- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- eBay Groups

- eBay Categories

- Books

- Booksellers

- Re: A tax question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

A tax question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-08-2022 02:37 PM

Kind of complex, and silly (for me) since I haven't paid taxes since Trump doubled our exemptions. BUT

This year we are all (at least partially) beholden to the Bank of eBay for our payments, which they hold until the purchase has been shipped and the payment cleared. This naturally creates a condition where eBay has $xx.xx in that gap between transaction completion (payment) and payment release. That is not our money, we have not yet earned it, and the fees which are pulled from our earnings are (theoretically) not yet transferred to eBay's General Fund (or other). Which of course leads to another question, but later for that.

This particular $xx.xx is "Held over" until the next statement, and paid in the next month which means that the amount on hold at midnight on Dec. 31 is eBay's and not part of our taxable income. Right?

It doesn't matter to me, as I said. But for those with strong holiday sales and longer lag times it might matter to the amount owed to the TaxMan.

Other things I've noticed, so far, is that Store Fees no longer appear in the transaction report at the end of the year. They are not in the monthly statements either. Don't forget to manually add them to your Schedule C, or S Corp, filing.

Re: A tax question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-18-2022 05:24 PM

Yes, ebay and taxes. Now I don't trust ebay any further than I can throw ebay, and I only have a few items listed these days, as I no longer list new items on the site. Twenty-three years on ebay has been enough. Every time I do sell an item, I make a note with pen and paper as to the sale price and payout amount. This year I added up my total sales and they were several thousand dollars less than the 12 month total on MY EBAY as of 12/31/2021. The payout amount, however, was close. So whether ebay is considering the payout amount as total sales I really don't know, and since my sales weren't sufficient to receive a 1099 this year I probably never will know (this year, anyway). Next year, however, anyone with $600 in sales will receive a 1099.

Re: A tax question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2022 01:27 PM

eBay will report your shipping charges as income--because the IRS views it that way. You collect that money, and then you pay for shipping and write off those expenses as a cost of goods sold.

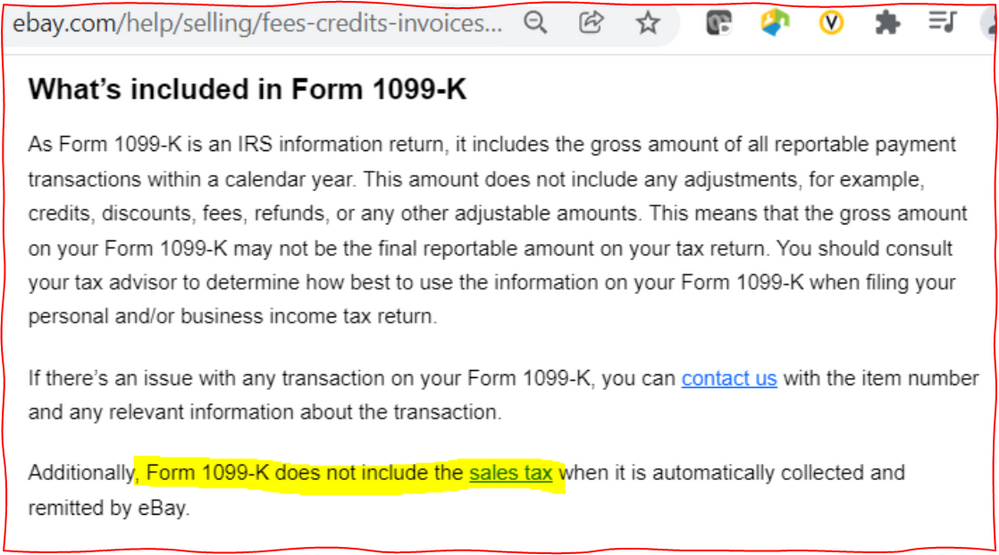

They may also report sales tax they collect on your behalf even though you never see it and are not responsible for remittance. They should not, but that doesn't mean they don't.

Re: A tax question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-23-2022 01:43 PM

"Form 1099-K does not include the sales tax when it is automatically collected and remitted by eBay."

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794