- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Re: Charging tax on United States coin sales

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-29-2023 09:41 PM

Does eBay still charge tax on the sale of U.S. coins? I have not sold coins on eBay recently because eBay has been charging tax on the sale of U.S . Coins. They have lost my business because charging tax unnecessarily by eBay is a big ripoff and I do not want to be ripped off by anybody. I will resume selling coins on eBay only if eBay does not charge a tax on the sales of U.S. coins. Can eBay shed light on this sickening issue? U.S. Mint sells yearly proof sets to the public and resale value of these sets nowadays is roughly one tenth, yes 1/10th, of the U.S. Mint issue price. What a wasteful investment! Buy a set from U.S. Mint for $22 plus shipping and resell the same set for $2.00. What a shame! Now we have to pay tax on the $2 recoup and net 9 cents on the dollar; with shipping, it will become a return of 8 cents on each dollar. I don’t mind the big loss because I enjoy the hobby. But I mind adding fuel to fire.

- « Previous

- Next »

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 11:37 AM

@farmalljr wrote:You apparently have not read my responses. You are making assumptions of the situations I explained.

What state the sellers resides in means nothing on the sales tax issue. At least as far as eBay is concerned. It's all on the buyers state. I live in a state where bullion isn't taxable. I only used to buy in the bullion category. I was charged sales tax several times. It's not a seller issue with listing. It's an eBay issue with non compliance. eBay was and likely still is, illegally charging sales tax when none were due.

End of story. I have personally experienced it. Many others have too. You explanation does not make those situations disappear or explain them away. Not being a jerk about it, simply saying many posters here don't understand the situation and have little to no experience with it. Everyone finds it easy to blame the seller for doing something wrong, and sometimes they do. But in all of my own situations, that was not the case. It was ALL on ebay.

I don't know what it is you are trying to do. Stir conflict or just be snarky. I really don't care. I did NOT respond to ANYTHING you said until you directed a post to me and misrepresented what I was posting about.

The ONLY thing I blamed on Sellers is if they post what they are selling in the wrong category, that can affect sales taxes. And yes this happens and yes there have been threads about it over the years.

Now lets just part ways. We have no need to further discuss this. Thank you.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 11:47 AM

@hajnick wrote:

@albertabrightalberta wrote:You are mistaken.

It's not ebay that charges sales tax. It's your state for which ebay collects sales tax and forwards it.

Different states have different taxability on coins. You'd have to check your own state's department of revenue website to see what's taxable and what's exempt from sales tax.

Be aware that any site you do business with is required to collect tax and forward it to the various states.

Neither Illinois nor the U. S. Mint charges any tax on the sale of U.S. coins or banknotes. I have no trouble understanding this issue but eBay seems to have trouble understanding this issue. And I neither need nor care for you to understand it for me. I just want eBay to stop charging tax on eBay coin sales because it is not necessary if the seller lives in Illinois. I am not sure how to stop eBay from doing that.

I note you use the word seller.

Tax is based on the buyer and the state they are in. Yep the states now charge tax, and the buyer pays it.

Hurt your sales. Yep it does; and nothing eBay can do about it but collect it and remit it.

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 12:04 PM

I'm not sure it hurts our sales anymore. I think in the beginning it did, but now buyers are use to it and have very likely found out that they have to pay the tax just about no matter where they purchase on the internet.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 06:31 PM

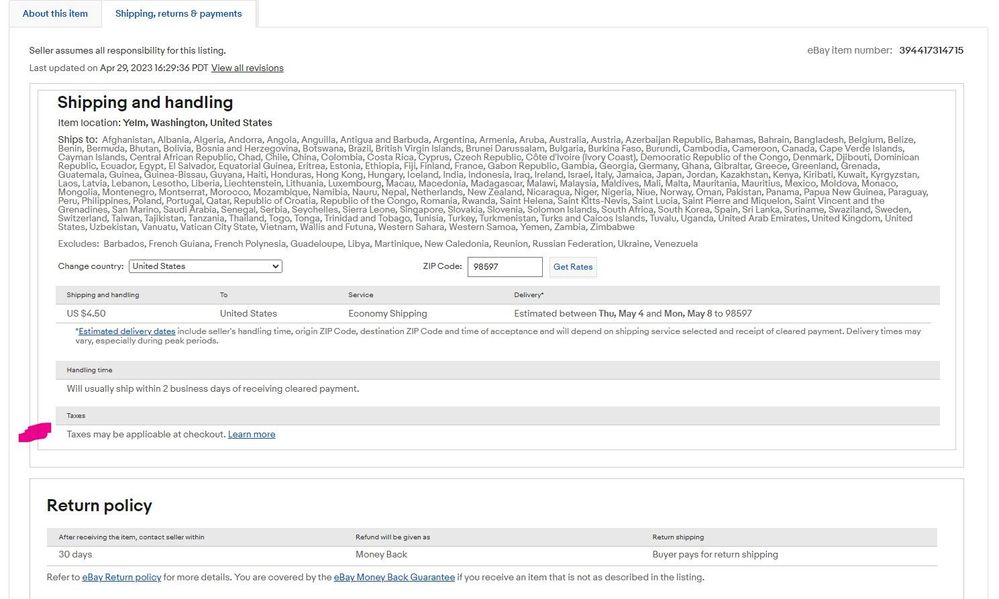

As I said earlier, I will give it a shot and see what happens. I will note in ‘seller description’ that buyer beware that a sales tax will likely be levied and bidders should be aware of that before bidding. Seller has absolutely no say with regards to the sale’s tax. Thank you for bidding! Nick

