- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- VAT being added to UK sales listings

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-22-2023 07:14 PM

I was born in the UK and lived there until 2017 before moving to the USA. I created an ebay.co.uk account in 2001 and still use it to this day to buy items from both countries without any issues.

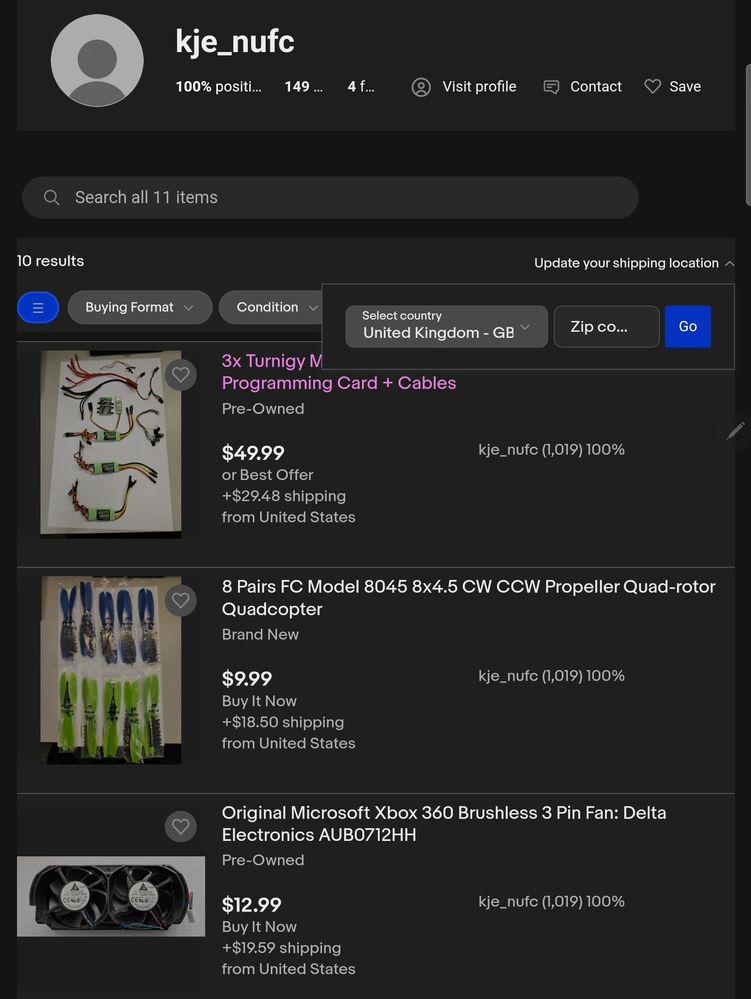

I have 100% feedback with over 1,000 purchases/sales.

I still have a home and bank accounts in the UK and during a recent visit there I listed some items that were gathering dust on ebay.co.uk to sell with prices listed in GBP (British Pounds). A prospective buyer reached out to me to today notify me that when they click Best Offer or Buy It Now, the listing then adds VAT to the item, increasing its cost by 20%. While the addition of tax after a sale is common in the US and is based upon the sales tax of the purchase state, the UK is different, the price you see is the price you pay. If a price tag on an item in a store says 20 GBP, you pay 20 GBP at the register.

My listing clearly shows that my items are listed in the UK so prospective buyers should not be charged VAT. Is there a way that I can prevent this from occurring? Or should I simply create a whole new ebay.co.uk account which has solely a UK address tied to it? I've seen other users try this, but because they reside in a different country to the one they are creating the account in (in my case I live predominantly in the US but would want to create a UK account) eBay thinks something fishy is going on and suspends/blocks the account. After working hard to achieve 100% feedback over the last 20 years it would be a shame to have to start a selling account from sctratch.

Any advice as to what the best course of action is would be greatly appreciated.

- Labels:

-

Taxes

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-22-2023 07:20 PM - edited 12-22-2023 07:23 PM

Your feedback shows you are registered in the United States that is why your UK buyers are being charged VAT. There’s no way around that unless you open a new account and register it in the UK. Then you’ll face another problem, your items will be coming from the states making you look like a drop shipper.

If my response is incorrect someone will be along to correct me.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 02:17 AM

This has nothing to do with where your account is registered it has to do with how eBay displays your listings on eBay uk.

