- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Changes on how Sales Tax presents for Sellers!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 10:53 AM

Ebay just made an announcement on the announcement board regarding this, but I know that many don't regularly visit the announcements and/or aren't signed up to receive an email update for announcements. So this thread is just an effort to keep us informed on changes that we should be in the know about.

Here is the announcement and then the link.

On October 1st, we announced changes to the way taxable transactions are processed and how taxes are collected for remittance, and those changes are now live.

Starting now, the way taxable transactions are processed and how taxes are collected for remittance will change, as follows:

- In states where eBay is required to collect Internet Sales Tax from buyers, order totals sent for processing will reflect the gross order amount inclusive of tax.

- Once settled, the tax amount will be automatically deducted for remittance to the applicable taxing authority.

- A record of the sales tax portion of the order will be available on the Seller Hub Order details page and through our Download order report.

Please note the applicable tax will continue to be paid by the buyer and you do not need to take any action.

We understand that the holiday selling season is nearly upon us and we are working to make this transition as smooth as possible.

Learn more about Internet Sales Tax in the eBay Seller Center. If you have questions about how Internet Sales Tax may affect you, we recommend consulting with your tax advisor.

Note: These changes do not apply to sellers currently enrolled in managed payments.

As always, thank you for selling on eBay.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:02 AM

Please note the applicable tax will continue to be paid by the buyer and you do not need to take any action.

Readers need to note: the above portion of the announcement is probably NOT a true statement for most sellers.

Sellers will need to 'keep track of' (on a possible daily basis) the amount of tax that is being REMOVED from ebay from your paypal account, as paypal will issue you a 1099 with the 'gross' amount you collected. The AMOUNTS REMOVED by ebay for buyers taxes around the country, will be a TAX DEDUCTION for your Federal and State Income Tax as this, in essence, is a 'false' profit, if you don't "capture and deduct" this money at tax time.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:30 AM

@corvettestainless wrote:Please note the applicable tax will continue to be paid by the buyer and you do not need to take any action.

Readers need to note: the above portion of the announcement is probably NOT a true statement for most sellers.

Sellers will need to 'keep track of' (on a possible daily basis) the amount of tax that is being REMOVED from ebay from your paypal account, as paypal will issue you a 1099 with the 'gross' amount you collected. The AMOUNTS REMOVED by ebay for buyers taxes around the country, will be a TAX DEDUCTION for your Federal and State Income Tax as this, in essence, is a 'false' profit, if you don't "capture and deduct" this money at tax time.

Yes absolutely. All sellers should keep complete, detailed records even if they aren't big enough to get a 1099 from PP or MP/Ebay. Even those that don't qualify for 1099's should be reporting to their states and of course there are those pesky income taxes. So good records are key.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:38 AM

Glad I live in a non-facilitator state. I have enough paperwork to deal with both on and offline lol

We seem to be getting closer and closer to a situation where nobody is responsible for what they did but we are all responsible for what somebody else did. - Thomas Sowell

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:42 AM

@mam98031 wrote:Ebay just made an announcement on the announcement board regarding this, but I know that many don't regularly visit the announcements and/or aren't signed up to receive an email update for announcements. So this thread is just an effort to keep us informed on changes that we should be in the know about.

Here is the announcement and then the link.

On October 1st, we announced changes to the way taxable transactions are processed and how taxes are collected for remittance, and those changes are now live.

Starting now, the way taxable transactions are processed and how taxes are collected for remittance will change, as follows:

- In states where eBay is required to collect Internet Sales Tax from buyers, order totals sent for processing will reflect the gross order amount inclusive of tax.

- Once settled, the tax amount will be automatically deducted for remittance to the applicable taxing authority.

- A record of the sales tax portion of the order will be available on the Seller Hub Order details page and through our Download order report.

Please note the applicable tax will continue to be paid by the buyer and you do not need to take any action.

We understand that the holiday selling season is nearly upon us and we are working to make this transition as smooth as possible.

Learn more about Internet Sales Tax in the eBay Seller Center. If you have questions about how Internet Sales Tax may affect you, we recommend consulting with your tax advisor.

Note: These changes do not apply to sellers currently enrolled in managed payments.

As always, thank you for selling on eBay.

