- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Deduct sales tax already paid on resell items

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-24-2020 05:54 AM

First, I know this is likely a question for a tax accountant, but wanted to see if anyone else addressed this yet with their accountant.

Since I do not have a resellers certificate in my state (PA) because I don't meet the thresholds, I still end up paying sales tax on the items I am paying. THEN the sales tax is also paid by the buyer through the new laws for online market place sellers. Should I not get to deduct these taxes - dollar for dollar?

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-24-2020 06:51 AM

Since the eBay seller does not receive ANY of the sales tax paid by the eBay buyer, you may NOT deduct those sales tax payments. Those sales tax payments are paid directly to the individual states by eBay.

However, the eBay Final Vale Fees also include the sales tax paid by the buyer; so you MAY be able to deduct that percentage of the sales tax (and NOT the ENTIRE sales tax collected by eBay). Check the eBay FVF rate schedule for the proper percentage amount to deduct.

If you buy items for resale, you should keep track of the ENTIRE amount which you have paid, for your tax purposes.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-24-2020 08:14 AM - edited 09-24-2020 08:16 AM

You should include the tax you actually paid on the items you buy for resale as part of your purchase cost when you prepare your schedule C for taxes.

You must also deal with buyer paid tax if you receive a 1099 and use that as your starting point for gross income. You can either reduce your gross receipts, or you can record the tax on the tax expense line on schedule C - per IRS guidelines either method is acceptable. I prefer the tax expense method, so that you are starting with the 1099 amount, which is reported to the IRS.

If you do not receive a 1099, just start with your gross sales wothout the buyer paid sales tax.

Be careful not to deduct the sales tax a second time, if you are starting with a total that does not include the tax. The final value fee on the tax is an expense, the tax itself is not.

wooden_flower Volunteer Community Mentor.

wooden_flower Volunteer Community Mentor.eBay member since 2001.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-27-2020 12:42 AM

I think you may have some misunderstandings.

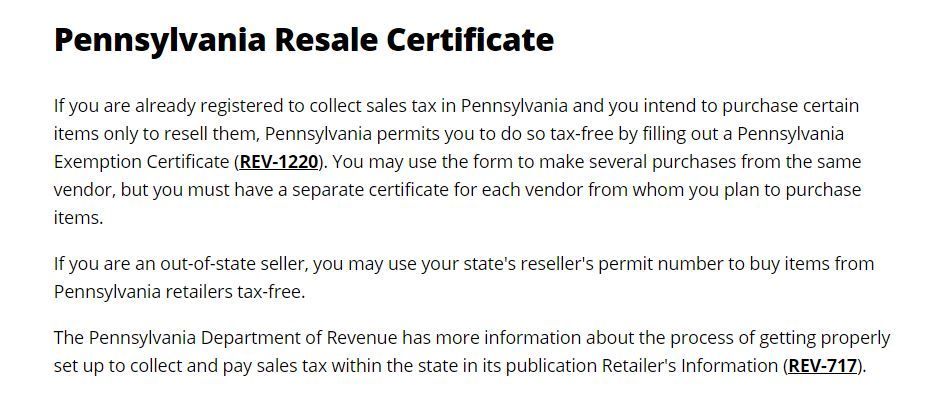

To have a resellers certificate, there should not be any "thresholds" to meet with your state. If you are a registers business with your state, you should be able to get your reseller's certificate. You may want to look into that. The reseller certificate has nothing to do with sales tax charged to your customers. A reseller's certificate is so YOU don't have to pay sales tax when you purchase items for resale or that end up a component of what you sell. And for some states they will allow you to purchase your shipping supplies with no sales tax too.

If you are currently paying sales tax on items you purchase for resale, then yes those are expenses you can write off.

https://www.revenue.pa.gov/FormsandPublications/FormsforBusinesses/SUT/Documents/rev-1220.pdf

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 02:05 PM

If I'm understanding what the question is asking, which is the question I have issues finding an answer to, then it hasn't been answered. I'm not saying that the information stated is incorrect, just that what is being asked isn't answered. Although I could be wrong.