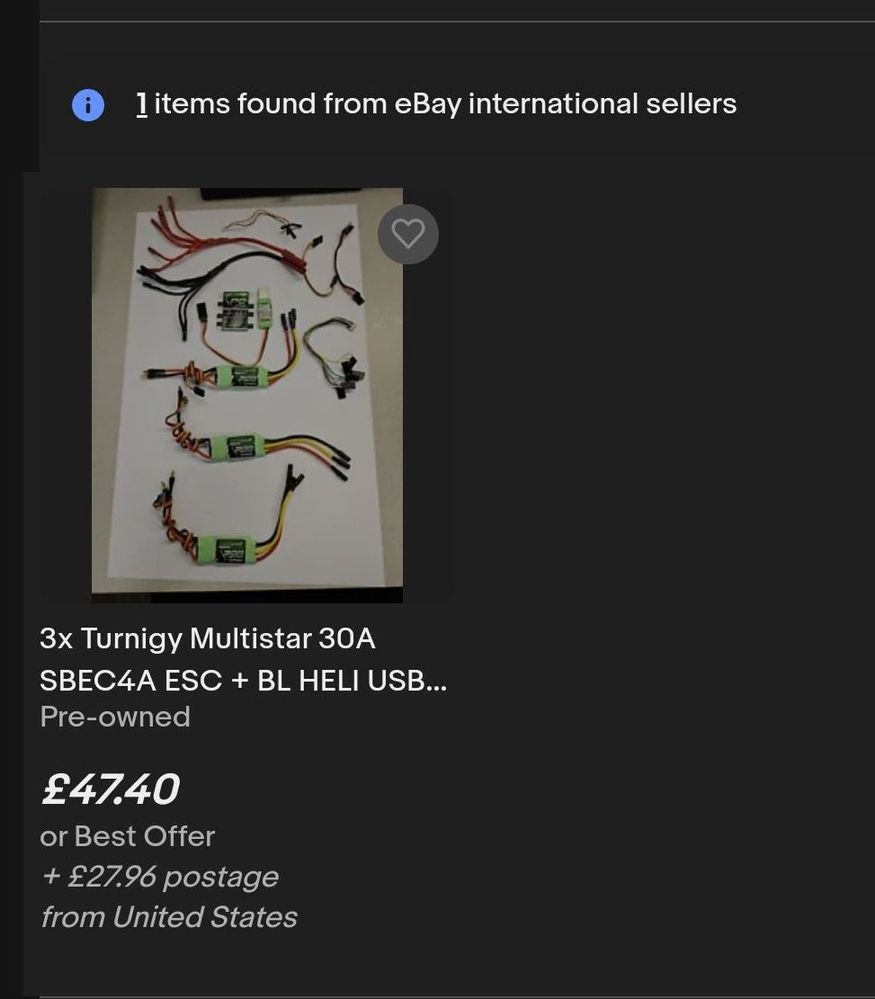

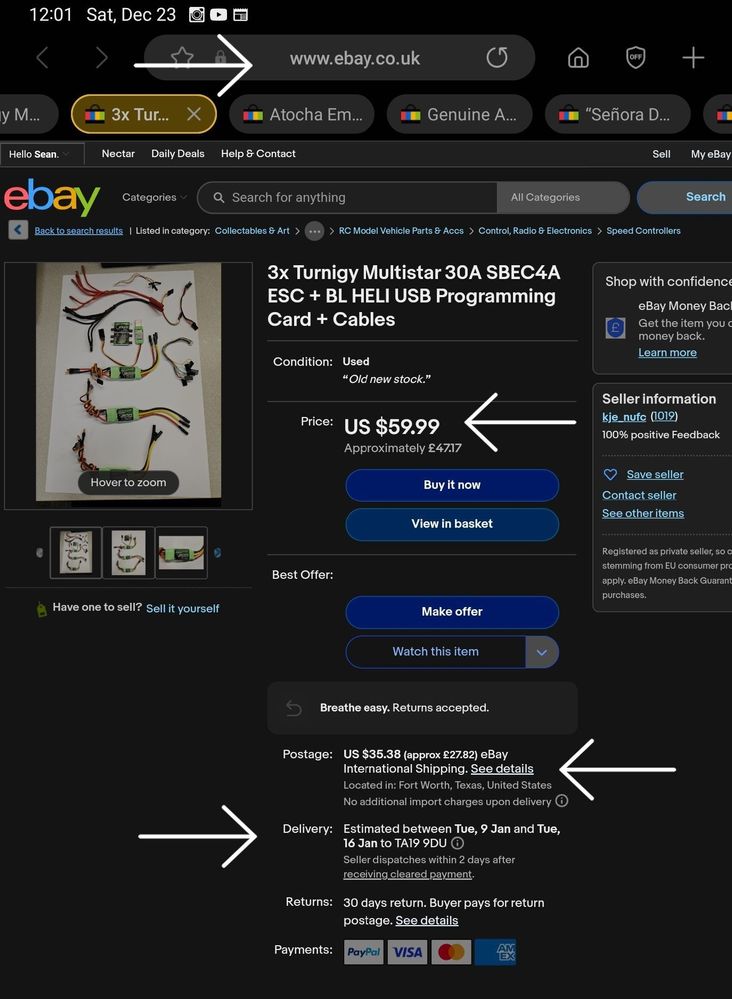

Here is your listing on eBay.com

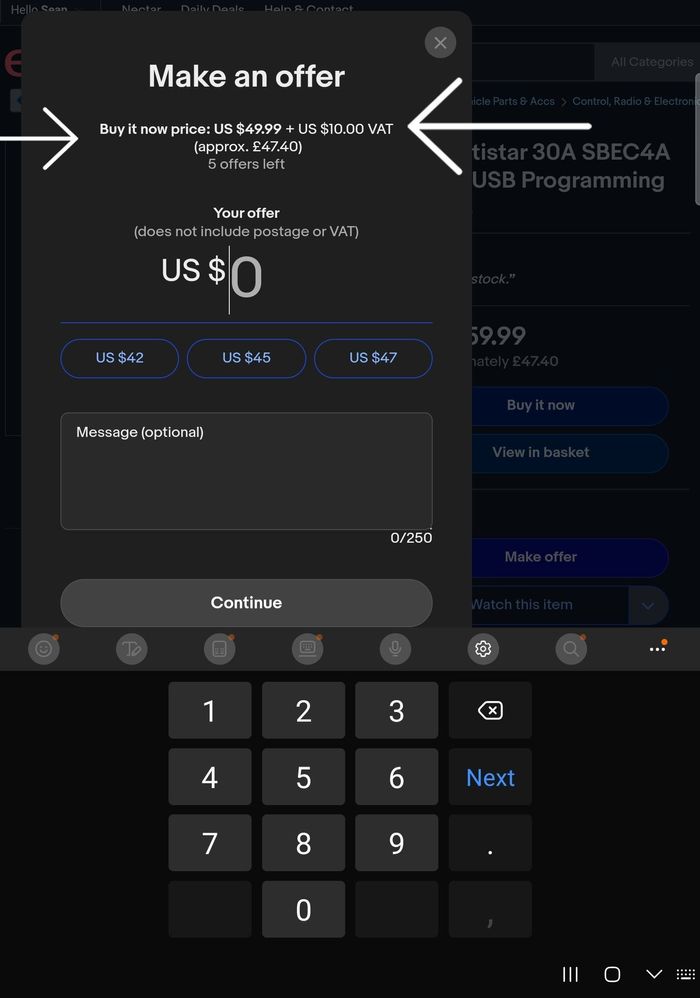

And here is how someone shopping on eBay uk sees that same listing. Notice that VAT has now been added.

ON eBay UK VAT has automatically been added but when a listing has best offer a buyer is then shown the price without VAT added so that they can make an accurate offer. It can be somewhat confusing for the buyer but it's the best solution that eBay was able to come up with.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 04:19 AM

Seller is in the United States, shipping from the United States so naturally a buyer in the UK will be charged VAT.

You just proved my point.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 07:14 AM

@kje_nufc wrote:

..I still have a home and bank accounts in the UK and during a recent visit there I listed some items that were gathering dust on ebay.co.uk to sell with prices listed in GBP (British Pounds). A prospective buyer reached out to me to today notify me that when they click Best Offer or Buy It Now, the listing then adds VAT to the item, increasing its cost by 20%. While the addition of tax after a sale is common in the US and is based upon the sales tax of the purchase state, the UK is different, the price you see is the price you pay. If a price tag on an item in a store says 20 GBP, you pay 20 GBP at the register.

My listing clearly shows that my items are listed in the UK so prospective buyers should not be charged VAT. ...

