- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Do eBay gross sales (1099) for 2022 include sales ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:11 PM

So.......I've been paying taxes on my self-employment for years. But starting in 2022 I apparently will be getting a 1099 from eBay. I want to make sure my books jive with the 1099. What is included in the 1099 amount?

I know it's sales + postage but what about eBay collected sales tax?

I'm so confused because my tax guy in the past said to included sales tax in my gross sales and then deduct it as an expense. And now I'm trying to do my taxes for 2021 and I'm having a VERY hard time find out what eBay charged in sales tax. Like I have to go through EACH transaction individually? There has to be an easier way!

And I'm even more concerned for 2022 taxes. I would like to start my books off "right" so my books agree with what eBay is reporting to the IRS. But I don't know if that includes the sales taxes or not?

Please help, I'm very confused at this point. Thank you!

Solved! Go to Best Answer

Accepted Solutions

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:36 PM

Prior to the Supreme Court decision many sellers were collecting and remitting sales tax for items they sold to buyers in their own state, if their state had sales tax. The ecommerce sites like eBay now collect and remit those sales taxes to the individual states so they are NOT included in your gross sales from the ecommerce sites.

However, if you are selling on sites like CL that do not collect and remit the sales tax then you would be required to collect and remit those taxes to the state(s). Those WOULD be reported in your gross revenue and deducted as an expense on your schedule C.

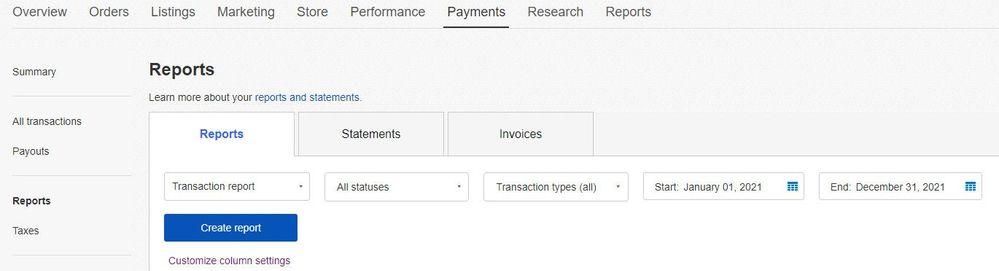

As an FYI there is a consolidated report you can pull from eBay that will give you your gross revenue for the year as well as the expenses including fees, shipping (actual cost), refunds, etc. From your seller hub using the Payments drop down select reports. Select Transaction report and set the start date at 1/1/2021 and the end date at 12/31/2021. Run the report and eBay will send you a message when the report is available to download. It comes as a CSV file which you can open and save as EXCEL. You can then rack and stack the data in whatever form you feel comfortable with. I generally make several tabs to separate, sort and total the data. There are some columns that you can hide or delete but I always keep a copy of the original data pull in the first tab.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:16 PM - edited 03-15-2022 02:17 PM

eBay's Help page about 1099-K says, "Form 1099-K does not include the sales tax when it is automatically collected and remitted by eBay."

https://www.ebay.com/help/selling/fees-credits-invoices/ebay-form-1099k?id=4794

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:36 PM

Prior to the Supreme Court decision many sellers were collecting and remitting sales tax for items they sold to buyers in their own state, if their state had sales tax. The ecommerce sites like eBay now collect and remit those sales taxes to the individual states so they are NOT included in your gross sales from the ecommerce sites.

However, if you are selling on sites like CL that do not collect and remit the sales tax then you would be required to collect and remit those taxes to the state(s). Those WOULD be reported in your gross revenue and deducted as an expense on your schedule C.

As an FYI there is a consolidated report you can pull from eBay that will give you your gross revenue for the year as well as the expenses including fees, shipping (actual cost), refunds, etc. From your seller hub using the Payments drop down select reports. Select Transaction report and set the start date at 1/1/2021 and the end date at 12/31/2021. Run the report and eBay will send you a message when the report is available to download. It comes as a CSV file which you can open and save as EXCEL. You can then rack and stack the data in whatever form you feel comfortable with. I generally make several tabs to separate, sort and total the data. There are some columns that you can hide or delete but I always keep a copy of the original data pull in the first tab.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:44 PM

Get a new tax guy.

