- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Buying

- WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 05:38 PM

I HAVE BEEN PURCHASING LAPTOPS THAT ARE USED AND HAVE TO FIX. EBAY HAS CHARGED ME MULTIPLE TIMES AN EXTRA 5.00 CALIFORNIA TAX FEE THAT I SHOULD NT HAVE TO PAY UNLESS I PURCHASE A NEW OR REFERBISHED LAPTOP. THE TAX IS SUPOSED TO BE FOR BRAND NEW AND REFERBISHED ELECTRONICS. WITH THE OTHER CRAZY FEES THEY CHARGE, WHAT ARE THEY DOING WITH THAT EXTRA 5.00 THEY HAVE TO BE KEEPING IT FOR THEM SELVES. I KNOW IF I DONT LIKE IT I DONT HAVE TO BUY OR SELL FROM HERE. BUT WHAT WILL THEY COME UP WITH NEXT, A FEE TO LOOK AT ITEMS ON EBAY, 10 CENTS TO LOOK AT THIS ITEM. IS THIS HAPENING TO ANYONE ELSE

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 06:15 PM

Ebay is required to collect sales tax according to the laws of each state. They remit all the taxes they collect to the states, so no, they're not keeping it for themselves. Many states have exceptions to the taxation rules, but there's no way eBay can apply them on an item-by-item basis for 1.5 billion listings. So they apply them according to the category in which an item is listed. It's likely that the fee was imposed because of the category in which the laptop was listed.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 06:45 PM

yes, this law came in effect in 2018 on refurbished laptops. i have bought over 30 laptops that needed repair. it has only been the last four i purchased, the others i have not had to pay a recycle fee. i always go to the same place to purchase laptops

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 07:26 PM - edited 11-25-2022 07:29 PM

Yes you are correct, the ewaste fee is only for purchases of "New" and "Manufacturer refurbished" electronics. Ebay started charging the fee incorrectly about 2 weeks ago again. You need to contact customer service to request a refund for any ewaste fees you paid that were added to "Used" and "For parts/NW" laptops. I notified ebay 2 weeks ago and they seem to be dragging their feet to repair their error and issuing the refunds. I also called the CA tax dept. to let them know of this recurring issue. I also called the CA tax dept. to let them know of this recurring issue. You can call Michelle at 916-309-8009 , and email complaints to michelle.cano@cdtfa.ca.gov

Maybe they can help get ebay to move a little faster...

I also started a similar thread here about 2 weeks ago which has more info:

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 08:00 PM

I called eBay, the rep said we are just doing what California law tells us to do. So I asked to speak with a supervisor someone in charge. Talked to her and she said the same thing. We are just doing what California law tells us to do. I asked them why haven't they taken from the last 20 laptops I purchased. She said maybe they just caught on. I said that's your answer, told her I want this looked into. I want a complaint number and a email to verify this matter will be looked into. She said we will look into this. I said how do I know you're not blowing me off, didn't like that much. I know how they work your told things to shut you up. She said you will get email about us looking into it. I started to say something else only got halfway through my sentence and she hung up fast. They don't care , their to busy counting the money coming in to pay attention to other people's problems. But I will call that number. It's like know one has a good or logical answer, everyone says the same exact thing.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-25-2022 08:31 PM

I found the ebay best customer for this was on facebook. They escalated the issue and requested refunds for my orders. They told me to pay and I would be refunded although they can't do it themselves, so now it's a waiting game.

Please call mishelle and let her know, but you'll also need to email your complaint for her to better understand it. That's what she told me. The more customer complaints the better.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-26-2022 06:05 AM

ok thanks, i know 5.00 isn't a lot. but it adds up if you buy a lot. i fix the laptops that i buy from here, so they are making quite a bit off me. i buy and pay extra fee, then i sell same laptop i fixed up, and get charged the other fees they charge, sometimes after all the work i do it's hard to make a profit. And when i sell a laptop that goes to California then they have to pay that tax. And you don't know it until the end of a sale, and you see that recycle fee and say what is this. And if you make a mistake and put your item in the wrong category then you get charged more fees. What's that old saying the 2 things in life are death and taxes

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-26-2022 07:57 AM

Not just that, everything costs more in California. All those laws they keep passing can have a down side.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2023 08:41 AM

Ebay is collecting this California E-waste recycling fee in error for most cases of laptop sales on their platform. They are absolutely, explicitly, and without shame collecting the fee on laptops that are listed as "used" or "for parts/repair" by their sellers. Ebay should only be collecting the fee for "new" or "open box" or "manufacturer refurbished" laptops. The appropriate California regulation that covers this fee is located here:

https://www.cdtfa.ca.gov/formspubs/pub95.pdf

And the relevant part of the official California state publication is this - quoting directly:

"The fee does not apply when a customer purchases a video display device that is any of the following:

• Used but not refurbished.

