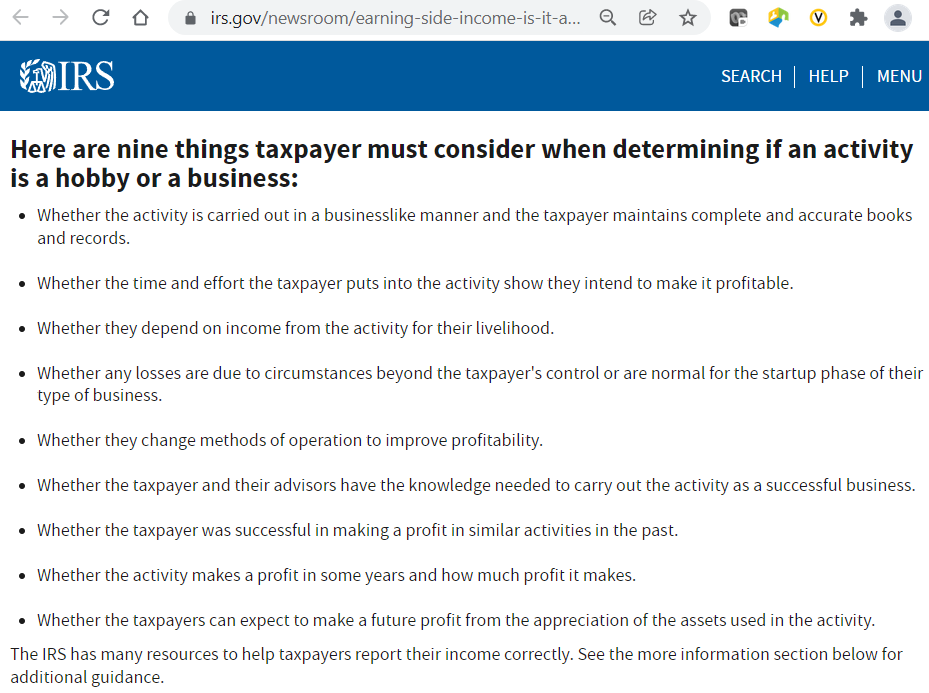

Besides that, the latest version of this information from the IRS doesn't say anything about how many years an activity should make a profit in. So, no more "free pass" if you made a profit 3 years out of 5, I suppose.

https://www.irs.gov/newsroom/earning-side-income-is-it-a-hobby-or-a-business

Re: New Tax Laws -- Info for Confused Small Sellers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-03-2022 02:56 PM

@stainlessenginecovers wrote:Here's an example of Hobby turned into a Business:

I bought Collector Coins (pennies) from 2000 to 2010, as a hobby. But, since I was aware that things go up in value, they were also an 'investment'. Since none of the coins have went up in value (any SUBSTANTIAL value), and now I've decided to collect 'quarters instead of penny's). So, the $5000 worth of pennies I've collected are now my cost basis to start a 'business' selling pennies online. I have now converted my 'hobby' into a business and since listing and selling on the internet (eBay for example) and I now begin to keep 'books' while selling these pennies, I will now WRITE OFF ALL EXPENSES SELLING THESE.

I also plan to now buy "lots" of pennies and sell them individually for a profit (even if $1 each sale over fees and shipping costs).

So, now- aren't I now a business? When I file my 1040A and use Schedule C and pay the 15.3% Self Employment tax on the 'profits' (after cost of item, shipping, fees are deducted)- so again, therefore I now turned my 'hobby' into a business?

EXACTLY. Great post. I kind of always considered mine a business anyway. Same logic as yours word for word just different hobby.

- « Previous

- Next »

- « Previous

- Next »