- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- 1099 Income Tax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 10:38 AM

Sorry for bringing this up as it probably has been discussed at length here, but I am still confused.

What is going to happen effective 1-1-2022 - are ALL sales over $600.- counting towards an amount shown on a 1099 at the end of the year and is every seller liable to pay income tax on that? Even for stuff we have owned for years and are selling as private parties, not a business?

If so, 12-31-2021 will be my last day as a seller on ebay....

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 10:57 AM

You are supposed report all income to IRS (whether you receive 1099 or not). Remember EBAY is now reporting all sales and remitting "sales tax" under your social security#. If you fail to report income (you could audited and pay huge penalties).

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 11:07 AM

@ima4nr wrote:Sorry for bringing this up as it probably has been discussed at length here, but I am still confused.

What is going to happen effective 1-1-2022 - are ALL sales over $600.- counting towards an amount shown on a 1099 at the end of the year and is every seller liable to pay income tax on that? Even for stuff we have owned for years and are selling as private parties, not a business?

If so, 12-31-2021 will be my last day as a seller on ebay....

That could be, but your tax liability for this year and any prior years' liability would still be relevant

....... "The Ranger isn't gonna like it Yogi"......... Boo-Boo knew what he was talking about!

Posting ID Only.......

Yes, I have no Bananas, only Flamethrowers.......

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 11:12 AM

With or without a 1099 everyone has always been required to report

any income and pay taxes if owed.

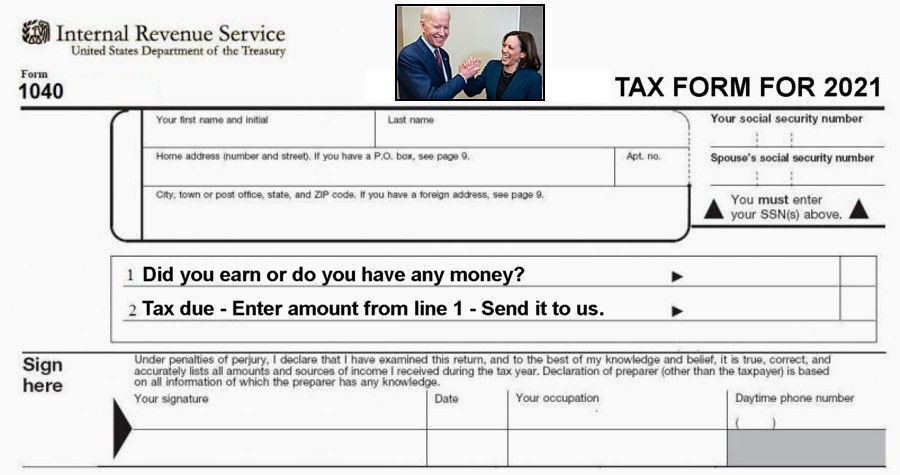

Just fill out this simple form and you will be all set and not have to worry about a 1099.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 11:17 AM

"are ALL sales over $600.- counting towards an amount shown on a 1099 at the end of the year"

All sales including that first $600 will count. And have always counted. The change in the threshold for the 1099-K form only affects whether you (and the IRS) get the form, it doesn't change what you are supposed to report as income.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 11:24 AM - edited 09-07-2021 11:25 AM

You report it, but it may not "all" be taxable.

Only the profit after deducting all the expenses it taxable.

Deduct:

cost of goods

shipping

eBay fees

packing materials cost

cost to drive to the shipper

other

2022 will be no different than the years that preceded.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 11:44 AM

Yes, you WILL be issued a 1099 if your TOTAL sales are at or over 600 dollars. You are REQUIRED to report every sale, every bit of income, even if it's only 5 dollars. You are allowed to deduct certain things from your tax LIABILITY.

So reporting your INCOME, does not equate to OWING more taxes, though it CAN. If you want to be "done" with eBay, you better be done BEFORE 12-31-21 because you are not paid instantly. The lag of payments will mean all sales about the final week of December, will be paid out in January.

If you are a tax dodger, you may want to quit now. There was already one thread posted not that long ago, about the IRS auditing them because they were not reporting their sales (because they had not received a 1099 in the past). 1099 or not, you are REQUIRED to report ALL of your income. Anything sold digitally has a paper trail. 1099 or not, eBay/the IRS know. eBay will willfully report on any seller at the request of the IRS, no warrant needed. They have already given open backdoor access to all governmental agencies.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:15 PM - edited 09-07-2021 12:16 PM

@ima4nr wrote:are ALL sales over $600.- counting towards an amount shown on a 1099 at the end of the year and is every seller liable to pay income tax on that? Even for stuff we have owned for years and are selling as private parties, not a business?

