- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Buying

- Re: Sales Tax Charged by Ebay for Seller from Chin...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-11-2019 11:05 AM

I understand that Ebay is now considered a Facilitator in a few states and due to recent tax law changes, Ebay must charge, collect and remit sales tax on what sellers sell on this site to certain states that require it. I get all of that.

I live in one of those states. But what I don't understand is why sales tax was charged to me on something I purchased from a seller in China. I wasn't aware that the tax laws of a state could affect a seller located in a different country.

Or is it just my misunderstanding and the states do have the right to charge sales tax on sales from an international seller? What the heck am I misunderstanding.

I just have a desire to understand.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Solved! Go to Best Answer

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 03:41 PM

@imspad wrote:I'm talking about CHINA. There is NO Sales Tax for sales in China. So saying this money is "sales tax" is a fraud, plain and simple. And that "FACT", makes no difference what congress says and is a matter of consumer "common law". They will be sued. They will loose. They will be forced to give all the money collected for foreign countries marketed as "sales tax" but actually defrauded out of the consumer back.

Watch and learn!

The item coming from China doesn’t make a difference. The facilitator tax is based on the business eBay does in the state where the buyer purchases from. So it’s based on the buyers state tax laws and the amount of business eBay a company in the US gets from that state.

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 04:52 PM

Where do you get your information?

Why do you believe eBay is "obviously" pocketing the money?

Making a false statement about where the money is going is wrong, unless you have solid facts to support your statement. How long would a state which has enacted a law to reap more revenue allow eBay to take money that rightfully belongs to that state?

eBay fought this new law with all its strength, but it's in effect anyway.

What eBay class action law suit do you figure is being filed?

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 04:56 PM

This will be my last attempt: No, China probably does not have a state sales tax; however, 34 states in the US now have this law. You, the buyer, are not buying in China, you are buying in your state in the US.

Just like shopping at WalMart, you, the buyer, pay state sales tax to the state where you are shopping.

When shopping on eBay or other online venues, you, the buyer, pay state sales tax to the state where your purchase is being sent.

After this, I have to give up.

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 05:09 PM

@imspad wrote:I'm talking about CHINA. There is NO Sales Tax for sales in China. So saying this money is "sales tax" is a fraud, plain and simple. And that "FACT", makes no difference what congress says and is a matter of consumer "common law". They will be sued. They will loose. They will be forced to give all the money collected for foreign countries marketed as "sales tax" but actually defrauded out of the consumer back.

Watch and learn!

No one in China is charging you a tax. The tax you had to pay has NOTHING to do with China. Sales tax has nothing at all to do with where the product originated. It could me China, Australia, Canada, Mexico, or your neighboring state. NONE of that matters. What matters is that you had it delivered into a state that has a Facilitator law in place.

YOUR state representatives passed a law so that ALL marketplaces have to charge and collect for ANY sale of an item that come INTO your state. Period. Sales tax is ALWAYS a tax on the destination of the item. Where it came from does not matter at all.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 05:11 PM

@imspad wrote:I never said anything about "internet tax".

I'm talking about CHINA. There is NO Sales Tax for sales in China. So saying this money is "sales tax" is a fraud, plain and simple. And that "FACT", makes no difference what congress says and is a matter of consumer "common law". They will be sued. They will loose. They will be forced to give all the money collected for foreign countries marketed as "sales tax" but actually defrauded out of the consumer back.

Watch and learn!

You are absolutely correct. And China is NOT charging or collecting a sales tax from you.

Your STATE has passed a law that REQUIRES Ebay to charge and collect a sales tax for ANY purchase to be delivered to someone in your state. You don't like the law, take it up with your state representatives. They wrote it and enacted it. Not Ebay and certainly not China.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-27-2019 05:14 PM

@bonjourami wrote:Yes there is tax for buying from China, if the buyer is buying online and lives in one of the states that is collecting it.

Heck it doesn't even have to be online. How many times have you picked up something at a store that says the item came from China. When you take that item to the cashier, my bet it you have to pay a sales tax on it if one is required in your state, right.

Same thing on the internet. As I know you know!! I just thought I'd post another example.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2019 07:43 PM

Let me get this I can by something from ny and not be charged sales tax but if I buy from China I need to pay sales tax as if I bought it in LA 🤦🏻 Looks like some one need to get this to the court as this seems an expensive interpretation of the law ( literally) 🤦🏻

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2019 08:20 PM - edited 12-05-2019 08:20 PM

@cai7202 wrote:Let me get this I can by something from ny and not be charged sales tax but if I buy from China I need to pay sales tax as if I bought it in LA ...

No, you don't get it yet. If the package is delivered to a state where eBay is required to collect sales tax, then they will collect the sales tax. It doesn't matter whether the seller is in NY, California, China, or Mongolia. The sales tax collection is based on the delivery location, not on the seller location. If you are in California, then eBay will charge sales tax for all of your purchases regardless of seller location.