• Part of a motor vehicle, as defined in Vehicle Code section 415, or a component part of a motor vehicle assembled by or for a vehicle manufacturer or franchised dealer. This includes replacement parts for use in a motor vehicle.

• Contained within, or a part of, a piece of industrial, commercial, or medical equipment, including monitoring or control equipment.

• Contained within a clothes washer, clothes dryer, refrigerator, freezer, oven or range, microwave oven, dishwasher, room air conditioner, dehumidifier, or air purifier.

• Contains Organic Light-Emitting Diode (OLED).

• Cell phone, including smartphone with screen size greater than four inches.

• eReader/eBook-Reader or eInk"

(Bold emphasis above on "Used but not refurbished" is my own)

I contacted Ebay several weeks ago about this, and mentioned that the fee was also incorrectly collected several years ago before they fixed the bug in their software that runs the checkout process. The Ebay rep said I should receive a refund after she presented the info I provided to the appropriate higher-ups, but that has not yet happened. Shocking, I know.

The history of the incorrectly applied fee is simple: Recently (sometime around early October, 2022), Ebay "overhauled" their checkout software and once again the "bug" crept back into the code from the earlier version from many years ago, and they've been collecting this fee ever since. California explicitly does NOT require the fee to be collected on the vast majority of laptops sold on Ebay's platform (which are used and sold by their original owners after perhaps an upgrade). What's happening with all of this money, quite likely millions of dollars that should not be collected? Why can't Ebay just fix their code again? It gets updated regularly with new fees/taxes/surcharges/payment options/etc., so it's not like nobody there is familiar with the code base!

To be fair to the state of California, I personally believe that this is a VERY sensible fee to collect on new items that will eventually make their way to a dump or recycling center (preferably the latter). California would prefer (and they mention this in their publications and videos) that items be reused as often as possible before finally giving up the ghost and hopefully being recycled into new products, as certain metals, plastics, glass, etc. is extracted from the original item. Philosophically, I'm totally on board with this. But even California will admit that you can only send a covered item into the recycling system once - you can't keep doing it each time the item is resold as used (hopefully several times) in its lifetime. That's why they only require the fee to be collected once, when a covered item is purchased as new or manufacturer refurbished by its original/first owner. Simple, right? So what's the problem, Ebay? FIX YOUR CODE!!!

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2023 10:31 AM

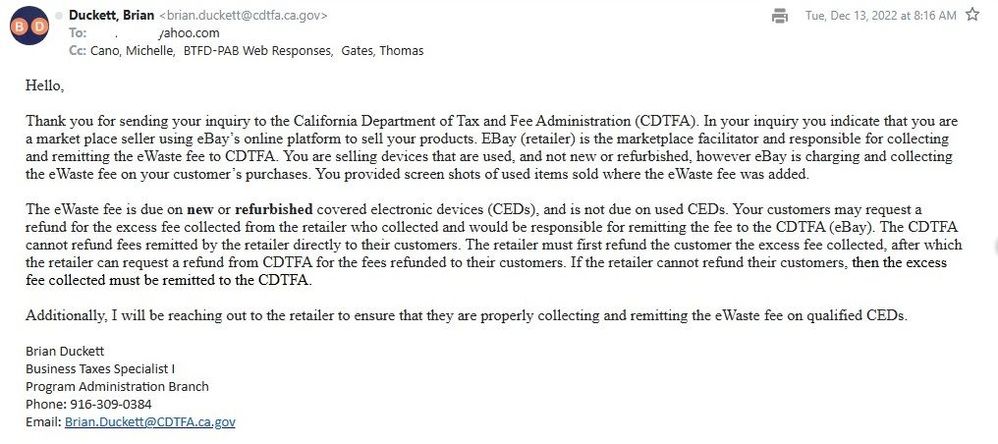

I have contacted,Brian.Duckett@CDTFA.ca.gov many times, I have also contacted Ebay , you get the same answer from everyone you talk to on Ebay, even the management, this

Brian Duckett

Business Taxes Specialist I

Program Administration Branch

Phone: 916-309-0384

Email: Brian.Duckett@CDTFA.ca.gov . I have a pic of my email i got from him.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2023 10:52 AM

If you don't mind paying that fee, just sit back and pay. This is another answer you will get (Thank you for calling eBay this evening. A request has been made on your behalf to ensure the Electronic waste recycling fee for California was charged correctly on your recent purchases.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-15-2023 03:18 PM

My guess is ebay is enjoying the extra 3% they are collecting.