...

I understand what you are saying about how VAT is displayed in the UK, and how it is different from how sales tax is displayed in the USA.

However, your statement which I highlighted above in red, is not correct, or no longer correct. Since 2021, eBay has been required by law, to collect VAT on all purchases delivered to a shipping address in the UK, unless the seller is VAT registered, and is required to submit the VAT on their sales themselves.

Your account is registered on eBay.co.uk as a private seller, meaning you are not a business, and not VAT registered. Therefore, eBay assumes that the price you set does not include the VAT, and eBay adds on the 20% VAT so that the price shown to a potential buyer on eBay.co.uk includes the VAT as it is supposed to.

When your listings are viewed on eBay.com (eBay USA), but with a delivery address in the UK, the VAT is shown as a separate line item because eBay.com displays it the way sales tax is normally shown, separately, and added on at checkout.

As far as I can see (and the other responders) all of your listings were made on eBay.com, and the locations are shown as Fort Worth, TX. I searched on eBay.co.uk, but I couldn't find any listings on that website. If you could share the item number of one of your listings on eBay UK, we could take a look for you.

However, either way, the assumption that UK buyers do not have to pay VAT on items that are located in the UK is a misunderstanding. That is not the case anymore. On eBay UK, VAT is included in the purchase price (and so is transparent) and on eBay USA, VAT is shown as a separate line item like sales tax, as @go-bad-chicken showed. But the bottom line price is the same, either way.

eBay VAT information from the buyer's viewpoint:

https://www.ebay.co.uk/help/buying/paying-items/paying-tax-ebay-purchases?id=4771

From the seller's viewpoint:

https://www.ebay.co.uk/help/selling/selling/vat-obligations-uk-eu?id=4650

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 07:19 AM - edited 12-23-2023 07:20 AM

@ebooksdiva wrote:Your feedback shows you are registered in the United States that is why your UK buyers are being charged VAT. There’s no way around that unless you open a new account and register it in the UK. Then you’ll face another problem, your items will be coming from the states making you look like a drop shipper.

If my response is incorrect someone will be along to correct me.

Sorry, @ebooksdiva, but that is incorrect.

eBay is required to collect UK VAT on all purchases that are being delivered to an address in the UK, no matter where the items are being shipped from, or where the selling account is registered. You can check the links in my previous reply.

It is not possible any more to tell which website an account was registered on, because the registered address does not necessarily match the website. So there is no reason to think that OP is not correct that his account was registered on eBay UK.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 07:29 AM - edited 12-23-2023 07:34 AM

Ok thanks…

I naturally assumed since I’m in the US registered in the US and my item is being shipped from the US that my UK buyers are being charged VAT. So I assumed it’s the same for the OP since their items are coming from the states to the UK.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 09:46 AM

The situation is a little different to what @ebooksdiva wrote, essentially

The item listed is located in the UK and is being sold to a UK only audience. It's not coming from the US and being posted to a UK address, it's strictly a UK to UK transaction.

What is interesting is that when I lived in the UK I would sell on eBay routinely and the price I listed the item at (if we exclude postage to keep things simple) was the price the buyer would pay.

I just ended up creating a new eBay account so my Us and UK accounts are totally decoupled from one another to avoid this issue completely. It's a shame I had to do this as the 100% feedback thousands of completed transactions are lost for UK sales, as I essentially start from 0, which will likely dissuade buyers, but it's all I can do.

Thanks to @lacemaker3 @go-bad-chicken @ebooksdiva for all of your support. I'm glad I was able to resolve the situation.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-23-2023 09:56 AM - edited 12-23-2023 10:01 AM

@kje_nufc wrote:

...

What is interesting is that when I lived in the UK I would sell on eBay routinely and the price I listed the item at (if we exclude postage to keep things simple) was the price the buyer would pay.

...

Thanks to @lacemaker3 @go-bad-chicken @ebooksdiva for all of your support. I'm glad I was able to resolve the situation.

From what you said before, you were living in the UK up until 2017. That was 5 years ago, so any sales you made back then don't show the price or currency on your feedback page any more. At that time, eBay wasn't required to collect VAT on purchases that were shipped to addresses in the UK. This is a change that happened a few years ago; in 2021 if I recall correctly. eBay UK will send the VAT they collected to the government for the sale.

