- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Internet tax death of ebay

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 09:42 PM

WOW, Just WOW. Used clothing being taxed. Items from China being taxed. Who on earth is going to buy used clothing or poor quality items from China that can't be returned when you have to pay $20 tax? I mean for real? Why is used stuff being taxed when it was taxed the first time it was sold? What's next? Will Garage sales charge tax? I can't believe our elected officials allowed this to happen. I can understand tax on large businesses but small time people selling used stuff out of their closet is crazy.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 09:50 PM

ebay should have lobbied harder with lawyers to prevent this from happening. i was about to buy an iphone for $450. get to checkout and i see sales tax for $39. insane. that's just free money i have to give to the govt. when ebay is a FLEA MARKET. WHO pays sales tax at garage sales and flea markets? this is all second hand stuff other people do not want. obviously i passed. i can no longer buy expensive items because the benefit of doing so on ebay has vanished. i can just pay the tax in real life and save on shipping anyway by being there in real life. i feel terrible because ebay is of course not at fault although they could have done better with lobbying against this law. i guarantee sellers will be hurt, not just buyers.

most buyers will shift to online flea markets such as offerup and craigslist. that's the only way you would get some real discount for buying used items.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 10:23 PM

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 11:18 PM

And then, when the United States Government reports how deep in debt the USA as a country has gotten, that is also their fault? How exactly are they supposed to pay their government employees, lets just say nobody should have to pay any tax...

Right?

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-05-2019 11:21 PM

@classicsuperette wrote:ebay should have lobbied harder with lawyers to prevent this from happening. i was about to buy an iphone for $450. get to checkout and i see sales tax for $39. insane. that's just free money i have to give to the govt. when ebay is a FLEA MARKET. WHO pays sales tax at garage sales and flea markets? this is all second hand stuff other people do not want. obviously i passed. i can no longer buy expensive items because the benefit of doing so on ebay has vanished. i can just pay the tax in real life and save on shipping anyway by being there in real life. i feel terrible because ebay is of course not at fault although they could have done better with lobbying against this law. i guarantee sellers will be hurt, not just buyers.

most buyers will shift to online flea markets such as offerup and craigslist. that's the only way you would get some real discount for buying used items.

What makes you believe that Ebay didn't work very hard on preventing internet sales tax? Do you say that because they weren't successful or do you know about something specific they didn't do?

If you buy that phone locally for yourself, you will have to pay sales tax. So what is the difference of paying it on the internet?

Ebay outgrew "flea market" status many years ago. Now with over 6.7 million active sellers in the USA and over 25 million active sellers worldwide, the "flea market" days are long gone.

"i can no longer buy expensive items because the benefit of doing so on ebay has vanished. " If you are basing your decision about this solely because Ebay is having to charge sales tax, you are going to be very disappointed to find that just about anywhere you go on the internet to buy stuff now, you will be paying sales tax. This is NOT just on Ebay. The Supreme Court ruled last year on this subject.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 03:52 AM

If you didnt know we elected the Great Tax Collector 3 years ago and hes just doing what he was born to do

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 06:47 AM - edited 06-06-2019 06:47 AM

you didn't mention (or notice probably) that even the shipping fee is being taxed.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 06:58 AM

If you buy used clothes from a thrift store they are certainly taxed. Used comic books from the comic book stores are taxed. Used books from a book store are taxed. I don't really understand why you expected used items to be exempt on eBay.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 06:58 AM

What concerns me is that we may be taxed on items that are NOT taxable in our respective states.

I've noticed a few things in my own purchases, so I am going to wait and see if anyone else experiences it. Right now, I think no one has really taken notice. While I have no objection to paying the proper taxes I'm concerned about being charged for items considered non-taxable in my state. Sometimes when I feel I am working to support everybody but myself. For now, I'm keeping a tab on how much I pay and on what.

Admittedly, there is very little in MY state that ISN'T taxed. Prescribed medicines aren't but band aids are, food isn't but snacks, prepared foods and restaurant meals, sodas and the like are. Storage space is taxed, as are health club memberships. There doesn't seem to be any info about getting any erroneous charges refunded, either.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 07:42 AM

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 07:44 AM

Ebay needs to notify buyers and sellers of these new taxes. The message is not getting out.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 07:50 AM - edited 06-06-2019 07:51 AM

there is and has been a vat tax in europe they didnt implode our city will tax you at a flea market or a garage sale if they catch you selling anything doesnt stop anyone from selling or buying. seems like you should do some research before you make a blank statement like that. guess what things cost money so unless you want to die from hunger naked im pretty sure you will pay what it costs

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 08:28 AM

ebay should have lobbied harder with lawyers to prevent this from happening.