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 06:32 PM

@mam98031 wrote:

@farmalljr wrote:You apparently have not read my responses. You are making assumptions of the situations I explained.

What state the sellers resides in means nothing on the sales tax issue. At least as far as eBay is concerned. It's all on the buyers state. I live in a state where bullion isn't taxable. I only used to buy in the bullion category. I was charged sales tax several times. It's not a seller issue with listing. It's an eBay issue with non compliance. eBay was and likely still is, illegally charging sales tax when none were due.

End of story. I have personally experienced it. Many others have too. You explanation does not make those situations disappear or explain them away. Not being a jerk about it, simply saying many posters here don't understand the situation and have little to no experience with it. Everyone finds it easy to blame the seller for doing something wrong, and sometimes they do. But in all of my own situations, that was not the case. It was ALL on ebay.

I don't know what it is you are trying to do. Stir conflict or just be snarky. I really don't care. I did NOT respond to ANYTHING you said until you directed a post to me and misrepresented what I was posting about.

The ONLY thing I blamed on Sellers is if they post what they are selling in the wrong category, that can affect sales taxes. And yes this happens and yes there have been threads about it over the years.

Now lets just part ways. We have no need to further discuss this. Thank you.

I am trying to do none of the things you ASSUME. I am explaining, though actual experince, what is probably happening. You and several others, want to keep pointing the blame everywhere other than when eBay screws up.

It has been pointed to miscatagoration. It has been pointed to the state the buyer lives in. Sure, in some instances these may be true.

However, most buyers of coins and bullion have some level of experince. They are 99% of the time, familiar with their taxation laws. eBay has and apparently still does, charge tax when none is actually due to be collected. Instead of always blaming something else, maybe it's time you consider eBay screws up, intentionally or unintentionally. Because I have personally experienced their screw ups more than once. My friend has as well. Another poster here chimed in telling us the same thing.

It does not help the OP or their buyers, giving them half the information or a jaded view of the situation. Yes, the OP should make sure the listing is correct. However, they also need to be AWARE that eBay has screwed up many times in the past, charging sales tax when none was actually due to be collected. With THAT information, they can inform their buyer that they need to contact CS to get the tax back.

It's quite popular here to blame the seller for everything, no matter who was at fault. You like to skip over eBay ever making any mistakes, and act like eBay never does anything wrong. I don't know why you get your feathers so ruffled over that. eBay has obviously made bad decisions in the past, and will continue to screw up in the future. If you are not open to discussing things with people you have options. You could ignore comments you don't want to respond to. You could avoid posting all together. But you don't get to tell anyone here what they are going to do. If you don't want to participate in a discussion, you can walk away at any time. There is no need to make up things about other posters (ME), implying false statements of their intent. I do not appreciate the hostility of making a statement that I am trying to stir conflict or that I am be snarky. Neither of those things are true. Like others here, I am attempting to help the OP understand what is likely happening, because it has happened to ME.

Like you, I have responded to other posters here. I have not singled you out somehow.

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 08:50 PM

To your point of what "dealers" pay for them. Yes, in person at a coin shop they pay ridiculously low prices. I deal coins on EBay. Buy & sell them. I sell 1999-2006 at an average of $11 each. Date run 1999-2006 (1 each, 8 total) I sell for $99.95 free shipping. Literally sold 6 of these date runs within a couple weeks. Works out to $90 + $10 to go towards shipping. I happily pay double or more what your coin dealers pay, because I turn them around for a quick easy profit. So, yeah, Brick & Mortar coin dealers dealing with the public pay pitiful prices, I buy all my coins on EBay and resell them and do very, very well (at least I think so and most people I tell about my business). So, that's why I was serious, I'd love to buy them for $2-3 a piece 🤣 I'm here paying more on EBay. LOL! Proof sets of all years (1950s-2020s are my biggest sellers, especially 20-teens)

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 08:58 PM

You are either seriously confused or conflating sales tax with income tax.