If you registered your new account on eBay UK as a private seller, then eBay is still collecting VAT on the sales. eBay will increase the price you entered by 20%, so that buyers see the selling price including VAT. Exactly the same as was happening with items listed on your previous account.

So there was no need to register a new account. It doesn't change anything.

You will have to register your new account with managed payments to receive payment, providing a bank account at a UK bank, with your name and address on it. All the information on the bank account has to match exactly to the info on your eBay account.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-27-2023 05:19 AM

Hi there, an update on an increasing frustrating/infuriating situation...

As advised by others on the forum I created a new eBay UK account and listed 4 items.

2 sold, payment via Buy it now. 1 collected by the buyer, the other ready to be posted.

Yesterday I receive a notification that my account has been suspended and to call eBay to provide additional information, which I did. I'm now told that my account will not be unlocked nor will I have access to the funds for the items I sold, but no reason has been given for this. Absolutely ridiculous.

I won't be sending the second item I sold because I will have no means of receiving the money generated for its sale. I sent a message to the buyer of the 2nd item and "refunded" them as it was the right thing to do. I'm presuming those funds will come from the money eBay is holding onto and I won't be double charged, but at this point I've lost all confidence in eBay's ability to handle things with integrity so they will probably charge me for that too.

Obviously the first sale I made is a complete write off, the buyer has their item already and I have no funds for it. So I essentially gave someone a free Xbox...

A total fiasco from start to finish, but I appreciate the advice I've had on the forum.

If anyone knows someone at eBay customer services that can help me resolve this situation that would be greatly appreciated.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-27-2023 05:40 AM

@kje_nufc, I'm sorry this happened, but it should be possible to get through it.

Nobody here advised you to an open a new account. Unfortunately, when a brand new account is opened and then immediately jumps into listing and selling high-priced items, this frequently happens. It is usually just necessary to provide proof of your identity.

What, exactly, did the message from eBay say? What information did they ask for?

If your account in the UK has been linked to this account in the USA, then that could be an issue. They may be suspicious since both accounts are actively selling in different countries. So that's another red flag, unfortunately.

FYI, new or infrequent selling accounts are normally subject to payment holds of up to 30 days. So the payment probably would not have been released immediately, at any rate.

For the item that was picked up, did you offer local pickup on the listing? Did you scan the QR code or enter the 6-digit code from the buyer to prove that it had been collected by the right person?

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-27-2023 05:55 AM

Thanks for the advice. The message I received stated that "you have been temporarily restricted from buying or selling because of concerns on your ebay account".

They asked me all manner of questions, ID, phone number, address, birth date, items I was selling and my intentions for use of eBay. Then they claimed their "automated system" had determined that my account is not eligible to be re-opened. When I asked why this was so, so that I could show I had nothing to hide and only honest intentions I was told that eBay aren't allowed to disclose the reason. Which I find outrageous.

Naïve from me but I did not receive the two micro transactions into my bank account to verify my payment receipt source yet and it's been way over the stated duration so I guess I won't be receiving those either...

For the item that was picked up, indeed it was local pickup and I did provide the 6-digit code, so everything is above board and the item is showing as picked up.

While I acknowledge that eBay may be taking exception to something (it would be helpful if I knew what that was instead of all of this cloak and dagger nonsense) the reality is I made a genuine sale, provided the buyer with goods and now am out of pocket for funds owed to me by eBay. I would have no issue if they blocked future purchases or transactions, but it's total hypocrisy when eBay is happy to receive commission from a purchase, yet not pay out to the seller.

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-27-2023 06:32 AM - edited 12-27-2023 06:36 AM

With a "temporary restriction" it is possible to get it lifted, but it's very hard to help you when you don't answer questions. We need the information we ask for, to be able to help you.

I found a couple of listings (an X-box and a PlayStation) that you had originally posted on this account on eBay UK and then ended, and I found the X-box listing that you relisted and sold on the new account on eBay UK. I have to admit, that looks very suspicious. It looks like your account (this one) has been hacked, taken over by a hijacker.

A small, fairly inactive selling account like yours, is a prime target for hackers. Once they get in, they take steps to make sure their scam listings are hard to spot for the account owner. Posting the listings on a different eBay website is a great way to hide the listings, and make it hard for them to be detected. Then, ending the listings on this account makes it look like you found them, and took steps to get rid of the hacker, and then the same items, with the same photos and description, same location in the UK, are relisted on a brand new account just created the same day on eBay UK. Oh yes, that looks very suspicious.