{snip}

eBay is of course not at fault although they could have done better with lobbying against this law

South Dakota vs. Wayfair et. al. was a Supreme Court case, not a "law". There is no way to "prevent" the Supreme Court from rendering a decision.

eBay did "lobby with lawyers", however. They filed a 50+ page amicus brief, which is really the only way a third party can "lobby" the Supreme Court of the United States.

most buyers will shift to online flea markets such as offerup and craigslist

That has been a regular prediction on eBay for the past couple decades. But I am skeptical that people will get in a car and drive across town to meet someone in a McDonald's parking lot just to a buck or two on a $50 item.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 08:34 AM

If you read the eBay policy, it says when a return occurs the tax will be refunded. I haven't bought something that needs to be returned.

I do know they do tax everything because there system cannot figure out what is taxed and what isn't. In my state clothing is taxed but it is a different tax than everything else and it is only taxed over a certain amount per garment as it is not a sales tax but an excess tax, aka only expensive clothing not a $10 tee shirt at the drug store but a few hundred dollar shirt is! eBay also has food which some is taxed and some isn't: Soda and water are but tea and coffee isn't. They need to figure this out fast or they could find themselves in real trouble because we, the buyers can call our tax revenue department or what ever it happens to be called to complain about a merchant not taxing stuff correctly.

Internet tax death of ebay

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2019 08:48 AM

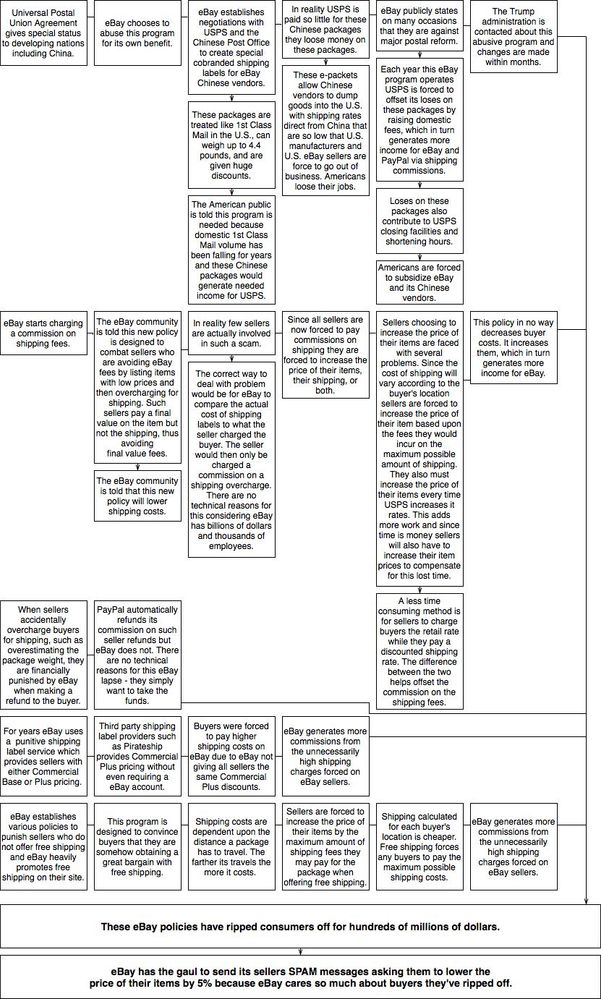

Far more concerning are shipping costs, which eBay has caused to go up.

The purpose of these eBay efforts to drive up shipping costs is to generate more profits so that eBay manager's can get their their bonus pay. That is all eBay cares about!

The long term effects of these efforts is that less and less items become viable to sell on eBay as shipping costs are too high.

I moved most of my inventory off eBay years ago due to eBay's efforts. I make more money that way.

This diagram is missing eBay's sale of third party insurance on its site, which further denies USPS of income. Insurance was one of USPS's profit making areas, which they will have to make up for by raising rates.

Taxes are only a percent of the purchase price whereas shipping costs can easily exceed the price of the item.