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-05-2019 09:47 PM

@nobody*s_perfect wrote:

@cai7202 wrote:Let me get this I can by something from ny and not be charged sales tax but if I buy from China I need to pay sales tax as if I bought it in LA ...

No, you don't get it yet. If the package is delivered to a state where eBay is required to collect sales tax, then they will collect the sales tax. It doesn't matter whether the seller is in NY, California, China, or Mongolia. The sales tax collection is based on the delivery location, not on the seller location. If you are in California, then eBay will charge sales tax for all of your purchases regardless of seller location.

Might I add that even if sales tax was not being collected by the seller at the time of purchase, you should have been paying it yourself to the state on previous purchases. Many states have lines on their state income tax returns just for this purpose. Even now, if one's state has not yet passed legislation to require marketplace facilitators like eBay and others to collect this tax, the buyer is required to still pay it to the state. The only thing that marketplace facilitator laws did was turn sites like eBay, Amazon and others into tax collectors for the state and stop many of those that weren't paying the taxes required of them to pay by the state from not paying them. No new taxes were added. Only now it is harder to evade paying them.

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-03-2020 09:41 AM

Clearly you have some misunderstandings about this. Ebay has no choice. Ebay didn't pass these LAWS. Ebay fought hard for years to prevent the start of internet sales taxes. Google it and you will find it to be true.

Ebay has no options here. By law they have to collect sales tax for sales that are delivered to 38 states in the USA. If this is affecting you in your state, you need to contact your state representatives as they are the ones that passed the law to make Ebay have to collect these taxes.

And by the way. It isn't just Ebay that has to charge the sales taxes for 38 states. It is all similar sites. Etsy, Amazon, Etc.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2020 12:26 PM

@mam98031 wrote:

@no_zero369 wrote:Hmmm, what is to stop some "genius" from setting up Tax Tables for all of the jurisdictions that are now requiring sales tax, and then claiming they are exempt under the dollar limits and number of transactions thresholds? Is eBay monitoring that?

They don't need to. Ebay is collecting the Sales tax in the states that currently require it and Ebay will be remitting it to the appropriate states.

The problem is that they're doing it incorrectly. Nothing on eBay that is a used item should be charged sales tax!

The inherent nature of the website implies that absolutely NOTHING on this site is a licensed 'retail purchase' either which inherently implies that even with NEW items paying Sales Tax should be the EXCEPTION not the standard.

The only situation wherein it would be acceptable to collect sales tax is if the following conditions are met:

1) The seller is an eBay store with a Tax ID.

2) The item is New.

3) The store is located in a state which requires tax collection across state lines.

4) The item itself is marked as "not yet taxed" (meaning that it was purchased wholesale, in bulk, buy a business with a Sales Tax ID under which to remit that tax).

5) The buyer does not have other exceptions on file (such as they are a wholesaler, non-profit, etc).

The way taxation is currently setup, eBay is collecting a MASSIVE amount of "fees" under the guise of "Sales Tax" and while they are assuredly remitting those necessary, they are most definitely making a MASSIVE profit.

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-04-2020 12:43 PM

@arkusaj7 wrote:

@mam98031 wrote:

@no_zero369 wrote:Hmmm, what is to stop some "genius" from setting up Tax Tables for all of the jurisdictions that are now requiring sales tax, and then claiming they are exempt under the dollar limits and number of transactions thresholds? Is eBay monitoring that?

They don't need to. Ebay is collecting the Sales tax in the states that currently require it and Ebay will be remitting it to the appropriate states.

The problem is that they're doing it incorrectly. Nothing on eBay that is a used item should be charged sales tax!

The inherent nature of the website implies that absolutely NOTHING on this site is a licensed 'retail purchase' either which inherently implies that even with NEW items paying Sales Tax should be the EXCEPTION not the standard.

The only situation wherein it would be acceptable to collect sales tax is if the following conditions are met:

1) The seller is an eBay store with a Tax ID.

2) The item is New.

3) The store is located in a state which requires tax collection across state lines.

4) The item itself is marked as "not yet taxed" (meaning that it was purchased wholesale, in bulk, buy a business with a Sales Tax ID under which to remit that tax).

5) The buyer does not have other exceptions on file (such as they are a wholesaler, non-profit, etc).

The way taxation is currently setup, eBay is collecting a MASSIVE amount of "fees" under the guise of "Sales Tax" and while they are assuredly remitting those necessary, they are most definitely making a MASSIVE profit.

Once Ebay becomes responsible to collect and remit sales tax due to an MFL being in place, ALL SELLERS are blocked from being able to collect sales tax in those states. You can go to your tax table and try to set up some percentages, but you won't get far. So sellers misbehaving in these regards is highly unlikely.