I believe the question has to do with the sales tax paid by the reseller. I also do not have a certificate which would allow me to purchase wholesale without paying sales tax on the retail value of the products. Therefore, when I resell an item, that item is being taxed twice. Where on the tax form Schedule C to I report that sales tax I paid so that I can get reimbursed?

If I'm wrong about my evaluation of the question, I should probably submit a question on my own.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 02:09 PM

If you plan on buying for resale I would highly suggest you get a resale certificate

I did in California because of the high tax

Always consult a specialized Tax person but you will want to keep records of the tax you paid and dudect on you're taxes

But again, seek professional advice

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 02:21 PM

You don't get 'reimbursed' for the sales tax that you paid on the items you bought for resale - you just include the cost of the item plus the sales tax you paid as your cost of purchases on schedule C.

So the total you paid for the item including tax is deducted from your sales, along with other expenses to calculate your net profit. It is your net profit that is taxable.

As suggested, if you intend to continue to buy items for resale, you should register with your state as a retailer/reseller so that you do not have to pay the sales tax when you buy.

wooden_flower Volunteer Community Mentor.

wooden_flower Volunteer Community Mentor.eBay member since 2001.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 02:30 PM

Schedule C is part of your Federal Income Tax preparation.

Sales Tax is a state tax.

The federal government is not going to reimburse you for an overpayment of state taxes.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 02:45 PM

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 03:15 PM

Yes, but you should deduct as part of your product cost, not as a tax expense, just to keep things nice and tidy on schedule C.

The OP is still out of pocket the majority of the sales tax - it being a deductible expense means he saves just a % of what he spends. The best solution is still to register as a reseller and not have to pay it.

wooden_flower Volunteer Community Mentor.

wooden_flower Volunteer Community Mentor.eBay member since 2001.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 03:17 PM

@coastaltechsolution wrote:

but if OP keeps records of sales tax paid for resale then that is deductible on schedule C

Correct. It becomes part of their COGS (cost of goods sold).

However, the OP will still owe the State of PA tax on their total income as well.

We have had a re-sellers certificate for years, but not everyone will honor it. We have zero issues when ordering direct thru a vendor. Not every retail establishment will allow it, but we do always inquire.

....... "The Ranger isn't gonna like it Yogi"......... Boo-Boo knew what he was talking about!

Posting ID Only.......

Yes, I have no Bananas, only Flamethrowers.......

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 03:25 PM

If you buy on eBay for resale, you can register with eBay for tax exemption.

wooden_flower Volunteer Community Mentor.

wooden_flower Volunteer Community Mentor.eBay member since 2001.

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 03:26 PM

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-03-2021 03:27 PM

I have a CA resellers certificate and have not found any issues with any business honoring it

of course that could happen anytime

Deduct sales tax already paid on resell items

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-04-2021 10:48 PM

@aphroditeanderotes wrote:If I'm understanding what the question is asking, which is the question I have issues finding an answer to, then it hasn't been answered. I'm not saying that the information stated is incorrect, just that what is being asked isn't answered. Although I could be wrong.

I believe the question has to do with the sales tax paid by the reseller. I also do not have a certificate which would allow me to purchase wholesale without paying sales tax on the retail value of the products. Therefore, when I resell an item, that item is being taxed twice. Where on the tax form Schedule C to I report that sales tax I paid so that I can get reimbursed?

If I'm wrong about my evaluation of the question, I should probably submit a question on my own.

Sales taxes are STATE taxes. The only thing that have to do with a Schedule C is that they are a deduction IF there was sales tax reported in your Gross Sales.

Or on the Schedule C you deduct the products costs of items sold, that cost would include the taxes you paid, so the deduction is a little larger and being considered in the net income. This is what you are talking about above.

Sales tax paid by the seller on products they actually resold is a write off as part of the cost of goods sold on the schedule C. It is NOT broken out separately, it is just part of what the seller paid for products they sold.

If you are spending a decent amount of money on taxes when you are reselling the stuff, it is likely more cost effective for you to file the appropriate paperwork with your state and get a tax exempt status on stuff you resale.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999