Everyone .......call this number if you are wrongfully being charged from ebay.

Taxpayers’ Rights Advocate

Call for help with problems

if you have been unable to resolve through normal channels (for example, by speaking to a supervisor): 1-888-324-2798

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2023 09:07 AM

@rail322012 wrote:I have contacted,Brian.Duckett@CDTFA.ca.gov many times, I have also contacted Ebay , you get the same answer from everyone you talk to on Ebay, even the management, this

this is email i got from them I have contacted Ebay many times, it doesn't matter who you speak with, even the management. This is the response you get ( EBAY DOESNT COLLECT THESE TAXES THE STATE OF CALIFORNIA DOES) I talked to Brian about a week ago, he said Ebay is still doing this, I said yes they will not refund my money, He said the state doesn't just collect the taxes, Ebay is supposed to set up guidelines for these taxes, and he said he already contacted them, but he will again. It is clear that Ebay won't do anything until they are forced to do so, they have their tax specialists, but either don't understand, the difference between used and new items. I have contacted Ebay and told them would you like to see my email from the state, but they just blow me off. We need more people to call Brian and complain because nothing is being done. Here is his number.

Brian Duckett

Business Taxes Specialist I

Program Administration Branch

Phone: 916-309-0384

Email: Brian.Duckett@CDTFA.ca.gov . I have a pic of my email i got from him.

@rail322012 if it were me, I'd also be filing reports with the California Attorney General's Office and the FTC.

https://reportfraud.ftc.gov/#/assistant

eBay is profiting off of this "mistake" because they charge the final value fee on the total amount of the sale. Even if it's only $0.35-$0.65 per transaction depending on if the seller has a store subscription, that's still an extra fee the seller should not be charged.

In my experience, even if eBay does eventually refund the few buyers who complain, those refunds are processed separate from the original transaction and don't automatically refund the additional fee overcharge to the seller.

eBay needs to fix this issue for both buyers and sellers - since it's been going on this time for several months now it would appear they are in no hurry and may need additional "motivation" from the proper authorities to do the right thing.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2023 10:24 AM

I am doing my part trying to get Ebay to fix this issue. Just a few people getting involved isn't enough, that's why this is still happening. There must be thousands of people this is happening to, just sitting back waiting for other people to do this isn't going to fix this. To me you would think there would be more than 10 people responding to this post. There is more than enough information in these posts to call the right people to get this fixed, (People get involved / take an hour of your time and numbers get things done. I know 5 dollars these days isn't a lot. It is the principal, i don't like being taken advantage of. Just think if you buy 10 laptops on Ebay so you can fix them up. You just spent 50 dollars in fees that aren't supposed to be taken. I really can't understand how this happens, Ebay's office is in San Jose California, I will guarantee Ebay knows by now, they are applying this tax wrong, they have their own tax people, you think a big corporation like this doesn't know the tax laws. They figure no one is going to do anything. And they are probably right.

WHY IS EBAY CHARGING 5.00 FOR A CALIFORNIA TAX ON ELECTRONICS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-19-2023 10:29 AM

I called eBay, the rep said ...

The phone reps do not work for eBay so don't bother with them. They work for a subcontractor out of Utah.

She has a script and a quota. Sending you to her manager meant she got to take a pee break.

The manager has a script and a quota.

And any call centre employee is allowed to hang up if the caller becomes belligerent.

https://www.facebook.com/eBayForBusiness/ — Message button in upper right on landing page.

https://twitter.com/askebay?lang=en

https://community.ebay.com/t5/Selling/How-do-I-contact-Customer-Support/m-p/32016431#M1783851 -> Automated Assistant, type AGENT -> enter. You will then get more options.

The social media Chat accounts are covered by trained eBay employees with some authority.

And you get a transcript so you can compare what you heard with what you were told.