- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Is an Uber Ride to the post office Tax Deductible?...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 03:06 AM - edited 09-19-2023 03:06 AM

This is a serious question I pondered on my Uber ride home from the post office today... sellers often talk about gas & mileage to & from post office being tax deductible... what about cost of an uber ride? My thoughts are yes, it is deductible.

Please don't tell me to consult a tax professional. I'm not truly/seriously seeking tax advice. I'm sharing a question that crossed my mind today.

Unnecessary, but to answer the potential question... Normally I walk, ride my bike or drive to the post office. Driving wasn't an option today and I had a 40+lb package I NEEDED to pick up ASAP, so I walked there and Ubered home...

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 03:53 AM

I would at least try to claim it. The only problem is getting a receipt. During an audit, they'll ask for a receipt.

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 03:58 AM

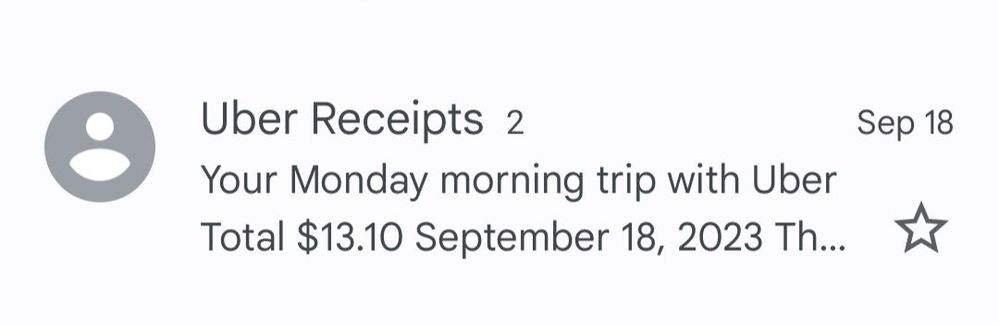

Uber emailed me a receipt immediately after the ride. This is from my email inbox.

But as with everything, there are always records of "orders" and "payments" on any online account you have. Can always print an invoice or "receipt".

Uber isn't a traditional taxi service (call for a cab or stand on the curb in the city and stick you hand out), it utilizes an online account (i.e. paper trail).

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:12 AM

It is deductible and I have done it on a couple of occasions when my car has been in the shop and I needed to get things to the PO.

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:30 AM

Anything, absolutely anything you do that involves your business and cost's money or mileage is tax deductible. I write off the most I possibly can every year and that includes uber trips if needed, meals, car washes, storage, mileage from sourcing etc... etc... so yes you can. I also drive uber in the winter months as well and I pick up a decent amount of business people and they all write it off, as I've asked them about it.

Also, not a tax professional, no idea what I"m talking about and not tax advise.

Crazy how we even have to say that in the first place.

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:31 AM

You betcha!

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:36 AM

Exactly what I figured. Was probably going to write it off regardless 🤣 I was feeling extra stingy when I saw the price. I mean $13 isn't bad to go pick up about $6,000+ in new inventory a day or two sooner than I would otherwise, but the $13 was still bugging me so I figured I gotta squeeze something out of it.

Haha, well, I figure everyone wants to CYA and say they aren't a CPA. I made sure to put it in my OP so I didn't get a laundry list of replies saying "consult a CPA, stop asking us". There is a distinction between legal/tax advice & academic conversation. This falls into the latter (or was intended as such).

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:39 AM

You can schedule online for the USPS to pickup packages at no fee's for the services.

Is an Uber Ride to the post office Tax Deductible? 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-19-2023 04:49 AM - edited 09-19-2023 04:51 AM

Thanks, I'm aware of it and do use that as needed.

This was me picking up a very large package from a PO Box, not me dropping packages off.

Edit: Okay, actually I did drop packages off... I walked there, usually walk or bike. I needed the Uber on the return trip because there was no way I was carrying a 42 lb box 3.5 miles home by walking or biking.