- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- New-ish seller, confused about eBay international ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New-ish seller, confused about eBay international shipping fees

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2023 11:44 AM

Hi all. I've been selling on eBay for a few months now and at first it seemed to go really well. Now, after getting a store, its seems that I sell less? Also, I recently had an international sale where I had measured and weighed the item to calculate shipping which the buyer paid and was $15 going to the UK. Now, eBay charged me $23?? I"m confused. It was for a belt which the purchase price was $25. After price of goods, sales taxes, promoted listing fee, final value fee, and VAT, I literally paid eBay more than $7. I'm feeling a bit discouraged. I am a small seller but was hoping to grow to a big enough store that I can retire from my 9-5 job that is quite literally making me sick. But how can I make any money with all these fees? What is the key to making a go of this on eBay? Thanks!

New-ish seller, confused about eBay international shipping fees

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2023 12:04 PM

What were the dimension?

What kind of outer packaging did you use?

How much did it weigh?

What shipping method did you use?

The $23 was for shipping?

New-ish seller, confused about eBay international shipping fees

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-03-2023 12:36 PM

I took a look at the belt you sold and the shipping was shown to the buyer as $15 using eBay International Standard Delivery. When you purchased the actual shipping label did you purchase it through eBay and did you in fact use the eBay International Standard Delivery service or did you by chance change the shipping method? As a side note the eBay International Standard Delivery will be going away and is being replaced by the EIS program which looks pretty good. There should not have been any sales tax on a foreign sale but the VAT tax is literally the same thing. EBay should have collected the VAT from the buyer or the buyer should have paid it when it went through customs. If eBay collected it from the buyer you may have paid a FVF on the tax.

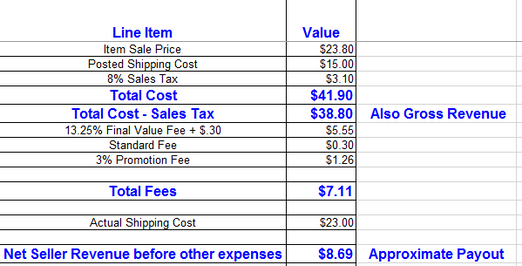

As a seller the key to realizing a decent ROI is to have a cost model that you utilize to reverse engineer your listing cost. As a starting point you take into account all of the eBay selling costs which include the FVF's, PL fees and the shipping costs. You have to take a guess on the sales tax since it is not the same across the board for all states, cities, counties......... Once you have the costs estimates plugged in you can adjust the listing price to the point where you achieve an acceptable return. This will give you net payout from the eBay transaction. After that or in conjunction with that you will need to factor in the other costs that are external to eBay like COGS, supplies, packing materials, POV and Federal and State income taxes. As an example on your belt. your item actually sold for $23.80 I had to guess at your promotion rate and the tax.

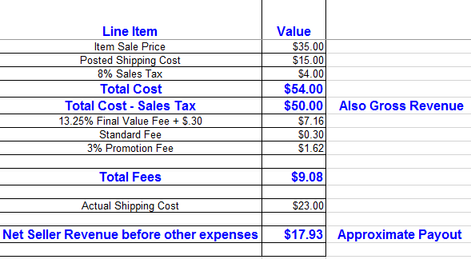

Had you listed the belt for $35.