- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Tax information

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 10:47 AM

Hello all. I am not new to Ebay but I am trying my hand at reselling thrifted items as a side hustle. At present I have sold around 55-60 items and haven't really been tracking the income since it's been an experiment. But I am at the point where I have probably made enough that I will have to report to the IRS. I'm not sure what that process will be. I guess my concern is that next year should I consider this business income and start itemizing, paying quarterly, etc? I'm really not sure what to do. I would like to keep this a part time gig for now but was wondering what to do if business picks up. Any advice would be appreciated.

Solved! Go to Best Answer

Accepted Solutions

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 11:20 AM

To give you a general idea and for reporting this year, you can go to your sales area in your seller hub.

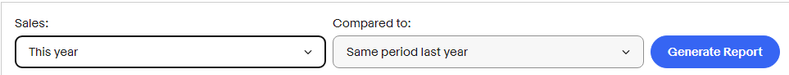

click on the little > on the right and you will get the following screen. Change the Sales field to This year using the drop down menu then click Generate Report.

This will give you a breakdown of your gross sales and selling expenses at least those expenses related to eBay. Ignore the taxes and fees area these are funds eBay collects from the buyer and remits to the proper entity. They are not part of your income nor do you pay taxes on them.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 11:09 AM

You are selling to make a profit. You should be reporting this income anyway.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 11:18 AM

It may have been an experiment in your eyes, but it's taxable income in the eyes of the IRS.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 11:20 AM

To give you a general idea and for reporting this year, you can go to your sales area in your seller hub.

click on the little > on the right and you will get the following screen. Change the Sales field to This year using the drop down menu then click Generate Report.

This will give you a breakdown of your gross sales and selling expenses at least those expenses related to eBay. Ignore the taxes and fees area these are funds eBay collects from the buyer and remits to the proper entity. They are not part of your income nor do you pay taxes on them.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 11:28 AM

You need to figure out a Bookeeping system to keep track of everything.

Read this information from IRS. It may help you understand how to report on-line sales.

https://www.irs.gov/pub/taxpros/fs-2023-06.pdf

Updates to frequently asked questions about Form 1099-K

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 12:16 PM

I am trying my hand at reselling thrifted items as a side hustle

You were a business the minute you started to resell.

I am at the point where I have probably made enough that I will have to report to the IRS

You are a business and so you have to report income to the IRS.

next year should I consider this business income

You should do that this year since you are a business.

and start itemizing, paying quarterly, etc?

Itemizing is your decision. Paying quarterly depends upon whether you need to or not. It is not a choice.

I would like to keep this a part time gig for now but was wondering what to do if business picks up

You need to report income whether it is part time or not, and whether it picks up or not.

I'm not sure what that process will be.

You report your income and expenses on Schedule C of form 1040.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 01:33 PM

There is a lot of bookkeeping involved when running an EBAY business. IRS requires that you report all "gross income" (even if you think your EBAY business is a hobby). When you file "income taxes" as a business you can deduct expenses (EBAY fees, shipping labels, cost of goods, mileage, packing supplies, office supplies, etc). You only pay income taxes on "net amount" (after all deductions). Be sure to keep all receipts to prove your deductions.

EBAY has a "easy to read" 1-page available that shows YTD totals for (orders, refunds, EBAY fees, shipping income). Go to Payments, Reports, REPORTS (NEW) and enter time period.

You should create Excel spreadsheet to track all your inventory (include the following columns). You keep the same inventory spreadsheet "forever" and just keep adding/or subtracting. IRS requires you to report "beginning inventory on hand Jan 1st" and "ending inventory on hand Dec 31" every year.

Inventory# (that you create for every item)

Date you purchased item

Cost of goods

Description

Date sold

EBAY order#

Returned merchandise

Date of return

Cost of goods (add to inventory)

Resold merchandise

Date of sale

Cost of goods (subtract from inventory)

Sold items (subtract "cost of goods")

New inventory added (create new inventory# and add item to your list)

Returned merchandise (add "cost of goods" back to available inventory)

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 02:17 PM

You should create Excel spreadsheet to track all your inventory (include the following columns). You keep the same inventory spreadsheet "forever" and just keep adding/or subtracting. IRS requires you to report "beginning inventory on hand Jan 1st" and "ending inventory on hand Dec 31" every year.

Inventory# (that you create for every item)

Date you purchased item

Cost of goods

Description

Date sold

EBAY order#

Returned merchandise

Date of return

Cost of goods (add to inventory)

Resold merchandise

Date of sale

Cost of goods (subtract from inventory)

Sold items (subtract "cost of goods")

New inventory added (create new inventory# and add item to your list)

Returned merchandise (add "cost of goods" back to available inventory)

For most small sellers there is no need to report inventory and there is a small business exemption

Inventories

Generally, if you produce, purchase, or sell merchandise in your business, you must keep an inventory and use an accrual method for purchases and sales of merchandise.