Now you know why your UK account was suspended. When you spoke to them, you probably sounded offended, and used words like "outrageous" and " cloak and dagger nonsense", which is exactly how a hacker would sound because they were trying to avoid suspicion. In this situation, of course they're not going to tell you what the red flags were, that would just teach you (a hacker) how to avoid detection in the future.

Maybe (just maybe) this account is OK, but the one that was just created on eBay UK really looks like a hacker. However, it has not been made NARU (not a registered user) yet, so it may be possible to salvage this situation

So, having explained why this is happening --

I see that the Xbox listing on your new account did have local collection as an option (good). However, it is not showing up on eBay Terapeak research as a sold listing, which it should be since it was paid for. That makes me wonder about the current status of that transaction.

Are the funds showing as being on hold?

Or has eBay cancelled the transaction?

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-28-2023 08:18 AM

I searched for more info about this on the eBay UK community, and it appears that eBay there is just as adamant about confirming identity as they are here in the USA. Sellers report that they have to provide copies of utility bills in their name; based on your story, you won't be able to do that since you haven't lived there for 5 years. The UK government is requiring eBay to collect Know Your Customer information, and also to report income information for tax purposes, as I understand it.

I haven't been able to find out what happens in the UK to funds that eBay can't release to the account owner. I expect that there will be a method similar to the states' abandoned funds here in the USA. If only because USA common law is based on English common law in all states except for Louisiana.

I was able to find the transaction for the box the buyer picked up on Terapeak, so it hasn't been cancelled or removed by eBay. That's a good sign.

Here are some threads from the eBay community in the UK, with advice from experienced responders there on what to do in this situation. If you post there, you should use the account you opened on eBay UK.

A thread posted yesterday from a new seller in the same situation:

A thread from earlier this year, which suggests that failure to adequately prove your identity (to the UK government's standards) may be the cause. Also that the funds will be released after the risk of chargeback has passed (probably a total of 6 months, or 180 days):

You can also try contacting eBay through their Facebook or Instagram accounts with your explanation. Those reps have more power than the call or chat reps do and maybe they could talk to the proper people (in the U.K. ?) to resolve the situation.

https://www.facebook.com/eBayForBusiness/ — Message button in upper right on landing page.

https://www.instagram.com/ebayforsellers/

VAT being added to UK sales listings

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-28-2023 09:08 AM

Thanks for sharing the additional information.

I can easily provide UK bills, I still have a home there so have any bill they want (council tax, water, electric, gas, bank statement, you name it). However, these were never asked of me.

