- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Report eBay Technical Issues

- Multiple reports of people being charged/overcharg...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-19-2020 11:02 PM - edited 12-19-2020 11:04 PM

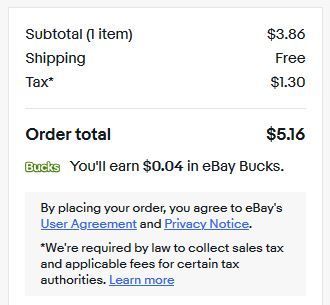

Long time user here. There are various threads popping up this week in the Buying community of people seeing high taxes charged for various types of items that far exceeds state taxes. In my case I kept seeing 33% sales tax for button cell batteries, but not for all battery sellers. In some cases it was the correct 8% sales tax for me. Other purchases I made in other categories seem to be unaffected.

Go back and check the sales taxes on your recent purchases.

Other threads I found:

https://community.ebay.com/t5/Buying/363-sales-tax/td-p/31447157

https://community.ebay.com/t5/Buying/Sales-tax-on-bullion-coins-in-washington-state/m-p/31447295

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-20-2020 11:32 AM

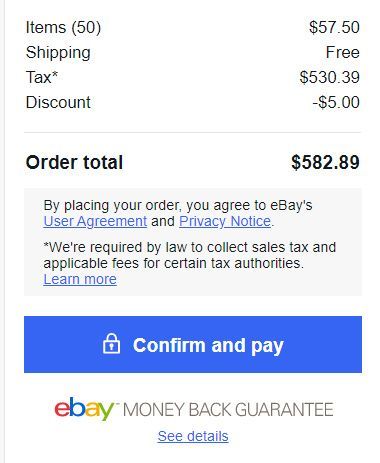

Adding myself to this thread.

Once you add multiple items to your cart it can look really crazy.

50 batteries at $1.15 each = $530 in taxes

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-20-2020 11:47 AM

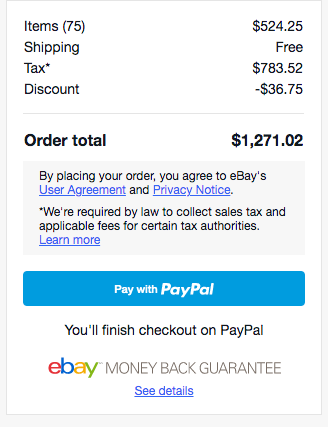

What I have been able to figure out so far for me (Though seems to be different for people in other states)

is it is adding a $10 fee per item + the correct 5%

I suspect it might have something to do with a lead acid fee for my state (Wisconsin) But that is only for the kind of batteries you might use in a car.. The big heavy kind.

This should not apply to single use household batteries. Flashlight batteries, watch batteries, etc.

However, it does not seem to be affecting every single seller. Only the majority of them.

2 sellers in the same category and the same state can show a different tax amount.

Overcharging for sales tax is the sort of thing that class action lawyers get really excited over. So would be a good idea to get to the bottom of this quickly. If this is indeed a legitimate fee, there should be a disclaimer explaining it.

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-20-2020 12:45 PM

We are experiencing the same issues. It may seem like eBay is currently have a glitch that includes all batteries (any sort) to have a lead-acid fee? or correct me if im mistaken

just to be clear. so far its New York addresses and Minnesota addresses. any other address to the best of my knowledge - this overcharge tax does not occur

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-21-2020 08:55 AM

Another update.. It seems that listings I was able to find and purchase from that did not have the incorrect tax now all have the tax added.

It now appears that as far as I can tell everything in the single use battery category is overcharging taxes.

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-21-2020 09:29 AM

I just checked "c" batteries to PA..........just the normal 6% tax...........

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-21-2020 01:42 PM

Just checked here and it looks like the correct 5% is being applied.

Seems the problem has been solved!

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-21-2020 07:31 PM

Just started a few days ago, and I am still being charged sales tax for numismatic purchases which are tax exempt.

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-15-2021 09:05 PM

eBay has overcharged me for sales tax (I am the buyer) form out of state sellers to Illinois, even though I am in Chicago, which does have a 10.25% sales tax however when a seller, retailer et al do NOT have a physical presence in Chicago the buyer, me, should be charged 6.25% sales tax. I have written numerous emails to them and phoned them. The overcharges started in 2021 and there has been no change in the sales tax structure in Illinois or Chicago.

I first noticed this when I bought a $500+ item and have since reviewed everything that I have purchased from eBay and not only are they overcharging, but they are in fact exceeding 10.25%.

I am furious as well as frustrated, I do not know which government agency to contact. Does anyone on here know whom I should call? I am thinking class-action-lawsuit

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2021 05:25 AM

Don't know if this works...........but have seen reports that if your registered address zip code has the extra 4 numbers, the local tax will be charged.........without it you are charged the state rate.

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2021 06:38 AM

The base sales tax rate in Illinois is 6.25%, but there are RTA, local and county taxes in Chicago, depending on your exact address. See here:

https://www.avalara.com/taxrates/en/state-rates/illinois/cities/chicago.html

Illinois did make some changes to the Retail Occupancy Tax rules regarding facilitators that went into effect January 1st. See here:

In addition, Illinois charges sales tax on the shipping, so be sure to take that into consideration when calculating your sales tax rate:

https://blog.taxjar.com/sales-tax-and-shipping/

More discussion of Illinois here:

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-21-2021 08:39 PM

I'm also from Illinois. I just went to buy an item for $159 and the tax was 12.72 which seemed a bit off. Looked into it and you're right, our state internet sales tax is 6.25%. Ebay was going to charge me 8%. It's only a difference of $2.79 but it's the principle of it plus why should I pay more than it's suppose to be. Who ends up with that overcharge? Why can't ebay get it right?

Multiple reports of people being charged/overcharged for sales taxes... Check your purchases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-21-2021 08:45 PM

Illinois collects tax on the shipping you paid, as well.