Exception for small business taxpayers.

If you are a small business taxpayer, you can choose not to keep an inventory, but you must still use a method of accounting for inventory that clearly reflects income. If you choose not to keep an inventory, you won’t be treated as failing to clearly reflect income if your method of accounting for inventory treats inventory as non-incidental material or supplies, or conforms to your financial accounting treatment of inventories. If, however, you choose to keep an inventory, you must generally use an accrual method of accounting and value the inventory each year to determine your cost of goods sold in Part III of Schedule C.

Small business taxpayer.

You qualify as a small business taxpayer if you (a) have average annual gross receipts of $27 million or less for the 3 prior tax years, and (b) are not a tax shelter (as defined in section 448(d)(3)). If your business has not been in existence for all of the 3-tax-year period used in figuring average gross receipts, base your average on the period it has existed, and if your business has a predecessor entity, include the gross receipts of the predecessor entity from the 3-tax-year period when figuring average gross receipts. If your business (or predecessor entity) had short tax years for any of the 3-tax-year period, annualize your business’ gross receipts for the short tax years that are part of the 3-tax-year period. See Pub. 538 for more information.

Treating inventory as non-incidental material or supplies.

If you account for inventories as materials and supplies that are not incidental, you deduct the amounts paid or incurred to acquire or produce the inventoriable items treated as non-incidental materials and supplies in the year in which they are first used or consumed in your operations. Inventory treated as non-incidental materials and supplies is used or consumed in your business in the year you provide the inventory to your customers.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-21-2023 02:34 PM

Looking at the feedback you've received as a seller, it's been a long experiment and you've sold 608 items, a tad bit more then 55-60.

You should have been reporting your income all along.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 12:30 PM

I haven't been selling all along. I've had an account since 2010 but only sold things occasionally to either help a family member or clear some clutter. That was scattered and scarce. I have purchased more than sold. I said I just recently started selling to make a profit and that is the truth. Since you don't know you shouldn't comment. I was only asking for advice, not criticism. So thanks.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 12:41 PM

Getting tax and recordkeeping advice on a forum can be good or can be big trouble.

Start here with the IRS

https://www.irs.gov/pub/irs-pdf/p583.pdf

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 01:43 PM

The IRS has surprisingly good resources. First thing I'd do, though, is check your state requirements and see about getting a business license for a sole proprietorship (yourself) - here in Washington one can apply online, pay a small fee and receive the physical license (here it includes a reselling permit since I'm a retailer).

The process is made easy with some simple and easy to follow tax software - I use TurboTax Home and Business, but others have recommended Taxjar. TurboTax steps you through everything on filing.

I haven't found the paperwork at all onerous for tax reporting - it's neither complex nor is it time consuming - it's just important that one keeps it current so you don't end up sitting up half the night on April 12 trying to get things figured out lol (I did that once years ago - never again). I might spend a half hour a month updating my tax records. A spreadsheet does help - I have one with macros to track inventory and expenses as well as revenue.

When you dine with leopards, it is wise to check the menu lest you find yourself as the main course.

#freedomtoread

#readbannedbooks

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 01:56 PM

@happyval05 wrote:I haven't been selling all along. I've had an account since 2010 but only sold things occasionally to either help a family member or clear some clutter. That was scattered and scarce. I have purchased more than sold. I said I just recently started selling to make a profit and that is the truth. Since you don't know you shouldn't comment. I was only asking for advice, not criticism. So thanks.

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 02:10 PM

@slippinjimmy wrote:

@happyval05 wrote:I haven't been selling all along. I've had an account since 2010 but only sold things occasionally to either help a family member or clear some clutter. That was scattered and scarce. I have purchased more than sold. I said I just recently started selling to make a profit and that is the truth. Since you don't know you shouldn't comment. I was only asking for advice, not criticism. So thanks.

That's a handful of items a month. Why are people hammering on this? It's irrelevant to the question.

When you dine with leopards, it is wise to check the menu lest you find yourself as the main course.

#freedomtoread

#readbannedbooks

Tax information

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-24-2023 03:16 PM

In all honesty this isn't the place to get tax or bookkeeping advise as everyone's situation has differences.

The best way to handle your questions is to talk to a tax professional. If you been having someone do your taxes every year then go to them for advice. If not, it sounds as if it's time to look into getting someone to help you. I'm sure besides eBay you have other things in your financials that also can come into play. The worse advise you can get is the wrong advise. Spend a little to know what your doing is right. If you ever get called in on something, I'm sure if you tell them, Well someone on eBay told me to do it this way. It's not going to go well.