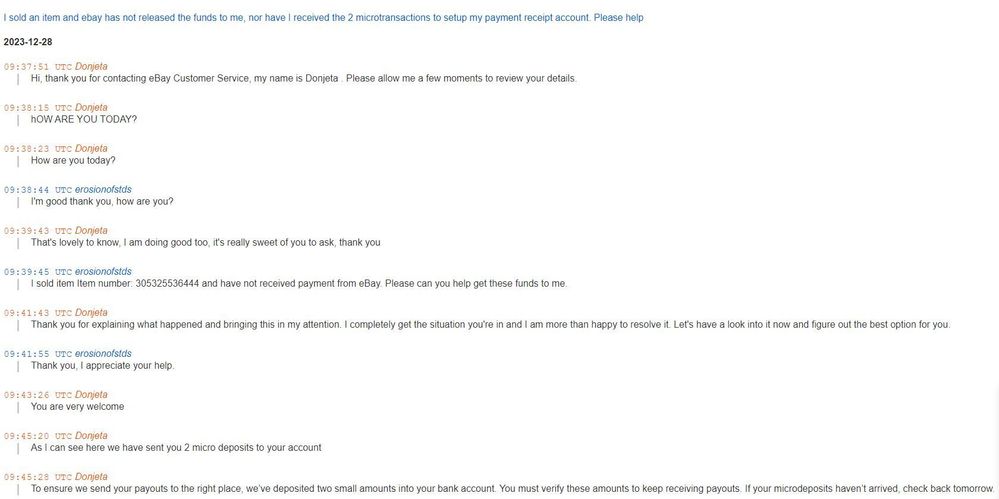

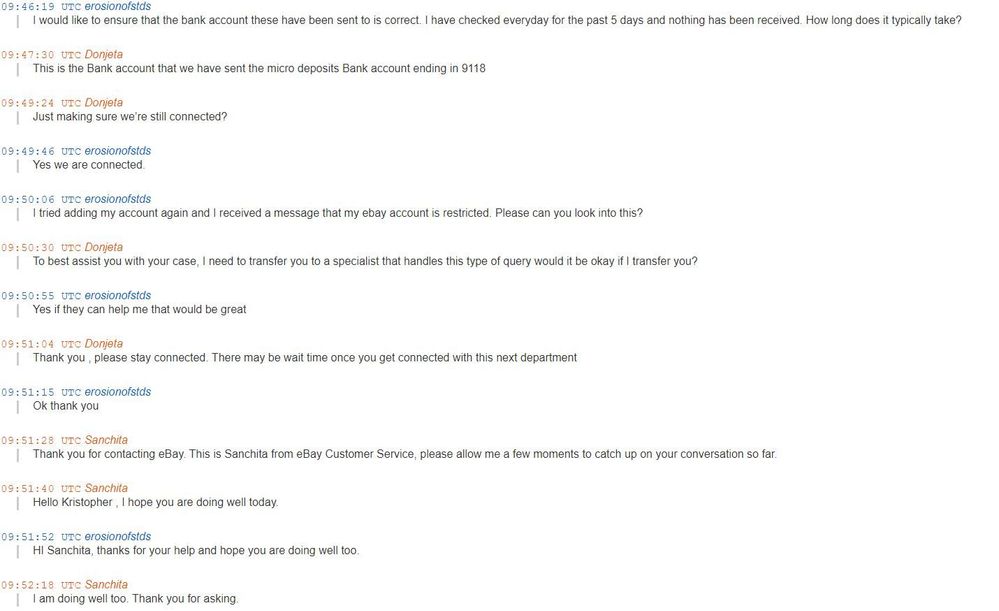

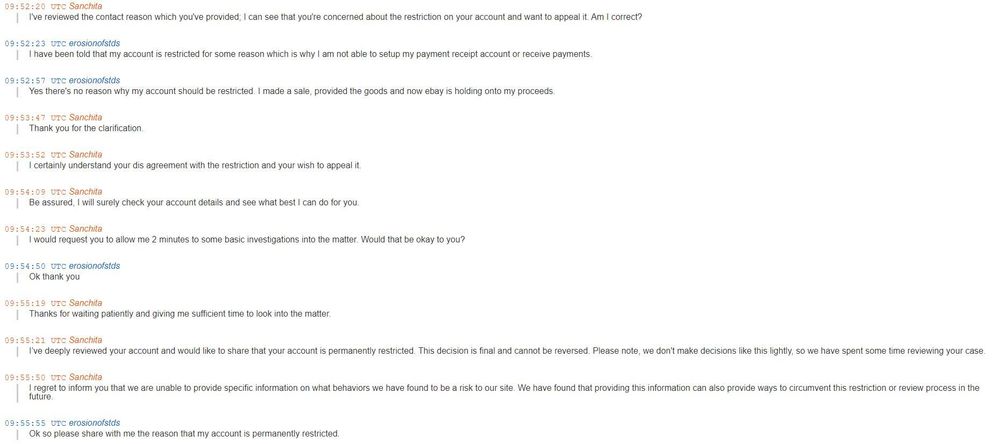

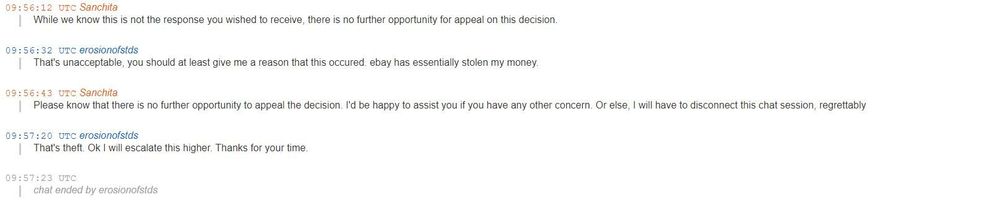

I again attempted to resolve the situation through live chat, their phone system wasn't working, I've attached a copy of the transcript to share with you.

Moral of the story is that my account is permanently suspended and eBay will not provide a reason for its suspension. Furthermore I am not able to appeal the decision and my funds will be held hostage by eBay as a result.