Your first comments regarding sale of legal tender vs collectibles, when it comes to sales tax, is completely false and irrelevant. Taxes are determined by local/state taxing bodies. It doesnt matter whether the item is sold above face value. A coin that is deemed legal tender or currency is not subject to sales tax in many states in the US. This is the premise and at the heart of this conversation

You are CORRECT regarding income tax. However, that has absolutely nothing to do with this conversation. Your comments of talking to an IRS agent, yes, of course, if you sell ANYTHING for a profit, you owe income tax. However, this ENTIRE thread, is about SALES tax. (Not the same thing)

All you have done is confuse the situation for yourself and others.

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 10:47 PM

@hajnick wrote:As I said earlier, I will give it a shot and see what happens. I will note in ‘seller description’ that buyer beware that a sales tax will likely be levied and bidders should be aware of that before bidding. Seller has absolutely no say with regards to the sale’s tax. Thank you for bidding! Nick

Ebay already adds that comment on the Shipping Page.

mam98031 • Volunteer Community Member • Buyer/Seller since 1999

mam98031 • Volunteer Community Member • Buyer/Seller since 1999Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-01-2023 11:11 PM

Thanks for your input and I do like your enthusiasm. Yes, perhaps you are right. Dealers pay $3 for clad proof sets while they go for $11 on eBay. Just think of the time it takes to list an $11 item, the fees you have to pay eBay and PayPal, the shipping and trips to the post office and all the time and headaches to get the $11 deal done. Dealers that have deep pockets deal with items and lots that are much higher than $11. Clad proof sets are rubbish to them. They offer ridiculous prices because the dealers don’t want to bother with coin market rubbish, no insult to the lovely and shiny clad quarters, dimes and halves. Their profit comes from popular items and clad as well as silver proof sets, while well liked by hobbyists, don’t make dealers any profits because they don’t move. They are dead to them. A dealer paid me $20 today for 2009 Lincoln proof commemorative PCGS PF69 and I bought it for $65. These collector items don’t move unfortunately. They may sell much higher on eBay but you have to take into account the collateral time and material expended to sell an $11 item. Nick

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-02-2023 02:38 AM

Well, Nick, I do consider the time and collateral involved in selling...

I guess I can qualify as an EBay coin dealer, I sell all things US numismatics/bullion dated 1800 to present, & I sell $10,000-$15,000 in gross coin sales per month with a 28%-33% average profit margin on that gross #. ($3,000-$4,000 monthly profits on the low end). My business is the size it is because I grew it organically starting 1 year ago with a small cash investment... so my pockets are only as deep as the monthly profits provide, and I use them to grow exponentially.

My turnover rate is quite high/fast, as my inventory is typically valued at less than 2x monthly sales, so it's not like I'm sitting on a year's worth of inventory... I'm always buying because I can rarely keep up with demand and have had to regularly raise prices. With my sales and reinvestment I continue to grow steadily and exponentially.

I don't sell anything cheap (just check my store), I do actually compete with a number of bigger name coin dealers (of course some of them are just priced astronomically, and sometimes I'm the one with astronomical prices, but I'm almost always priced far above the average for EBay).

This past month was slower at $11,000 in gross sales for the month, but a quick look tells me I did over $4,000 in proof set sales alone (36%+ of total sales).

Proof sets are my easiest things to sell as I never create new listings, only use existing listings. I buy them in bulk, sometimes 100+ at a time and can get them up in my store extremely quickly. Selling '99-'06 proof sets individually would be a total waste of time, hence why I mentioned I sell them in date runs, 8 each, $100 lots incl shipping (an effective value of $11 ea). Those make $28 on each sale (worth it) and I turned 6 of those lots in 2 wks last time I had a bunch. Not a huge amount, but a nice return on my investment and draws business and repeat customers.

I don't know the economics of being a store front coin dealer. I don't know their market place. I do know mine, mine is greatly made up of proof sets, and I think I can say quite fairly, I do well.

I also know nothing about the economics of long term investments in coins, because I don't own any of them long enough for a price/market change to occur. I sell them near-immediately, hence how I can make a profit regardless of long term trends.

So I guess I'm left with saying, I'll take my "enthusiasm" and continue hawking my "slow moving, rubbish", as it has worked quite well for me, thank you, LOL. This isn't just a my hobby for me, although I do usually put in 30 hrs per week at most, so I'm not even full time either!

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

05-02-2023 05:43 AM

Thank you so much for sharing. This is encouraging and I do wish you the best. Thanks again! Your info is very valuable. Nick

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-26-2024 11:14 AM

There is No sales tax on US currency coins or paper. In most states it is a felony. I have adjudicated cases on State and Federal courts. The reason there is no sales tax on US currency is because the US mint is not a business it is a government agency. Talk to any attorney.

Respectfully Submitted

1689371

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-26-2024 11:21 AM

This is an old thread and will be closed by the mods. If you have a problem with eBay collecting sales tax, try talking to your Congress member.

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-26-2024 11:24 AM

Then you are sadly misinformed

Re: Charging tax on United States coin sales

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-26-2024 11:44 AM

- « Previous

- Next »

- « Previous

- Next »