Your statement above is seeking a "yes" or "no" answer to a question whose answer is more complicated that "yes" or "no".

All payments processed for a taxpayer by a payment processor will count towards an amount reported in a 1099-K at the end of the year, and every taxpayer should account for that 1099-K when they file their taxes.

But accounting for those payments means explaining them, not necessarily paying taxes on them. There are many expenses a taxpayer can deduct as a result of your eBay activity to offset the payments that arose from that activity.

@ima4nr wrote:If so, 12-31-2021 will be my last day as a seller on ebay....

I hope you realize that even though you do not currently receive a 1099-K, you are still required to report the income and explain it to the IRS. The 1099-K does not create an additional tax liability; it just makes it easier to catch the people who do not report their income.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:20 PM

This is all totally ridiculous. I have always considered this a private sale of used items I own which are not income taxable. How in the world would you be able to document original purchase price for an item that you bought 30 years ago in order to deduct this from the sales amount. Any garage sale income is liable to income tax? What country are we living in? I am glad all you guys are so keen to hand money over to the IRS while Bezos et al pay nothing.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:32 PM

@ima4nr wrote:This is all totally ridiculous. I have always considered this a private sale of used items I own which are not income taxable. You considered incorrectly. How in the world would you be able to document original purchase price for an item that you bought 30 years ago in order to deduct this from the sales amount. Here's some good new/bad news: Good news: You don't need those receipts. Bad news: Because they wouldn't be deductible anyway. If you're not doing this as a for-profit business, then you cannot deduct your expenses. This went into effect in 2018, i.e., during the previous presidential administration which did so much for the wealthy. Any garage sale income is liable to income tax? Yep. What country are we living in? The one where the wealthy don't pay their fair share of taxes. I am glad all you guys are so keen to hand money over to the IRS while Bezos et al pay nothing.

Here's an overview of the relevant 2018 tax-deduction policies for hobby vs business:

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:36 PM

If you sell, you're a business.

It's odd that so many don't understand this.

But don't worry about having to pay taxes this year. Worry that once this year's income is reported, the IRS might start looking at your past years. Sellers who haven't been paying taxes might owe fines, penalties and ton of back taxes.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:44 PM

@iart wrote:If you sell, you're a business.

It's odd that so many don't understand this.

.....

The IRS has specific policies for determining whether your sales are a business or a hobby for tax-filing purposes. The distinction is more important than ever since it now affects what expenses (if any) can be deducted.

https://www.irs.gov/faqs/small-business-self-employed-other-business/income-expenses/income-expenses

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:44 PM

In general, if I am selling items I am a business.

I have always reported my income from eBay, shows etc. It is of NO importance to me if they generate a 1099 or not as I see it.

If I am at a trade show and sell 1000 of a friend stuff I am responsible as i see it. Of course I back out my expenses cost of goods, mileage, store fees, shipping supplies etc.

This has been true since the start. I have/am and will always be responsible for my income taxes no mater what this or other sites do or not do.

It is remarkable to me that people do not think they owe taxes if the sell on social media sites. They do. Is it easier to get away with, I do not know, maybe. Its just not worth the risk to me.

Anyway, I could be wrong, I am no accountant/lawyer for sure. Its just how I see things.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:45 PM - edited 09-07-2021 12:49 PM

@ima4nr wrote:This is all totally ridiculous. I have always considered this a private sale of used items I own which are not income taxable. How in the world would you be able to document original purchase price for an item that you bought 30 years ago in order to deduct this from the sales amount. Any garage sale income is liable to income tax? What country are we living in? I am glad all you guys are so keen to hand money over to the IRS while Bezos et al pay nothing.

I agree Bezos and all the wealthy should be paying their fair share, but that won't help me with what I owe. Too often the rich have been given all the tax breaks and were given another big one just a few years ago.

1099 Income Tax

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-07-2021 12:47 PM

@caldreamer wrote:You are supposed report all income to IRS (whether you receive 1099 or not). Remember EBAY is now reporting all sales and remitting "sales tax" under your social security#. If you fail to report income (you could audited and pay huge penalties).

100% correct. My friend did not report income from eBay and was audited for a tune of reportedly 8K.