Funny, I saw the first announcement of this a while back and thought it said it was going live November 1st, so I was checking our sales from over the weekend and didn't notice that anything had changed. I went back and re-read that original announcement and realized it just said "in November", so I was going to post here to see if anyone knew when it would start. Then I saw a sale come through a little while ago with the tax the new way, so I figured the answer was "now" and sure enough the announcement was updated. ![]()

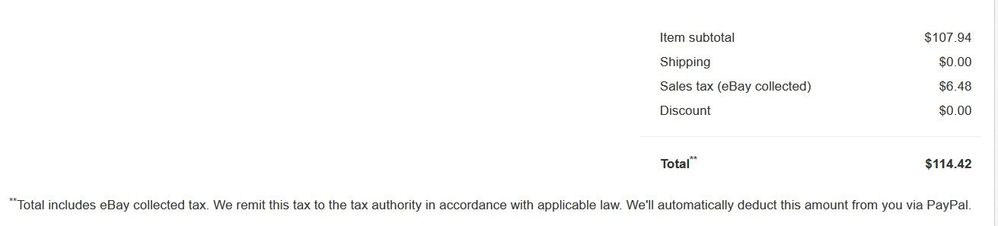

For anyone wondering, here's what it looks like now both in seller hub and in PayPal.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:56 AM

I'm getting confused. So now ebay will add the sales tax to the sold total, but not charge FVF for the tax part, but will report the additional collected tax part on the 1099K for me to deduct later?

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 11:58 AM - edited 11-04-2019 11:59 AM

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:01 PM

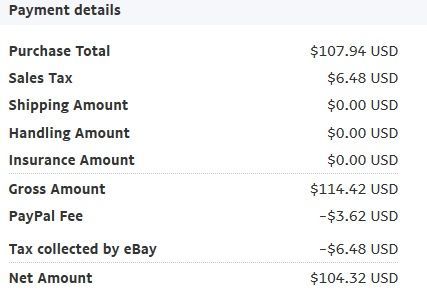

Everyone should note that the Paypal fee is taken on the total INCLUDING THE SALES TAX. It's a small amount, but still is an increase on overall "costs of doing business".

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:01 PM - edited 11-04-2019 12:03 PM

@fern*wood wrote:I'm getting confused. So now ebay will add the sales tax to the sold total, but not charge FVF for the tax part, but will report the additional collected tax part on the 1099K for me to deduct later?

If you are using PayPal and it is a marketplace facilitator state - the full amount, including tax, gets sent to you through PayPal. PayPal charges you their processing fee on the full amount. Then, the tax amount gets deducted and sent to eBay since they are legally required to collect and remit it. eBay does not charge you FVF on the tax amount.

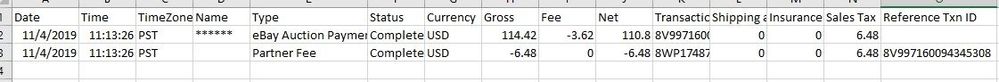

PayPal will presumably include the tax amount in your 1099K. But also, based on the way it is displaying in PayPal right now, you should be able to easily see in PayPal reports the amounts deducted and sent back to eBay. That should make it easier to deal with come tax time, but not as easy as not having to deal with it at all.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:05 PM

This is my question about how this is all going to shake out ..

If the buyer in a particular transaction gets a refund, are they going to expect the gross amount refunded to them? Would this buyer expect to be getting $114.42 back from the seller because, of course, that is how much they paid them?

This looks like an accident looking for a place to happen to me.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:13 PM

@autopiacarcare wrote:

PayPal will presumably include the tax amount in your 1099K. But also, based on the way it is displaying in PayPal right now, you should be able to easily see in PayPal reports the amounts deducted and sent back to eBay. That should make it easier to deal with come tax time, but not as easy as not having to deal with it at all.

For reference, here's how it appears in a downloaded report from PayPal. Looks like they are calling it a "Partner Fee" and they have a reference ID that links back to the original transaction.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:15 PM

How easy and decent it could have been for Paypal to move their fee down ONE line? I know it's usually a small amount but we sellers are squeezed in every direction and now pay fees on money we never even see!

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:19 PM - edited 11-04-2019 12:20 PM

@dtexley3 wrote:Everyone should note that the Paypal fee is taken on the total INCLUDING THE SALES TAX. It's a small amount, but still is an increase on overall "costs of doing business".

@dtexley3 - Also noteworthy is that anyone using PayPal Working Capital Loans is going to get hit even harder, since the payback on those loans comes out as a percentage of each sale. All the way around, I see this as eBay's way of sticking it to PayPal and those who still wish to use their services instead of switching to Managed Payments.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:26 PM

I don't see where eBay is "sticking it to paypal". What I see is that eBay shifted the transaction cost (2.9% of the sales tax amount) to the seller. I sincerely doubt that there is any cost at all to eBay when the sales tax dollars flow out of paypal.

I have no idea if paypal passes the amounts directly to the states, back to eBay, or to another entity that gather's up the funds and disperses them on eBay's behalf.

Changes on how Sales Tax presents for Sellers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-04-2019 12:28 PM

I wonder if the sales tax collected will show on the sales reports because I don't use the hub but get my fees off that monthly report.