How can you claim money never paid to you as income and then turn around and deduct it as an expense? That money goes straight to eBay who sends it to the state sales tax agency. It never comes anywhere near you.

Great Moms turn them off first.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:50 PM

@divwido wrote:Get a new tax guy.

How can you claim money never paid to you as income and then turn around and deduct it as an expense? That money goes straight to eBay who sends it to the state sales tax agency. It never comes anywhere near you.

You can do it either way, report the Sales Tax as part of your gross and deduct later or don't include in the gross and don't deduct later.

The net result is EXACTLY the same as far as income tax liability goes.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 02:54 PM

The problem is, and I'm aware of that, it is INCORRECT. That money never even references you by name or number, it is NOT income, no matter how eBay writes it up. Accounting is about making the numbers correct, not making a mess. Adding it adds more money to your income and it's not even true.

Great Moms turn them off first.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 04:34 PM

Your books should be your books and used to ensure the numbers eBay reports are correct. Sales tax in not gross income or adjusted modified income or net income. Get a new "tax guy".

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:24 PM

(...sorry to the OP...this is off the topic but it's somewhat related to sales tax...)

...once I dined at Sushi Deli in San Diego...when checked out, the waiter asked me if I wanted to add tip to the bill so he can run my card all-at-once...I thought it was convenience so I told him the amount of the tip (not bragging, but I'm very generous in tipping due to be business owner in food chains, I knew my helpers rely on tips beside wages)...before putting down my signature, I was shocked that the store charged tax on my tip...their explanation just liked eBay = total sales amount...

...I disagreed, forcing them to re-run a new bill, no tips added on bill but cash on hand...

...no way I would let Uncle Sam get his greedy hands on this matter...enough, period...!!!

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:33 PM

@divwido wrote:The problem is, and I'm aware of that, it is INCORRECT. That money never even references you by name or number, it is NOT income, no matter how eBay writes it up. Accounting is about making the numbers correct, not making a mess. Adding it adds more money to your income and it's not even true.

the difference in treatment is because of the difference in collection..........

BEFORE ebay began to collect sales taxes on a universal level.......sellers were collecting it themselves and remitting it to their individual states......... so a tax accountant would be correct in saying to count as income and then deduct as an expense because the seller actually collected and disbursed.

When Ebay began to collect it universally and remit to buyer's states, then it became accepted because of their disbursement for a seller not to have to "account" for the collection/disbursement......ebay shoulders that burden now.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:37 PM

Thank you. I think the reason I got into the habit of including the tax as part of the gross sale is because there was a time when eBay and PayPal were together and (if I remember correctly) the sales tax was included in the total amount of the sale. So I was including in in the gross, then deducting it, because I thought that was safer than using the gross amount minus the sales tax. It was because it used to be shown on the PayPal records so I figured it was part of the sale price. But now eBay is doing it's own payments and it's apparent that I probably shouldn't be doing that.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:40 PM

Thank you! That report was a little tricky to find (because you would think it would be under the "reports" tab instead of payments) but I did find it and printed it out. Thank you!

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:48 PM

So would it be safe to say the only thing I need to be concerned with as far as eBay income is concerned, is what they directly deposit into my bank account? If they take out seller fees for instance, I really don't have to worry about including that as income and deducting it because they already took it out before giving me my payment (similar to the sales taxes), correct?

So really, I just need to worry about what they are directly depositing in my bank account and don't fret over the taxes or seller fees, correct? That would make life easier!

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 07:54 PM

No, you have that backwards. If you get a 1099-K then it does NOT show just the amount that was deposited into your bank. You have to report the full 1099-K amount and deduct allowable expenses.

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-15-2022 09:52 PM

Thank you for your help. I really appreciate it. But I'm confused by this. If the 1099-K does not just show what was deposited into my account, then what else DOES it show?

I do keep track of all my expenses. It's just what goes into factoring the gross income I'm having trouble with. For instance, we already decided sales tax doesn't go towards my gross income since I never actually see it. Do seller fees count towards gross income and then have to be deducted? Or since eBay keeps that money and I never actually see it in my bank account (similar to sales tax), can I just disregard it for tax purposes?

Do eBay gross sales (1099) for 2022 include sales tax? I don't want my books to be a mess!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

03-16-2022 02:00 AM

@victoryranchtrails wrote: .... Do seller fees count towards gross income and then have to be deducted? ...

Yes.