- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Q4 Earnings Report Comes Out Today

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 11:52 AM

Based on the unexpected Winter Seller Update it should be interesting. I encourage everyone to read through the call log when it's posted. Not that it changes anything however you can see the direction Ebay is going to take and what is up and coming.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 11:58 AM

Agree that the 4th quarter 2021 report should be interesting but what I am really waiting to see is the first quarter of 2022 and any impacts the Federal 1099 reporting requirements along with the fee increase is going to have on the active seller population although that may be hard to ascertain since eBay does not separate the individual market details, i.e. the U.S. sellers from the other geographic eBay sites. I do know from past reports that about 1/2 of eBay's revenue comes from foreign markets.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 12:15 PM - edited 02-23-2022 12:19 PM

@dbfolks166mt wrote:Agree that the 4th quarter 2021 report should be interesting but what I am really waiting to see is the first quarter of 2022 and any impacts the Federal 1099 reporting requirements along with the fee increase is going to have on the active seller population although that may be hard to ascertain since eBay does not separate the individual market details, i.e. the U.S. sellers from the other geographic eBay sites. I do know from past reports that about 1/2 of eBay's revenue comes from foreign markets.

eBay has a P/E ratio of 3.

That generally means investors think the business will last about 3 years at current levels. That's how the market has it currently priced.

Of course, there could be other factors but there just does not seem much to be excited about. I hope they defy expectations on that. But innovation is badly needed.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 12:58 PM

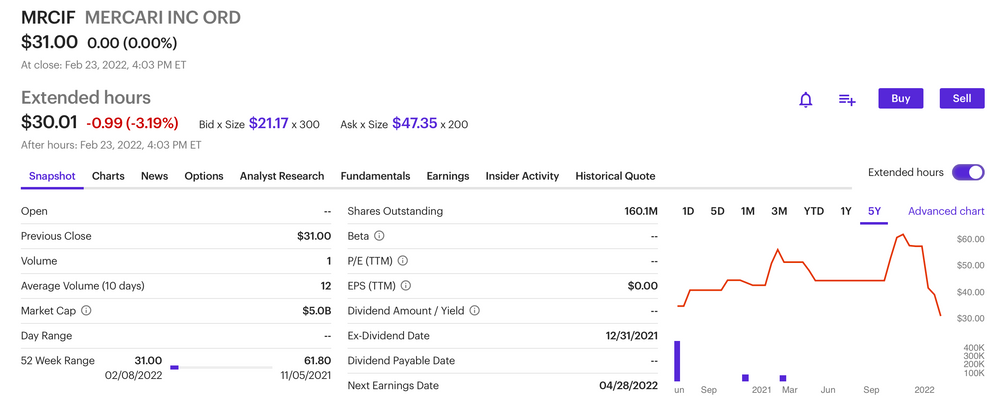

Agreed but not sure the P/E ratio equates to how long a company will survive it's more about their stock price and the earnings potential. EBay's P/E at 3 compares to Amazon at 47, Esty at 76 and Mercari at 407. There's a message there somewhere.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 01:11 PM

@dbfolks166mt wrote:Agreed but not sure the P/E ratio equates to how long a company will survive it's more about their stock price and the earnings potential. EBay's P/E at 3 compares to Amazon at 47, Esty at 76 and Mercari at 407. There's a message there somewhere.

People generally look at return in terms of years. The market thinks eBay is good for it's current earnings level for 3 years.

Probably equally wrong as Mercari current earnings being good for 407 years.

If it sounds crazy, think about a small business which earns(profits) 200k per year. If you thought it would continue to make 200k per year for the next 20 years, what would you pay for it today?

General idea is 10x, or a p/e of 10. More if you want to own it for longer than 20 years or see more upside in the current earning potential.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 01:22 PM

@dbfolks166mt wrote:Agreed but not sure the P/E ratio equates to how long a company will survive it's more about their stock price and the earnings potential. EBay's P/E at 3 compares to Amazon at 47, Esty at 76 and Mercari at 407. There's a message there somewhere.

Actually a correction to my earlier message. I looked, and

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 02:50 PM

Fully understand the P/E ratio the one issue has always been nothing will remain constant of any length of time when it comes to the market and value indicators. With a P/E of 3 it would indicate that it would take 3 years to recover your initial investment in the company so on the surface the stock appears to be a good buy, aka cheap. However that is not the only ratio or factor investors look at and it goes without saying that that ratio is not going to hold constant for 3 years. In contrast Amazon is on the expensive side of the PE ratio and Mercari is in another world. The P/E ratio is just one factor in playing the market and while a lot of investors use it as a starting point the smart ones take more of a macro rather than a micro view.

If there was one magic formula none of us would need to sit here and sell on eBay we could all just be day traders and rich ones at that.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 02:51 PM

Exactly and that is one of the flaws in just looking at the P/E ratio.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 03:04 PM

Day trading is just gambling.

I'm a fan of p/e when evaluating an investment. If it's too cheap as in Ebay's case, you need to be aware of why. Too expensive and you need to see if p/fe truly justifies it or not. Usually doesn't.

Balance sheets are a pretty good magic formula.

Q4 Earnings Report Comes Out Today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-23-2022 03:18 PM

@dbfolks166mt P/E is measure of today the multiple of the earnings per share to today's stock price. A stock with $1 in earnings per share selling for $30 is a p/e of $30. It does not indicate how long it will take get a return. Looking at future P/E might give a look.

A comfortable P/E is subjective to a stock. If you have a growth company, and Amazon remains a growth company, then the P/E is very much based on maintaining growth and can be a crazy multiple. If growth slows the stock drops. Some grwth companies with rising stock prices don't even have profits. eBay appears to be a maturing company and while it would need to grow earnings to increase its stock price. It would not be expected at this point to grow earnings by 20-30% a year as some growth companies might do. eBay might grow earnings by cutting costs or raising fees or some combination (fees have already been raised). Might try to grow through acquisitions (though that hasn't worked so well for eBay has it). It might try try and reinvigorate growth by aggressive customer acquisition of some form. eBay might maintain its stcok price and investor interest by returning more in dividends.

No one can fully predict. All I know that eBay once a market disruptor and engine of growth has become a follower.