Ebay is complying with the laws that they are required to comply with. If there are specific things within those laws that you disagree with, then you need to take it up with your state as they wrote the law. Ebay can not change what they are doing simply because some users think they should. So you need to start with your state representatives to get things changed.

Sales tax has NEVER EVER been driven by the origination of the product. Some of the confusion regarding this is because we all call it sales tax, even the states do, but it reality it is Use Tax when it comes from out of state and/or country.

Use tax is a sales tax on purchases made outside one's state of residence for taxable items that will be used, stored or consumed in one's state of residence and on which no tax was collected in the state of purchase.

Your misunderstandings of how this works is very similar to others that have posted on the threads. But it is simply a misunderstanding.

And BTW Ebay is not so short sighted as to break the laws in 38 states in order to make some extra money in the short run. Then be hit with multiple law suits for not complying with the laws and paying all the penalties, interest, court costs and lawyer fees. It is just so silly to think a company would risk there entire company over this.

I know it is easier to blame Ebay for all this but there is no basis in fact for that, simply misunderstanding the MFLs it what is going on. Ebay isn't the only site that charges these taxes. So if Ebay is doing what you suggest, so is Amazon, Etsy, Walmart, Sears, ETC. They are all in on a massive conspiracy to steal from us all.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2020 04:30 PM

Same situation here.

Seller in China offered item at a fixed price. PayPal checkout showed exactly that price. Seller did not state that taxes of any kind apply. Notification from eBay that item had shipped showed a different price, now it included tax.

Who gets this tax? China? My State? If my state does, then why doesn't every transaction from States in the USA charge tax for the seller's State plus tax for my State. eBay seems to be facilitating in the same way for each sale.

---------

Note: when double checking the seller's location, in case they are shipping from a USA location, it showed they ship from an international location. The seller is listed as in China/HongKong/Taiwan. Since when did eBay allow sellers to make/post political comments? That is, Taiwan as part of China?

Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2020 05:10 PM

@finecollections1978 wrote:Same situation here.

Seller in China offered item at a fixed price. PayPal checkout showed exactly that price. Seller did not state that taxes of any kind apply. Notification from eBay that item had shipped showed a different price, now it included tax.

Who gets this tax? China? My State? If my state does, then why doesn't every transaction from States in the USA charge tax for the seller's State plus tax for my State. eBay seems to be facilitating in the same way for each sale.

---------

Note: when double checking the seller's location, in case they are shipping from a USA location, it showed they ship from an international location. The seller is listed as in China/HongKong/Taiwan. Since when did eBay allow sellers to make/post political comments? That is, Taiwan as part of China?

Again, sales tax has NEVER been driven by the products origination. It just doesn't work that way and never has.

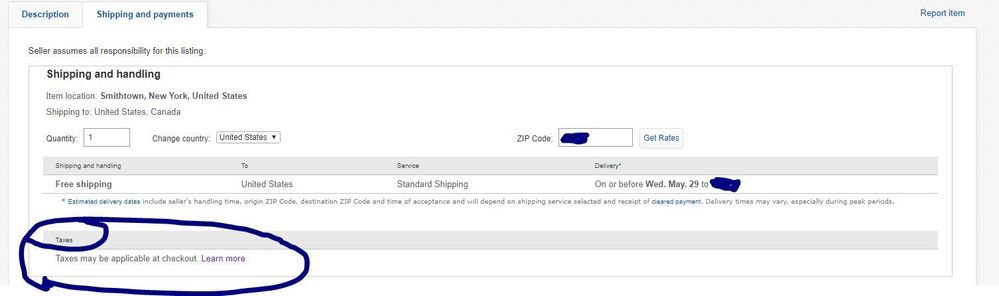

Yes the seller's listing did state there may be sales tax, you just didn't notice it. Please see the pic below.

The sales tax will show on the invoice as you prepare to submit payment for the item you purchase.

Ebay will get the money for the sales tax and they will remit it to the appropriate state as the law in that state provides.

Ebay is responsible in 38 states to collect and remit sales tax. I'll provide a link below you will find informative.

https://www.ebay.com/help/selling/fees-credits-invoices/taxes-import-charges?id=4121#section4

It does NOT matter where in the WORLD the seller it located. It matter to which state the item is shipped to.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Sales Tax Charged by Ebay for Seller from China????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-05-2020 05:23 PM - edited 01-05-2020 05:24 PM

"The way taxation is currently setup, eBay is collecting a MASSIVE amount of "fees" under the guise of "Sales Tax" and while they are assuredly remitting those necessary, they are most definitely making a MASSIVE profit."

NO,NO,NO!!

You are totally misunderstanding this.

Simply put, eBay is forced by USA law to collect the tax and then submit said collected tax to the state of the USA buyers of said purchases made here on eBay. Currently it is PayPal that is making the extra monies by charging their transaction fees on the total transaction amount of purchases including the tax. However, that tax amount that is processed by PayPal is in turn transferred back to eBay who then submits that tax to the proper state.